When we think of Takaful, Islamic insurance, we think of the Arab world or Malaysia. In

reality though, Takaful started in Africa in the late 1970’s in Sudan. Takaful started from

the desire of Islamic banks, very young at that time, to obtain insurance coverage for its

risks. Their shariah (religious) councils forbade conventional insurance, thus Takaful was

borne.

The beginning:

The original Takaful operators (companies) generally considered profit secondary to

obtaining coverage for their Islamic banking sister companies. This reflected in the

model used in Sudan. Outside of Africa, in Saudi Arabia a cooperative (mutual) approach

was promoted. In Malaysia, although the first Takaful operator also had an Islamic Bank

as a sister company, profit took on a much more prominent role.

Today Takaful is a hot topic in Africa. In Tanzania Takaful guidelines are being launched

which is likely to ignite the demand for Takaful in the country. In Kenya there are also

Takaful guidelines launched recently with a corresponding interest in launching

Takaful. Takaful Insurance Africa, started in Kenya, has since expanded into Somaliland

and has expressed an interest in expanding to a number of other countries in the

region. Morocco has new Takaful guidelines and Egypt has significant Takaful

business. Takaful also exists in such countries as South Africa, Nigeria and Ghana to

name a few.

Basics of Takaful

Takaful ensures the operational model and contracts between all parties follow shariah

law. The key aspects are:

- Riba, interest bearing investments, must be avoided

- Investments must avoid haram (unacceptable) industries such as casinos and breweries

- Maisir, gambling, must not be present in contracts

- Gharar, uncertainty, must not be present in contracts

Avoiding riba presents challenges in markets where Islamic banking is not

advanced. Malaysia is one of the few markets where there are sufficient asset classes to

actively manage assets and liabilities through asset strategies. In other markets

management will need to be through the products sold and guarantees (explicit or

implicit) given.

Gharar presents the greatest challenge in Takaful, as conventional insurance is built

upon gharar. A policyholder pays a premium and in return receives coverage. The

insured event may or may not occur, which is pure uncertainty. In Takaful participants

jointly donate to a risk fund which pays out benefits. In this way the participants are

jointly covering each other in the spirit of mutuality.

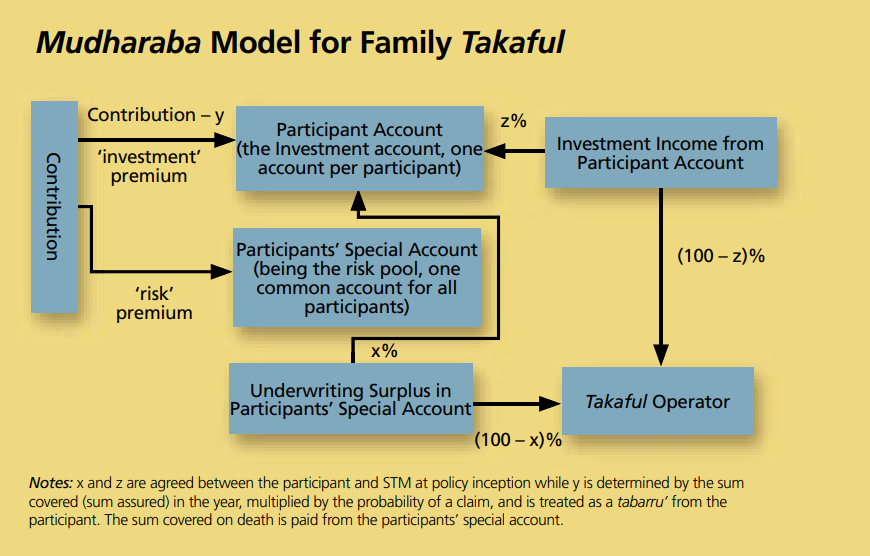

There are two main operational models in Takaful: Mudharabah and Wakala (and a

combination of both). Mudharabah roughly means profit sharing whereas Wakala

means agency. In a Takaful model the role of the participants (policyholders) and the

operator is clearly segregated. For instance, in most models there is a separate

operators fund, risk fund and savings fund with expenses being paid from the operators

fund and benefits paid from the risk fund. In a Wakala model the operator charges fees

for work performed. These fees are paid into the operators fund to cover costs as well as

profit. In a Mudharabah model the operator receives a share of investment profit and /

or underwriting surplus which is used to cover expenses and profit. There are also

models which combine both, i.e. Wakala with Mudharaba on the investment profit. More

detailed illustrations of the common models in use will be shown in a future article.

For the actuary the challenge is combining shariah requirements (which vary by country)

with ensuring shareholders receive a fair return on capital and the risk profile of the

operations is acceptable and understood by the shareholders and participants. The

operator will appoint a shariah council consisting generally of three to five scholars and

it is the role of the actuary to learn what models and structures are acceptable from

them and to work with management to determine which of the acceptable structures is

optimal from a financial and risk management point of view.

Misconceptions in Takaful

One misconception in Takaful is that Takaful is purely for social good and not for

making profit. In reality it is possible for shareholders to earn a decent profit. The key

will be to attain a critical size such that the fees being charged under Wakalah and the

level of profit sharing in Mudharabah can cover expenses and provide for profit. Making

profit is acceptable in Islam, but with transparency and in accordance with Islamic

principles.

Another misconception is that Takaful is only for Muslims. The reality is that Takaful is

simply insurance which follows Islamic principles. The principles of fairness, transparency

and sharing of profits can and does attract both Muslims and non-Muslims. In Malaysia

there are Takaful operators where the majority of participants are non-Muslim! In this

regard it is vital that conventional insurance companies that want to start up sister

Takaful companies segment their markets between Takaful and conventional insurance,

ensure sufficient product differentiation or ensure the return on capital is consistent in

the pricing of the two operations. The risk of Takaful cannibalizing conventional

insurance sales is real and is a prime concern with business planning and strategy.

In some markets there is a misconception that Takaful is simply a name change, that

conventional principles and operations can simply continue as is. The reality is that even

if contributions (premiums) in Takaful and conventional insurance are equal, the risks

could be very different. This could greatly affect shareholders profit under adverse

conditions. Whereas in conventional insurance our actions are held accountable by the

board of directors and the regulator, in Takaful our actions are also accountable to Allah

swt as others are depending on us to ensure our operations comply with Islamic

principles.

In the Middle East especially there is a misconception that Takaful should be cheaper

than conventional insurance. This is emphatically not true as the underlying events or

risks being covered do not change when covered under Takaful. Having said that, it is

hoped that anti-selection and fraud would be lower in Takaful, but even this is not a

given. A Takaful operator thus must have the same focus on technical operations as

conventional insurance.

Several years back the CEO of Takaful Insurance Africa explained some of the challenges

of educating non-Muslims in particular on shariah law. He humorously pointed to

instances where potential participants asked if they cheat the company whether the

operator will cut off their left hand or their right hand! The reality is that by taking

Takaful the participant is taking insurance which follows Islamic principles, not accepting

shariah as the law of the land, an honest concern in some markets.

Conclusion

Takaful has its roots in Africa. The Islamic principles of fairness, transparency and sharing

of profits resonate strongly in many African markets, and with regulations steadily

appearing throughout Africa Takaful is set to take off. To be truly successful there must

be a merging of shariah concepts and technical concepts, each having their role in

ensuring the success of the company. The business plan must be clear in its segmenting

of business and product design structure as well as risk management. In a future article

we will explore more deeply the models currently in use and innovating products which

can be developed much more easily in Takaful, such as microtakaful. The author can be

reached at hassan.odierno@actuarialpartners.com for more details.

This article was originally published in Insurance Times (Tanzania) April 2016.