In November 2019, I wrote about the journey so far on the application of IFRS 17 to takaful. The accounting profession consensus at that time was to move (under IFRS 4) from a multi columnar approach to a single column accounting. Additionally the accounting for the takaful entity would follow that for insurance as the opinion was that takaful involves a transfer of risk from the participants to the takaful operator and as such should be accounted for like any insurance company notwithstanding how takaful is practiced in Malaysia, a case of perceived substance over form.

In April 2020, the MASB released a Paper (the Paper) outlining their latest iteration of how takaful should be accounted for in Malaysia. This note is a critical analysis of the Paper and seeks to understand whether the proposed approach can faithfully represent the business of takaful and yet adhere to IFRS 17.

So, what has changed since November? The MASB has now moved beyond just considering the takaful contract in isolation but has also considered the guidance provided under Islamic Financial Services Act 2013 (the IFSA) and the Takaful Operating Framework 2019 (TOF), two regulatory documents that guide the practice of takaful in Malaysia. It is to be expected that the way the takaful contract itself is worded can vary from one takaful operator to another. Nonetheless it is important to realize that all takaful contracts should be interpreted in accordance with both the IFSA and the TOF. Where the takaful contract has a clause that is inconsistent with either the IFSA or TOF, its interpretation would be subservient to IFSA and TOF. Furthermore, compliance with Shariah law is mandatory for any Islamic contract and in the takaful contract there are at least two types of Shariah contracts mentioned, typically the wakala contract and the tabarru’ contract.

The wakala contract is a contract between the participant and the Takaful Operator (TO), not between the Takaful Fund (TF) and TO. The wakala fee is therefore deducted from the gross contributions (i.e. premium) and does not make its way first into the TF before being paid to the TO. This reflects the fact that the party contracting with the TO is the participant and not the TF. In Family takaful there can be a Participants Investment Account (PIA) in addition to the tabarru’ fund. In general takaful, however, there is only the tabarru’ fund. It is also clear that under TOF (paragraph 16.13) the only fees that can be payable from the tabarru’ fund are the performance fee and any fee the TO sets as a proportion of the tabarru’ contribution. Both these fees, however, are only payable subject to satisfying certain conditions, one important condition being that the sum of the two fees cannot exceed the surplus allocated to the participants in the tabarru’ fund, and another condition being that it can only be payable from the tabarru’ fund which has no qard outstanding.

The tabarru’ literally means a donation and needs to be recognized as such for the risk sharing portion of the (common) fund to be Shariah compliant. It is paid by the participant to the tabarru’ fund and in return the tabarru’ fund is expected to compensate the participant should the contingent event occur. To emphasize this donation feature, paragraph 14.3 of TOF states that the participant is only entitled to get back a portion of the tabarru’ amount upon surrender of the contract. Should this happen, the participant would be entitled to the unexpired portion of the tabarru’. Under no other circumstances would any portion of the tabarru’ be refunded.

MASB’s Paper’s

The following are the conclusions set out in the Paper:

- A separate column for a TF can be presented in the primary financial statements of a takaful entity in a manner that is consistent with MFRSs and, depending on the circumstances, may be required in order to ensure the financial statements provide relevant information that is useful to those users with an interest in the TF’s activities when they make economic decisions.

- Based on cost-benefit considerations, two columns should be presented – one for the TF and one for the takaful entity as a whole.

- The information in the TF column and the information in the takaful entity column should be determined by applying the relevant MFRSs. That is, each column would be MFRS-compliant on a stand- alone basis. In this regard, both the TF and takaful entity would apply MFRS 17.4

- The TF column must not be more prominent than amounts explicitly required to be presented by MFRSs in the takaful entity column.

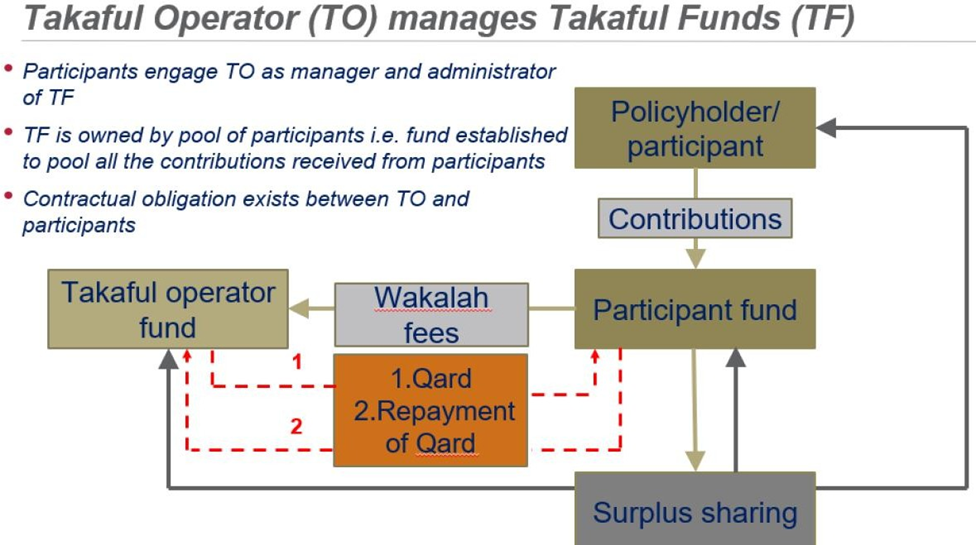

The Paper then goes on to explain the flow of funds between the TO and the TF in the following (diagram reproduced from the Paper):

I have three observations to make on the diagram above:

- Notwithstanding the current accounting convention under IFRS 4, there is an error in defining the flow of funds. In accordance with IFSA and TOF the contributions do not first flow to the Participants Fund before being split between the amount in respect of wakala and the tabarru’ amount. As explained above, TOF places strict conditions as to what and how much can be paid out of the tabarru’ fund to the TO and, for family takaful, while the PIA can be a temporary receptacle for the wakala fee from the gross contributions, passing the wakala fee through the PIA would be contradictory to the TOF. The only wakala fee that would be payable from the PIA is any wakala fee payable to the TO for managing the investments in the PIA funds and is usually expressed as a percentage of the Net Asset Value (NAV). This wakala fee is in addition to the wakala fee deducted from the Gross Contributions.

- The wakala contract is between the participant and the TO, not between the Participants’ Fund and the TO.

- The “surplus sharing” mentioned in the diagram is not actually surplus sharing as understood conventionally. The conventional interpretation of surplus sharing is sharing in both positive surplus and negative surplus (i.e. losses). In IFSA and TOF it is clear that all surpluses accrue to the participants. Neither guideline mentions that the TO is entitled to share in the surplus of the tabarru’ fund; instead the TO may be entitled to a performance fee out of the positive surplus payable to the participants. The tabarru’ fund is indeed a Mutual. This is important as it is our understanding that the Shariah does not allow the TO to (conventionally) share in the surplus of the TF under tabarru’. Doing so would break the first tenet underlying takaful, that it is risk sharing among participants, not risk transfer to the insurer. The first charge on any surplus accruing to a policy in the tabarru’ fund is to support any onerous contracts, followed by to repay any qard outstanding, then perhaps set aside as a reserve against future unexpected claims and, finally should there be any remaining surplus, only then can this be distributed to participants.

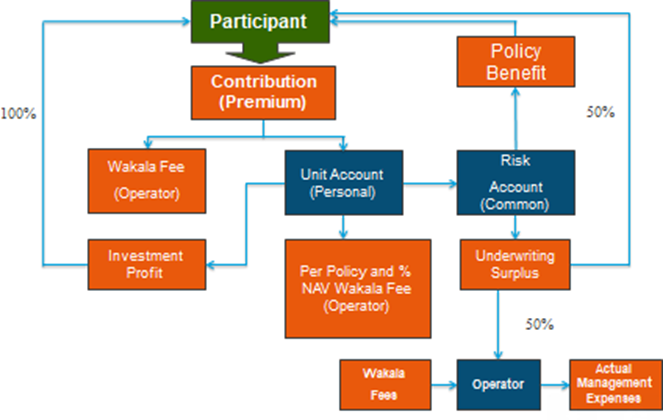

Thus, instead of the flow shown in the Paper, the flow of funds should be as follows (assuming a family takaful Operator) so as to be consistent with the provisions in TOF (the diagram assumes the maximum 50% of the underwriting surplus is distributed as performance fee to the TO):

After a lengthy discussion in the Paper about the acceptability of the multi-column approach under IFRS 17, the Paper proceeded to provide the following three options as to how to present the financial results of the reporting entity under IFRS 17:

Option 1: Three columns – (1) TF, (2) TO (and adjustments) and (3) TE

Option 2: Three columns – (1) TF, (2) TO and (3) TE

Option 3: Two columns – (1) TF, and (2) TE

Where TF: Takaful Fund, TO: Takaful Operator Fund and TE: Takaful Entity

All three options recognizes three very important concepts

- The ownership of the TF is separate from that of the TO.

- That the insurance element as traditionally understood takes place in the tabarru’ fund within the TF. As such IFRS 17 applies to the tabarru’ funds and possibly those PIAs that house the savings component of the gross contribution.

- That the TO is the manager and administrator of the TF providing services for which it earns a fee, and as such IFRS 15 may be applicable.

Under Options 1 and 2 it is our understanding that the line items under TF and TO would somehow consolidate into the appropriate line item in the final column for TE. The only difference between these two options is that, under Option 1 there would be an intermediate column to “adjust” the sum of the line items from the TF and TO columns to the TE column, whilst under Option 2 the reconciliation is done instead in the notes to the accounts. Under Option 3, the entries under the TE column would be derived without constructing the TO column. Given that under all three options, the TE column must be identical, a valid question to ask is: how would the TE column under all three options be determined?

The answer to this question is buried in the last paragraph of the last Appendix to the Paper (Appendix C), which says:

C.9 Note, however, that from the perspective of the takaful entity as a whole, the combined TF and TO activities would constitute insurance services to be accounted for under MFRS 17.

After allocating nearly all of its 19 pages of the Paper to explain the difference between takaful and insurance, the MASB’s conclusion remains unchanged from its November position, that the TE for all intents and purposes should be accounted as an insurance entity. Effectively, the MASB still concludes that the TE practices risk transfer, and not risk sharing. That is the reason why under all three options the TE column would be the same. This then begs the question whether the proposed accounting format would be Shariah compliant after all.

Recently the Islamic Financial Services Board (the IFSB, an international standard setting body whose principal objective is to adapt existing international standards, including those set by the International Association of Insurance Supervisors, to be consistent with Shariah principles, and recommend them for adoption) released an Exposure Draft on Transparency and Market Discipline in Takaful (the ED). This ED is intended to set out requirements to be applied by regulatory and supervisory authorities (RSAs) to takaful undertakings (TU) and retakaful undertakings (RTU). The purpose of this ED is to promote transparency and market discipline by providing sufficient disclosures both to the market and to actual or potential participants. The ED’s ultimate goal is to protect the interests of participants, shareholders, investors and other stakeholders, along with maintaining the stability of the takaful industry. Under Section 2.1 on Prudential Disclosures it says, “The supervisor requires TU/RTU to disclose relevant and comprehensive information on a timely basis in order to give participants and market players a clear view of their business activities, risks, performance and financial position”. Specifically, paragraph 35 says:

Information should be sufficiently comprehensive to enable participants and market players to form a well-rounded view of a TU/RTU’s financial condition and performance, business activities, and the risks related to those activities. In order to achieve this, information should be:

- well-explained so that it is meaningful;

- complete, so that it covers all material circumstances of a TU/RTU and, where relevant, those of the group of which it is a member; and

- both appropriately aggregated, so that a proper overall picture of the TU/RTU and of individual funds within it is presented, and sufficiently disaggregated, so that the effect of distinct material items may be separately identified.

As this proposed IFSB standard is targeted towards the RSAs it is therefore Bank Negara’s call to determine whether the recommendations in the MASB Paper meet the objectives of the ED.

On our part, we now need to consider the title of this note, Applying IFRS 17 to Takaful – Constraints and Challenges. Why is it that the MASB is so insistent on treating takaful as equivalent to insurance? Are there sections in the IFRS 17 standard that make it difficult to apply IFRS 17 to the takaful business as we know it? Is there not enough time before the standard becomes effective to formulate a more shariah compliant accounting basis?

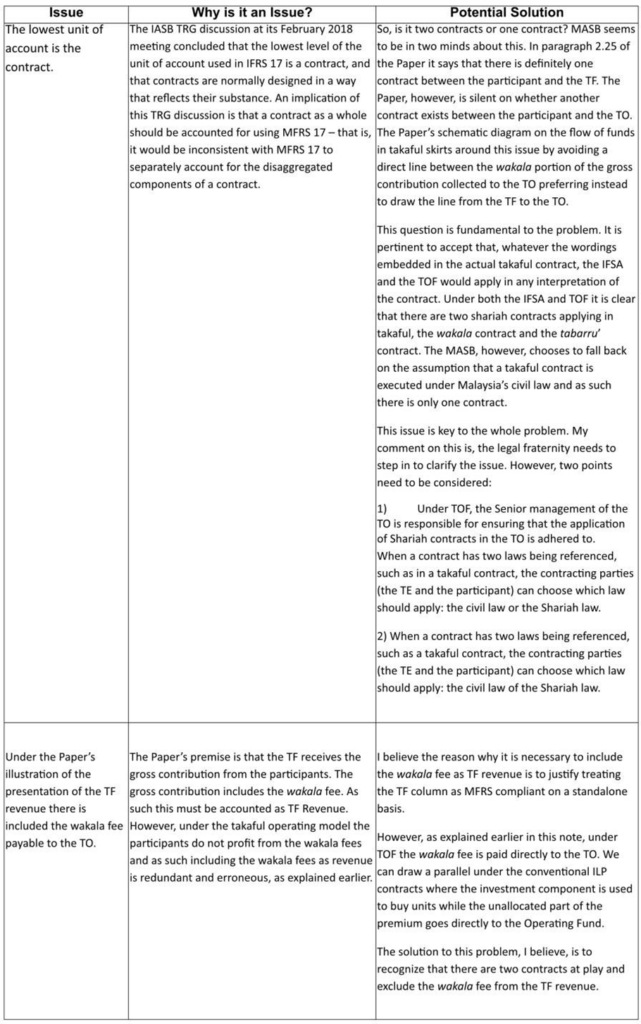

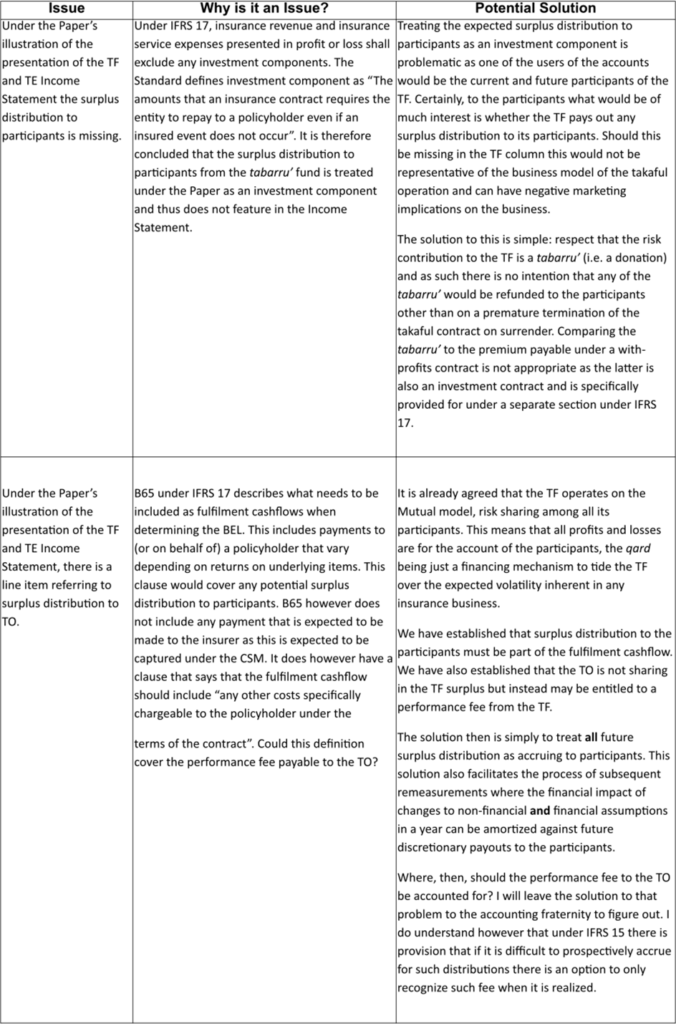

To understand the constraints and challenges posed by applying IFRS 17 to takaful I have prepared the table below to highlight the issues and perhaps potential solutions:

Conclusion

It is my opinion that the accounts of the takaful entity must endeavor to preserve the spirit and functionality of takaful. The columnar approach is welcomed. The issue is how should the TE column be constructed?

To ensure that the TE column faithfully reflects the takaful business, the TE column should retain the operating features of takaful, that of a mutual for its insurance business and that of an agent as a manager and administrator for the takaful business. Accounting under the TE column as insurance, apart from potentially raising issues with Shariah, involves several IFRS 17 accounting requirements which are inconsistent with how takaful business is conducted. This includes requiring a cohorting of takaful contracts and an immediate recognition of subsequent annual gains and losses from changes in financial assumptions. Given that the effective date for the implementation of IFRS 17 has been pushed back yet another year, I urge the takaful industry to rise up to the challenge to determine how better to represent its business to both its participants and its investors. For public listed TEs where financial results determine the market valuation, it is all the more important for the accounting under IFRS 17 not to result in a material change from the current financials, something the Board of Directors would be very interested in learning now rather than later.