I am often asked about life as an actuary. The easiest way to explain it is, do you like puzzles? Actuaries solve puzzles. We use mathematics as well as business sense to figure out what no one else can in order to manage risk. Actuaries traditionally have worked in insurance companies and in the pensions field, but increasingly we are in non traditional fields such as risk management, investment banking and fintech. For me I am in consulting, where I do traditional appointed actuary work as well as business projections, strategic work assisting to set up insurance companies, product pricing and other special projects. I started out in life insurance and have started to move into general insurance as well.

I first learned about actuarial science in my university. I was an electrical engineering major but noticed I was better at mathematics than most of the math majors. I did well in the science subjects but the math subjects was like a sanctuary for me, some place I could just let my mind go free solving increasingly complex math puzzles. I had a supportive lecturer explain what actuarial science was (we didn’t really have internet then, I kid you not). I had my first internship at John Hancock in Boston, using my math brain in the business world was absolutely amazing and had me sold on this as a career choice.

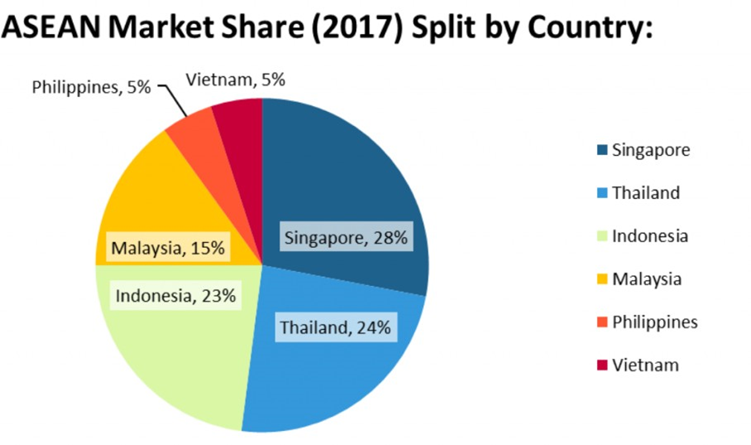

What I love about my work is the variety of projects we work on and in so many colorful and interesting countries. For example I am appointed actuary for insurers in Malaysia, Brunei, Hong Kong, Sri Lanka, Mauritius, Kenya, Tanzania, Burundi and Uganda. I also either currently or recently have been involved in projects in the Maldives, Saudi Arabia, Cambodia as well as others. There is such diversity in these countries in the products, regulations and style of business that I can learn in one country and use to assist other countries. One of my passions are Takaful, Islamic Insurance. Takaful instills ethics and religious principles into insurance, which is fascinating to me. In Takaful we must continuously think about what fairness means, which due to the complexity of insurance is something actuaries are well suited for. As religious traditions and even how Islam is perceived vary by country Takaful as well varies by country. To me this offers an amazing opportunity to understand how differing traditions and feelings about religion can effect technical issues and use it to find a solution which is just right for a country. At my current level I spend quite a bit of time training younger staff and clients which is another passion of mine.

To be an actuary you need to pass the actuarial exams. Most actuaries will pass exams from the US, UK or Australia. Other countries have their own exams such as Indonesia and Taiwan, but these are the main countries. Normally a degree in Mathematics or Actuarial Science is very useful in passing the exams, but not necessarily required. In the UK you can get exemptions for the lower exams based on your coursework so it is much more advantageous to be an actuarial science major as opposed to mathematics or anything else, but in the US there is a lot of potential diversity in degree choice. In the US the actuarial science degree program might be in the business faculty, mathematics or statistics, so this shows the variations in focus which is possible. There is no right or wrong choice here. For instance I was a mathematics major rather than actuarial science, and I know actuaries who were statistics majors as well as finance and economics. As long as you pass the exams you are fine.

So, what will you be asked in a job interview? Well, for me the first gate is your grades. I would normally look for a first class honors degree or a 3.5 grade point average with a few exams passed. From there I would want to know how well you can solve puzzles, as life as an actuary is full of unknown situations where you must dig down to truly understand the problem, and from there find solutions for the client. The ability to dig down into root causes of problems and issues is difficult to teach in school, so we really try to assess if this trait is a part of you. From there we would want to know about your personality and communication skills, as actuaries are only effective if we can get our message out. We regularly present at board meetings, so we can be completely 100% correct but if no one understands that they will simply ignore us and we have failed.

As an actuarial graduate you will start as an analyst, getting involved in the detail work such as data cleanup and basic calculations and experience studies in actuarial pricing, valuation and projections. I think one of the main lessons is that trust needs to be earned. We do not make machines, we work with ideas and use huge amounts of data and calculations. It is very easy to make mistakes so we must be methodical in order to gain the trust of others. Once trust is broken in can take a lifetime to gain it back! An analyst will work with data to ensure it is accurate, consistent with the data we used in the past and complete. We can have all the best calculations but if we missed some data we will still be wrong!

After several years of work experience and passing exams you will progress to being an actuarial associate. At this level you are moving from asking ‘what’ to asking ‘why’. Understanding the big picture is increasingly important, such as why we use the methodologies we use. Soft skills are just as important as technical skills at this level as you are communicating results to others as much as doing technical work. An important lesson in this stage is the need for sanity checks in everything we do. This is useful in catching errors as well as being able to explain ourselves to non-technical people.

The next level is a young qualified actuary. At this level ideally you are working with a more senior actuary learning how to make decisions: what do we do when data is not ideal? What are the risks in a business strategy and how do we quantify it? How shall we present the issues and risks to management to ensure the message is understood?

As a more senior actuary the work is amazing as we are routinely in situations where there is no right or wrong answer. A reality is that there is rarely one correct answer or way to do things, so we need to really listen to others, understand their situation and then decide with an open mind the reasonableness of the situation and risks.

Using UAE as an example, an actuary practicing in the UAE must show the regulator how we ensure our calculations and our reports are kept at a high quality and peer reviewed. This is a necessity in the work of the actuary due to the large volume of data and number of calculations. Some of the major work we are required to do in the UAE includes:

- Prepare reports on the Company’s portfolio of risks, loss ratio trends, capital adequacy, technical provisions, and availability of solvency requirements in the Company.

- Review the Company’s pricing policy for insurance products and the soundness of its underwriting policy in general.

- Review the sufficiency of reinsurance coverage and the appropriateness of liability retention by the Company to its financial capabilities and the structure of the risks portfolio.

- Assess the soundness of the investment policy applied by the Company.

- Review the financial position of the Company and the risks it faces.

- Set the technical basis for pricing new insurance products that the Company intends to market and specify the amounts payable to policyholders of life insurance policies upon termination thereof.

All of these points relate to risks in some way, understanding risks and using this understanding to help the insurance company succeed.

For Takaful companies in the UAE we also need to consider fairness:

- Review the level of contributions which the Company requires the participants to pay and whether they are based on sound technical bases.

- Review the loss ratio in the participants’ account, and in case of continuing losses in this account, the Actuary must conduct technical analysis to determine the reasons behind such continuing losses and whether they are due to the loadings paid from the account or due to the underwriting policy adopted by the Company or for both reasons. He must also present an annual report to the Company’s board of directors along with the measures he recommends to fix the problem.

- Review the investment policy applied by the Company with regard to investing the monies available in the participants’ account and present his findings to the board of directors.

- Review the bases on which the surplus in the participants account is distributed and present his findings to the board of directors of the Company.

- Review the Company’s policy in calculating the Wakala Fee and Mudarabah share, and present his findings to the Shariah Supervisory Committee and the board of directors.

These points make it clear that actuarial science is an integral part of Takaful in ensuring fairness and risk management.

Finally in the UAE if the actuary sees a situation which is likely to cause harm to the insurer and the insurers management and board is not taking the necessary actions the actuary must report this to the regulator. Thus we are performing work not just for an insurance company but on behalf of the policyholders. This job scope is typical of the actuary in other areas as well such as Malaysia.

I hope this helps explain what an actuary does and why I love my job so much. Feel free to contact me with thoughts or ideas or questions, hassan.odierno@actuarialpartners.com, www.linkedin.com/in/hassan-scott-odierno