A popular topic of discussion with our clients lately has been what the short and long term effects of Covid-19 will be on our actuarial work. Traditional year-end work in many of our markets has included the projection of solvency over the next several years, meaning as actuaries we need to make assumptions for the future. This article describes some of these discussions. Please feel free to email or comment on your own thoughts to keep the discussion going.

The most obvious aspect of our work is with morbidity experience such as hospitalization and major medical claims. The effect of Covid-19 will greatly depend on the market, as some markets as standard practice may exclude coverage for Covid-19. For instance in Malaysia we have a standard exclusion clause for hospital indemnity and surgical coverage for communicable diseases requiring quarantine by law. As a general guide those markets which were most affected by SARS in the past (early 2000’s) are more likely to have such exclusions in place. Of course some insurers have announced that they will still pay claims for Covid-19.

The next most popular topic of discussion has been with mortality and whether our current pricing accounts for black swan (extreme) events such as Covid-19. The reality is that the mortality risk for healthy lives is only significant for older ages, starting with ages above 60 and more pronounced for ages above 80. For healthy lives below 60 the excess mortality is unlikely to be significant. It is more unlikely for there to be exclusion clauses for deaths due to Covid-19. A small survey has shown HIV / AIDS to be the only widespread exclusion. Fortunately the mortality tables in many developing markets already have buffers built into the tables at higher ages. This is because when we build mortality tables we are dependent on the data underlying the table. It is common for insurance to be purchased by people from their 30’s to the 50’s as well as children as part of education insurance policies but less likely for older ages (and insurance is relatively newer in the developing world together with relatively high lapse rates, meaning less policyholders have become old). Thus when building mortality tables for older ages we tend to build conservatism in to account for the lack of data.

Substandard lives are a different issue. Some types of substandard lives are much more at risk due to Covid-19, in particular cardiovascular (heart) disease, chronic respiratory disease (such as asthma), diabetes, high blood pressure, kidney disease and cancer. It is quite possible that the current loadings are inadequate but again due to a lack of data current loadings are already likely to have some buffer to cover the potential increase in claims. It remains to be seen whether loadings for such substandard risks will be increased over the long term.

Another actuarial assumption is lapsation. Over the short term surely lapse rates will rise as policyholders struggle to pay bills due to quarantines, lockdowns and restricted movement orders. The effects of this will be mixed, as increases in lapsation means less policyholders will still be around to cover management expenses, but for those lapsing policyholders in many cases the insurance company will make a profit on the lapse (surrender). In the earliest policy years a lapse will cause a loss but in later years (especially after the third policy year) an immediate profit will arise. Generally speaking if there is a surrender value offered this surrender value will be set such that an immediate profit will result if a lapse occurs. We say immediate profit because long term there will likely be negative effects as the insurer’s embedded values will reduce due to the higher lapse rates. The exact effect(s) will depend on the reserving basis being used together with the surrender values given.

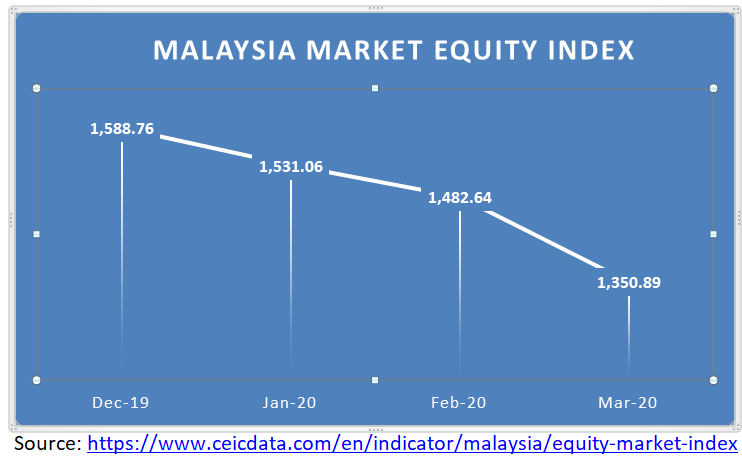

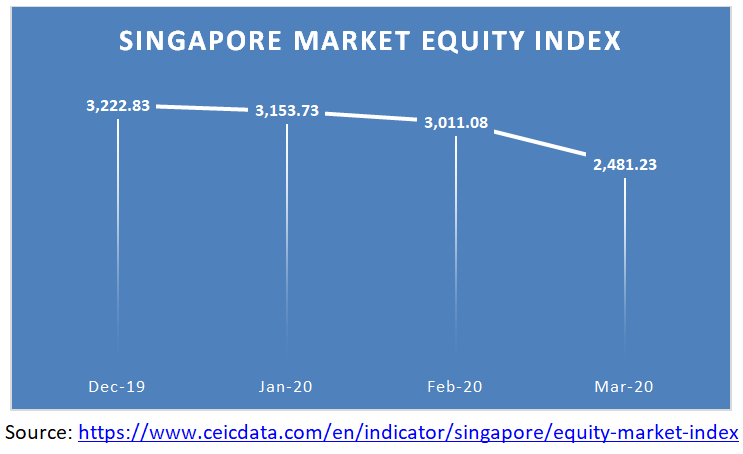

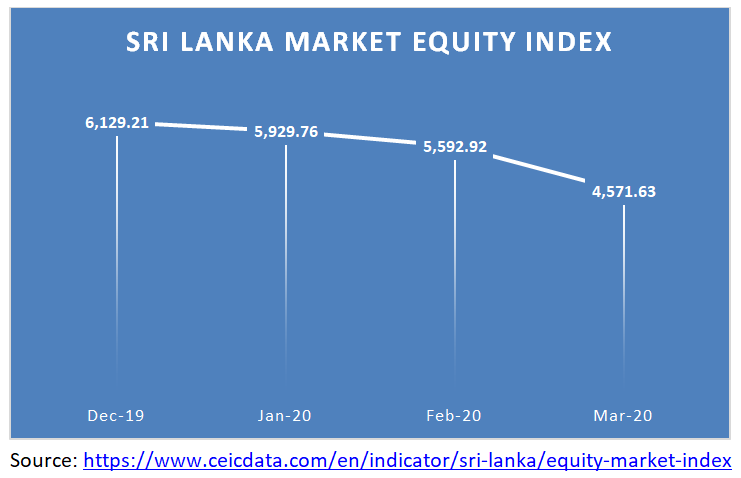

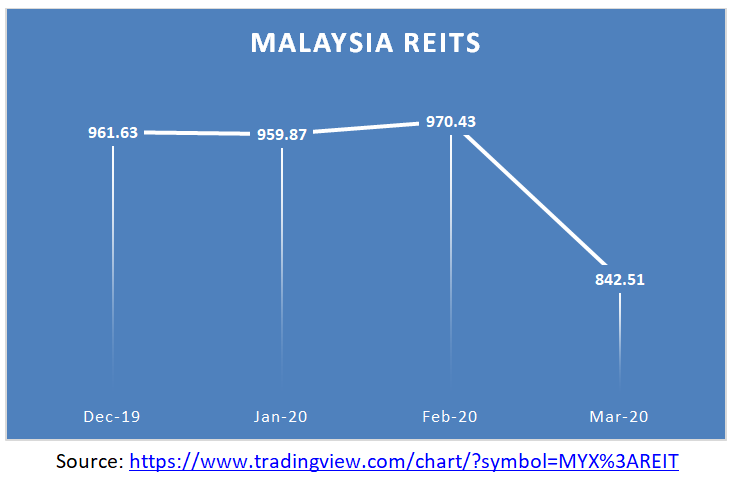

Over the short term insurers are likely to be badly affected by investment performance due to Covid-19. In countries with risk based capital solvency regulations the major asset class tends to be bonds, both government and corporate bonds. Stock markets as well are being hit. In Malaysia the stock market has gone down by approximately 237 points between December 2019 and March 2020. Other countries around the region have shown similar performance as seen in the diagrams below:

Even investments such as properties are potentially affected due to the inability of some tenants to pay rent.

The exact effect will depend on the types of insurance products which were sold. Those insurers with higher levels of guaranteed products and mismatched assets and liabilities are likely to be punished badly during these uncertain times, whereas insurers selling mainly unit linked products with no guarantees will fare relatively better, though they still will be receiving less income from such products as some fees depend on investment performance and unit values. A challenge for Takaful in particular is that since many of the unit linked policies which were sold were sold with a number of medical, unit linked and other similar riders attached there is a worry over sustainability of the policies if the investment climate does not rebound or is very slow to rebound. A similar worry is that for many Takaful operators Mortgage Reducing Term Takaful is a very significant part of the business inforce. This business is sold with a single contribution and an implied (or formal) guarantee of coverage (and little to no buffer to cover shortfalls in investment returns).

In our actuarial projections there is a very close connection between the projection of management expenses and the projection of new business. To be precise we hope that the total loadings for management expenses through increasing levels of new business grows higher than the growth in management expenses. During periods of restricted movement it is very likely that the agency force will be unable to sustain sales growth due to the current focus on face to face discussions. The extent of the challenges will depend on the level of “digitalization” of the insurers’ processes. It remains to be seen if marketing and advertising reduces accordingly in order to maintain the connection between growth in total loadings for management expenses and the management expenses themselves or if marketing and advertising expenses increase to assist agents in these difficult times. For those insurers who depend on the sales of mortgage reducing term policies, they are likely to face difficult times in the short term.

Longer term things look very different. In Malaysia even over the course of the one month restricted movement order we have seen so many online businesses sprouting up literally overnight. This newfound convenience will surely continue to fuel the growth of online business. It will be up to insurers to take the opportunity to rework processes to allow agents and policyholders to do more things online. As more businesses are online the ability to link insurance coverage online will correspondingly increase. This will also be fuelled by an increased awareness of the need for risk management. Finally, we truly hope that there will be a quantum leap in the awareness of the need for consistent savings. This in turn can only be good news for insurers, especially those insurers willing to innovate into new designs and structures to help the bottom 40% of wage earners (B40) save regularly and manage their risks.

We would love your thoughts and comments. Please email the author at Hassan.Odierno@actuarialpartners.com or https://www.linkedin.com/in/hassan-scott-odierno/