In April I wrote a critical piece on the MASB’s Paper (the Paper) outlining their latest iteration of how takaful should be accounted for under IFRS 17. I ended the paper by alluding to the material change a Takaful Operator (TO) can expect in its financial results in the transition from IFRS 4 to IFRS 17 should the MASB’s proposed basis be accepted by the TOs.

In this note I will first analyze the current accounting for takaful under IFRS 4 and explain what will change from an accounting and financial perspective should the proposed basis be adopted. This would not be an exhaustive list as the intention is to highlight certain aspects of the Paper which need our attention. I will then finish off the note by giving my thoughts on whether this change in financial perspective would be appropriate, considering the objectives of the IASB in crafting IFRS 17.

Let us start with the current accounting basis which is IFRS 4 compliant. Under IFRS 4, takaful is accounted on a columnar basis: one column for the TO, one column for the Takaful Fund (TF). The Takaful Operator Fund and the Takaful Fund would consolidate into the Company Fund. This consolidation is necessary under IFRS 10. The objective of IFRS 10 is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. By accepting that IFRS 10 applies in the TO’s IFRS 4 financial statements, the accounts indirectly give recognition that indeed there are two separate entities within the one company, the TO and the TF. This recognition is missing under the Paper; in its place is the (one) Takaful Entity (TE) column which accounts for the takaful business as insurance (Appendix C, Para 9 of the Paper), practicing risk transfer. The TO (if shown) and the TF columns are only there as it provides information required by the reader of the accounts.

This is a fundamental change in the presentation of accounts for TOs. If accepted it makes a strong statement that from an investor’s perspective (investors are the primary readers of the accounts) takaful should be accounted the same as insurance. The implication of this to an investor would be that any investment decision should be based on the figures gleaned from the TE column and, to a creditor, any valuation of the credit worthiness of the TE would need to consider the financials as presented in this column.

IFRS 17 will change how management run their insurance business. Life insurance will be more affected with the implementation of IFRS 17 than general insurance. Life insurance revenue will reduce, significantly in Malaysia, as insurance revenue will be stripped of its investment component. The timing of emergence of profit for the investors will also change as profits would now be earned as service is provided. There will also be greater transparency as to where profits and losses are expected to emerge. All these are good for the investors though initially there may be a downward rerating of the business; a “healthy” insurer reported under IFRS 4 may not be so healthy when seen through the lens of IFRS 17. What IFRS 17 brings to insurance is greater transparency and accountability. But remember, IFRS 17 was designed for insurance, not takaful. So, what does IFRS 17 accounting, as proposed in the Paper, promise TOs? Let us start with how takaful is currently accounted under IFRS 4.

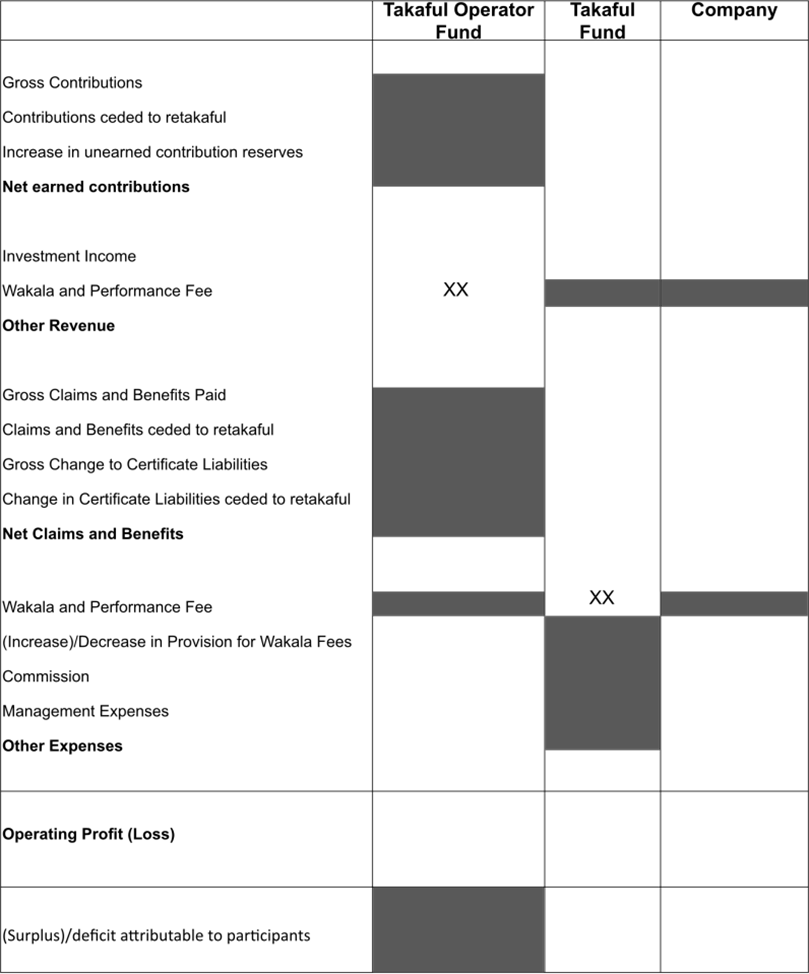

If we consider the current typical format of the Income Statement for a takaful operator (see below) the flow of funds is clear and is in accordance with the takaful operating model (bar one entry which I will comment on).

Table 1: Takaful Company Income Statement

The shaded cells in the Income Statement are not applicable for the column while the XX entries denote the interfund cash flows.

The reader needs to consider the following when analyzing the presentation above:

- The Income Statement follows the cash flows other than the presumption that all the Contributions first flow to the TF. As a result of this assumption there is a need to also assume that a portion of this gross contributions, being the wakala fee, subsequently flows to the TO. The performance fees in this presentation resides as part of the line item for wakala fee (XX in the presentation). Depending on the takaful operating model, there can be several other components to this performance fee, for example investment performance fee levied on the Participants Investment Account, which is due to the TO in addition to the initial wakala fee deducted from the gross contributions. Not every TO follows exactly this presentation format. In many TO accounts, performance fees are instead labelled simply as surplus sharing to the TO. Notwithstanding this portrayal of the performance fees, it is important to remember that the takaful operating model in Malaysia is primarily the wakala model under which the TO is entitled to various fees for managing the TF and does not share in the surplus or deficit in the TF. This is clearly set out under the Takaful Operating Framework (TOF).

- We now turn to the technical reserves. Firstly, what are these technical reserves? In the Income Statement above there are two technical reserves relevant to the gross liabilities of the Company, namely: Gross Change in Certificate Liabilities and Increase/Decrease in Provision for Wakala Fees. The former represents what needs to be set aside in the TF from the contributions after deducting the wakala fee to meet liabilities underlying the takaful contracts. The latter provision represents what needs to be set aside in the TO from the wakala fees to meet the future expenses. Under the current basis the technical reserves do not include any expected future surplus distribution to the participants.

There can be a big difference in the results of these calculations depending on how the wakala fee is set. The important thing to understand is that the required technical reserves, and by implication the profits accruing to two different TOs, for the same contract and under the same set of assumptions as to future experience, can be markedly different depending on how much wakala fee each TO takes from the gross contribution. This is primarily due to the different ways that profits are attributed in the TO and TF under TOF.

- The technical reserves are calculated off balance sheet by the actuary using assumptions as determined in accordance with BNM RBC guidelines. This includes using the latest non-financial and financial assumptions. Thus, the impact of changes in the assumptions gets immediately reflected in the Income Statement. Unlike under IFRS 17, there is no CSM to cushion the impact of any changes in non-financial assumptions. Also, importantly, the impact of changes to financial assumptions are reflected separately in the two different funds, the TO and the TF, and thus the impact to profits from changes in these assumptions is correctly accounted in each Fund.

- Under the current accounting basis, investment income from the TO fund and TF also accrue separately. Given the different asset allocation strategy followed in each fund, the rate of return is unlikely to be identical for the two funds. Again, this is important from a profit attribution perspective as, while the TO is entitled to all the investment profits arising from the TO fund, participants are entitled to all investment profits emerging from the TF (net of any performance fees).

Applying IFRS 10, the Company Income Statement column is then simply the consolidation of the TO and TF columns. A question I would pose to the reader now is, would it be appropriate to change the way in which the Company column under the current accounting convention for takaful is presented, from one which is a consolidation of the results from the TO and TF columns to one which treats takaful as insurance? Under the latter the Income Statement is reengineered, effectively treating the Company as an insurance company rather than a takaful company.

The MASB has not outlined in detail how the TE column in its Paper will be constructed other than to state in paragraph C6 that it is to be accounted as insurance services under IFRS 17. The premise made under the Paper is that there is only one contract in play notwithstanding the separate funds. As there is one contract there will be one CSM. There will also be only one Best Estimate Liability (BEL) for each contract, and this technical reserve would incorporate all cashflows, expected expenses and claims. The fulfilment cashflows to determine the BEL unlike under IFRS 4 will also include the surplus expected to be distributed to the participants. The performance fee would not be in the fulfilment cash flow and so would accrue as part of the CSM. Importantly the Risk Adjustment (RA) attached to all the non-financial cashflows would fall as profit to the Company if actual experience equals expected. The RA is the compensation the Company requires for bearing the uncertainty on the amount and timing of the cashflows that arise from the risks as it fulfils its obligations under the insurance contracts. Thus, variations in actual claims experience from expected whether it gives rise to an underwriting profit, or a loss, also accrue to the Company. In addition, the difference between the actual investment profit (under both the TO Fund and TF) and the expected investment profit, would also flow to the Company’s Income Statement. Finally, changes in the financial assumptions used when recalculating the BEL would flow directly to the Income Statement, increasing or reducing the profits accruing to the Company in the year.

It is obvious from the above that if the recommendations in the Paper were to be accepted by the takaful industry, then the accounting representation of the economics of the takaful contract would be distorted. As explained in the first note in this series, the economics of takaful can be determined by first identifying who benefits under the contract, then just how do they benefit and finally, by how much. I believe it is not the intention of the authors of IFRS 17 to change the business model of the entity adopting the standard, rather more to make the accounts of the insurance business of the entity more transparent to the reader of the accounts. In takaful the insurance business is conducted in the TF and, as such, this is where the standard should be applied and this is where the standard should be confined to.