Since the introduction of IFRS 17 in May 2017, Actuarial Partners (AP) has expanded time and energy to determine how the standard could apply to takaful. This is important for takaful companies in Malaysia as, unless explicitly exempted, they are required by Bank Negara to comply with all IFRS standards. Unlike AAIOFI, the IASB standards are designed to cater for conventional finance, not Islamic Finance. As such, applying IFRS standards to Islamic Finance, including takaful, can be challenging but not impossible as the Standards tend to be principles rather than rules based.

This note outlines our journey so far. The journey has been challenging and frustrating at times but never boring! As a start, perhaps it would be instructive to first outline our reading of the position of the various stakeholders in this journey. When I say stakeholders, I refer in particular to the accounting profession, the takaful operators and the regulator, Bank Negara Malaysia. From the various discussions we have had with the various stakeholders, we infer that the accounting firms in Malaysia are generally of the opinion that takaful involves a transfer of risk from participants to the operator, and as such should be accounted for like any insurance company. Their view is based on the ability of the Tabarru’ fund (where the participants’ insurance risks are pooled) to call upon a qard from the operator, should its liabilities exceed assets.

I believe the accountants are approaching this question from the wrong aspect, perhaps because they do not fully understand the concept of takaful as practiced in Malaysia. I believe the right way to approach this is first to look at the economics of the contract. What I mean by the economics of takaful is identifying who benefits under the contract, then how do they benefit and then by how much. Only after this has been carefully articulated and understood, will we see how the principles expounded under IFRS 17 can be fitted into the takaful economic model.

To date and from our observations of events that have transpired, the takaful industry as a whole has just not put much effort to do this. As preparers of the accounts, this is their responsibility; the auditors’ role is simply to confirm compliance. At this time, we suspect that the preparers are simply passing on their responsibilities to the accountancy firms. This could be due to several factors:

- The preparers (i.e. takaful operators) are part of a Group which includes insurance companies. The Group, in turn, is putting all their resources into applying IFRS 17 to insurance and is not inclined to want to spend too much time or effort on takaful which, after all, is a small percentage of their total business. Thus, they are quite happy to follow the path suggested by the accountants.

- The accountants point to the fact that the smallest unit of account is the contract, and in takaful, there is only one contract even though the contribution is split into two, one part to the operator’s fund and another to the participants’ fund. However, in determining this smallest unit of account, they are not giving proper interpretation to the definition of a “contract” as set out in the Standard (see later).

Given the above, the default approach in applying IFRS 17 to takaful is then to simply account at the entity (i.e. company) level, thus moving away from how takaful accounts are currently prepared under IFRS 4 which shows three columns; Operator, Participants and Company. While the accounts would only show the entries at the entity level, there would be some disclosures to the notes of the accounts. However, from our observations of the draft proposed notes to the accounts, the “disclosures” do not make reference to the main accounts, rather they are more “statement of facts”. This absence of more comprehensive disclosures in the notes of how the takaful business is progressing is, in my opinion, due to reluctance on the part of the accountants to dilute the financial results as set out at the entity level (entity being the company).

For example, when the proposed disclosures refer to takaful, they propose to disclose only the assets in the Participants’ Risk Funds (PRFs), not the liabilities (this disclosure is voluntary). There are no disclosures of the surplus standing in the PRFs. The proposed disclosures also mention takaful benefits “shared” (a reference to risk sharing perhaps?) which is the first time I have heard this terminology used in takaful accounts. The proposed disclosures do show the wakala fee but this is not set against expenses and thus, does not disclose the surplus arising in the operator fund from being a wakeel. All these are important information to the reader of the accounts in order to understand the “economics” of takaful but there are serious gaps in the information provided and whatever information is being disclosed does not provide an understanding of the progress of the takaful business.

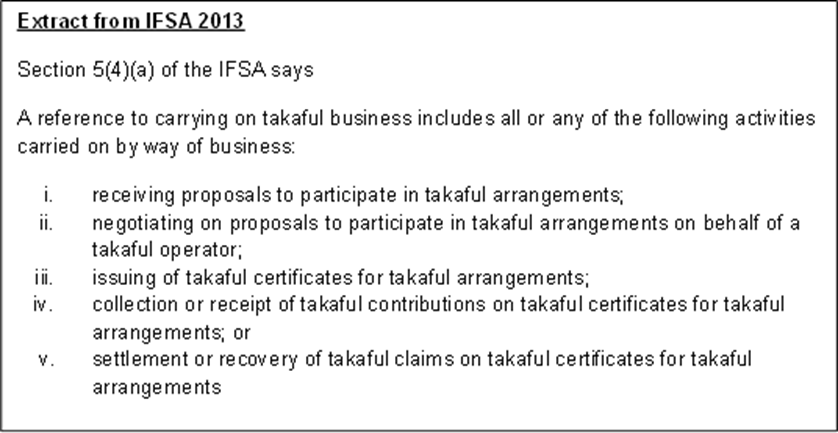

AP’s view on the practical application of the takaful contract is that, although there is only one contract underlying a takaful policy, there are supporting regulations that clarify the existence of two separate “services” under the contract, one being the risk sharing among the participants, the other referring to the takaful administration business being conducted by the operator. As defined under the Islamic Financial Services Act 2013 (the IFSA), takaful business does NOT include the underwriting of insurance risk (see section 5(4)(a) of the IFSA, extracted below). The requirement for a qard only comes under section 95 of the IFSA and is mentioned as a financial support which does not necessarily have to come in the form of a qard from the operator (e.g. the operator can provide a guarantee of a loan to the takaful fund from a bank).

Added to this, IFRS 17 has a definition on what exactly a contract is and I reproduce this statement below:

Contracts can be written, oral or implied by an entity’s customary business practices. Contractual terms include all terms in a contract, explicit or implied, but an entity shall disregard terms that have no commercial substance (i.e. no discernible effect on the economics of the contract). Implied terms in a contract include those imposed by law or regulation.” IFRS 17

The accountants may then pick on the part of this statement, which says “but an entity shall disregard terms that have no commercial substance (i.e. no discernible effect on the economics of the contract)” to argue that the movement of funds between the operator and takaful funds as simply inter-fund transfers and is of no economic value. However, I would counter argue that the split of the takaful contributions, the different ownership of the funds under the takaful model, HAS a discernible effect on the economics of the contract. The truth of the matter is the financial results to the operator would be different if accounted for as insurance as opposed to as takaful.

Shariah is another important stakeholder in these discussions. It was our understanding that although many takaful Shariah scholars have approved the application of the single entity accounting under IFRS 17, this approval was conditional on the “missing columns” being disclosed in the notes to the accounts. Obviously then, the content and format of the proposed notes were not shared with them. AP has referred a draft version of the proposed notes to the accounts to a group of takaful Shariah committee members and there was a unanimous agreement that the notes were insufficient as they do not convey the essence of takaful. While there is no Shariah prohibition on IFRS 17 in general, there is the issue of possible misrepresentation (which is one of the responsibilities of the Shariah board, to prevent misrepresentation of the takaful business to the stakeholders) without a detailed disclosure of how the takaful model is applied.

What are Bank Negara views on this? We understand that Bank Negara is very concerned that the presentation of the IFRS 17 accounts would not be Shariah compliant. In particular they are concerned that the presentation:

- Does not reflect the role of the takaful operator as only the wakeel of the participants, not the underwriter of the risks.

- Is not clear that the takaful operating model is one of risk sharing and not risk transfer.

- Is not sufficiently transparent and does not accurately reflect the different ownership of the various operating funds in takaful.

- Is not clear as to how surplus is being generated and how surplus is being distributed.

Indeed the journey is not over.

What is important is that the various stakeholders need to agree on the basic principles of takaful and the difference between takaful and insurance. Only then can we come to an agreement as to how takaful should be treated under IFRS 17.