There has been only a handful of takaful M&A to date in any jurisdiction and the issues are only going to be even more difficult to resolve for want of any international standards to follow. How can M&A happen in the takaful space and what are the complexities that have to be considered? Mr Zainal Abidin Mohd Kassim of Actuarial Partners Consulting offers some solutions.

The number of takaful operators (TOs) globally has grown exponentially, but very few have actually achieved critical size. Many TOs currently experience expense overruns where expenses incurred are in excess of what their contracts can support.

In some jurisdictions, the wakala (agent) fees charged are higher than justified by pricing, leading to the takaful risk pool incurring deficits. This arises in particular with general takaful where TOs price their products according to market but choose not to limit their wakala fees to what such market rates can support.

TOs are increasingly competing not just with other operators, but also with conventional insurers. This can either be through the insurer’s takaful windows or just similar insurance products. Because insurance is a volume game, TOs are at a severe disadvantage as many of them are only recently set up and thus are far from achieving critical size. To overcome this disadvantage, TOs may look to M&A to gain the competitive edge.

The types of M&A activities possible in the takaful space can take different forms, each with differing issues that need resolving.

Type A: M&A between 2 takaful operators

This happens when two TOs decide to merge their operations. Unlike M&A between two insurers which will see the merger of two balance sheets, a merger between two TOs will see the merger of at least four balance sheets, two TOs’ funds and two participants’ funds. Issues which need to be addressed include:

- The treatment of any outstanding qard (interest-free loan) in the two shareholders’ funds;

- The treatment of any undistributed surplus in the two participants’ funds; and

- Differences between the takaful models currently practiced by the two TOs.

These issues need to be addressed from two perspectives – Shariah and actuarial.

From the Shariah perspective, akad (terms of agreement between the TO and the participant) is key in the fiq muamalat (commercial transaction) context. The Shariah board of the TOs can be quite strict in certain aspects when it comes to changes in akad and, in some jurisdictions, the regulator places additional requirements from the Shariah perspective when it comes to M&A.

As an example, some Shariah scholars forbid the write-off of any outstanding qard. This can be an issue as the merged entity would then need to consider how the outstanding qard should be repaid, for example, whether it should be repaid before the merger (which is unlikely) or subsequent to the merger. If done subsequent to the merger, will it be repaid from the consolidated participants fund or should the participants’ funds not be merged until the full amount of the qard is repaid?

Another issue is the question of the treatment any surplus retained in the participants fund. Should it be distributed to existing participants prior to the merger, given to charity, or transferred to the consolidated participants’ fund? These issues have to be addressed from the actuarial perspective (equity) and the Shariah perspective (fiq muamalat).

Type B: M&A between takaful operator and takaful window

Type B refers to the M&A of a TO with a takaful window. The issues raised under the Type A merger are also relevant here.

Other issues that arise depend on whether a TO absorbs a window or vice versa.

If a TO were to absorb a window, the M&A is made easier as what is needed is just a transfer of the window’s takaful fund to the TO’s takaful fund. These assets would need to be Shariah-compliant and acceptable as such by the receiving TO’s Shariah board. Any qard due to the insurer from the takaful fund would remain with the insurer which housed the window as there is no merger of shareholders’ funds.

Converserly, it is more complicated if an insurer were to absorb a TO’s business into its window. Can the insurer just acquire the TO’s takaful fund? This can be problematic as the wakil (agent) is being changed from a fully Shariah- compliant operation to a window operation. What about the shareholders’ fund of the TO? Would that be absorbed into the insurer’s balance sheet? Also, what should be done with qard accrued by the TO’s shareholder’s fund?

When two insurers merge, their shareholders’ funds are combined. This raises the question of the accounting treatment of qard in the insurer’s consolidated balance sheet when it absorbs a TO.

A possible solution would be for takaful windows to follow “conventional accounting standards” and the qard be written off. The Shariah board of the window may be open to this option as their responsibility only starts when the takaful fund is absorbed in the window. On the other hand, the Shariah board of the TO may not have a say in this as once the TO is sold, their responsibilities are terminated.

So perhaps by default no Shariah issues arises on the qard but only those issues highlighted under the Type A M&A remains when an insurer housing a window acquires a TO.

Type C: M&A between takaful operator and insurer

This type of M&A is interesting as it raises the valid question of why a TO would want to merge with an insurer. The scenario may arise if the merged entity intends to set up a takaful window.

The answer is that such an M&A automatically results in the reduction of the per-unit cost of maintaining both the takaful products and the insurer’s products. It may happen, for example, in Pakistan which recently allowed the setting up of windows.

With the entry of windows, existing TOs may find their business model no longer competitive and see a strategic merger with an existing insurer, which is considering setting up a window, as a means of remaining competitive.

Under these conditions, it may be appropriate to outsource the management of the TO to the insurer instead of merging the funds.

By doing so, the takaful fund of the TO becomes the de facto “takaful window” of the insurer and the TO’s shareholders’ fund becomes just a source of regulatory solvency capital as all expenses are met through the outsource arrangement.

This type of merger may also make sense if the insurer is seeking to convert its business model from insurance to takaful.

In such an M&A, the insurer and the TO would merge their balance sheets and any qard can be transferred to the new entity. What the “new” TO can do is to seek dispensation from its Shariah board to runoff the combined entity’s existing conventional insurance business.

How to value in an M&A

In any M&A, there will need to be a purchase-and-sale arrangement where one shareholder compensates the shareholder of the other for the “value of the business” transferred.

In actuarial terms, this is made up of two portions: the embedded value (the value attributable to the existing book of business) and the structural value (the value of the “goodwill” or the value of the existing franchise, primarily the existing distribution and products).

Additional factors to be considered when an M&A involves a TO or takaful fund include:

- What credit to give to shareholders for any existing qard?

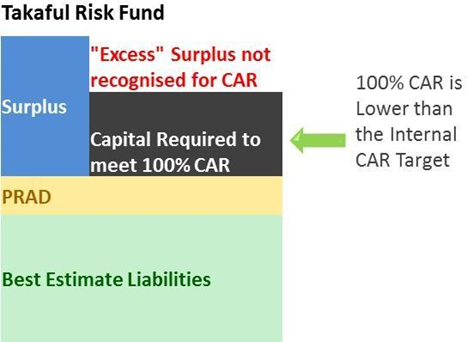

- How to value the expected surplus emerging from the existing block of business when calculating the embedded value and how to value the expected surplus from new business when valuing structural value?

- Should the buyer (or for that matter, the seller) factor in a change in the existing takaful model when determining the structural value? This is because for the same premium/contribution rate for a particular product, the structural value to the TO would be different. Changing variables such as wakala fee would also change the structural value even if the takaful model remains unchanged.

- What credit should be taken for any cost savings of the merged entity?

It is clear that M&A in takaful is more complex than those in conventional insurance. There has been only a few M&A involving takaful to date in any jurisdiction and the uncertainties are only going to be more difficult to resolve as there are no international standards with which to follow.

Proper actuarial and Shariah consultations is therefore crucial before undertaking such a venture.