Introduction

This project has started from two very diverse initiatives. One is a microinsurance project we have been assisting a client on for Malaysia and the other is our work helping to run a food bank in our home state of Negeri Sembilan Malaysia.

Microinsurance is a sexy topic at the moment in Malaysia, as there is a strong desire by our regulators to increase the insurance penetration in the country. The most straightforward way of increasing insurance penetration is to grow microinsurance, as this is the means to reach large numbers of people in the shortest time. This is also the means to reach the people who need insurance the most. In terms of the segment of the market we are talking about for microinsurance, this is what is called the B40 in Malaysia, the bottom 40% of wage earners. To be precise, the bottom 20% of wage earners probably do not have sufficient disposable income to afford insurance of any sort, so government initiatives will need to be sufficient, as well as the initiatives of insurers such as PruBSN who are using zakat funds as well as donations from policyholders. The key market segment for microinsurance is the market just above the bottom 20%, namely the rest of the B40 and the lower part of the M40 (middle 40% of wage earners).

Of course, to truly succeed in microinsurance we need to segment this portion of wage earners much more finely. For instance, this market segment includes government workers (with generally very good insurance coverage already), factory workers (also with reasonable insurance coverage), gig workers, industries such as farming, fishing and plantations as well the self-employed with virtually no insurance whatsoever and significant risks to be insured. For each of these segments we will need to determine very precisely the risks they are facing and how insurance and other services can help overcome those risks. We will also need to determine how to access the market, as high commissions and marketing costs will destroy the product. Beyond that we will need to determine how to administer the product including claims management to be as straightforward as possible. All of these will vary depending on the particular market segment, but hinge on one thing: the ability of potential participants of such a microinsurance scheme to recognize the value of insurance in their personal risk management, i.e. financial literacy.

A separate initiative has been the development of a food bank in Negeri Sembilan. Through this initiative we have collected volunteers from around the state representing various segments of the market who truly need us: Malay, Chinese, Indian, Asli (natives), Muslim, Christian, Buddhist, Hindu, Sikh and more. We have targeted a wide variety of volunteers as this ensures that we reach all segments of the needy in the state. We have been collecting vegetables, fruits and bread which are about to expire from major supermarkets across the state and getting them to the needy. In 2021 we delivered 54,000 kg (59 tons) of food to the needy. We also deliver other provisions such as rice, cooking oil, sugar and whatnot to the particularly critical needy. We also assist the needy to find the services they might be eligible for and getting work where possible. We have found a few characteristics of the needy, namely families with:

- Disabled family member

- Single parent family

- Applicant living alone without support

- Breadwinner unable to work

- Elderly without children support

- Family with poor living condition

- Family with chronic medical problems

- Family with a lot of children / dependents

These needy families are people who have fallen through the cracks, where government and other programs simply are not sufficient. We assist them with their immediate needs, though for longer term plans we firmly believe that increasing the education level, particularly financial literacy, is key, along with encouraging a love for knowledge.

Covid 19 has truly exposed the challenges of this market segment in children’s education. The government has done an admirable job of trying to ensure no children are left behind, but this doesn’t take away from the fact that whereas some children have been using nice computers and laptops for online classes, this has been extremely challenging for the lower communities. Thus we simply must instil a love for learning and education among the youth, as we firmly believe that with a love for learning and education needy families will have a better opportunity to move up the social ladder. Better education will lead to wider work opportunities while concurrently increase financial literacy including insurance.

Thus our modest goal is to start with developing a love for mathematics in our own state, focusing on using mathematics to increase financial literacy. We hope that as a love for mathematics grows this will lead to increasing interest in other subjects as well. We also hope that success in our state will eventually lead to replications of these programs, nationwide and lessons learned being applied outside Malaysia.

Financial Literacy

Bank Negara Malaysia (BNM) recently released the Financial Sector Blueprint, 2022 – 2026. The goal of this blueprint is to assist Malaysia’s economic transformation, elevate the financial well-being of households and businesses and advance digitalisation of the financial sector. Besides that, it aims to position the financial system to facilitate an orderly transition to a greener economy and advance value-based finance through Islamic finance leadership. One interesting point from the Blueprint is the mention of Malaysia’s financial literacy score and comparison with other countries. This score is from an international survey of adult financial literacy, organized by the OECD. The survey measured three elements of financial literacy:

- Financial knowledge

- Financial behaviour

- Financial attitude

These three elements represent three concrete goals for increasing financial literacy. In connecting this to the goal of growing a love for learning in general and mathematics in particular, any efforts we make must focus on increasing financial knowledge. Through this increased knowledge and awareness, behaviours and attitudes will change. Of course there can be other programs on changing behaviours and attitudes, but our focus will be on knowledge. From the 2020 OECD survey, the following are the countries with the top financial literacy scores and splits by the three elements:

Table for Top 3 Scores based on each element

Case Study – Hong Kong:

Hong Kong takes the lead in financial literacy score due to their overwhelming score in financial knowledge. However, challenges remain in their financial behaviour and attitude as they fall behind slightly as compared to other countries. According to a survey done by MWYO on the Youth Financial Literacy in Hong Kong, a majority of respondents (67%) are not regular savers, and roughly one-third do not see the benefit in saving. Respondents’ top financial objectives also include short-term goals such as tourism and purchasing consumer items. In terms of culture, Malaysia is very similar to Hong Kong making their experiences very valuable to us and, therefore, replicable in Malaysia.

The Investor and Financial Education Centre (IFEC) in Hong Kong created a number of interactive financial education tools that are now available on the IFEC website.

Among the tools that are available include:

- A Budget Planner

- Money Tracker

- Savings Goal Calculator

- Cut-back Calculator

- Debt Calculator

- Net Worth Calculator

- Retirement Planner

- Budgeting spreadsheets

Interactive financial health check in which users may input information about their own financial condition and receive advise

Source: https://www.ifec.org.hk/web/en/tools/calculators/index.page

It would be very useful to have such tools available in Malaysia, so NGO’s and others can use them to increase the financial literacy of their targeted segments of the population. A net worth calculator and budget calculator can be found on the Malaysian Financial Planning Council (MFPC) website. From an education point of view, it would be useful for students to understand the mathematics behind the above concepts.

Another initiative of the IFEC is hosting competitions from time to time to encourage financial education (Latest one being “The Chin Family Tour Guide Challenge”)

Source: https://www.ifec.org.hk/web/en/other-resources/activities-and-events/money-challenge-2021.page

We feel such competitions can be successfully replicated in Malaysia.

Case Study – Slovenia:

In terms of cultural differences, Slovenia and Malaysia are worlds apart. Nevertheless, their success in financial education can be a very valuable experience for us to learn from. In recent years, Slovenia has placed upmost importance on financial education. This can be seen in the exponential increase of number of people reached indirectly during the Slovenia Global Money Week from 8,550 people in 2018 to 80,000 people in 2021, an impressive tenfold increase over a 3-year period.

We are particularly interested in their financial education schemes designed to specifically target population of different age groups which include:

- children in nurseries;

- children in primary school;

- young persons in secondary schools;

- young adults in higher education schemes;

- young adults outside the formal education system;

- employed adults;

- elderly; and

- education that must meet specific needs of individual target groups

This is a very diverse set of target groups. In our project we will be targeting children in primary school and young persons in secondary schools. We will split these two target segments into upper and lower grades, making 4 distinct target groups.

One aspect of the efforts in Slovenia led to research on the existence of financial literacy keywords in the syllabus and materials taught in schools. A result of that research was a listing of the following areas of financial literacy which should be covered by financial education:

- money and transactions (paying, purchase, credit cards, bank account)

- planning and management of finances (budget, yields, lending of money, etc.)

- risks and profit (investments, insurance, instalments, interest rates, currencies)

Current efforts in financial literacy in Slovenia focuses on the first aspect, money and transactions, and less on the other aspects. These three areas would be just as relevant for Malaysia.

Sources:

- Government efforts on financial education

Source: https://www.gov.si/en/topics/financial-education-2/

- Global Money Week initiative reached a lot of people

Source: https://globalmoneyweek.org/countries/77-slovenia.html

- Research on School Curriculum in Slovenian Elementary Schools

Case Study – Austria:

Austria is one of the countries that rank tops in terms of financial literacy across the survey. It also has one of the highest living standards and in the OECD countries, making it a good role model to learn from. Although financial literacy is not compulsory in schools, Austria still manages to achieve great success in their financial education mainly due to the exemplary cooperation between the public and private sectors and the active role of the financial regulator.

Financial education in school has specialized competency descriptions, which are given below:

- having sufficient basic and key competences to orient and participate in economic life;

- knowing the basics of establishing and managing a household as one’s own responsibility and taking into account one’s personal life situation;

- being able to reflect on one’s personal needs, economic possibilities and values;

- knowing the basic rights, duties and options as consumers when concluding contracts;

- being equipped with sufficient basic mathematical skills to be able to manage personal finances, make decisions tailored to one’s own economic circumstances and make provisions for the future;

- knowing the extent and effects of the use of digital data and their interconnectedness, and responsibly manage one’s personal data.

In terms of teaching methodology, it emphasizes in particular that the beginning point of teaching financial literacy can be the everyday life of students, and that they should be taught to reflect on their own behaviours. The topic should make people more conscious of their own acts and the repercussions of those actions. These same points would be useful for Malaysia, and a similar focus on the everyday life of students.

Currently, a total of twenty-six stakeholders which include business and consumer organisations, consumer protection agencies, NGOs, museums, etc assist the teaching of financial education in schools of all levels, either directly through their presence in schools and by welcoming students to their premises, or indirectly through the production of pedagogic resources for instructors or teacher training. For our project, incorporating other stakeholders into the training aspects would definitely be helpful.

Teacher’s training is a key component of successful financial education in schools. In Austria, a framework for the teaching of financial education in schools has been provided and it applies to Austrian institutions responsible for teachers’ professional development. Several initiatives have also been designed, one of it being Euro-Prof’s by the Central Bank of Austria (OeNB). This initiative can be attended by university teachers or as part of continuous professional development at OeNB premises. We similarly agree that a key feature of anything we do will be educating teachers.

Austrian National Financial Literacy Strategy implementation (2021-2026)

Life stage approach & priority audiences

8 life stages identified

- Attending School

- Higher education and life-long learning

- First job

- Working Life

- First major purchase

- Planning for the future

- Family Life

- Enjoying senior years

Our project will focus on education while attending school, teaching concepts related to financial literacy for the remaining 7 stages.

5 priority target groups

· Children and Young people, age 6-19, attending schools in the Austrian educational system (YS)

- Young people outside of schools and young adults (14-mid 20s) (YO)

- Women (W)

- Working adults and small entrepreneurs (WAE)

- (Potential) retail investors (RI)

Whilst we feel these five priority groups are also a priority in Malaysia, especially women, our focus would be on children and young people attending school. Having said that, particular issues relating to women will be incorporated into our project.

Key efforts

1. Online self-assessments

o Wissenstest

- Developed by OeNB

- Based on the questions in OECD/INFE Toolkit to measure financial literacy and inclusion (OECD, 2018d)

- Allows a comparison between the user’s financial literacy and that of a reference group based on age, gender, highest educational qualification and federal state

- Intended to raise awareness of one’s financial literacy levels

The idea of an initial assessment to raise awareness of one’s financial literacy levels is excellent, and something we intend to incorporate into our project.

o Second test

- Developed by two private sector institutions, ING and Three Coins

- To help one get a better understanding of ones own financial personality

- Get hands-on tips to adapt their own financial behaviour based on the test result

This more advanced test, conducted after a period of initial training and lessons, is also excellent to help maintain interest in developing financial literacy.

2. Consumer websites and calculators

o Finanz ABC

- Website developed by the Financial Market Authority

- Help consumers and investors to make financial decisions according to their financial situation, needs and goals

- To meet needs of population, tool offers information based on complaints filed by consumers, and helps them navigate the offers by banks, insurance or investment companies and comprehend the risks of the product available in the Austrian financial market

Incorporating such a tool into the project will provide real life skills relating to financial literacy in Malaysia.

3. Budget Tools

- Developed by ASB Schuldnerberatungen GmbH on dedicated websites

- The budget calculator & templates used by debt counselling organisations for clients

- Revised every year based on debt problems of Austrians

- Developed a calculator optimised for mobile use

- Another tool offered by Klartext Finanzielle Gesundheit / Schuldnerberatung OÖ, in the form of a digital tool or booklet to help consumers make a budget and plan their income and expenses.

Similar to HK, having such tools available can be useful as students and young adults can be trained to use such tools.

4. Children, Young people and Young adults (YS, YO)

- Support from The Austrian Bankers Association (Bankenverband, ABA) on selected projects and initiatives

- Projects start at primary school to familiarise children with correct use of money and economic relationships

- Children’s book “Selling Money!” help children at elementary schools learn in a vivid manner what money is

- Insights from the “Youth – Newspaper – Business” project in cooperation with the renowned daily newspaper “Die Presse” (written by pupils)

- “Be the boss yourself” is the motto of the “Schulbanker” education promotion project of the German banking association. (20-year-old project, children can take seat on board of office of virtual bank and experience first-hand how business and competition work)

- European Money Quiz (schoolchildren between ages of 13 and 15 compete in exciting online challenge every year)

These are also excellent ideas for Malaysia and can form the basis for a yearly competition.

Sources:

- https://www.threecoins.org/

- https://www.ebf.eu/wp-content/uploads/2020/11/EBF-Financial-Literacy-Playbook-for-Europe.pdf

- https://www.oenb.at/dam/jcr:d0e4d3c1-83a2-466d-8efe-6749fc075d9b/04_MOP_Q3_20_Financial-literacy-in-Austria.pdf

- https://www.bmf.gv.at/en/top-subjects/Austria-s-National-Financial-Literacy-Strategy.html

Case Study – Germany:

Germany performs a large survey on 14 to 24-year olds conducted by the Association of German Banks (Bundesverband deutscher Banken, BdB) every 3 years.

o 3 factors were concluded that can greatly improve one’s journey through life:

- economic understanding

- basic financial literacy

- some financial skills

Certainly at the start of the project we should perform a similar survey to determine the level of financial literacy of students and look for trends by school, location, gender or other aspects.

School competitions:

o “School banker” (Schulbanker)

- Introduced in 1999

- Sophisticated business game for pupils (grades 9 to 12)

- In small groups (3 to 6), pupils lead their virtual bank through different markets

- They decide on interest rates and loans, create bonds, close or open branches and spend money on marketing

- For three months, all the teams (around 800 per round) play on 20 markets

- Best 20 teams will play against each other in Berlin

- “School banker” has won the Comenius Edu Media Award for the past three years in a row

This type of competition for perhaps the lower secondary school students would be helpful in gaining an interest in financial literacy.

o “Youth and Economy” (Jugend und Wirtschaft)

- Introduced in 2000

- Managed by BdB in cooperation with one of the largest German newspaper: the Frankfurter Allgemeine Zeitung (FAZ)

- 1000 pupils from secondary schools receive the newspaper daily and learn to read the economic section of the paper

- Pupils then write articles about companies that have never been published in the paper

- The pupils’ articles are then printed in the economic section of the FAZ every month and quarter

- The three best pupils and their schools win prizes

Although in Malaysia most newspapers have moved to digital publications rather than physical newspapers, similar initiative can still be implemented. For instance, one of the major financial oriented newspapers can be used to teach students (and teachers!) to read the economic section. The students are then asked to write articles about companies (with small operations) as a way to raise awareness on localized businesses. The better articles can be published and awards given out.

Malaysian Financial Literacy

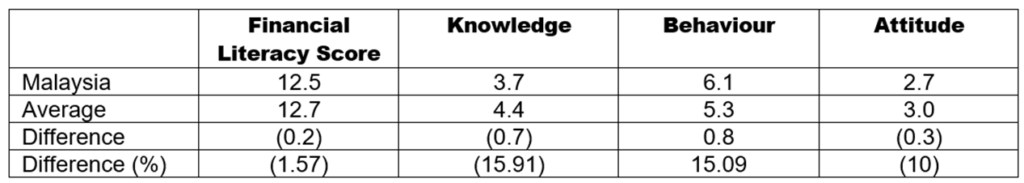

Malaysia Score’s in each element as compared to the Average

From the table above, it is clear that Malaysia is ahead of other countries in terms of behaviour but lags behind largely due to the lack of knowledge and attitude. We will explore the reasons of this in the following sections.

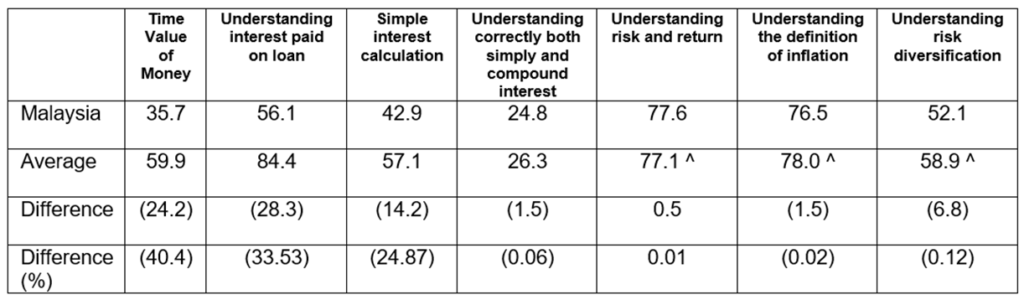

Malaysian Financial Knowledge:

- 7 questions

- 1 point for each question

Test on basic knowledge of financial concepts like inflation (Time value of money), simple and cumulative interest and risk

Malaysia Score’s in each element as compared to the Average

All of these seven topics are vital topics to be introduced in this current project:

- Time value of money

- Interest paid on loans

- Simple interest calculations

- Simple and compound interest

- Risk and return

- Definition of insurance

- Risk diversification

Increasing awareness in all seven of these categories will increase the awareness of insurance protection as a means of risk diversification, risk and returns and even the value of insurance as a regular savings program.

Malaysian Financial Behaviour:

The OECD/INFE Toolkit measures financial behaviour by incorporating a variety of questions to find out about three potentially prudent financial behaviours such as:

- Saving and long-term planning: a set of questions will be designed to indicate if individuals are actively saving, if they borrow or avoid borrowing to make ends meet in case of any short-term financial shortfalls, as well as whether they set for themselves long-term financial goals.

- Making considered purchases: questions to explore if individuals have sought independent information or advice when considering making a purchase (of financial products and services); if multiple options are considered before making a selection; and if they conduct researches by shopping around rather than purchasing the most readily available product or service.

- Keeping track of cash flow: questions seek to understand if individuals keep a watch on financial affairs, and if they pay their bills on time and avoid falling into arrears.

Although Malaysia did relatively well in this category, it is still very clear that we have a long way to go. In this sense initiatives can be developed further as a part of other sections to help adjust financial behaviour.

Malaysian Financial Attitude:

The OECD/INFE Toolkit includes three attitude statements to gauge respondents’ attitudes towards money and planning for the future. A higher score is given to those respondents that exhibit more positive attitudes towards the long-term goals and towards saving. These questions will ask people to use a scale to indicate whether they agree or disagree with the following statements:

- “I tend to live for today and let tomorrow take care of itself” (long-term).

- “I find it more satisfying to spend money than to save it for the long-term” (saving and the long-term).

- “Money is there to be spent” (long-term and saving).

Each of the statements focuses on preferences for the short-term through ‘living for today’ and spending money. These kinds of preferences are likely to hinder behaviours that could lead to improved financial resilience and well-being. The toolkit aims to capture the extent to which people show more financially literate attitudes: that is, the extent to which people disagree with the statements.

Incorporating lessons from other markets

The above case studies show a nice range of practices and steps which can be applied for Malaysia. In particular:

Our focus would be on four subsegments of students:

- Early primary school

- Later primary school

- Early secondary school

- Later secondary school

Necessary financial literacy skills

- Money and transactions

- Having sufficient basic and key competences to orient and participate in economic life

- Paying bills

- Large Purchases

- Credit cards

- Bank accounts

- Planning and management of finances

- Knowing the basics of establishing and managing a household on one’s own responsibility and taking into account one’s personal life situation;

- Being able to reflect on one’s personal needs, economic possibilities and values;

- Budgeting

- Understanding how to plan and save

- Keeping track of personal finances

- Yields

- Lending of money

- Retirement planning

- Risks and profit

- Risk and return

- Using insurance

- Risk Diversification

- Instalments

- Interest rates

- Currencies

Required mathematical skills

- Working with probabilities

- Math Reasoning

- Time value of money

- Interest paid on loans

- Simple interest calculations

- Simple and compound interest

Our goal is to equip students with sufficient basic mathematical skills to be able to manage the above aspects in a fun and engaging manner to stimulate a passion for learning. The focus will be on examples using everyday life in Malaysia, thus making the learning as practical as possible. A strong secondary goal is to build up the skills of teachers, as teachers have such an important influence on students.

Elements of everyday life which will be focused on:

- The choice of going for higher education, whether universities or other choices

- Choosing a profession, the risks and risk management required and skills needed

- Navigating the working Life

- First major purchases, such as car, house and laptop

- Planning for the future

- Family Life such as getting married, having children

- Women specific issues will also be addressed

Ideally real life examples from local newspapers will be used.

At the outset there will be an initial assessment to raise awareness of one’s financial literacy levels, and a later more advanced test, conducted after a period of initial training and lessons, to maintain interest in developing financial literacy.

Ideally a set of tools such as those used in Hong Kong will be developed and used in teaching students as well as being a resource for adults.

After a period of preparation there will be competitions split into each of the 4 categories of students. Examples would be such as the below:

- Be the boss: children can take a seat on board of an office of a virtual bank and experience first-hand how business and competition work

- Malaysian Money Quiz

- School banker

- Sophisticated business game for pupils

- In small groups (3 to 6), pupils lead their virtual bank through different markets

- They decide on interest rates and loans, create bonds and other financial instruments, close or open branches and spend money on marketing

- For three months, all the teams (around 800 per round) play on 20 markets

- Best 20 teams play against each other in the capital

- Youth and Economy

- Students from secondary schools receive the newspaper daily and learn to read the economic section of the paper

- Students then write articles about companies that have never been published in the paper

- The students articles are then printed in the economic section of a major newspaper every month and quarter

- The three best students and their schools win prizes

- The hardest math problem:

- The Hardest Math Contest (scholastic.com)

- The Hardest Math Problem Student Contest is an annual competition presented by Scholastic, The Actuarial Foundation, and the New York Life Foundation that challenges grades 6–8 students to solve multistep, grade-appropriate math problems with real-world situations and engaging characters. – 3 grand prizes of $5,000 each plus a laptop.

- Math skills rely on both numbers and words. Calculating an answer is important and so is explaining it.

- Malaysia: Using math to solve issues relating to financial literacy, especially insurance as a means of risk management. Prizes could be 1 per category – one per participating school, winners proceed to a second round at district level, winners of that will proceed to a third round at the state level (can have VIP around to judge or give prizes out).

- Modelling the future

- Modelling the Future Challenge – Real-World Actuarial Math Modelling Scholarship Competition for High School Students! (mtfchallenge.org)

- The Modelling the Future Challenge is a real-world competition for high school students combining math modelling, data analysis, and risk management into one exciting challenge! To compete, students conduct their own research project modelling real-world data to analyze risks and make recommendations to companies, industry groups, governments, or organizations. Join the challenge to put your critical thinking, mathematical reasoning, and analytical skills to the test! You’ll also have a shot at your part of the $60,000 worth of scholarship prizes!

- Malaysia: we could get sponsors with specific needs and their own prizes, and then the students (in particular the oldest category) compete accordingly.

Next Steps

The next steps include:

- Research as to the potential number of schools and determination of which types (or all types) of schools will be eligible. For instance will small religious schools also be included? What about private schools?

- Determination of the competitions which will be held and skills required to succeed

- Obtain funding or sponsors for the prizes for the various competitions

- Design of websites to increase financial literacy. Where such websites already exist (this needs to be researched), determine the reasonability of using those websites directly

- Building of the materials required to teach financial literacy, using online resources where possible (but the materials themselves are likely to be printouts to cater for rural or underprivileged kids with little or no access to the internet)

- Reaching out to potential schools to obtain buy in (announce the prizes and competitions)

- Finalization of the competition materials and process for such events

The scale of this project is indeed daunting, but with some effort we can succeed with our goal of increasing financial literacy and a love for learning, especially mathematics. This increased financial literacy can then be used to drive forward inclusive insurance to the people who need it most.