Malaysia’s takaful industry is mature at 30 years of age this year, but there are challenges that need to be overcome in order for it to progress to the next stage. Mr Zainal Abidin Mohd Kassim of Actuarial Partners evaluates the sector’s performance.

This year marks the 30th anniversary of the establishment of the first takaful company in Malaysia. Syarikat Takaful Malaysia started operations on 22 July 1985, two years after Bank Islam Malaysia launched Islamic banking in the country. Much has been achieved over these 30 years but the question now is, what would the industry look like in the next 30 years?

The Malaysian takaful market is unique in that it operates in a thriving conventional insurance environment. Unlike many countries in the Middle East where insurance (in particular life insurance) is not particularly valued, Malaysia has a reasonable-size insurance industry compared to other developing countries. Malaysia therefore has the longest recorded history where takaful has competed with conventional insurance.

Worrying trends

Chart 1 shows the progress of family takaful in contrast with life insurance. It is apparent that the growth of both family takaful and life insurance annualised premium/ contribution equivalent (APE) stagnated in 2013. Early indications are that 2014 was not much better in terms of growth of the two industries. What is especially of concern for family takaful is that nearly 30% of its APE comes from single contribution credit protection business as opposed to just 7% for life insurance. This means that takaful growth is vulnerable to any downturn in Islamic financing.

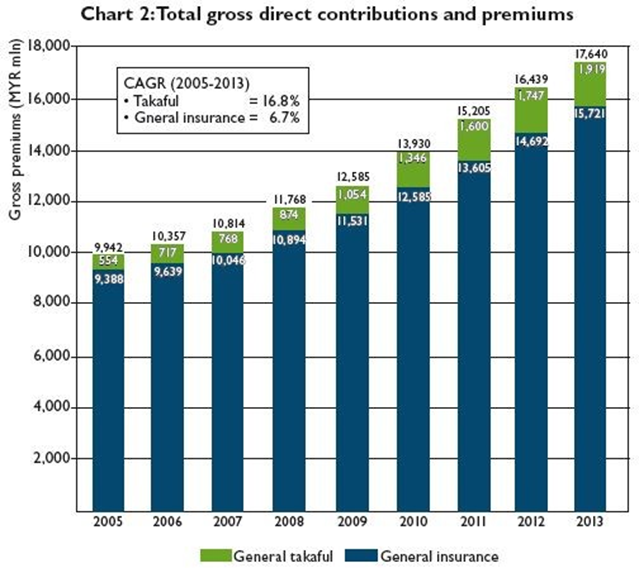

Chart 2 shows similar statistics for general takaful and general insurance. The steady growth of this sector reflects the growth of the GDP of the country as a whole. The share of takaful since 2005 has grown from 5.5% of total premium to 10.9% of total premiums in 2013. In contrast, the family takaful business in 2013 made up 18.5% of total APE. Another obvious feature of general takaful is its higher exposure to the motor class as compared to its conventional cousin.

The recent trends of takaful in Malaysia are therefore worrying. It is pertinent to note that the spurt of growth in family takaful contributions observed in 2007-2009 reflected the entry of over 20,000 takaful agents with the issuance of four additional new takaful licenses in 2006. There was another spurt of growth in the number of agents in 2011-2012 when another four new takaful licenses were issued in 2010-2011. However, the subsequent spurt in APE growth in 2011 and 2012 was only half of what was achieved by the earlier issuance of licenses.

Obviously, the ability of issuance of new takaful licences to boost takaful growth is limited in any market. Furthermore, in an insurance market dominated by multinational insurers where most of these insurers already have takaful siblings, it is unlikely that issuing more takaful licences will further boost the takaful industry by any significant degree.

The need to differentiate

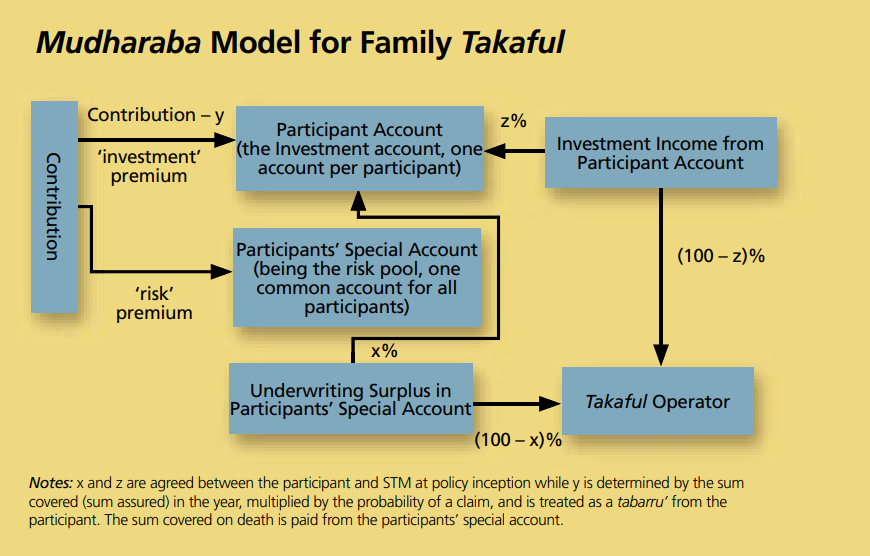

The primary challenge for Malaysia’s takaful sector would be how to further differentiate itself from conventional insurance. While the policy structure and business model for takaful are different from insurance, it can be argued that apart from the potential of the participants receiving a surplus distribution at the end of the policy term, the consumer experience is not very different. This needs to change.

There is a danger that if nothing more is done to improve on the consumer experience, takaful operators would end up competing purely on price. Takaful operators cannot base their business model on price competition. General takaful in Malaysia is also overly dependent on the motor and fire classes, both of which are currently protected by tariff. There are plans to lift the tariff in 2016. Should this happen, it is likely that the general takaful industry would

invariably shrink as conventional insurers reduce price to increase market share. From a consumer’s viewpoint, an immediate discount on price wins over the promise of a surplus refund should good experience persist.

Regulatory support essential

Where then do we see the takaful industry in Malaysia developing in the next 30 years? We have seen the takaful market in the Middle East shrinking in 2014 due in part to excessive competition. We see this possibly also happening in Malaysia. Takaful operators in Malaysia need to do more to differentiate themselves from conventional insurance. However, the industry cannot do this without the support of the regulator.

The push by the regulator for more solvency capital for takaful operators is a double-edged sword. It may increase protection for policyholders but it also results in squeezing the industry, particularly as most takaful operators have yet to achieve economies of scale compared to their conventional counterparts.

Malaysia has taken its takaful industry forward by capitalising takaful operators in the same manner as conventional insurance. As a result of this approach, it is observed that it becomes difficult for the consumer to differentiate between a takaful product and an insurance product. This leads to a limited choice of products available and discounting on price. The former limits the ability of the industry to expand the market whilst the latter puts takaful operator at a disadvantage compared to conventional insurance products given that takaful operators are generally smaller.

A mutual model?

Takaful regulators should consider creating an environment to revive the mutual model rather than go solely with the hybrid proprietary model. It was recently reported that China has drafted rules to launch mutual insurance pilot schemes in the country, in a move that is expected to eventually deepen insurance penetration in the country.

Malaysia should also consider this option, as takaful by definition is a cooperative. Having a mutual takaful model alongside a hybrid proprietary takaful model allows for a greater access to the Muslim market. This is essential as a significant percentage of the Muslim population in Malaysia lies in the lower income group usually associated with the microtakaful market, where a mutual model is more likely to succeed.

At a crossroads

The takaful industry in Malaysia is at a crossroads. It needs to plan how to reinvent itself to address the weaknesses underlying the industry. Not all of the existing takaful operators in Malaysia currently enjoy a long-term, sustainable business model. The industry as a whole should consider how it can provide the public with a better experience compared to conventional insurance, such that takaful can excel as compared to its conventional cousin. The regulator, on its part, needs to reassess how the takaful market can be developed further. At this stage, it would seem that the time for takaful version 2.0 has come.