This article describes conservatism built into the Risk-Based Capital (RBC) basis in Kenya, and potential further areas of conservatism. The concepts here also in many other countries, but Kenya is used here as an example. As actuaries, we enjoy solving puzzles. This is why many of us got excited in our younger days for mathematics and brought us to actuarial science. Two of the greatest puzzles of our work life right now are RBC and IFRS 17. This article focuses on RBC.

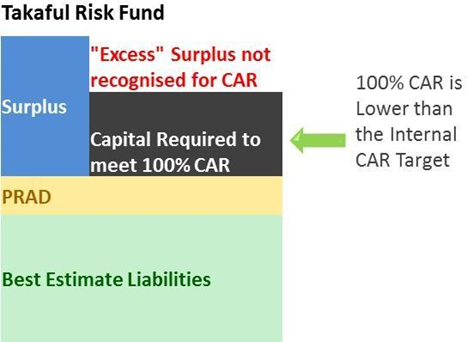

RBC can mean different things to different countries. Here, we are loosely referring it to both solvency calculations as well as gross premium reserving. Gross premium reserving refers to calculating actuarial reserves on best estimate assumptions as to all income and outgo of the insurer. We would use a risk margin, called PRAD in some countries such as Malaysia. Whereas in Malaysia, the actuary explicitly calculates the 75th percentile for any assumptions we make, in Kenya explicit risk margins are mandated, ranging from 10 – 25% of the best estimate assumptions. Generally, these assumptions are prudent and consistent with other countries. As actuaries, we determine their reasonability based on the volatility of our assumptions.

One point of conservatism however is with respect to discounting. Discounting is mandated to be at the risk free rate, both for liabilities as well as assets. As the yield curve changes, asset as well as liability values change. Thus, the actuary does not actually make any assumptions here. The regulations however currently interpret investment return volatility to be applied to discount rates. For the 5 or 6 life insurers in the market with significant long duration liabilities such as annuities and whole life plans, this can be very significant conservatism.

A second level of conservatism is with respect to participating policies. Should an insurer have adverse experience, one option is to cut bonuses. Thus, at least some of the difference between reserves on guaranteed benefits and total benefits including bonuses should be allowed as capital available in solvency calculations. Some countries such as Malaysia allow 50%, which implies that there is some desire by insurers to not cut bonuses until necessary. In Kenya, this implies that insurers will never cut bonuses even under adverse conditions.

A third level of conservatism is in not allowing negative reserves at a policy level. From an IFRS 17 point of view, this has at least partially prepared insurers for aspects such as Contractual Service Margins. From an RBC point of view, this results in conservatism however. Take the scenario of a very profitable product. Premiums will be much higher than benefits and expenses, and as gross premium reserves are outgo minus income, this results in negative reserves. If we need to later change our assumptions due to adverse experience, our reserves might not change as they had been zeroed out. Thus, there would be no effect on the revenue account, and is a layer of conservatism.

A future level of conservatism is in respect to IFRS 9. IFRS 9 refines the methodology for calculating the market values of assets. As an example, take loans. When we take the value of loans, currently we do not take into account the probability of the loan going into default. When the loan actually defaults, we impair the loan. With this in mind, when we have the value of the loan, we have RBC charges to account for this potential default. However, once IFRS 9 is implemented, the market value of the loan will already be net of this risk. Thus, if RBC is not adjusted for this, there will be yet another layer of conservatism.

Conservatism is fine in the face of unknowns. As actuaries, we pride ourselves in being prudent in our modelling and predicting the future. However, the goal of RBC is generally to be very precise in our prudence. Implicit prudence would thus seem to go against the original concepts of RBC. We have used Kenya RBC as an example, but the concepts are general to many countries in one form or another. Our goal as actuaries is to solve the puzzle of RBC, firstly what is the theory and correct methodology of RBC (specific for each country and circumstances) and then how best to optimize results on an RBC basis.