IFRS 17 is coming, this is a reality. In many cases, the timing of IFRS 17 is unfortunate as Gross Premium Valuations (GPV) and Risk Based Capital (RBC) had come several years earlier. In countries such as Sri Lanka and elsewhere, we had used a net premium valuation (NPV) for reserving. NPV generally meant conservative assumptions and methodology with a resulting gradual release of surplus.

Once we moved to GPV, we calculate reserves on best estimate assumptions and methodology with specific padding for adverse experience. For many plans, this meant a large release in surplus. Most jurisdictions just allowed this release of surplus to how into profit, but in Sri Lanka, this surplus was termed one-off surplus and held back in the life fund. The question now is whether insurers should release this surplus into profit once allowed by the regulators in Sri Lanka (IBSL). This is where IFRS 17 comes in.

IFRS 17 in effect goes back to the gradual release of surplus of NPV but on a very explicit basis. This is not done through conservative assumptions but rather through explicitly holding back surplus through the contractual service margin (CSM) and releasing it over time through profit carriers. The question thus, arises as to whether insurers in Sri Lanka should take the one-off surplus through dividends to shareholders or keep it as a buffer for this CSM.

This is not a decision which can be made with confidence without a study being performed on the size of this CSM versus the size of the shareholder’s fund. This is especially so as paying dividends means also paying taxes on those dividends. What we need to avoid is the potential for a huge capital injection to cover CSM, which actually doesn’t make sense as we would be injecting capital to cover future transfers to shareholders!

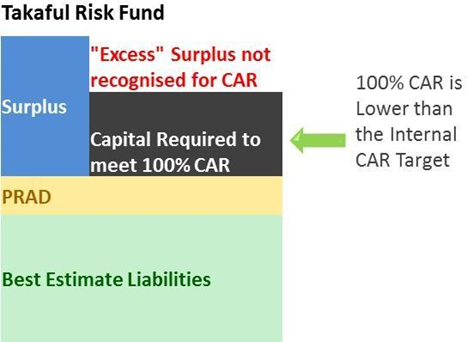

It is also important to realize when deciding on the size of CSM for the existing book of business (which is dependent on the profit carrier chosen) that a small CSM would mean more volatility in future IFRS 17 profits as the CSM acts like a “shock absorber” for any future adverse changes in assumptions in the fulfillment cash-hows. This discussion also relates to the impact on RBC as an important consideration is the capital adequacy ratio (CAR), which is capital available over capital required. Should the one-off surplus be allocated into the shareholders fund but left there, then there will be no effect on the CAR but if this is given via dividends to shareholders the CAR will reduce, in some cases drastically. Thus, this also must be a consideration.

Related to this is the level of CAR which is appropriate for the insurer, which can only be determined through capital management planning (CMP). CMP will look at the potential volatility of CAR and resulting levels required to ensure it remains above 160% at all times, as below that there will be much closer regulatory scrutiny. In particular asset liability management (ALM), challenges such as matching the durations of assets and liabilities tend to result in significant volatility of the CAR. The impact of IFRS 9 where assets are all marked to market and loans need to allow for expected losses will also result in continued volatility.

We thus, strongly recommend that the one-off surplus not be released as dividends to shareholders without proper studies as to the ability of the insurer to withstand the initial set up of CSM as well as the resulting volatility of CAR.

One additional aspect being considered currently is the need to be prudent in calculating GPV by holding a minimum of the surrender values. This can be easily done through the elimination of negative reserves at a plan level (policies with no surrender values in effect have zero as the surrender value, which is higher than the negative values of the calculated GPV), especially riders, and the setting up of minimum reserves equal to the fund value for universal life type products.

Whilst this is prudent, the question is whether this makes sense in the wider discussion of RBC. RBC was designed to ensure the solvency of the insurer. On a going concern basis, we determine the potential risks of the company to continuously demonstrate the minimum required CAR. There are many things in the future which could affect the insurer such as:

- The yield curve could change and affect the value of liabilities and assets differently.

- Equity values could drop

- There could be defaults in corporate bonds (greater than provided under IFRS 9)

- Assumptions used in the calculation of liabilities such as lapse rates, mortality rates and expenses could vary from what was expected, either due to one off shocks or long term changes.

- There could be operational risks

If we assume that all the insureds will surrender their policy (winding up basis), then none of the above risks can occur! It is for this reason the RBC guideline in Sri Lanka and many other countries have a separate risk charge which is applied to the total surrender value less the total GPV reserves. This is called SVCC and is compared to the other calculated charges on a going concern basis.

Thu,s, forcing GPV reserves to be at a minimum of the surrender value for negative reserves at the policy level, whilst being prudent under GPV, does not make sense and is overly conservative for RBC.

These issues show the challenge of the insurance industry currently, balancing GPV and RBC issues whilst ensuring insurers prepare steadily for IFRS 17. As RBC and GPV are for solvency and IFRS 17 is for investors and readers of company accounts, these are in fact very different purposes. We must not allow prudence in preparing for IFRS 17 to affect the true and accurate portrayal of the solvency position of the insurer via RBC. We must diligently ensure BOTH the accurate portrayal of the solvency position and preparations for IFRS 17. This will ultimately probably mean two different sets of accounts, one for investors, and one for the regulator.

Whilst the solvency position, RBC, is well established in Sri Lanka, there are ways of better understanding how solvent an insurer needs to be. We do this via the CMP mentioned earlier, where we study the various risks and volatility of the CAR and then what can be done to reduce this volatility or if we should simply accept the volatility as a reality of operating in Sri Lanka. As an example, can we:

- Match assets and liabilities? This may not be possible given the current state of development of the capital market in Sri Lanka.

- Reduce investments in risky assets

- Diversify our product mix?

- Increase reinsurance?

Once we determine how much risk we are willing to accept, we then monitor the volatility of this risk and use this to determine the minimum CAR we should target (Individual target capital level, ITCL) to ensure CAR remains above 160% at all times. This process will very likely involve ALM analysis on a regular basis, with the investment and actuarial departments working closely together. Of course, we would like an insurer to be as solvent as possible, but an insurance company is a business, and shareholders of an insurance company need an adequate return on their capital.

Overcapitalization will simply result in higher profit margins being forced onto products sold to policyholders, or certain useful products being withdrawn from the market which is not in the best interests of anyone. In terms of preparation for IFRS 17, the first step is to have spreadsheets which carefully model the main products being sold currently. These spreadsheets can be used to carefully walk through the processes which will be required in the accounting system as well as the requirements of the core IT system. It is vital that insurers don’t simply receive a report on an implementation plan for IFRS 17 which perhaps, only the actuarial department understands, but rather based on the actual products being sold all stakeholders including the Board of directors and upper management understands the exact workings involved and decisions to be made.

With this understanding we can discuss:

- The balance between tweaks to the accounting and core IT systems versus major overhauls

- The need for automated processes to ensure raw data from core systems get into a format which can be immediately used in actuarial systems to ensure the finance departments get the information they need on a timely basis

- The need for additional staffing and resources, especially actuarial staff in the finance team

- Training and education needs of staff

- The need for revised KPI’s, such as a move from top line KPI’s to bottom line (IFRS 17 profits?)

- Product development strategies under IFRS 17

- The role of the Chief Risk Officer in implementing IFRS 17