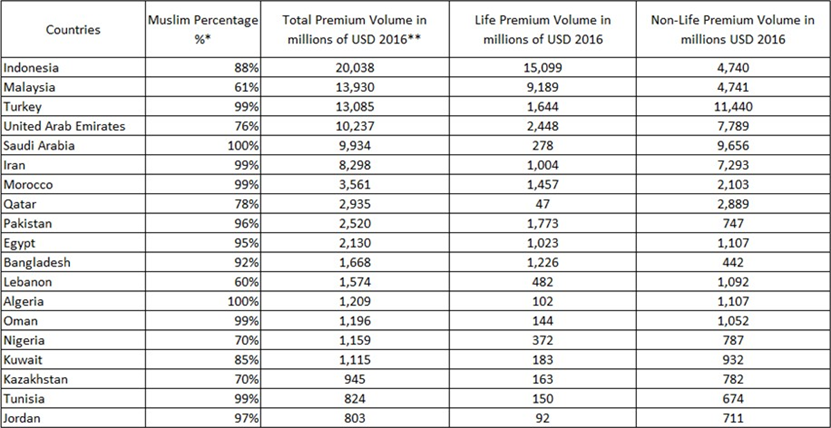

Turkey represents an interesting market for Takaful. The table below shows the current insurance sales of Muslim majority nations (over 50% Muslim). The table is ranked by total insurance sales from the 2017 Swiss Re Sigma report:

*Premium result from Sigma 3/2017: World Insurance in 2016

**Muslim % from http://www.muslimpopulation.com/ as at 2016

The numbers above are for total insurance premiums rather than purely Takaful, but it shows the potential for Takaful in Turkey. Unlike the two countries above them, in terms of insurance premiums Turkey takes on perhaps a more discreet approach to Islamic finance, preferring the more inclusive term Participation insurance rather than using Arabic terms where possible. We see this in other countries such as Kazakhstan as well, so success of Takaful in Turkey will very likely result in a number of other Muslim countries taking a similar approach.

Participation Insurance regulations have taken effect since 20 December 2017. In line with this we now have Takaful contributions shown separately so we can have a good feel for progress there. According to the Insurance Association of Turkey, in January 2018 the total Takaful contributions for January 2018 is TRY109.47 million (USD$28.8 million), split as 96% in non-life and 4% in life. Out of the non-life 60% is in motor. These figures do not include shariah compliant pension business, which is perhaps TRY1.2 – 1.3 billion per year. For the overall market including conventional insurance non-life insurance represents just over 85% of total premiums.

Participation Insurance (Takaful) Players in Turkey (Non-Life)

- Neova Sigorta

- Doğa Sigorta

- HDI Sigorta

- Unico Sigorta

- Ziraat Sigorta

Participation Insurance (Takaful) Players in Turkey (Life)

- Bereket Meklilik

- Katılım Emeklilik

- Ziraat Emeklilik

The general model used in Turkey is to charge a wakala fee on the contributions and share in investment profit. Underwriting surplus generally belongs completely to participants. The level of wakala fees is not constant by Takaful operator but as a guide Neova Sigorta charges a wakala fee which has varied by year ranging from 35% in 2010 to 29% in 2018. Ziraat Sigorta charges a wakala fee ranging from 35% in 2015 to 15% in 2018. In terms of investment profit sharing, Neova Sigorta currently takes 30% for shareholders, up from 20% from 2010 – 2016 whereas Ziraat Sigorta takes 20%.

It will be interesting to monitor developments in Turkey as Takaful grows based on its value proposition rather than from a focus on Arabic terms and Takaful being the halal (Islamic) choice. Whereas in Malaysia and Indonesia, after the initial development of Takaful the multinational players have grown to accept and embrace Takaful, in Turkey the Takaful players are thus far local players. The multinational insurers amongst the top conventional insurers in Turkey, namely household names such as Allianz, AXA, Sompo, Metlife, Aviva and Cigna have not yet moved into this segment.