Bank Negara Malaysia (BNM) has released an exposure draft of a new Takaful Operating Framework (TOF) on 18 May 2018 with comments welcomed until 18 July 2018. This new TOF is exciting as it solidifies Malaysia’s reputation as the leader in innovation in the Takaful world.

Among the new aspects of this TOF is the concept of a principle protected investment fund under a qard model. This is expected to allow for product structures closer to conventional insurance plans. Savings features will also be allowable for general takaful products, which will open up general takaful to potential innovation. As with any new product design or structure it will be important to ensure appropriate policies and practices are in place to manage emerging new risks such as asset liability management where principle amounts are protected. Whereas conventional insurance, especially in developed economies, has a full range of investment options in Islamic finance there are few investment choices to back principle protection.

Generally speaking the current practice in Malaysia is to have separate risk funds (PRF) for family and general takaful and within family takaful split between annuity and non-annuity (and sometimes group yearly rakaful). Any further splits would be done on a notional fund basis. In this new TOF a criteria is set for the potential setting up of a larger number of PRF, namely the consideration of:

- Different pricing methodology adopted for a specific type of takaful product due to business consideration or market practices;

- Nature of the risks, which can affect the pattern and predictability of claims;

- Different surplus distribution method

Whilst it is not clear how detailed the interpretation of the above criteria will be, it can be expected that for instance the differing classes of general takaful business could be in separate funds. With these new funds come new responsibilities, as the takaful operator will need to set out not only internal policies on investment and risk management but also a process to assess the performance of the additional takaful funds and its long term sustainability. BNM reserves the right to require the takaful operator to create additional takaful funds. These separate takaful funds will also need their surplus and deficit kept separate so no cross subsidization will be allowed.

The new TOF further specifies that in addition to payments of benefits to cover financial loss from misfortune such as death benefits or motor takaful claims and surplus sharing, payments from the PRF can also be for survival, maturity or cash payment benefits. Payment of such benefits from the PRF adds an element of guarantee and is thus a significant innovation from current practice. This further enhances the need for proper risk and investment management.

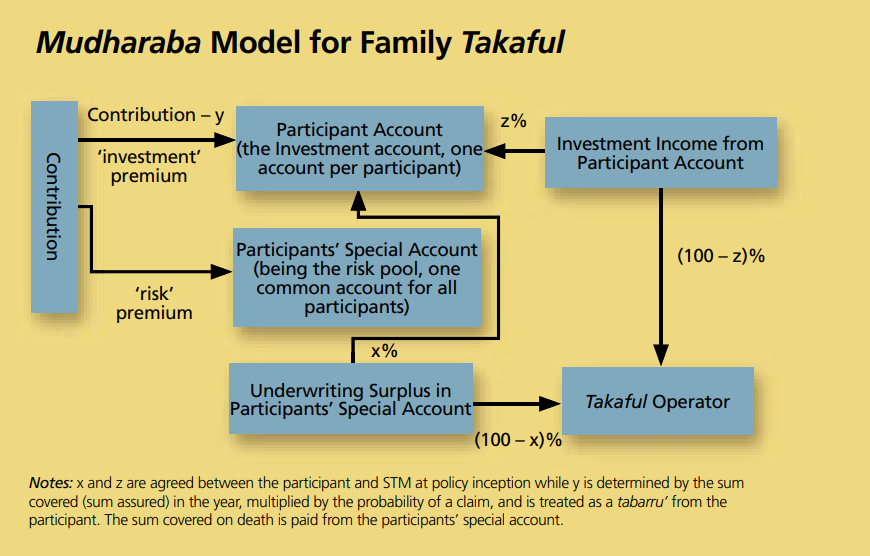

One area where clarification is given in this TOF is when there are cash withdrawals from the investment fund (PIF). Before any cash withdrawals can be given the operator must conduct a sustainability test to ensure that the withdrawal is not detrimental to the individual takaful participant’s future takaful benefits, and that the future takaful contributions in the PIF are sufficient to cover tabarru’ and any other charges throughout the term of takaful certificate. The results of the sustainability tests must be disclosed and communicated to the takaful participants. For those operators who tend to attach multiple riders to the takaful certificate this might require a fairly significant alteration to current processes and procedures.

In terms of product design before tabarru’ can be revised the operator must obtain the consent of the participant. Practical difficulties with obtaining consent might lead to increased buffers being built into tabarru’ charges. The revised TOF also specifies that the tabarru’ must be adequate to cover the risks in the PRF. Whilst this is obvious, a reality of some takaful product designs is the setting of contribution rates similar to conventional equivalent plans but high wakalah fees being taken out resulting in insufficient amounts for the PRF. The operator must also ensure that the contribution is sufficient to cover the tabarru’ throughout the policy term. This could be a challenge for unit deducting riders.

In the design of surrender values to participants the operator will need to consider the payment from both the PRF as well as the operator’s fund. This is especially true for single contribution plans, i.e., MRTT.

Similar to the current TOF the revised TOF will apply retakaful as well as takaful operators. Again, similar to the current TOF surplus sharing for particular treaties should follow the experience of the entire PRF and expensive retakaful rates is not considered a valid excuse for choosing conventional insurance over retakaful.

There is still time to comment, so be sure to make your opinions known! There are a number of important issues here which will need fine tuning and adjustments to existing processes and procedures. We welcome the opportunity to assist in helping you thrive in the face of continuing innovations and developments.