Introduction

Gantian Cuti Rehat – GCR for short – is one of the post-employment benefits provided to civil servants appointed through the Federal and State Governments, Statutory Bodies and Local Authorities in Malaysia. This benefit is in addition to the pension and gratuity benefits which are payable following an employee’s retirement. On retirement or death while in service, the benefit is paid in cash the amount of which is based on the accumulated number of days of unused annual leave and the employee’s last drawn monthly salary. The exact formula in calculating the benefit is 1/30 x number of days of unused annual leave x last drawn monthly salary. Employees are allowed to accumulate unused leave up to a maximum of 150 days. That translates to 5 months’ salary.

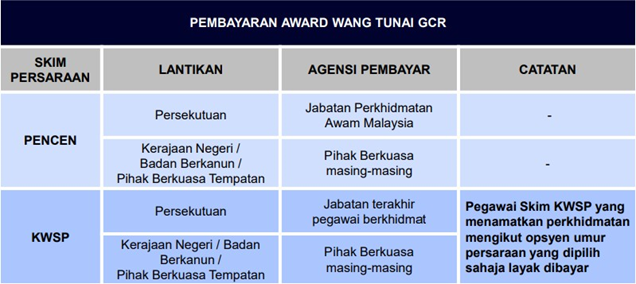

While pension and gratuity benefits are paid directly by the Federal Government, GCR benefit is unique in that the State Governments (Kerajaan Negeri), Statutory Bodies (Badan Berkanun) and Local Authorities (Pihak Berkuasa Tempatan) are responsible to pay the GCR benefits when their employees retire. The agencies responsible for the payments of GCR benefit are summarized in table below.

Extracted from Bahagian Pasca Perkhidmatan JPA: Panduan Mengurus GCR Perkhidmatan Awam Persekutuan

Accrual Accounting Principles

In line with the Government’s commitment to shift from cash-based accounting to accrual accounting, some agencies have started to adopt accrual accounting – the Malaysian Public Sector Accounting Standards (MPSAS), Malaysian Financial Reporting Standards (MFRS) or Malaysian Private Entity Reporting Standards (MPERS).

The key principles under accrual accounting for post-employment benefits (such as GCR) are a sponsoring entity is required to recognize:

- A liability when an employee has provided service in exchange for employee benefits to be paid in the future, and

- An expense when the entity consumes the economic benefit arising from service provided by an employee in exchange for employee benefits

In this case, Kerajaan Negeri, Badan Berkanun and Pihak Berkuasa Tempatan are the sponsoring entities for the GCR benefit. The sponsoring entities adopting accrual accounting would need to quantify the financial impact of the GCR benefits on their financial statements. So how does an agency quantify the GCR liability and expense in the financial statements?

Actuarial Estimates

With all the jargon and technical terms surrounding accrual accounting for post-employment benefits, it’s easy to lose sight of what constitutes the ultimate cost of the GCR benefit. It is important to note that the ultimate total amount of GCR benefits to be paid in the future are unknown and their ultimate costs depend on several factors such as future salary increases, future inflation (as salary increases are partly driven by inflation), number of GCR days accumulated etc. Through an actuarial valuation process, an actuary estimates this ultimate cost and allocates that cost to accounting periods. Actuaries will need to make assumptions about future experience of the GCR benefits such as the future increases in salary, how many GCR days employees are expected to accumulate and attrition rates whilst in service. Accounting standards typically require such assumptions to be determined on a best estimate unbiased basis.

Next

An actuarial valuation of a GCR scheme to satisfy the accrual accounting requirements may require weeks of preparation which include appointment of an actuary, collection of membership data, past experience analysis and determination of assumptions. This engagement can also include a program providing training and workshops to equip the entity’s public officers with the necessary knowledge in order to better understand the management of the Gantian Cuti Rehat benefits under the accrual accounting environment.

We have developed a simple GCR valuation calculator that provides an indication on the estimate of a GCR liability. You may go to this link to explore further!

For More Information

To learn more about actuarial valuation of Gantian Cuti Rehat, please contact:

Raja Arina