Introduction

We outline below our assessment of the Risk Based Capital (RBC) draft framework issued by Bank Negara to Takaful Operators (TOs) recently. We consider first the risk charges and the capital resources available. This is followed by pertinent issues that should also be considered – in particular, the impact on one of the most important features of a Takaful operation – the surplus distribution policy.

Risk charge considerations

The RBC risk charges are broadly similar to those of the conventional insurers’ framework.

- The asset risk charges are similar. The conventional insurers’ framework recently had a further refinement in recognising charges depending on the rating agency, which has been incorporated for the Takaful RBC framework.

- The stress factors to calculate Life Insurance Liability Risk Capital Charge or LCC (i.e. the “BE+PRAD+*” liabilities) are also similar.

- There is also an “equivalent” profit rate mismatch risk charge which uses a similar formula.

One distinction is that the expense risk charge and the operating risk charge are expected to be met by the shareholders’ fund.

Tabarru, if not guaranteed, should incur lower risk charges than guaranteed risk premium products.

Capital considerations

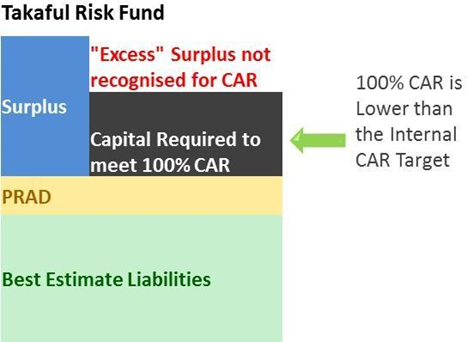

The current proposal within the discussion paper is that capital resources from the shareholders’ fund are made fully available; however, for each Takaful risk fund, capital resources are only recognised up to the amount of capital required for the fund (the so called Total Capital Required or TCR – but see later on the credit available to compute the total Capital Adequacy Ratio or CAR). Further excess surplus within the risk fund is not recognised as capital.

This has been done to avoid cross subsidies firstly between Takaful funds, recognising the segregated ownership of each Takaful fund, and secondly that between participants and shareholders.

Hence, smaller funds or funds with more volatility cannot rely on the support of other risk funds. Capital to meet this liability will need to be built up within the fund (up to the fund’s TCR) or be met by shareholders.

At the very basic level for the Family Takaful Fund (FTF), the TOF requires annuity related liability to be segregated from non-annuity related liability (termed as Protection in the RBC forms). Currently, FTF risk funds in Malaysia can be generalised into 4 types of funds:

- Annuity risk fund (if any)

- Family Takaful risk fund

- Group risk fund for group YRT products

- Mortgage or MRTT risk fund

Homogenous risks should be grouped but TOs need to be wary of too small a risk fund and the resulting volatility in underwriting results they would be facing.

The Supervisory and Internal Capital Target

Following on from this, further discussion is required as to who is expected to meet the capital required above 100% CAR – particularly on Takaful related liabilities. The limitation on recognising capital within the risk fund to TCR is not as straightforward when we consider the internal CAR target.

If, for example, this is 150% but capital recognised from the risk fund is capped at 100%, there is an immediate formula-driven capital deficit which would need to be borne by shareholders, notwithstanding that there is unutilised surplus in excess of TCR in the risk fund. This may not be the intention of regulators.

Impact on surplus distribution Definition of surplus – allowance for risk margin?

In most Takaful contracts, there is a mechanism to refund surplus back to participants, either on an annual basis or accumulated to maturity (the latter to ride out volatilities over the certificate term). How we define the surplus is important as this has an impact on our surplus distribution policy. Most contracts are vague when referring to “profits” but a few make reference to the need to meet reserving and solvency requirements.

Under TOF, there is now a requirement to document the surplus distribution policy at the outset and share this with the regulators.

There are three basic approaches to determining surplus distributable:

- Surplus after meeting best estimate liabilities i.e. true surplus

- Surplus after meeting liabilities at the 75th percentile; this is the statutory prescribed valuation basis. This approach theoretically holds back some surplus to manage claims volatility

- Surplus after meeting statutory liabilities AND solvency (i.e. capital) requirements. This approach is an extension of (2) above in that it provides for other volatilities that affect surplus, not just the claims liability

The third approach also saves shareholders from coming up with their own monies to meet capital requirements. This is only possible of course after the fund has built up sufficient surplus to cover the solvency margin. The implications, for contracts with surplus sharing, (and other than the first approach) going down the 3 approaches delays the emergence of profits to the shareholders.

The pertinent difference in these three approaches is the extent we delay the emergence of surplus to participants and whether the correct generation of participants will receive the surplus declaration.

Definition of surplus – what is the pricing basis?

It is our opinion that it is not appropriate to distribute surplus when no surplus is expected at the pricing stage until experience differs from expected (as observed over a suitable period), i.e. it is appropriate only to distribute surplus priced into the product in the first instance. The very nature of claims is that its experience will gyrate about the expected mean. Distributing all surpluses as they emerge will ultimately result in an accumulated deficit.

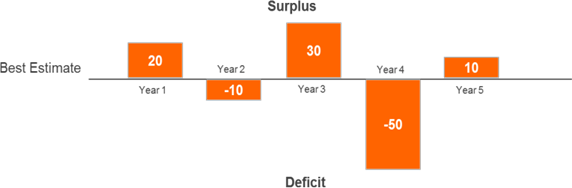

If we consider for example the following:

- Over 5 years the cumulative profit or loss is zero (20-10+30-50+10), and the Takaful fund carried forward at the end of year 5 is zero. However, if any surplus is immediately distributed and, if at the end of each year there is 50:50 surplus distribution to the participants:operator, the situation would result in the following:

- In this scenario and after 5 years the Takaful fund has a 40 outstanding qard (-50+10)!

- What has obviously happened is that, while the expected experience was borne out over the five year average, we had prematurely and mistakenly distributed (false) surplus of 20 to participants and 20 to the Operator resulting in a significant qard at the end of 5 years.

What the example above demonstrates is that before any surplus is distributed we need to set aside a claims fluctuation reserve. As a start, only priced-in surplus should be distributed in any one year.

Assuming there is “real surplus” to distribute, who is entitled to this surplus? Prior to a need to maintain a solvency margin the answer may be as simple as ‘the surplus should go to the participants’. However, that will change once we consider the need to fund the capital required to meet the solvency margin.

As a basic rule of equity, the basis of distributing “priced surplus” should have reference to who provides the capital and what is the return required on tied capital (defined as capital used to provide for regulatory solvency margin). In Takaful ideally this capital should be provided by the participants as a group, to truly reflect the risk sharing aspect of Takaful.

Definition of surplus – capitalisation of future profits?

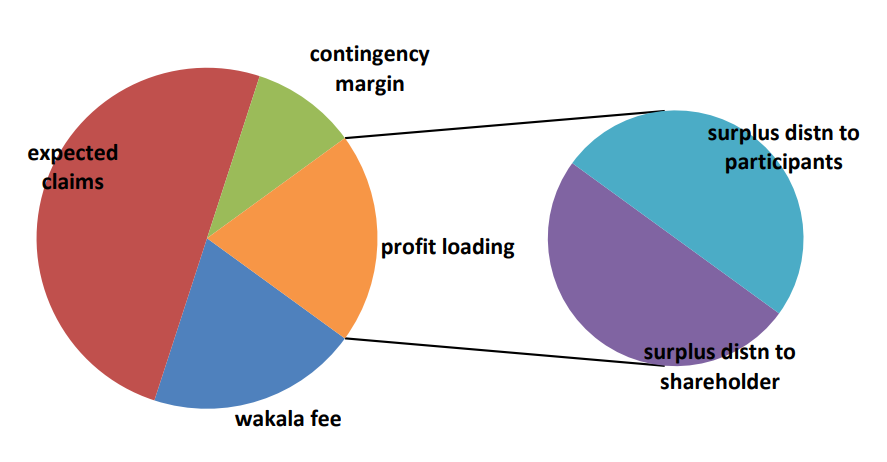

Cash flows defining liabilities determined on a best estimate basis and taking into account guaranteed benefits only, will result in the capitalisation of future undeclared “bonus”, contingency and profit loadings in the pricing basis.

A concern could be whether these profits (which for regular contribution Takaful plans represent expected surplus from future contributions yet to be received) should be recognised upfront or should accrue over the lifetime of the certificate. This is exacerbated for single contribution plans. Taking into account that in Malaysia some Operators, whilst sharing in surplus, do not share in losses, releasing all “expected future profits” at time zero is not in the interest of participants.

The TOF requires that surplus distribution for the year be “recommended” by the Appointed Actuary (AA) and endorsed by the board. Primarily the AA will need to consider the long term viability of the risk fund before releasing surplus.

The AA may hence be inclined to perform a Bonus Reserve Valuation (BRV), taking into account all guaranteed and discretionary benefits and using the best estimate investment returns (net of taxes and surplus sharing on investment income) so that all future surplus is not released on Day 1.

Paradoxically however, releasing or recognising all the surplus (including expected surplus which can be in the form of negative reserves) to shareholders will assist shareholders in meeting RBC requirements. For Takaful under the proposed framework, this (unfortunately) makes more sense given the limitation on recognising the “excess” surplus above TCR within the risk fund.

Definition of surplus should differentiate between CAR purposes and surplus marked for distribution

We’ve demonstrated that while surplus for the purpose of meeting RBC could be formula-driven, taking into account the excess of the fund over the actuarial liabilities, surplus recognition for surplus distribution should not be overly reliant on this basis. The Operator will need to form as part of the TOF a Policy on recognition of surplus/deficit and its allocation/ distribution. This should take into account at the very least:

- The pricing basis. Where the pricing basis is purely best estimate, the Operator should not share in the surplus until the certificate matures. This is because the volatility in experience may cause a surplus transfer when there should not be one, to the detriment of the overall health of the fund.

- The bonus loading. This should be released over the lifetime of the certificate rather than upfront from the capitalized loadings.

One way to ensure there is equitability in the surplus distribution policy is to adopt the approach for conventional participating with profits policies – i.e. by tracking the asset share, monitoring the bonus sustainability and providing terminal bonuses rather than releasing all surplus arising in the year.

Effectively, the definition of surplus for RBC will differ from the definition of surplus for surplus distribution. While it may be appropriate for surplus arising in the statutory valuation to be recognized towards computation of Total Capital Available (TCA), the AA would have a say on whether it is appropriate to distribute the surplus at each year end.

How does RBC apply to the Participants’ Investment Fund?

Discussions above have been focused on the Participants’ Risk Fund. We note that unit funds of conventional investment linked plans do not carry asset risk charges; the conventional RBC framework mentions “In the case of an investment-linked fund, TCR shall be computed for the non-unit portion of the fund, except for operational risk capital charges, which shall be computed for the entire fund”. This point has not been made explicit in the draft Takaful paper but is inferred.

“The PIF refers to the fund in which a portion of the contributions paid by takaful participants for a takaful product is allocated for the purpose of savings and/or investment. The PIF is individually owned by participant.” TOF

In the case of the Participants’ Investment Fund where the liability is limited to the investment value of the Fund (i.e. Participants’ Investment Account), we find that there is no asset related risk charges as the investment risk is retained by participants.

Expense Overruns and New Operators

Expected future expenses payable from the Takaful funds are to be included as the renewal expense assumptions in the valuation. For the expense liabilities of the shareholders’ fund, management expenses and any other expected future expenses payable from the shareholders’ fund in the course of managing the Takaful fund should be considered .

Although implied in Sections 8.6 to 8.8 of the Guidelines on Valuation Basis for Liabilities of Family Takaful Business; it is not clear if the regulators expect any future expense overruns to be capitalised. If so, new set ups or TOs which have yet to reach critical size may face a significant strain from capitalising the future expense liability and incur a heavy expense-related risk charge. If not, given the valuation is on the in-force block, a careful look is required to assess the appropriateness of the expense allocation between new and existing business. There may be an inclination to allocate more expenses towards new business to avoid a hefty expense liability. An expense study is required to analyse recent expenses, taking into account likely future improvement or deterioration. The AA should also assess whether the entity can fund future expenses from future expected income, including that from new business, or whether there is a need for additional capital – this may form part of the Dynamic Solvency Testing (DST) analysis for the annual Financial Condition Report (FCR).

Should you need further clarification on this note please contact:

Email: