The latest Sigma report has come out recently giving statistics for insurance in 2017. As part of that study we have taken the data from that study with statistics on number of Muslims and percentage of Muslims by country to arrive at the Insurance statistics of the Muslim world.

These statistics make a number of assumptions, namely the number and percentage of Muslims by country (taken from Wikipedia, from internal analysis the percentages seem to be reasonable or perhaps even a bit low). We have also assumed that the take up rate of insurance in a country is consistent between Muslims and non-Muslims. Considering that some countries do not have Takaful this might lead to under-penetration by Muslims but considering that this study’s goal is to show some of the low-hanging fruit for Takaful growth worldwide this assumption might be considered reasonable.

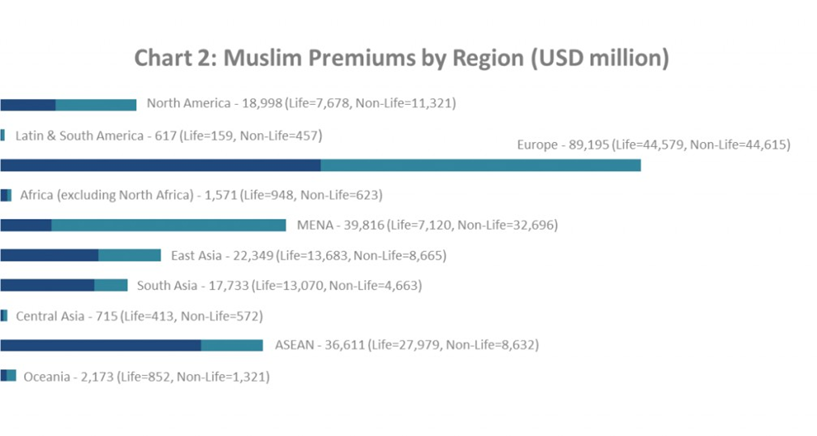

The charts above show that in terms of current spending on insurance premiums there isn’t a strong correlation between population size and insurance premiums. For instance, the region with the largest number of Muslims is South Asia though it is only the fifth largest region in terms of insurance premiums, and Oceania with less than a million Muslims has more spending on insurance than Africa’s 297 million Muslims.

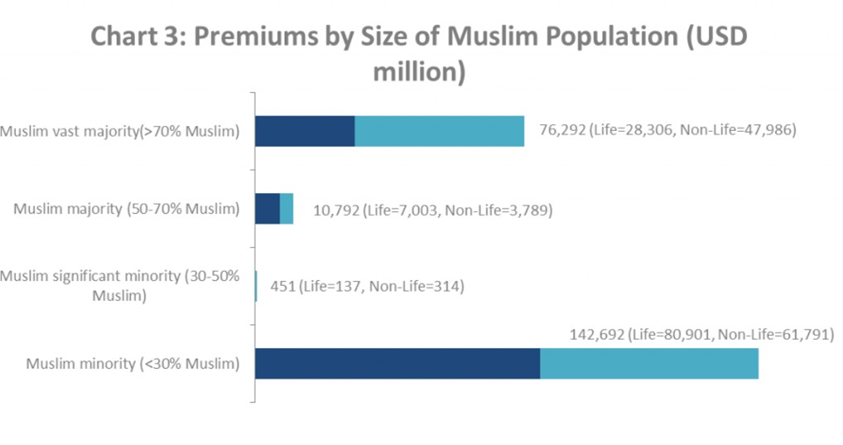

The chart above shows that by far the segment of countries with the largest spend on insurance by Muslims is where the Muslims are a minority, less than 30% of the country being Muslim. This implies that whereas Takaful windows have possibly a negative connotation in some regions, in reality this is likely a viable and necessary means to access Muslim insurance spending in many countries.

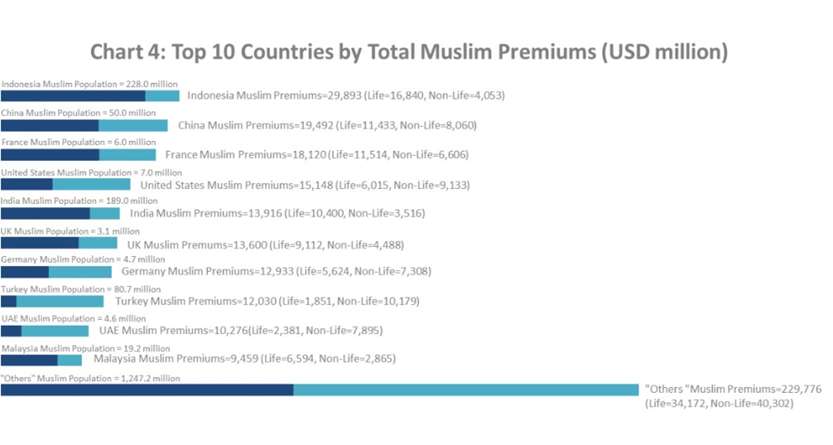

Out of these top 10 countries only in Indonesia, Turkey, UAE and Malaysia is Takaful widely available.

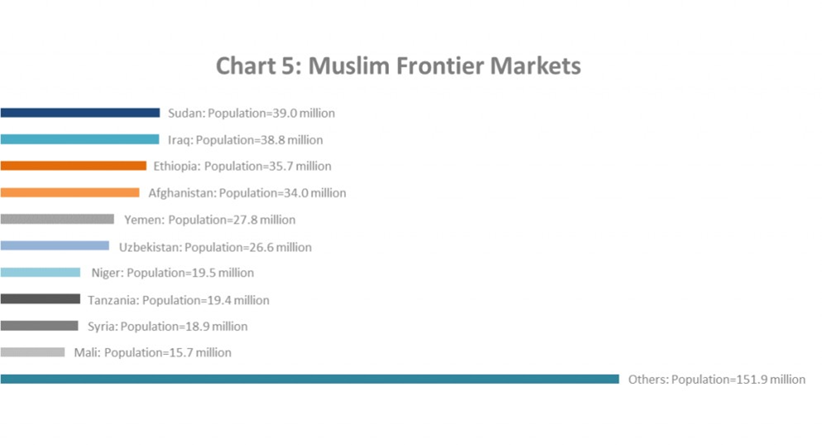

A frontier market is a market where premiums are not significant enough for entry into the Sigma report. The chart above ranks Muslim frontier markets by Muslim population.

This shows the potential of Takaful in both frontier markets as well as more established markets where Muslims are a minority. In a frontier market it is likely that an entirely different strategy may be necessary for success such as a discretionary mutual concept whereas in more established markets Takaful structures which replicate conventional insurance products to the extent possible may be desired. To discuss more on this study as well as potential strategies for tapping into the Muslim insurance market please contact us.