In the news recently Etiqa Takaful announced it will be expanding into more ASEAN markets in the next year. Whilst this is certainly great news for Muslims in ASEAN and Takaful globally, this begs the question of what does it mean to be an ASEAN insurer as opposed to a global or local insurer?

There are few ASEAN insurers which have expanded beyond its home market. Great Eastern has been in both Malaysia and Singapore for over a century, meaning when they started operations Malaysia and Singapore was not yet split. Great Eastern is also in Brunei as well as Indonesia and had been in Vietnam. From Malaysia Etiqa has already expanded into Singapore, Indonesia and Philippines. Tune has also expanded from Malaysia into Thailand. Out of Thailand Bangkok Insurance has expanded into Laos and Bangkok Life has expanded into Cambodia.

These insurers are the trailblazers of the Asean Economic Community, AEC. AEC has been discussed (and delayed) for a long time, but eventually will result in the ability of insurers from one country to freely set up operations throughout ASEAN (and of course follow the rules of each country).

In ASEAN culture is extremely important and not separate from the business world. Thus an ASEAN insurer would understand the importance culture plays in business, and understand that the many different cultures in ASEAN each need to be respected. Balancing with the respect for local culture would be the multinational branding. This branding implies that the insurer understands best practices of other local markets and what types of products and services would be effective in the country.

In terms of pricing and product profitability an ASEAN insurer has the potential to offer more affordable products as compared to a global insurer as resources are within ASEAN rather than potentially from more expensive global and regional offices. Return on capital requirements are also potentially lower than global insurers as there would be relatively less currency risk (which would normally be accounted for in return on capital calculations).

Finally, from an AEC point of view ASEAN insurers are more likely to encourage knowledge transfer amongst ASEAN nations and keep resources within ASEAN.

So, what do you see as the advantages of an ASEAN insurer and what is needed to encourage more such activity?

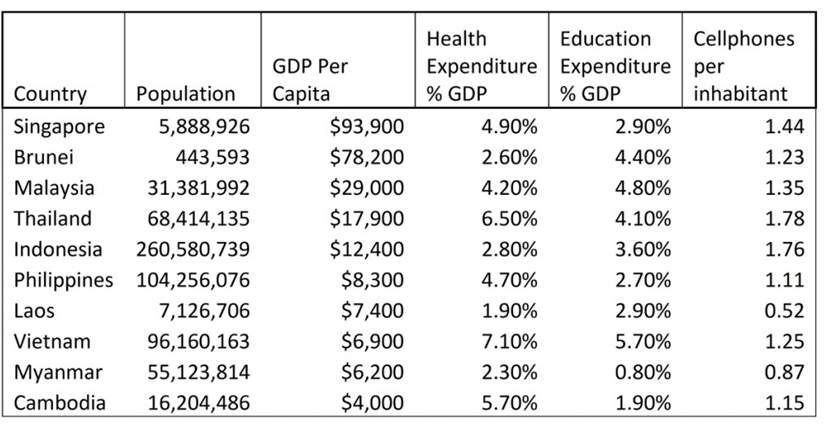

ASEAN Key Statistics: