The end of 2019 saw China face a new corona virus in Wuhan. The likely source was from consumption of exotic animals by a very small % of the population. This grew into what became a global pandemic in 2020 due to the ease of travel and the highly infectious nature of the virus.

Apart from human loss and the strain on the healthcare sector, the working population face financial strain from loss of income – business owners face meeting unwavering fixed cost during a lengthy period of poor or no sales, daily workers lose their only source of income. Consumers are also more careful in their expenditure with economic uncertainty looming overhead.

The tourism industry involving airlines and hoteliers is expected to face several months of restricted travel, and further months before the general population is willing to travel, especially internationally. Smaller airline companies are already going under.

The picture is bleak and it will be sometime before we can go back to “normal”. Beyond the short term market volatility evidenced in the drop of equity indices, the pandemic is expected to radically change global outlook in terms of economic growth and customer behaviour. Malaysia for example has revised its 2020 GDP growth down to 0.5% to -2% for 2020 against the 4.4% growth achieved in 2019. Credit spread on fixed income is expected to further widen. In the US, except during 2008, investment grade bonds are trading at their widest credit spreads over the past 20 years – averaging 4% in March 2020 against a historical average of 1.5%. Gold prices have spiked more than 30% since January 2020 as investors seek safer havens.

What does this mean for insurers? Insurers are normally well capitalised and expected to be able to weather short term financial storms. However, the new reality is unlikely to be “business as usual”. We discuss below some key areas that insurers face.

Impetus for an even lower interest rate environment, and rise of reverse margins for insurers

Declining interest rates as part of most governments’ economic stimulus measures will further increase pressure on insurers. Reverse margins occurs when there is a shortfall between investment income earned by insurers and the higher guaranteed returns they are required to pay policyholders. This was seen as a dominant factor for the collapse of several, rather large Japanese life insurers where competition in the 80s and the high interest rate environment then led insurers to offer too generous long-term yield guarantees over a lengthy policy term. In the early 1990s, when the country underwent recession followed by deflation with sub-zero interest rates, this created a shortfall between the investment income made by the insurers and the by then obviously high guaranteed returns they were required to pay policyholders. This coupled with a crumbling stock market and a significant decline in real estate values caused several insurers to collapse. Economic recession caused by the Covid 19 will give rise to similar situations for countries where the underlying policies guarantee returns amid declining interest rates. There is a rising concern in Korea where an estimated 40% of life insurance portfolios comprise of policies guaranteeing returns of over 5% p.a. in an environment where interest rates are now close to zero.

Non participating endowment products will carry guaranteed yields in order to meet the maturity benefits and any guaranteed periodic bonus or cash payments. In Malaysia, non- participating plans pre-RBC in 2008, were typically priced at 4% annual returns – which will now be a challenge to meet in the long term amidst falling interest rates. Further, although insurers may not have explicit guarantees on its portfolio – it may have implicit guarantees for example factored in its surrender values.

In valuing liabilities, most insurers use a prescribed discount rate curve that reflects the risk free rate in determining its technical provisions, with free capital to support any adverse change in the discount rate – which would mean most insurers would have set aside adequate provisions to meet future liabilities, and meet solvency requirements. Furthermore in recent years, most life insurers predominantly have a larger proportion in fixed income to meet liabilities as part of its Asset Liability Management policy and are expected to weather the change well – unless there are significant credit downgrades or failures among the issuers. Insurers operating under an RBC (risk based capital) environment are unlikely to have significant exposure to equities given the typically high capital charges on market risk for equity investments.

Insurers need to understand any underlying yield guarantees on their existing portfolio and ensure their investment strategy allows them to achieve those yields. Going forward in pricing new plans, insurers would have to be cognisant of the underlying yield assumption to be used in order to avoid onerous investment guarantees. This may mean a move further away from traditional savings type insurance products to more protection type product. Life insurers are already on this trajectory in preparation for the new financial reporting standards, IFRS 17.

Uncertainty around the Mortality and Morbidity Experience

At the time of preparing this report, the pandemic is far from over. Based on current statistics, our observation on the impact of mortality rates are as follows:

Case fatality defined as number of deaths over number of positive Covid 19 cases, vary with age with the older age groups significantly at higher risk of death. Case fatality is also significantly worse for patients with underlying co-morbidity. In terms of the impact on population mortality – one controversial view being put forward is if Covid 19 has hastened the demise of these impaired lives, it may not yet significantly contribute to an increase the number of deaths expected from the population as those who succumb to the disease would have ultimately died anyway due to pre-existing ailments.

The ultimate outcome heavily depends on exposure to the disease and the rate of infection. This in turn is influenced by government actions such as mandated lock down, the duration of the lockdown period and the public’s adherence to restriction on movement. Without them, the worse projection of fatalities will come true –as even though Covid 19 fatality rates are supposedly lower than SARS and MERS, infection rates are significantly much higher.

Over the long term, the impact on the population mortality rate is uncertain. One argument is that it could be lower, as the virus has killed the frailest within the exposed population and the remaining population which survived is likely healthier than average OR it could be lower if survivors of the infection is at worse risk as their respiratory systems have been compromised. Population mortality should also revert to normal once the diagnostics tools, therapeutics and vaccine are developed and made readily available.

The UK based study the Continuous Mortality Investigation (CMI) is monitoring if the excess number of deaths is within the range of typical annual volatility and is expected to revise mortality projections for CMI2020 (the UK mortality projection study) should it breach those numbers.

Business Outlook

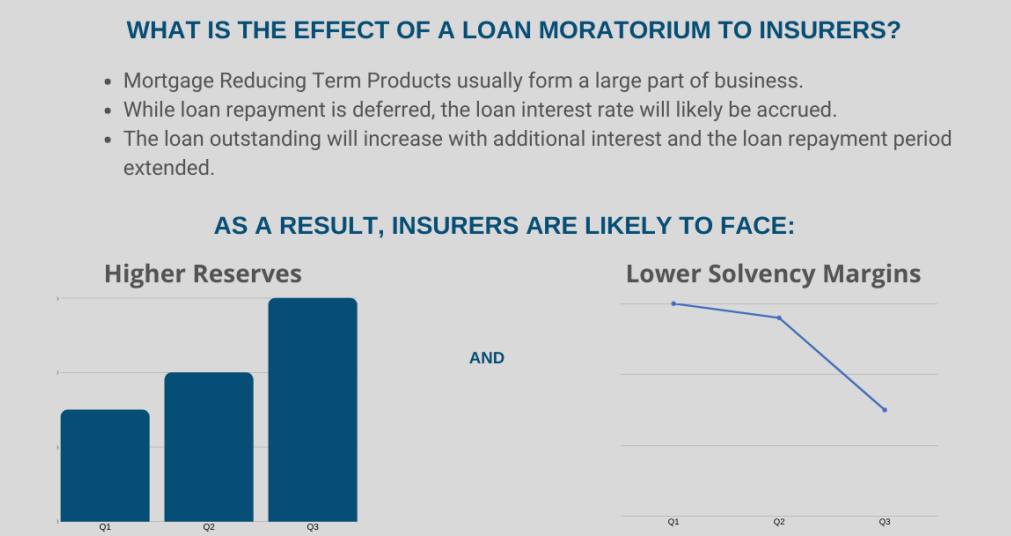

There is a financial cost to government’s moratorium on deferring loan repayment. While loan repayment is deferred, the loan interest rate is still likely left to accrue – the loan outstanding will increase with additional interest, and the loan repayment period is also extended by a minimum of the deferral period. If insurers as part of its social obligation are expected to meet the higher coverage than the reducing sum assured as per the policy contract- due to higher sum assured and extended coverage – this can be significant depending on the take-up rate and actual period of deferment. We note that in some countries, this can be up to 12 months. The result of this moratorium to insurers is likely to increase reserves and lower solvency ratios.

Credit protection products are a significant and steady source of premium income for insurers active in bancassurance. We would expect lower sales from mortgage term products in the near future as we anticipate less appetite from consumers in the housing market from uncertainty of their future income. However, we expect higher sales from credit protection cover for financing personal loans – which we anticipate to have a higher demand from the general public to tide this difficult time from loss of income.

For insurers that rely on face to face to generate sales, Covid 19 will have a significant impact on sales as the result of agents not being able to generate sales during the movement restrictions period. This loss of sales of typically more than 1 month would mean a much lower revised business projections and previous sales targets being unachievable. In the worst case scenario for an insurer, the lack of business generated may give rise to an expense overrun – meaning not enough contribution is collected to meet on-going fixed expenses – such as administrative, salaries and rental.

Investment linked products would be harder to market due to the volatility of the equity market. For existing policyholders, insurers face a challenge on maintaining persistency as the unit value takes a significant hit and significantly impacts sustainability of the policy to the projected maturity term. Investment linked products with medical riders are likely to be hardest hit should insurers make a call for top up premiums to repair losses on unit values. Where there is a guarantee on meeting the cover to the agreed policy term, such as on single contribution takaful plans, there is now a significant cost to that guarantee.

We anticipate a change in policyholder behaviour – increased awareness created by the COVID-19 situation will have a two-fold impact. Existing term and medical insurance policyholders will value their existing cover more and improve persistency. On the other hand, we would also expect higher demand of protection type products from those not already insured. However, we anticipate increased scrutiny on the terms and conditions of the policy contract for example where exclusions include loss of coverage due to pandemics.

Conclusion

These are challenging times but the insurance industry continues to provide much needed services. We have also seen regulators encourage insurers to play a role in taking social responsibility – so although exclusions may protect insurers from paying out in some cases, insurers are expected to step up a as a cornerstone of financial stability. Our take is that in the short term, insurers do not need to innovate new “savings type” products but to go back to the core business of protection in servings its customers.

About the Author

Aiza Yasmin Benyamin, FIA, FASM

Aiza is a partner with Actuarial Partners Consulting based in Malaysia and has over two decades of experience consulting to insurance firms and providing advice on social security funding requirements.

Contact

aiza.benyamin@actuarialpartners.com

www.linkedin.com/in/aiza-benyamin