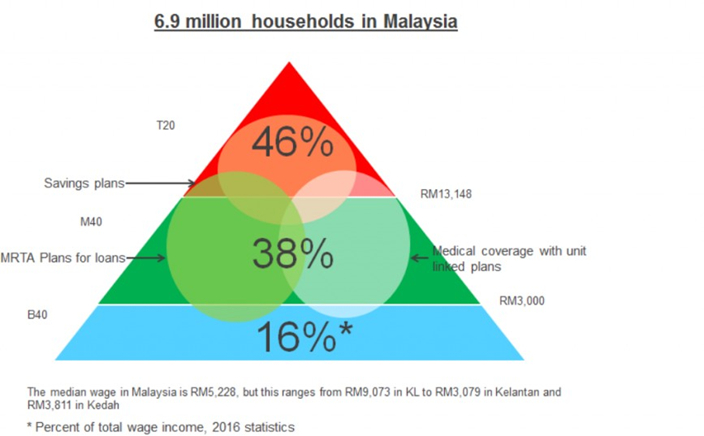

There are 6.9 million families in Malaysia, 40% have family monthly incomes less than RM3,000. Do these families have enough disposable income for traditional insurance products?

This is the question when designing products for the B40, or stated differently: can we use traditional products and structure, or do we need something different? This is what this article discusses. The statistics here is from 2016 as this has been in the news recently, but there are updated statistics for 2018 which increases this RM3,000 to roughly RM4,000.

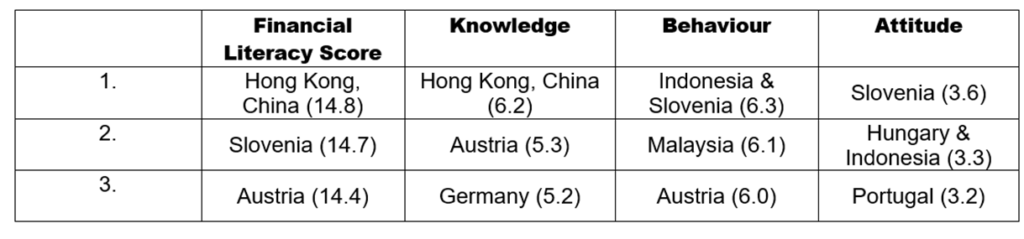

Whereas the top 20% of householders bring in almost half of the total wage income and the middle 40% another 40%, the bottom 40% only brings in 16% of total wage income. Obviously, insurance companies would much rather focus on the T20 and M40 markets. In Malaysia the top products in these top segments are savings plans, mortgage reducing term plans backing housing and other loans and medical coverage attaching to unit linked plans.

For the B40 certain elements are needed in insurance products and programs for success:

- Very useful benefits

- Package the product with other services (so people feel more value from the package)

- Simple administration.

- Easy access (low commission)

- Low regulatory costs

There are existing plans focusing on the B40, namely Perlindungan Tenang. A number of insurers and Takaful operators have developed such products, but success has been very limited. These plans are mainly one year death coverage, which although cheap, does not generally provide the types of coverage which will attract the B40. BNM has been actively trying to increase insurance penetration in Malaysia, through encouraging sales to the B40 through this as well as microinsurance.

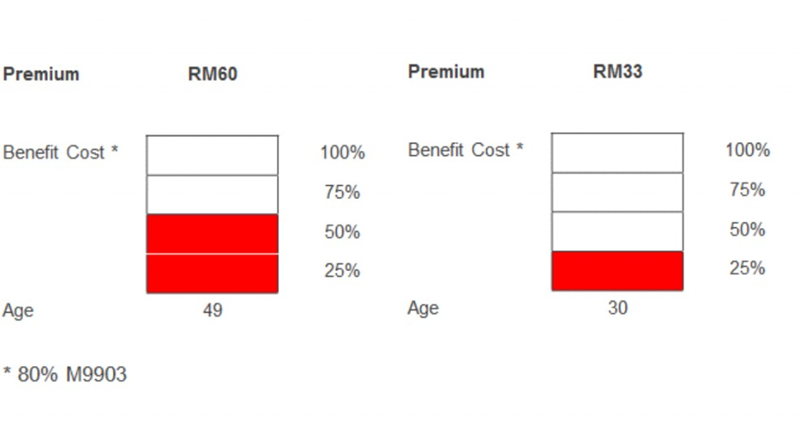

For an insurer providing one of the better values for the participant (RM10,000 sum covered):

With coverage limited to death and benefits not being a majority of the premiums this is unlikely to be an exciting prospect for the B40. A policyholder of course would not know his premiums are going to expenses more than to pay benefits, but this will show up in perceived value from the product.

When we say ‘useful benefits’ for the B40 everyone has their own definition of what is useful to them. For the B40 this would depend on who exactly are the B40. There aren’t any formal lists of the professions likely under the B40 unfortunately. The comments and discussion in this article are from my work with Kechara Food Bank, Negeri Sembilan. I helped to start the food bank operations in my home state, where we collect fruits, vegetables and bakery which are going to expire soon and get them to lower income families. We started a handful of volunteers with two Tesco outlets in the state and have grown to 16 outlets (Tesco, Aeon, NSK, Family Store, Econsave, Mydin and Zeemart) throughout the state and over 80 volunteers. In addition to providing food, we sit with the families to learn about their underlying needs and how we can help. We help them with monthly dry provisions such as rice, cooking oil and hour and also connect them to job opportunities and other aid groups where needed. Based on our experience these are a rough guide to the professions of the B40:

- Temporary B40

- Lower level civil servants

- Workers not using much physical activity (private companies)

- Workers using more physical activity

- Variable income

- Pensioners

Temporary B40 are fresh graduates, as the salary of fresh graduates tend to put them in the B40. Graduates tend to exit the B40 within five years, making them attractive to insurance companies in their own right.

Case 1: Yusuf

Yusuf graduated last year and is newly independent. There is very little desire to think of the future, but rather is excited to finally have money to spend. At this stage in his life, he desperately needs to start the savings habit, but initially for near term needs such as a new cellphone, vacation, computer games or other such things rather than for retirement or whatnot. In his case he has poor medical benefits as his first employer was chosen for his prospect to learn and develop rather than benefits (and the job market is not great at the moment). Initially at least he is not depended on (so he doesn’t need much death coverage), but this will change as he gets married and has children. Thus, he needs insurance which will grow with him automatically (increases upon marriage, children…) and can increase savings as salary increases.

Lower level civil (government) servants are another category of B40, with a wide variety of (mostly) white collar professions. Their needs would be in line with other white-collar professions but compared to employees in the private sector the level of benefits is relatively better. The need to save and develop a savings habit is similar to the needs mentioned for fresh grads (along with most of the B40 actually), although due to receiving a pension there is less need to save for retirement. An underlying trend in my work with the B40 is a relatively low level of savings, low or no habit of savings, and a lack of understanding of risk management and the need for insurance protection. I passionately believe this is something as a society we need to instill from a young age through school programs.

There is a program which started in 2018, EPF for housewives. This scheme (i-Suri) has started since 15 August. Requirements:

- Housewives that are registered in the eKasih system a/o 30 June 2018, including wife as Head of Household and females who are a widow, divorcee or single.

- Malaysian citizen and below age 60

- Contribute at least RM5 per month

- This scheme is currently in the first phase. Phase 2 (in 2019) will have the government contributing RM10 more into SOCSO. In Phase 3 (final phase in 2020), 2% of the husband’s salary will move into wife’s EPF account. (https://knowledgedatabase.info/how-to-apply-i-suri/)

- In the current phase the contribution of RM5 from husband is still on a voluntary basis. As long as there is a contribution of at least RM5, the woman is eligible to apply provided that the requirements stated above are fulfilled. (https://www.thestar.com.my/news/nation/2018/11/03/rm45mil-is-good-news-tohomemakers/)

This is great as a means of savings but must be made mandatory. This can provide a safety net in case of divorce in particular.

Another type of profession in the B40 are those with little physical component to their work, i.e., white collar workers. This would include people in administration, clerks, sales staff and service industry and to a lesser extent security guards and drivers. In addition to the need to develop the savings habit mentioned above there are additional needs depending on the underlying support structure. If they have parents, siblings or other relatives around to help take care of children then they have a layer of protection in case of emergencies. Without this layer there are much more significant risks and needs. Critical illness is one need of this market segment, as there are government hospitals which are free, but the parts and supplies are not and can get expensive. There is a scheme just starting, MySalam which gives benefits of RM8,000 payable for 36 critical illnesses for the B40 ages 18 – 55 as well as a daily hospital cash benefit. Thus, children and the elderly still represent a market need. MySalam is a free service which makes it particularly helpful. It is unclear how long such a scheme will be able to run on a free basis, though other innovative funding methods might arise in the future such as donation of surplus sharing by participants to MySalam or similar schemes.

Case 2: Lina

Lina is an accountant by training and worked for 12 years in a major bank in various roles. Unfortunately, she was a victim of domestic violence, which forced her to flee to a different state. In this new state she does not have the support structure she needs to care for her four children, so working is a challenge. She currently does odd jobs to pay the bills but should there be medical problems she will face significant difficulties.

Case 3: Jeff

Jeff is married with three children. The youngest has a hole in her heart. There is treatment but the first dose costs RM3,000, well beyond what he can afford.

Workers dependent on their physical well-being, blue collar workers, is another category of B40. This would include general workers, restaurant workers, cleaners, factory workers, general laborers, mechanics and fishermen. As these types of workers depend on their physical strength for work, should they fall sick or become disabled they can easily become permanently unemployed. Even when a sickness or disability is temporary, there is a chance the employee will be replaced. Coverage is required for TPD, PPD and temporary disability – daily or monthly amount rather than a lump sum. There is coverage while at the workplace or travelling to work through Socso, but coverage can be designed to complement Socso. The insurance industry could actually work with Socso to design complementary coverage. Coverage can also include shopping benefits, where shopping vouchers are given instead of cash benefits.

Case 4: Latifah

Latifah and Salim are both currently disabled. Latifah is a cleaner, but she broke her arm and it never healed properly. Thus, she is unable to work. It did not occur while she was working so she does not have Socso benefits. Salim on the other hand has a mental disability and found it very challenging to get work. There is assistance potentially available to him, but the challenge is convincing him he is actually mentally disabled (he hears voices) and get medical attention, which would lead to receiving monthly benefits (JKM).

Professions with variable income are another category within the B40. This would include mainly the self- employed / entrepreneur (crafts, food…). For every success story we see there are many others who are struggling. They are very dependent on their health, so medical coverage is a primary need.

Case 5: Rozi

Rozi used to be a manager at a factory earning a decent wage. He got married late in life and had his first child when he was 50. Unfortunately, his wife passed away shortly thereafter, leaving him alone to care for his daughter. As he cherishes his time with his daughter more than anything else he stopped working at the factory to become self-employed selling fried rice. This new career has its ups and downs, along with challenges. It takes time to build a following of regular customers. In the meantime, there is significant wastage of food. Compounding the challenges is the closure of the food center which he had been selling at. Should he develop medical conditions there is little buffer to protect him and his daughter.

The final broad category of B40 would be pensioners / retirees. Their income will be their pension, EPF, JKM, Baitulmal, help from children or continuing to work. If they do not have savings they are very vulnerable to medical problems. Although medical treatment is free in government hospitals there are many expenses which are not covered.

A new program called Peka B40 will help those above age 50 starting from March: health screenings, parts, travel expenses to the hospital and cash incentives to complete cancer treatment. There are still needs though.

Case 6: Rahim and Rossiah

Rahim and Rossiah are both retirees as well as diabetic. Rossiah has the additional complications of heart conditions and other medical challenges. Rahim was a lorry driver but after he lost his toes to diabetes, he has not been able to work. Unfortunately, they do not have savings. Rossiah in particular has the challenge of not being able to afford the needles which she requires to administer insulin. These needles can be expensive and not covered by government hospitals. Peka B40 will be helpful in this regard.

In addition to the needs highlighted above other useful benefits might include:

- Ambulance coverage. For B40 with no vehicle the cost of transportation to the hospital when needed, either for outpatient treatment or specialist treatment for disabled children is more than they can afford. Might also include coverage for prosthetics and wheelchair. Some of this is inside Peka B40 but is needed for all ages. These benefits tend to be included in some way or form in major medical coverage and are not a major part of the costs of the insurance. Thus carving out these particular coverages would add valuable benefits whilst still being affordable.

- Daily or monthly amounts for the parent when a child is hospitalized, TPD, PPD, temporary disability as they likely have no one to care for the child if there isn’t a strong support structure.

- Monthly amounts for the child who must take care of elderly parents who have medical conditions requiring constant care.

- Widow / widower benefit. Monthly amount payable for life even if remarries.

- Child benefit.

- Monthly amount until age 21 upon death of breadwinner.

Beyond useful benefits, the second need in selling to the B40 is to ensure the insurance coverage is packaged with other useful benefits. Without a very strong understanding of the usefulness of insurance in risk management, insurance will not be renewed when the insured doesn’t claim (not claiming in insurance is a good thing for the insured actually!) as the insured might not feel like they are getting their ‘money’s worth’.

There are many ways to package insurance benefits for the B40. One way which is in existence already is to package with funeral services. Mosques around the country provide funeral services along with some insurance protection for a small contribution. Participants value the entire package rather than specifically the insurance coverage, so renewal rates are very high. Unfortunately this scheme is currently mainly not insured formally, meaning there can be very variable levels of service and quality.

The third need in selling to the B40 is with simple administration as we simply must keep costs low in order to maximize value to the insured. This means selling (and pricing) on an individual basis would be unlikely to be feasible. Thus community (group) design is needed. A group policy approach would also reduce costs in terms of contract printing as well as stamp duty (RM10 for stamp duty is a small matter for a large policy but a large matter for a small policy).

A second part of keeping costs down is with respect to commissions and other selling costs. Current efforts to sell to the B40 have run into challenges with high selling costs, either due to agents wanting high commissions to sell such products or even when going direct, the third parties with the relevant data on participants asking for large fees for gaining access. This negates the whole intention for selling to the B40. An interesting development here is the development of the National Community Policy (NCP) which encourages grassroots level clubs aimed at empowering the B40.

A final step in selling to the B40 is keeping regulatory costs low. Shareholders do not need large profit; they need a fair return on capital. If capital (regulatory) requirements are low, lower profit provides a fair return on capital. We COULD ask BNM for special exemptions as this type of product is in line with national interests BUT it would be better to change the product design to make it ACTUARIALLY APPROPRIATE to have much lower capital (RBC, Solvency charges) requirements.

Take the RBC requirements for a non-par product as a starting point, when the product design is participating, we allow for some of the bonus loading to reduce capital requirements. If the design is unit linked the investment risks are passed on to the policyholder, so RBC requirements are correspondingly lower. If we design a product with no benefit nor investment guarantees, where the shareholder takes a service fee to manage the business, but all surplus belongs to the group the solvency requirements should be much lower. This is called a discretionary mutual. With such a design by right there would be no solvency charges except expense (operational) risk charges. This would allow for much more reasonable solvency requirements and thus return on capital.

Discretionary Mutuals are not recognized by the Insurance Regulators in the UK and Australia as insurers and as such are not regulated by Bank of England or APRA respectively. However, in Australia Discretionary Mutuals are regulated by the Australian Securities and Investment Commission (ASIC). We are not suggesting that discretionary mutual be set up in Malaysia without BNM purview but rather that it is well accepted that a regulatory ‘light touch’ is accepted practice.

In conclusion a number of excellent initiatives have come through recently for the B40. The time is now for insurers to follow suit and truly add value to the B40 group. Increasing penetration has been a goal of BNM for a long time and this will be key. The challenge:

- Provide very useful benefits, with loss ratios either relatively high for stable coverage or giving back excess surplus to the policyholders through cash or services.

- Find synergies to package this coverage with other services which the B40 will get value from.

- Keep the service fee to maximum 20% and no surplus sharing to the shareholder.

- Engage directly with grassroots organizations through NCP, either each insurer individually or via ASM, LIAM or MTA.

- For BNM: simplify the regulation of these funds and have fair RBC charges so a reasonable return on capital can be achieved.