The new TOF will surely spur product innovation. An open question though is whether we are still being held to the Wakalah model or if we can innovate beyond Wakalah. Mudharabah, although possible, can simply be considered a Wakalah model with zero Wakalah fee. TOF encourages innovation but there is still a basic structure whereby there is a risk fund for benefits and an operators fund for expenses (though it is getting blurred a bit with benefits paid from the operating fund). Innovation though by right could go beyond that, to having a cooperative structure where all expenses and benefits are in one fund.

TOF gives hope to innovation where it states that:

“1.4 The Bank also recognises that in response to the changing operating environment and advancements in technology, the licensed Takaful operator may rethink the Takaful business model in order to respond to the needs of Takaful participants and compete more effectively.”

In this regard, the licensed takaful operator may explore new business model which extends beyond the existing role of the licensed Takaful operator as the manager and administrator of Takaful business. Subject to prior approval of the Shariah Advisory Council and the Bank, the licensed Takaful operator may adopt any new Takaful business model.

In TOF, product design basic structure is listed.

“10.1 A licensed Takaful operator must structure Takaful products in accordance with the applicable Shariah contracts. While this policy document focuses on the operational requirements of Shariah contracts that are currently adopted by licensed Takaful operator including for wakalah, mudarabah, qard and hibah as part of its product structure, the Bank encourages the licensed Takaful operator to adopt other policy documents on Shariah contracts issued by the Bank. In applying these other Shariah contracts, the licensed Takaful operator must observe the requirements in the policy documents on Shariah contracts and other requirements specified by the Bank accordingly. A licensed Takaful operator must incorporate, at the minimum, the following elements in its product structuring:

(a) a tabarru’ element for the PRF of family or general Takaful products;

(b) where relevant, an investment element for family Takaful products; and

(c) where relevant, a savings element for family Takaful products.”

The following framework implies that several contracts can be structured at the same time in Takaful. This would help with IFRS 17 and be similar to Islamic banking which has multiple contracts in one:

“8.3 In relation to paragraph 8.2(a), the senior management must ensure that the policies consist, at the minimum, the following:

(a) provide for the underlying Shariah principle of mutual assistance among Takaful participants;

(b) clearly set out the contractual relationship between a licensed Takaful operator and the pool of Takaful participants; and

(c) clearly set out the contractual relationship between a licensed Takaful operator and individual Takaful participants, where relevant.”

Islamic Financial Services Act (IFSA

“90. A licensed Takaful operator shall establish and maintain one or more Takaful funds for any class or description of its Takaful business as may be specified by the Bank.“

Takaful funds are to be separate from shareholders’ fund.

“91. A licensed Takaful operator shall keep any Takaful fund established and maintained under section 90 separate from its shareholders’ fund.”

Based on these Acts, we do seem to be limited to variations of a Wakalah model. Below are potential innovations within a Wakalah framework.

Practices of Grameen Bank

Lending activities are just one part of their efforts with each activity directly or indirectly leading to increased lending and thus, profit to Grameen Bank. Individuals are NOT targeted, but rather groups of 5 unrelated members. 7 groups of members become a centre. Loans to a member must be approved by other members of the group and centre. Should one member not be able to pay, the other members of their group or centre assist. Grameen is not a charity, it is a profit driven organization, but over time the participants of the scheme have become owners of the bank through their participation. At the same time, a loan is given out a savings account must be opened, thus encouraging savings.

Digging deeper into the various activities of Grameen Bank, these activities follow along the lines of the United Nations Sustainable Development Goals (UNSDG). Takaful can do something similar, namely pick some relevant goals from the UNSDG, build them into the entire Takaful experience and then sell Takaful as a part of this entire experience. Participants will see the experience in terms of the UNSDG rather than purely buying Takaful. This will help to change the attitude of purchasing Takaful.

Friendsurance

Friendsurance is a partnership with dozens of insurance companies which offers insurers’ products (particularly auto and home) to customers online. On average, 80% of customers receive cashback of roughly 30% of premiums paid in total at the end of the year. In short, crowdsourcing is the method Friendsurance used to pool risk.

At the heart of this scheme is the increasing of deductibles, which reduces the cost of insurance. In return for the lower cost of insurance, should one of your group of friends make a claim, you will help them to cover the deductible. If your friends have the same experience as envisioned in the pricing of the underlying insurance product, then you will not save any money as any savings in insurance cost will be used to pay your share of the deductible of your friends. However, if your group is healthier than that assumed in the pricing of the insurance then indeed you will save money here. The effect of this is that you will actively hunt down healthy friends to join you. As an insurer, this results in better experience as well, giving a win-win situation.

A Proposed New Structure

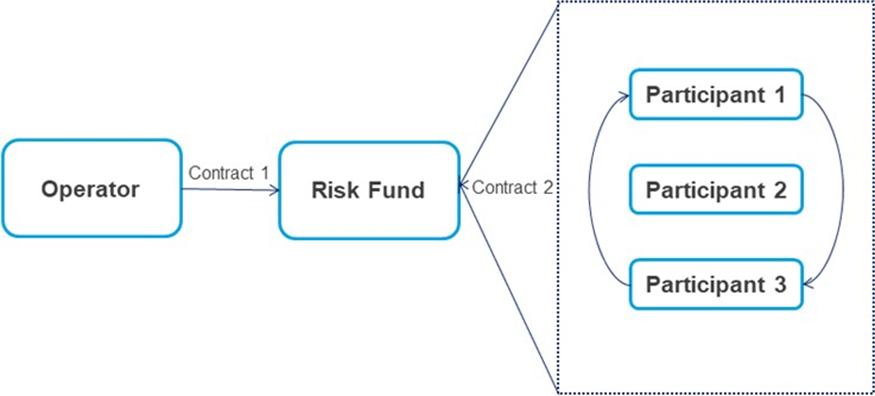

A new structure is suggested where there are two contracts. First contract is sent by the operator as manager of the risk fund and another one happens between individuals to the risk fund. The diagram below illustrates how the structure works.

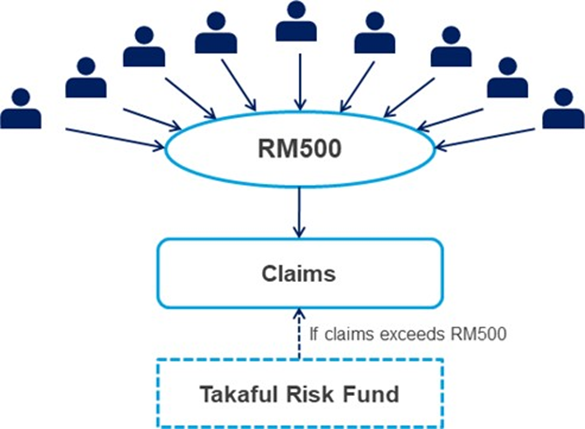

Next, there could be a Health product with RM50 deductible and the 10 participants helping each other by paying the RM50 if anyone claims, then Takaful paying if it gets over RM500. The diagram below illustrates how the process goes.

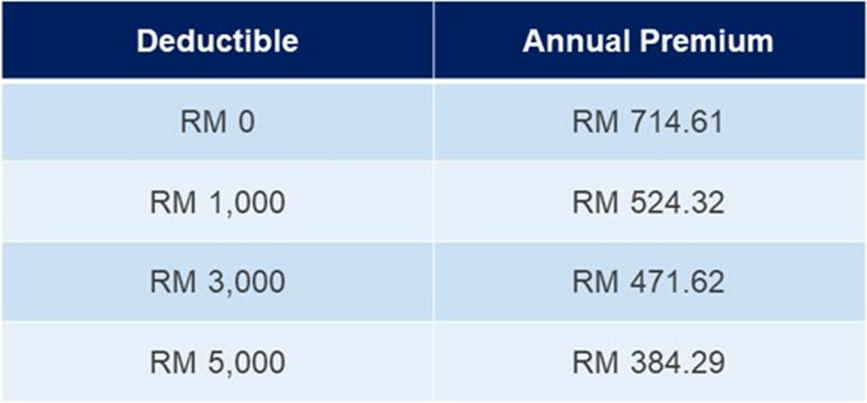

Assume a 28-year-old male as a teacher with annual limit of RM100,000 benefits. The following table shows a medical insurance example with different deductibles.

Xiang Hu Bao

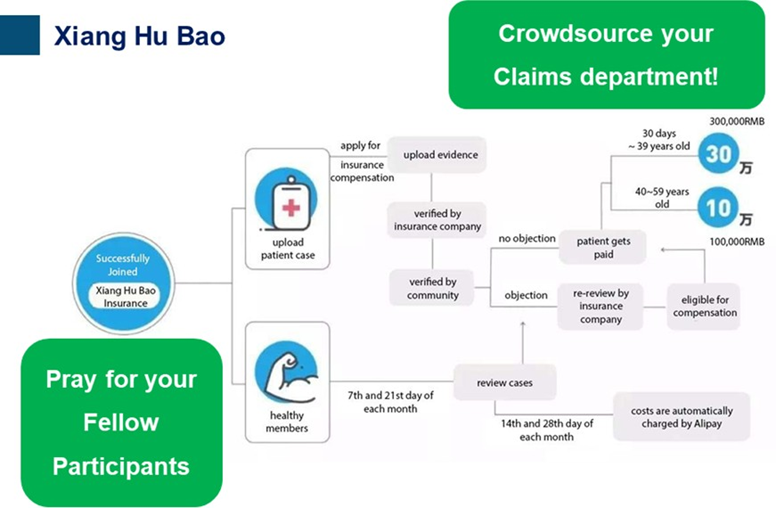

Ant Financial’s online mutual aid platform, Xiang Hu Bao, attracted 80m participants since its Oct 2018 launch (almost equal to Germany’s population), aims to provide online mutual aid to 300 million people in the next 2 years. Leveraging Alipay’s Blockchain technology to increase transparency and trust, Xiang Hu Bao, which literally means “mutual protection”, is an online mutual aid platform within the Alipay app that provides a basic health plan to protect participants against 100 critical illnesses. While Xiang Hu Bao is not a health insurance product, it complements other premium health insurance offerings in the market that have a wider range and depth of coverage. All participants share the risk of these critical illnesses and bear the related expenses as a collective. As of April 2019, approximately 47% of Xiang Hu Bao’s 50 million participants were migrant workers and 31% were from rural areas and county level regions.

“10.15 In relation to paragraph 10.14, where applicable, the legal documentation shall clearly stipulate the terms and conditions associated with the application of Shariah contracts in a takaful product which include, at the minimum, the following: (a) tabarru’ (i) a statement that the tabarru’ takes into effect when a takaful participant contributes to the PRF;”

Based on the framework above, can we design something like Ant Financial – everyone receives notice of the claim, and can contest within a short time frame? After that, everyone is charged for the claim rather than paying in advance. This design has a better look and feel in terms of participants actually owning the PRF.

Lemonade

Lemonade follows the traditional insurance model but provides insurance services with an artificial intelligence bot driven by social good. Thus, policyholders can purchase their insurance quickly via the Lemonade app, and claims are paid super-fast (three seconds in some cases). Lemonade charges a small hat fee (20%, similar to the Wakalah fee in Takaful) on whatever customers pay (premium). The rest goes to covering claims. Any ‘surplus’ is returned to the causes policyholders care about. Takaful can do something similar, embracing technology and instead of returning surplus sharing to participants, give to charities of the choice of the participant.