Introduction

Modern takaful is a hybrid, being neither wholly a mutual/cooperative nor exclusively owned/controlled by shareholders. To understand why this complex structure has evolved we need to understand why Sharia finds the traditional insurance contract unacceptable under the laws of Muamalat (the Sharia law governing business transactions).

The profit drivers of an insurance operation are primarily interest income, underwriting profit/loss and expense underruns/overruns. When the eventual experience of these drivers differs from expected (as determined when the premium rates were set) a profit or a loss will emerge to the insurer.

Sharia concerns as to the various sources of insurance profits

Insurance is a risk management tool allowing the insured to transfer ‘real’ risk to the insurer. A ‘real’ risk is an event where, should it transpire, only a loss can be incurred. Contrast this with ‘speculative’ risk where the risk taken can result either in a profit or a loss. In an insurance contract the insurer is taking on speculative risk.

Consider an insurer with only one insured. The premium is 100 whilst, should the insured event happen, the insurer will need to pay out 100,000. Obviously the insurer is taking on speculative risk and the insured has transferred the risk of loss to the insurer for a premium of 100. If the insured event does not transpire the insurer would make an underwriting profit of 100. This is Maysir or a transaction where the outcome is based entirely by chance and is not acceptable under the laws of Muamalat. Insurance companies manage this risk through diversification and reinsurance and by utilising a predictive claims model based on statistical experience. However, risks remain, as evidenced by the need for insurance companies to maintain sufficient risk capital to meet the possibility that premiums collected would be insufficient to meet claims.

Sharia is also concerned with transparency in insurance. The traditional insurance contract does not declare how much of the premium goes to meet expenses and commissions. These are services provided to the insured which are identifiable (and separately costed) in the insurance contract. Finally, as insurance premiums are paid at the start of the contract period and claims are settled later, the insurer must invest the premium. A staple asset class for insurers is interest bearing bonds or interest earning bank deposits. Such ‘riba’ based investments are not Sharia compliant.

Takaful then has to address these Sharia concerns of insurance. The current takaful model of choice is the wakala model. Under this model the takaful operator is designated as an agent (wakil) of the takaful participant. The takaful operator does everything an insurance company would be doing in exchange for a fee. The difference from the conventional insurance model lies in the physical segregation of the participants’ fund from the shareholders’ fund. This segregation applies also to the treatment of expenses where instead of operational expenses being charged directly to the participants, the participants are charged a fee payable to the operator. This operating structure thus attempts to segregate the profits and losses arising in an insurance operation by the nature of these profits and losses between the shareholders and the participants.

The table below summarizes how the Sharia concerns with conventional insurance are addressed in takaful.

| Insurance sources of Surplus/Profit or loss | Sharia concerns | Takaful/Retakaful Solution |

| Interest income | Riba | Sukuk Income/Islamic Bank accounts |

| Underwriting Profits | Maysir | Surplus refund to participants |

| Underwriting Loss | Maysir | Borne by participants |

| Expense underruns/overruns | Gharar | Wakala fees |

It would be noted that under this hybrid model (a cross between a conventional insurance structure and a ‘member-owned cooperative’ insurer) the insurance risks reside in the participants’ fund and effectively the risks are shared among the participants. Thus, the financial fortune of the participants and the operator can be different. This, together with the operational structure of the wakala model, gives rise to certain takaful specific risks which are explored in this essay.

What are the specific Takaful/Retakaful Risks

Sharia Risk

Any financial institution calling itself compliant with the laws of Muamalat must have a Sharia Board. This Sharia Board is responsible for ensuring that the operation of the institution is always in compliance with the Sharia law. This may seem straightforward if not for the ‘tiny’ detail that not all Sharia Boards think alike. What is permissible as ruled by one

Sharia scholar may not be deemed permissible by another scholar. These differences in opinion are greatest when situations arise which were not prevalent during the time in history when Islam was revealed. In such a situation the scholars are required to extrapolate from agreed sources of Islamic text (in particular the sunnah, or the practices and sayings of the Prophet Muhamad s.a.w and the Quran). In that process some judgment is required of the Sharia scholars and differences in opinions can arise.

There is also a risk that management may omit to refer certain operational practices to the Sharia Board which could compromise the continuing compliance of the takaful operator. Indeed there are companies that offer a Sharia Audit service to provide external confirmation that the Islamic Financial Institution remains in compliance with the laws of Muamalat.

In insurance, especially life insurance where the contracts can extend for a lifetime, changes in Sharia opinion may result in a takaful contract changing from being halal (Sharia compliant) to haram (non – Sharia compliant). For the takaful operator where its credentials rest on its Sharia compliance, this constitutes a significant reputational risk. In the worst case scenario a takaful operator may be liable to refund past takaful contributions should it transpire later that certain aspects of its operations were actually not Sharia compliant.

Surplus Sharing

Surplus sharing has become the major selling point of takaful. Unfortunately, determining exactly how much surplus should be distributed is never an easy task. This has to do with the ‘open’ nature of insurance participation (policyholders are continually joining and leaving the fund) and the volatility of insurance claims experience. The period over which surplus is calculated can be as short as one month, one year, three years (the practice at Lloyds in London) or even longer for catastrophic cover. It should be noted that the shorter the accounting period the greater the volatility in the profit/loss observed regardless of the nature of the risk.

There are two dimensions of risks associated with surplus sharing. The first is simply how to determine the surplus itself. This is due to the fact that the amount payable in the event of a claim is dependent on the severity of the loss and that events that give rise to a claim can be few and far between (e.g. a one in ten year event). There can also be delays in reporting claims and delays in determining the level/sharing of indemnity arising from the claim event. All these uncertainties would manifest themselves in the technical reserving set at the beginning and end of the accounting period. Should the technical reserves be inadequate, any surplus distributed in the period would be over-estimated. Conversely should the technical reserves be too high, the surplus distributed would be too little. That is the reason

why in insurance it is ‘surplus’ that is distributed not ‘profit’. Unlike profit, surplus is at best a guess, albeit an educated guess!

The second dimension of risk associated with surplus sharing happens when the takaful operator shares in the surplus but not in the deficit. These takaful models justify profit sharing to the takaful operator as an incentive for good risk and claims underwriting. Some Sharia scholars however regard surplus sharing with the takaful operator as not Sharia compliant (this difference in opinion is not likely to be resolved any time soon and can therefore also constitute a Sharia risk).

Why does sharing in surplus while not sharing in deficit constitute a risk? This flows from the uncertainty that is attached to the surplus/deficit amount itself and the asymmetric nature of the distribution. If one party only shares in surplus but not in deficits then any over distribution of surplus will result in an unfair (excess) distribution to the party which only shares in surplus (in this case the takaful operator).

Some practitioners advocate that, given the difficulty in determining what exactly the appropriate surplus to distribute at any one time should be, the surplus amount should instead be used;

- For charity, when the amount to be allocated is small or there is difficulty in apportioning surplus between the participants; or

- As a claims fluctuation reserve, to meet future rare claim events.

Qard write off

While Sharia scholars may have differing opinions on whether the takaful operator may or may not share in underwriting surplus, they unanimously agree that underwriting losses should be borne solely by the participants. This is the essence of ‘sharing of risks’ as opposed to the ‘transfer of risks’ practiced by conventional insurance.

There are unfortunately practical problems in enforcing this sharing of deficit among participants. If the participants expect that the sum assured would be paid regardless of whether there are sufficient funds in the participants’ pool to meet the payment, then extinguishing the deficit through reduced claims pay-out is not possible. An alternative is to make all participants pay more contributions in respect of the period when the losses occurred but this option is not practicable as it is unlikely that all participants would agree to pay more, after the event. The modern takaful solution to this problem is to require the takaful operator to extend a qard, an interest free loan, to the participants’ pool. Why a loan and not a direct transfer? The answer lies in the need to ensure that risks are shared among participants rather than transferred to the operator. Where a qard is extended it is with the

expectation that the qard will be repaid from future underwriting surpluses and therefore that losses are met by the participants. These surpluses may extend from current participants’ continued participation in the pool or even new participants joining the pool.

Unfortunately, given that surplus sharing has come to define takaful, there is a risk that a large unpaid qard will deter participants from renewing their policies in the pool and discourage new participants from joining the pool. The risk of the operator having to write off this qard to ensure that surplus continues to emerge in the future, so as to retain existing participants and continue to attract new ones, is therefore great.

It would be simplistic to assume that the takaful operator would not price in this possibility of a qard write off in determining the contribution rate it charges. A Risk Based Capital regulatory framework would factor in this risk through the need for additional shareholders’ capital. This capital requirement then triggers the need for a higher wakala fee to finance the additional capital. It is then very hard to argue that a risk transfer between the participant and the takaful operator has not effectively taken place as the participant pays an additional ‘fee’ to the operator in the expectation that the operator will write off some of the future expected qard arising.

Exit of investors

The need for risk capital in any takaful set up requires the continuing availability of capital interested in investing in takaful. The return to investors can come from dividends (which comes from retained profit) or capital appreciation in the equity of the takaful operation. For a public listed entity the increase in the market capitalisation of its shares reflect current investors’ perception of an expected increase in the future profit stream.

Unlike conventional insurers, takaful operators are still ‘young’. Many operators are still beset with the problem of expense overruns, when expenses incurred in managing the operation are greater than the total fees collected from the participants. Some are nursing large qards which may need to be written off as they are unlikely to be recoverable over the immediate future. In the MENA region a significant proportion of takaful operators’ profits stem from the profits made from investing the shareholders capital in the stock market, a source of profits which is unlikely to be consistently repeated every year. Should the takaful operation not be able to stabilise itself (by eliminating expense overruns and by generating underwriting surplus) it is highly likely that shareholders will plan to exit the takaful business. A best case scenario will see mergers and acquisition of the weaker operators. A worst case scenario can see shareholders walking away from their investment in a takaful operator. Should the latter transpire this would result in a loss of confidence among the public in takaful and be detrimental to the industry as a whole.

Unreasonable participants expectations

Insurance remains a mystery to the consumers. As a service it is very difficult to distinguish one insurance company from another. You only know for sure whether the insurer is ‘good’ or ‘bad’ when a claim is made, an event that does not affect most insured. In such a circumstance, price (or more specifically the premium rate) becomes a significant determinator of which insurance company is successful in attracting the most policyholders.

In takaful and especially when the cover is commoditized (e.g. motor where the cover is the same among all insurers), price competition can be intense. The paradox is surely obvious to the observer. As the insured is also the insurer in takaful, any undercutting of rates only results in a postponement of the day of reckoning, as ultimately the losses will be paid by the participants.

In practice however, the takaful operator ‘competing’ on price would be in the same position as an insurer competing on price, not withstanding that for the former losses are expressed as qards or loans. This similarity follows from the high probability that such qards will have to be written off eventually. Furthermore regulators do not recognise qards as assets that can be used for the purpose of solvency capital so qards will erode the takaful operator solvency position.

What are the root causes of these risks?

In this section we examine some of the root causes of these risks.

Sharia Risk

Sharia scholars generally are not familiar with the inner workings of insurance. Their perspective of insurance is moulded by the advice that they receive from the technicians. This shortfall in expertise can be partly mitigated by including experienced takaful practitioners as part of the Sharia Board. Indeed the regulator in Malaysia suggests a five person Sharia Board where two of the members are experienced industry professionals.

The Sharia approach to takaful can also be incremental in nature, providing one answer at a time in response to individual questions posed by the takaful operator. Over time such an approach risks inconsistencies arising across the takaful model. A move to a ‘principles based’ Sharia basis for takaful is therefore advocated rather than the current ‘rules based’ approach. This will avoid inconsistencies arising in the implementation of takaful and promote consistency of Sharia rulings on individual issues brought up for their consideration.

Another Sharia related risk arises when management refers technical related questions to their Sharia board without sufficient information being provided to the scholars. An example could be, “can the profit from the takaful policies be distributed through a subsequent

contribution rebate of a similar amount”. It would be unfair to expect the Sharia scholars to rule on this on a superficial basis without first explaining what exactly ‘profit’ is. The problem here can then surface when management goes to the actuary with the Sharia’s decision. Should the actuary raise an objection, the answer ‘the Sharia Board has decided’ has a certain finality to the issue, basically overriding technical concerns which the Sharia did not have a chance to review in the first instance. Another instance can be when the management goes to the Sharia Board for approval of the quantum of the wakala fee to be deducted from the participants’ pool of contribution. The Sharia Board will probably say that this is fine as long as it is disclosed to the takaful participants and can be justified by the expenses incurred by the takaful operator. However, we see in certain markets that this (high) wakala fee results in insufficient contributions remaining in the participant risk pool to meet claims. If the Sharia Board had been informed of this possibility it is likely that they would not have given their consent so readily.

Model Risk

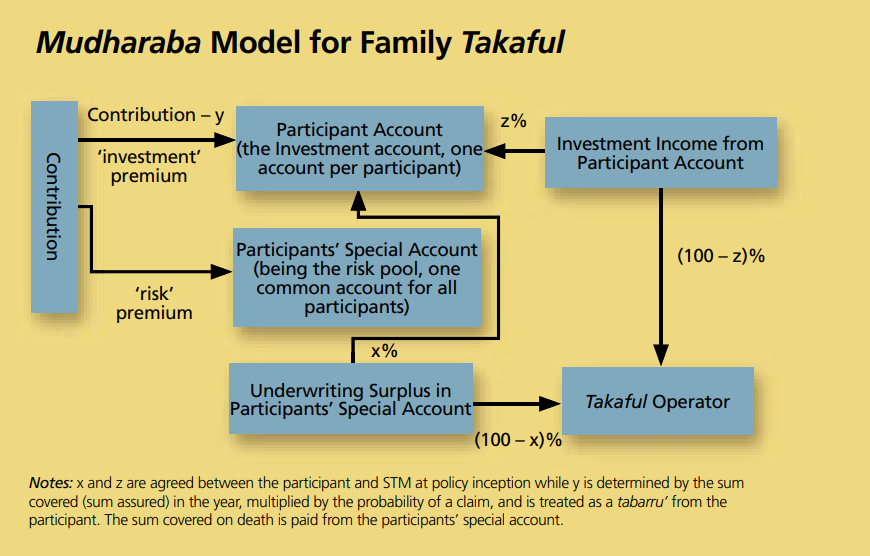

There is not one universal model for takaful. Syarikat Takaful Malaysia started off with the Mudharabah model but that has long been superseded by the Wakala model. Different models give rise to differing levels of specific risks. For example the risk of incurring significant expense overruns is the greatest in the Mudharabah model as it applies to Family takaful. There are some arguments that the Wakala model has a higher exposure to operational risk than the Mudharabah model. Also it would be apparent by now that the Mudharabah model carries a higher Sharia risk as compared to the Wakala model. This arises from the view held by the majority of Sharia scholars in the MENA region that the excess of premiums over claims is not “profit” as applied under the Mudharabah contract.

It is therefore important that investors/takaful operators take note of these risks before they choose the Model for their takaful venture. There are many issues related to Model risk which cannot be given justice within this short essay. One very important consideration for potential investors is to understand the implications on expected return on their capital for the Takaful model that they have chosen to implement.

Product Risk

An equally important source of risk in takaful is the risk associated with the Takaful product and its design. The failure of the first takaful company in the United Kingdom some years ago can be argued to have been caused by choosing motor takaful as their initial and only product. Choosing to compete on price, and in a product as commoditized as motor, is surely a recipe for disaster.

The takaful operator needs to ensure that the product that is chosen allows for the limitations of the takaful model it has selected. The product design should cater for how much capital the operator has and what are the financial expectations of the shareholders. Detailed consideration should also be given to the suitability of the products for the distribution channel to be employed and, last but not least, the suitability and acceptance of the products by the targeted segments of the market.

Agent versus Principal Conundrum

What is good for the takaful operator (who in a wakala model is the Agent in the equation) is not necessarily good for the participants (who are the Principals). Effective risk management is very dependent on aligning the interests of all parties to the contract.

Under the Wakala model, the more policies sold, the more the wakala fee collected notwithstanding whether the contribution rates are sufficient to meet the wakala fee and the expected claims. Under the Mudharabah model however the operator’s income is dependent on an underwriting surplus being experienced by the risk pool. Obviously the management will be inclined towards profitability to the shareholders and will make management decisions accordingly.

As an example, assuming that the management’s objective is to maximise income to the takaful operator, a wakala model can result in very competitive contribution rates but with high wakala fees which ultimately will result is large unpaid qard. This arises as, net of wakala fees, the amount going into the participants’ risk pool per participant is insufficient. Multiplying this per participant shortfall by the large number of participants attracted by the competitive rates will result in a large underwriting deficit requiring a large qard from the operator. This qard will continue to grow as long as the contribution rate and/or wakala fee is not duly adjusted. If instead the operator in the example had adopted a Mudharabah model the contribution rates would typically be higher than market rates as the operator needs to be relatively confident that a surplus will arise as his income is dependent on a surplus arising. An operator using a Mudharabah model is therefore less likely to have qard in its participants’ risk pool.

Conclusion

How then to manage these takaful specific risks?

The key is perhaps proper model and product selection. The selection should take into account the resulting levels of the different risks discussed in this essay. Given the significant capital investment required in takaful, in particular for systems and suitably trained human capital, careful thought should be given to how best to manage these risks (along with other risks that are part and parcel of insurance business) through the decisions made at the outset as to the takaful model and product of choice. Starting takaful is not just about having sufficient capital.

For existing takaful companies it is important that the Chief Risk Officers identify these takaful specific risks and continuously monitor these risks. These risks should form part of the Risk Register. Many of the risks touched on in this essay emanate from insufficient knowledge of the technical aspects of takaful and treating takaful like any other conventional insurance operation. Awareness is the start of the process of managing risks. Only after the risks have been identified can they be quantified, monitored and managed.

If you have any queries on the above please do not hesitate to contact:

Email: