IFRS 17 is an accounting standard that would come into force for financial years beginning 2021. It is an accounting standard that would apply for those account preparers which conduct insurance business, not just insurers. It applies to risk sharing business not just risk transfer as ultimately both operating models involve a pooling of risk, the difference being who ultimately will carry the insurance risk.

In Malaysia takaful operators that report on an IFRS basis would have to comply with IFRS 17. It is then necessary to determine how accounting will have to change to accommodate this Standard. The current thinking is to apply the Building Block Approach (BBA) or General Model to takaful. This article looks at the implications of applying this model to takaful and suggests an alternative which may be more appropriate for the business model.

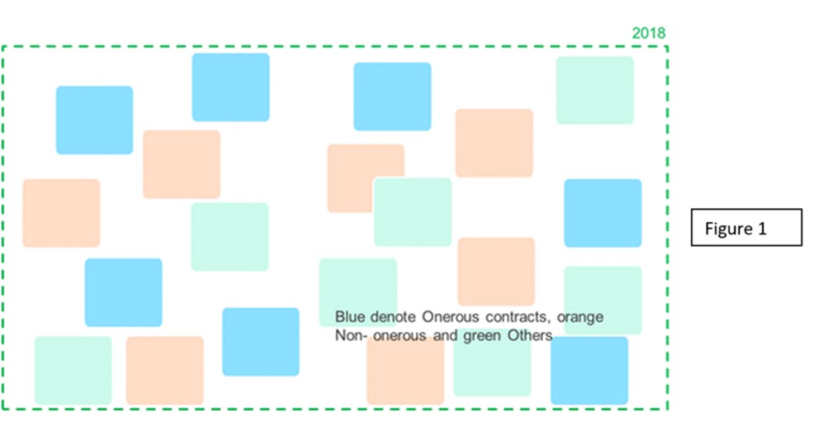

Under the BBA it is first necessary to group the contracts by risk and duration. The diagram below illustrates such a grouping for a portfolio of contracts issued in 2018:

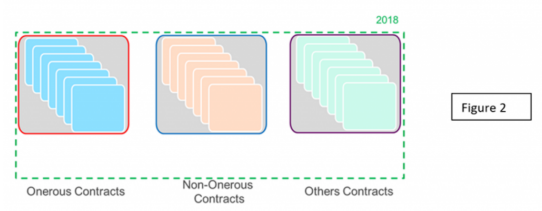

Then it is necessary to further classify these groups of policies between three basic categories:

- Onerous

- Non-Onerous

- Others

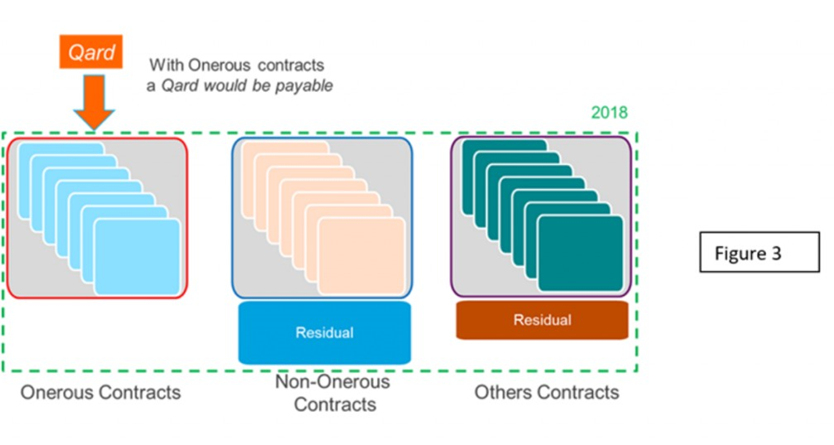

Based on the assumptions adopted it is then possible to calculate Residuals for each category of contracts. A Residual is the balancing amount at inception of the contract after deducting all the expected contractual benefits from the expected income. This is effectively an estimate of the lifetime surplus to be generated by the contract. As would be expected the residuals for Onerous contracts would be negative whilst the residuals for Others would be necessarily smaller per contract as compared to that for the non-onerous contracts. For takaful the so-called onerous contracts deficit would be funded through a qard as illustrated below:

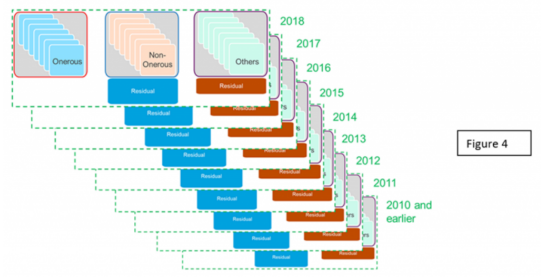

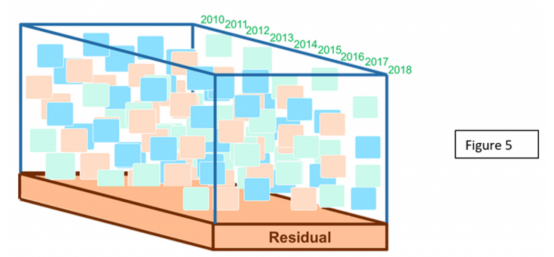

The Standard also says that contracts cannot be grouped if they are incepted more than one year apart. This means that accounting wise it is necessary to determine qard and residuals by yearly cohorts as illustrated in the figure below:

Under this application of IFRS 17 then each year’s grouping of separate onerous contracts would require a separate qard! On this basis the concept of risk sharing in takaful would be compromised severely as the qard for onerous contracts in each year is unlikely to be repaid resulting in effectively a risk transfer to the operator. Furthermore, the operator’s business model will be affected as takaful operators in Malaysia are underwriting 100% of losses but are only entitled to 50% of any surplus.

IFRS 17 however provides an alternative to the approach above. B67 to B70 of the Standard deals with Contracts with cash flows that affect or are affected by cash flows to policyholders of other contracts. Under such contracts there is effectively a transfer of the liability (fulfilment cash-how) from one group of policies (e.g., onerous policies) to another group of policies. The standard provides an example:

Suppose that payments to policyholders in one group are reduced from a share in the returns on underlying items of CU350 to CU250 because of payments of a guaranteed amount to policyholders in another group, the fulfilment cash flows of the first group would include the payments of CU100 (i.e., would be CU350) and the fulfilment cash flows of the second group would exclude CU100 of the guaranteed amount. After all the coverage has been provided to the contracts in a group, the fulfilment cash flows may still include payments expected to be made to current policyholders in other groups or future policyholders. Furthermore, the standard says that an entity is not required to continue to allocate such fulfilment cash flows to specific groups but can instead recognize and measure a liability for such fulfilment cash flows arising from all groups.

It can be surmise that this alternative applies to insurance contracts where there is effective a risk sharing among the policyholders.

Applying this option to takaful we can instead conceptualize takaful accounting as the diagram below would suggest:

Under this approach one Residual covers the entire portfolio. We envisage that the lowest level of aggregation under this approach would be at the Participants Risk Fund (PRF) level. Thus, for takaful operators with multiple PRFs each PRF would have its own residual.

The advantages of this approach are significant enough for takaful operators to investigate its practicality to its own operating model as:

- There is no need to segregate onerous contracts. These can be grouped with other contracts as long as there is sufficient surplus from other contracts in the pool to meet the shortfall in such contracts.

- There is no need to segregate by year of issue as the “surplus sharing” in takaful applies portfolio wide in each PRF.

More importantly this approach mirrors very closely the takaful operating model in Malaysia; specifically, a qard is only payable when the PRF is in a position of deficit.

There are many implementation issues under this model and the reader is advised to contact Actuarial Partners for advice on how to apply IFRS 17 to their takaful business under this alternative approach.