The extension of the Movement Control Order or MCO is expected to bring grave hardships to the bottom 40% of wage earners otherwise known as the B40. The goal of this article is to explain how the time value of money affects whether you should take advantage of these programs and some of the effects over the long term. With all the challenges of the MCO in Malaysia, of course it would have been best if everyone had some savings to fall back on, but the reality is that many do not have savings. In a 2019 report by the Financial Education Network, a grouping chaired by Bank Negara and the Securities Commission, 52% of Malaysians would have difficulty raising RM1,000 in an emergency, while an earlier Bank Negara report mentions that 32% of Malaysians can only cover a week’s worth of expenses if their income stops. Thus Covid-19 is putting a huge strain on Malaysians, especially the B40.

When we talk about the B40 we need to be clear who exactly the B40 are. Let me sort the B40 into a few groups:

- Fresh graduates. It is likely that their salary is being continued, so they are not badly off, but if they are in jobs with commissions and other variable income they are likely facing difficulties. There are some programs available to them to help.

- Lower level government workers. Their salary is being continued, so they again are not badly off.

- Lower level workers in the private sector getting a monthly salary. Again their salary is likely continuing, but if not then there are programs to assist them.

- Workers getting daily wage or self-employed. These are workers who might be very badly affected depending on the job and ability to operate during the MCO.

- Pensioners. Their income from JKM and Baitulmal is already set, but in many cases they depend on contributions from children, which might not be available anymore. Thus they potentially can be badly affected as well.

Of course there are other groups of B40, but these are expected to be the groups most affected by the MCO. Bantuan Prihatin Nasional is one scheme which will help the B40 (as well as M40 to a lesser extent), with a range of benefits announced.

In addition to these programs, there are other schemes such as the ability to withdraw some of your EPF savings as well as deferment of loan repayments. The examples we will show here are for people who have a choice whether to take money out of their EPF or defer loan payments. For those who have no choice and no income to buy food and other essentials of course that takes priority.

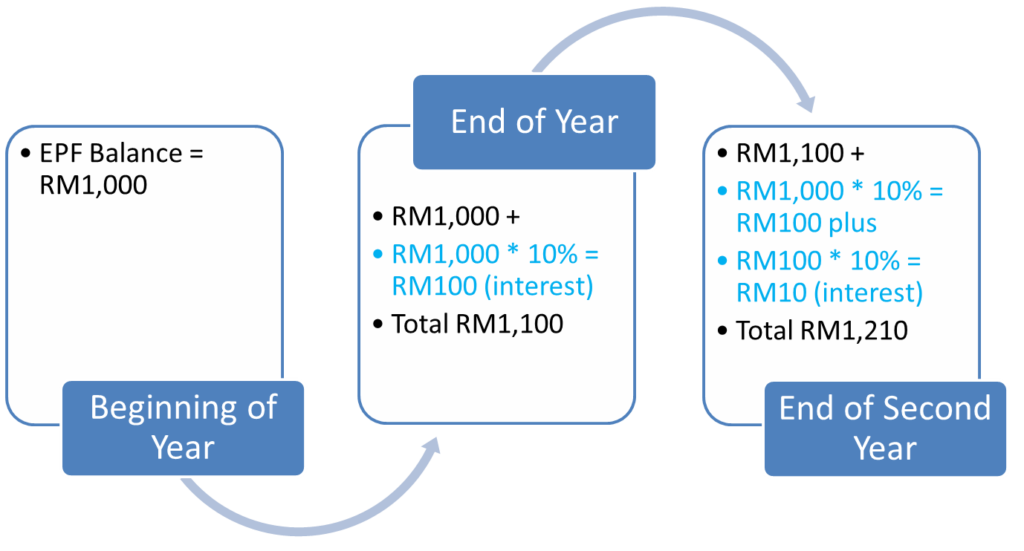

You can take up to RM500 a month from your EPF account 2 for up to 12 months. The process is simple enough from the EPF website, via email or directly at EPF (once the MCO is over). If you decide to take this money out though, please note compound interest will hurt you over the long run. Compound interest means you earn interest on your interest. Take a simple example, let’s say you have RM1,000 in your EPF and the crediting rate is 10%. Crediting rate is another way of saying interest. We might also say investment rate, they work the same actually.

At the end of the year you will have RM1,100, as the RM1,000 from the beginning of the year will have earned RM100. For the next year if we again earned 10% interest rate or crediting rate then not only will we earn RM100 on the RM1,000 from the beginning, but we will earn an additional RM10 as 10% of the RM100 we earned in the prior year. This doesn’t seem like much, but over many years this can make a huge difference.

Effect of the Time Value of Money

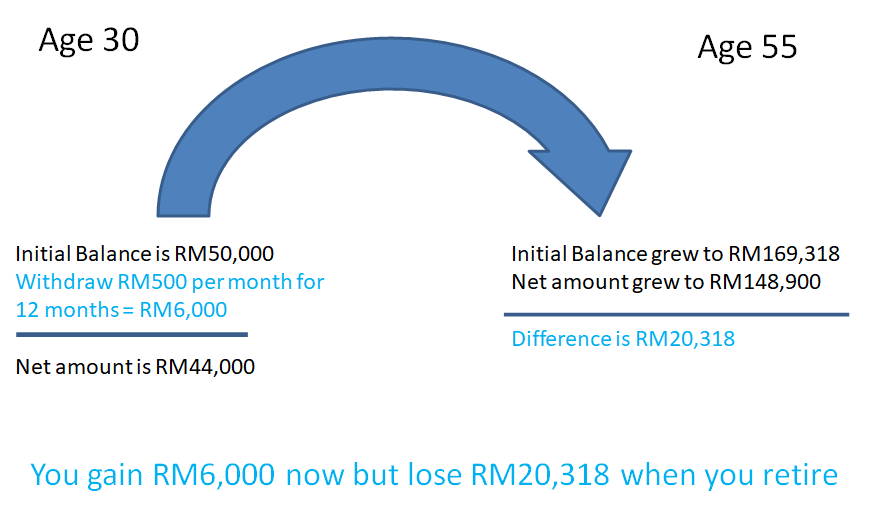

As a simplified example, assume you are 30 years old and have RM50,000 in your EPF account. If you take out RM500 per month for 12 months, this means you have taken a total of RM500 * 12 = RM6,000 out. By taking out your money early at the age of 55 the total amount in your account would be RM148,899.62. If instead you kept the money inside your EPF account, at the age of 55 the balance in your account would be RM169,317.75, which is RM20,318.34 more than if you took the money out. We are assuming EPF will credit 5% each year. Thus before deciding to opt into this scheme please consider the long term effects to your retirement funding.

Effect of Time Value of Money on EPF Withdrawal

Another example is the six month moratorium on bank loans. What this means is that you can delay the payment of bank loans for six months without incurring any penalty. This sounds great, but there is still the problem of compound interest. By not paying for 6 months you might have to pay more to the bank over the lifetime of the loan. What you need to ask your bank is whether interest will be accrued for the six months you stop paying. If they say yes then you need to ask the bank how much more you will need to pay by deferring the payments. Note that some banks have said they will not accrue interest and others have said they would for conventional loans but not Islamic loans, thus you need to ask your bank.

In conclusion these are difficult times for all of us, especially for the B40. Both the government and private organizations are trying their best to assist those in need. For any assistance which includes deferring payments or getting our savings early we must consider the effect of compound interest. Once things slowly get back to normal, we must all start the habit of saving on a regular basis. We will be putting more advice on savings and financial planning in our website, learnduit.com as well as our YouTube channel.

In the meantime, stay home, stay safe.

We would love your thoughts and comments. Please email the author at Hassan.Odierno@actuarialpartners.com or https://www.linkedin.com/in/hassan-scott-odierno/

We have put together a few videos relating to this, please see below for three different languages.

Here is English: https://youtu.be/trR-yybp5mQ

Chinese: https://youtu.be/JDlU5bZgDZk

Bahasa: https://youtu.be/0TSr6gAjcPo