The Australian regulator, APRA, is starting a pilot program in which their staff will sit in on the board meetings and executive committees of five companies in the banking, insurance and superannuation industries. They will do this to form a view of the culture of the company, to answer the question of whether the company demonstrates good risk culture. They will also spend three weeks interviewing internal staff down to the most junior level.

On the one hand this feels very invasive, with the potential of regulatory staff to resign and join a competitor of the audited company thus creating an unfair advantage. Even with protections such as a requirement of the staff to not join the industry within six months of resigning there are simple ways of bypassing this restriction.

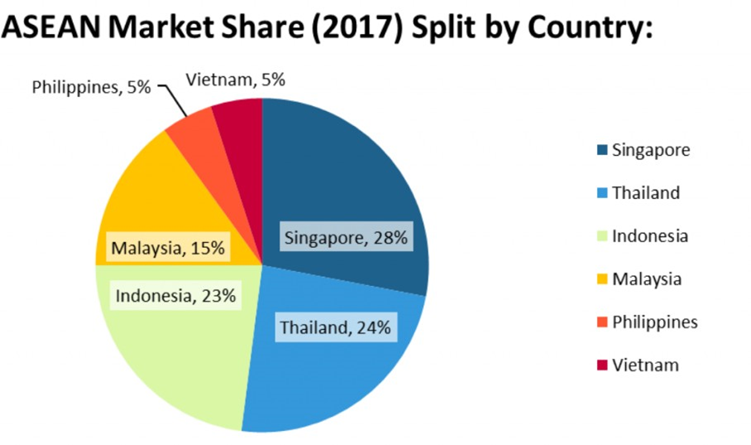

However, for a consultant, it is common to meet insurers who would like to save costs by simply “checking the boxes” with respect to guidelines relating to risk management. This would ensure that insurers follow the spirit of the regulation in addition to the letter of the law, which is an excellent step. Surely other regulators are watching this pilot program and it will be interesting to see if other regulators such as Bank Negara Malaysia follow suit.