Based on the regulations of Sri Lanka, we will need to reserve our policy liabilities using a Gross Premium Valuation (GPV) at the 75th percentile (i.e. Best Estimate + Risk Margin). In order to determine the 75th percentile reserves, we are required to run the reserves for four different scenarios, namely:

- high mortality high lapsation (HMHL)

- high mortality low lapsation (HMLL)

- low mortality and high lapsation (LMHL)

- low mortality and low lapsation (LMLL)

We will choose the maximum of these four reserves as the 75th percentile reserve and its scenario as our biting scenario. Note that the biting scenarios for liabilities under IRCC stressed scenarios are not determined individually, it would follow the biting scenario of the 75th percentile reserves.

Biting Scenarios for Universal Life Products

Based on our analysis, the biting scenarios of universal life products may change as time goes on due to its unique features and the policyholders’ background (e.g., level of financial sophistication, financial needs, etc.) in the country.

What’s unique about universal life plans is that each policy is backed with a fund value which increases as time goes on with additional contributions from premiums paid, as well as dividends declared on the existing fund value of the policy. The fund value will be payable in the event of surrender or maturity. Under GPV reserving, the fund values are projected from valuation date to the maturity date of the policy, which means that the present value of maturity outgo will increase over time as the policy moves closer to maturity.

With reference to the industry persistency studies, most insurers will have high lapse rates in the first few policy years, thus reserving under high lapsation (HL) scenarios would be conservative as we expect less future premium (income) received, which would increase reserves. However, due to the unique feature of universal life plans and improvement in yearly persistency, eventually, looking from a policy level, it would be more conservative to reserve under low lapsation (LL) scenarios due to the huge maturity outgo expected. Depending on the policy mix of the products, a switch in biting scenario may not cause a significant impact on the 75th and 99.5th percentile (LRCC) reserves. One reason behind this is that although there is an increase in maturity outgo, we also expect more premiums to be received and less surrenders, which would offset the increase in maturity values. However, this would hit the solvency quite badly especially when we calculate the IRCC.

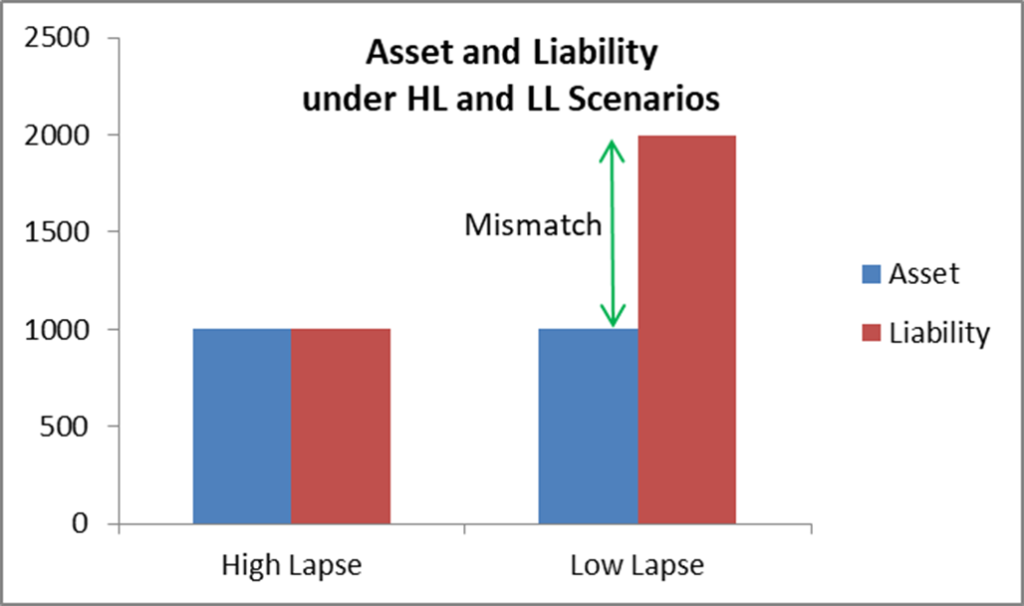

The IRCC is basically the present value of the surplus which is the difference between the asset and liability cash hows. A higher IRCC would imply a greater mismatch of assets and liabilities. Assuming that assets and liabilities are closely matched under original (HL) scenarios, a sudden switch in biting scenarios would cause a huge mismatch in cash hows at later durations. For example, for a policy maturing in 10 years’ time, the expected maturity outgo increased from USD1,000 to USD2,000 when the biting scenario switched from HL to LL, but the expected returns from the assets backing this policy is only USD1,000, resulting in a USD1,000 mismatch in 10 years’ time. This would increase the IRCC thus reducing solvency.

Based on this example, perhaps one way to mitigate this mismatching risk is to reserve using LL scenarios from the beginning, but this is not in line with the RBC guidelines currently in place since we need to determine the biting scenario based on the highest reserve calculated.

On the other hand, currently there is no clear direction on the treatment of negative reserves based on the Sri Lanka’s guidelines. What if the negative reserves are zerorised as per IFRS 17 standards? Would this prevent switches in biting scenarios?