Participating business in Malaysia contributed to a significant proportion of the Malaysian life insurance industry, particularly before the introduction of investment-linked business. Participating policies grew rapidly in the 1980s and 1990s, as the illustrated high rate of bonuses attracted the general public who typically favour savings-type policies compared to pure protection insurance policies.

Pre-asset share plans

Participating business sold before 2005 when the pivotal asset share guideline for participating business was issued by the regulators is termed within the industry as pre-asset share plans. They were sold based on a very attractive bonus scales and often illustrated over 20, and sometimes 30 years. Although the minimum rate of investment return on life fund investments which can be used for sales illustration purposes were prescribed by the regulators, the expected benefit payouts were initially illustrated using a single rate of investment return without any illustration of the potential upside and downside risk in the investment returns.

Necessary disclaimers were normally present in the illustrations but often were not clearly presented or communicated to policyholders. Hence, the illustrated bonuses were implicitly thought as guaranteed by some policyholders giving rise to questions as to what are policyholders’ reasonable expectations.

For these policies, a significant portion of the expected benefits payout comprised of terminal bonuses (i.e. bonuses which are payable only at the end of the contract term) and annual or reversionary bonuses were kept at a low level to minimise guarantees. In some cases dividends were adjusted to provide a substantial payout at maturity.

Another common marketing strategy was to use the option of a “critical year” where the policyholder can stop making payment at this critical year, and the future premiums are paid out from current and future bonuses, and still with a hefty bonus at maturity.

Indeed before the regulators clamped down on excessive reliance on terminal bonuses, the bulk of total expected bonuses were of the terminal kind. As such, given the minimal guarantees, companies were able to adopt a more risky investment strategy when investing premiums. These policies were priced assuming an expected long term yield as high as 8.5% p.a. helped in part with the higher bond rates available then and a reliance on continuing high return on equity investments. As a consequence of keeping guarantees to a minimum, companies were able to keep actuarial reserves low, and were able to use the excess accumulated premiums over actuarial reserves in the participating fund to finance its expenses and statutory solvency margins.

These products – being priced at returns of 8% p.a. to 8.5% p.a. – were able to illustrate returns of over 7% p.a. to the policyholder on premiums paid under a life policy, notwithstanding the cost of insurance and the high expenses incurred in writing each policy. Such returns were typically higher than the returns available on alternative forms of investment making saving through a life insurance policy an attractive proposition. Insurers were able to illustrate these high expected return to policyholders by providing minimal surrender values (which were very much less than their asset share) should a policy be terminated early by the policyholder.

As the policies lapsed or surrendered, surpluses made from early surrenders were then available to boost bonuses payable in future. Furthermore, by maximizing the expected benefits payout in the form of terminal bonuses, this enabled companies to maximise its capital position as the funds that would have been required to back any guaranteed benefits are now available for the purpose of supporting the fund’s solvency margin.

Invariably, bonuses needed to be cut as interest rates fell from their high in the 80s and insurers were not able to obtain the yield assumed in pricing these pre- asset share products. Regulators eventually stepped in by issuing JPI29/2004 which provided guidance on bonus revisions. In addition to the requirement whereby the legalities in the policy contract are to be observed, the regulation also requires bonus revisions to take into account policyholders’ reasonable expectation (PRE) and fair treatment of policyholders, including equity amongst different groups and generations of policyholders.

A further regulatory correspondence in March 2005 required that a minimum of 100% of asset share is to be payable on surrender from 15th policy year onwards for a whole life plan (mid-term for other plans). This single pivotal correspondence gave rise to the next generation of participating plans in Malaysia, commonly known as the Asset Share plans.

Asset share plans

Subsequently in 2005, in a move to improve equity to policyholders who surrender their policy before its maturity, the regulator introduced the concept of asset shares for participating business such that the payout for participating products is to be based as close as possible to 100% of asset shares in the event of a surrender, death or maturity (i.e. “asset share plans”).

Pre-asset share plans are also required to pay out asset shares on surrenders although there is scope to deviate from such requirements if the design of the plan does not permit the payment of asset shares as the surrender value.

The purpose of this regulatory change is to ensure fair and equitable treatment between different group and generation of policyholders and to meet PRE.

As a result, current participating products are no longer lapse supported and surrenders do not result in the release of significant surpluses. Furthermore, under the current Risk-Based Capital Framework (RBC) reserving requirement, technical reserves now reflect expected bonus payouts which give rise to much higher reserves than under the previous Net Premium reserving regime. Given their high expense base and coupled with higher reserving and solvency requirements for insurers compared to banks and other savings mediums, the ability for insurers to create saving products that are more attractive compared to alternative forms of investment thus becomes more challenging.

Managing policyholders’ reasonable expectations (PRE)

Benefit illustrations for asset share plans highlight that future bonuses will depend on the future mortality, expense and investment performance of the life fund and therefore PRE for these plans are largely met by paying out asset shares.

However for pre-asset share plans, the treatment of PRE is less clear. Arguably PRE is met if payouts are based on bonus illustrations, taking into account any legal obligations and past communications. Where bonus illustrations cannot be met, bonuses may be revised downwards taking into account the asset shares experience by different cohort of policies and potentially allowing for actual surrender experience.

Given the different PRE of expected benefit payouts for pre and post asset share products, the bonus policy for the two blocks of businesses are likely to be different. Correspondingly, the optimal investment strategy will also be different. For pre-asset share products, given the minimum guarantees, these policies can have a higher equity backing ratio as it is able to take on greater volatility in investment returns and allow for smoothing, and thus achieve higher expected returns in line with the sales illustrations to meet PRE. In addition, there should not be cross subsidy between the asset shares from the asset share products to subsidize the pre-asset share products.

Therefore, Treating Customers Fairly (TCF) requirements imply that the pre and post asset share products should at least be notionally segregated in the funds, for example, by having a notional asset backing ratio or by ring-fencing the pre- asset share products which are in run-off.

Given the recent additional requirements by the regulators to enhance the internal bonus policy of insurers (see Appendix A), insurers with participating funds would need to explicitly address the following questions:

- Should bonus policy be different for pre and post asset share plans?

- Should pre and post asset share funds be segregated to reflect any differences in investment strategy? For example, the high terminal bonuses illustrated in pre-asset share products imply higher allocation to equities to meet PRE.

- Should bonus policy be different for funds with different investment strategy? Funds planning on higher equity exposure (perhaps for the younger funds) should theoretically allow for regular bonuses to capture income yield and capital gains to be captured as terminal bonuses. Terminal bonuses should then be actively managed and its volatility communicated to policyholders.

- What smoothing approach should be used and how should this communicated to policyholders?

Managing a declining participating new business block

The industry has been observing declining participating new business trend, with companies moving away from selling participating products given the higher capital requirements under the Risk-Based Capital Framework as compared to the less capital intensive investment linked products. Companies need to ensure asset share is paid out to Treat Customers Fairly, and any further bonus enhancements should only be made from the inherited estate. The management and the distribution of the inherited estate is another is another area which can be subject to further technical and regulatory challenges.

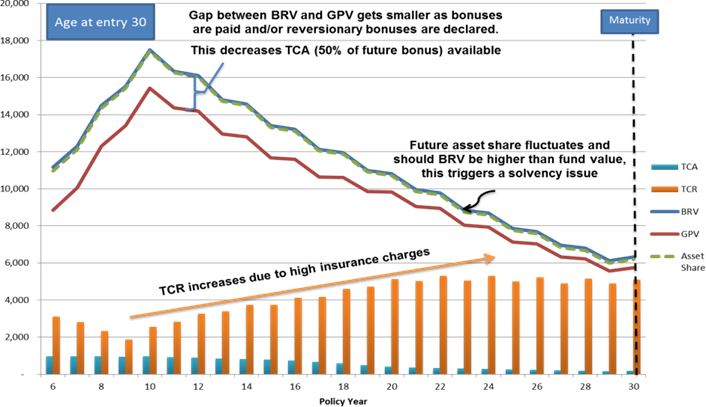

As the block of existing business goes into run-off, and there are more exits than new business entering the participating fund, companies face new challenges in managing the participating business. Figure A below shows a typical run off of a participating limited pay endowment product with cash dividends payouts as bonuses (i.e. a common pre-asset share product) and provides an illustrative example of the solvency issues for a maturing participating portfolio. For a maturing portfolio, particularly for a fund made up predominantly of legacy (i.e. pre- asset share) products, the level of guarantees increases as the regular reversionary bonuses are declared and become a guaranteed benefit.

This result in a continual reduction in the free capital available in the fund to meet regulatory capital requirements, with free capital defined as 50% of the difference between the participating fund value and the Gross Premium Valuation (GPV) reserves under the RBC Framework. Hence in the future, if not already currently, solvency for the participating fund is likely to be an issue.

Regulatory reserves are typically determined using a Bonus Reserve Valuation (BRV) basis, and if BRV targets to pay out 100% of asset shares, it is reasonable to expect the BRV (blue line) and asset shares (green dotted line) to be of similar levels. However, asset shares are directly impacted by actual yearly investment returns which tend to be variable, and therefore any changes in the market value of investments will also change the value of the asset shares. For a fund with minimal inherited estate, the value of the fund and the asset shares are the same.

Therefore unless there is flexibility in managing bonuses annually there is a higher chance of requiring capital injection from the shareholders fund (as required under Section 82 of the Financial Services Act 2013) due to the volatility of the fund value, particularly when the fund value dips below the reserves value (i.e. the green dotted line representing the asset shares and fund value to be below the blue line representing BRV). This is further exacerbated for funds with a higher proportion of volatile assets in the participating fund. Once shareholders inject additional capital into the participating fund there is no or limited avenue to get a refund should the solvency position improves in the future.

Figure A: Key challenges in managing a maturing portfolio of a typical pre-asset share participating business under the RBC Framework in Malaysia

Note: The above represents a limited pay participating endowment plan which pays out cash dividends as bonuses.

Unlike the participating funds in the UK which would have typically built up a substantial inherited estate, not all of the Malaysian insurers have access to such estates or orphaned assets in its participating fund to assist in the capital management and to meet the regulatory capital requirement.

Asset-Liability Management

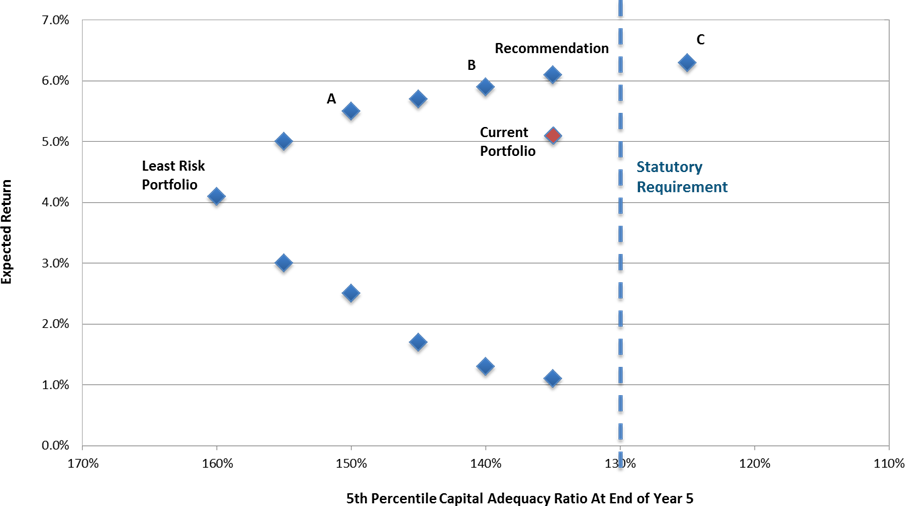

Given the importance of having an appropriate investment strategy to manage the differing risks underlying the various blocks of participating business, asset-liability management (ALM) is an important tool that can be utilized to investigate the concurrent impact on both assets and liabilities under various scenarios. Using ALM, companies are able to assess the CAR position using the current asset allocation strategy and investigate if changes are required for better matching of assets and liabilities.

ALM also enables companies to project the expected solvency position as the participating portfolio matures and future bonuses are declared to become guaranteed. Incorporating a stochastic asset returns in the projections will enable companies to investigate the Value at Risk (VaR) and the probability of companies having its assets falling a certain threshold level, and thus the need of further capital injection to the participating fund in order to meet its capital requirements. The ability to consider the investment variability of different asset allocation strategy is valuable in the assessment of the robustness of its capital position. Figure B below shows an illustrative example of the impact of various asset allocation strategies to the CAR position of the participating fund.

Figure B: Illustrative example of the impact of various asset mix to the CAR position of the participating fund

What’s next?

With a maturing block of legacy participating business and increased regulatory requirements, we believe that the application of ALM is essential and valuable to companies, for the purpose of monitoring and managing the participating fund. In most advanced markets, ALM is embedded in the processes of many companies with a significant participating business. The application of ALM includes the management and sustainability of the company’s bonus policy, the assessment on the robustness of the capital position under various stress scenarios as well as for any potential distribution of the inherited estate.

With the expected introduction of a minimum allocation rate for investment- linked policies as outlined in the recent ‘Concept Paper: Life Insurance and Family Takaful Framework’, there are some expectations that companies may return to selling participating products. In our view, without improving expected returns on the fund with higher exposure to growth assets, this is unlikely to be a feasible alternative given that the internal rate of return on the asset shares participating products currently are lower than bank deposit rates, and thus makes participating products less desirable as a savings vehicle to consumers. Also with the imminent introduction of commission disclosure, selling high commission participating savings product will be challenging given other more attractive savings options available in the market.

If you have any queries on the article above, please do not hesitate to contact the authors of this article or your usual Actuarial Partners consultants.

Email:

Zainal Abidin Mohd. Kassim, FIA

zainal.kassim@actuarialpartners.com

Aiza Yasmin Benyamin, FIA

aiza.benyamin@actuarialpartners.com

Appendix A

BNM recently issued additional requirements for participating business management, for the following key areas:

- Enhancement to the internal bonus policy of insurers: This includes explicit rules for bonus adjustments, triggers for management actions, explicit matrices for bonus determination, clear decision rules to be applied in an objective and consistent manner and any downward adjustments to be consistent with past practices.

- Annual sensitivity and stress testing: This includes assessments of potential events which can lead to future bonus adjustments and identification of key risk factors affecting sustainability of the participating fund.

- Enhancement of communication strategies: This includes the need for an effective communication to forewarn policyholders if required and to manage their expectations. There is also a requirement for a comprehensive risk assessment to different stakeholders with a corresponding action plan to manage the risks.