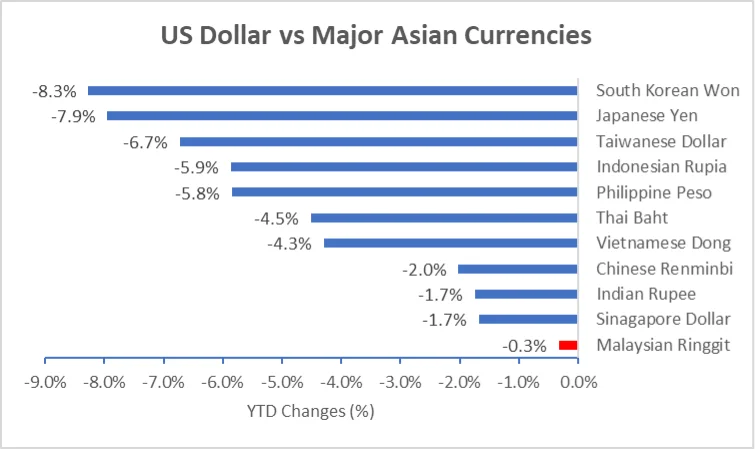

Contrasting Movements in Malaysia’s Government and Corporate Bond Yield Curves

Although Malaysia’s Overnight Policy Rate (OPR) has remained unchanged at 3% since May 2023, there have been notable shifts in both the Malaysian Government Securities (MGS) yields curve and corporate bond yields curve in the first half of 2024. This article aims to explore these changes and discuss their underlying causes.

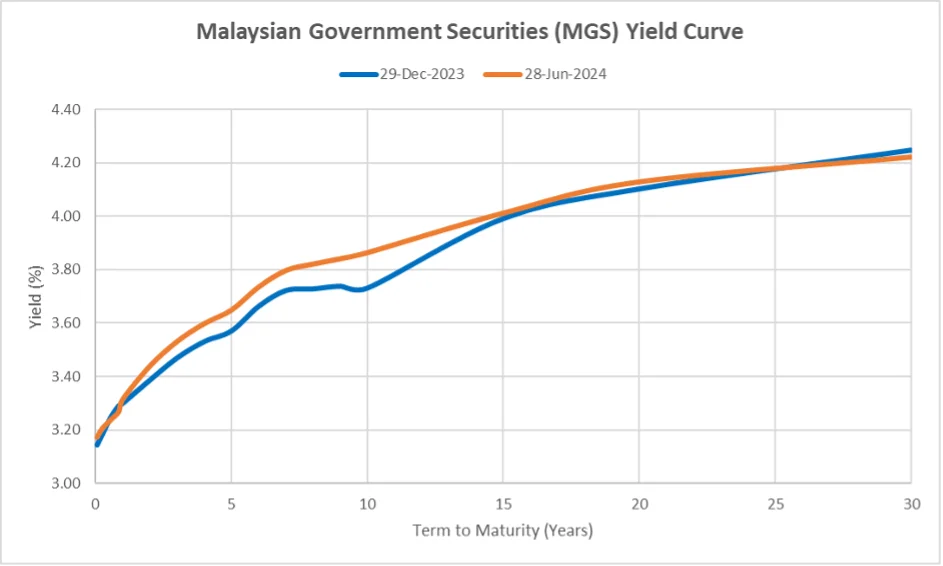

MGS Yield Curve

Source: Bank Negara Malaysia

In the first six months of 2024, the MGS yield curve underwent a moderate upward shift in the short to medium-term segments, while the long-term segments remained relatively stable. The starting point of the yield curve remained broadly unchanged at 3.2% per annum and steepened notably in the short to medium-term, with yields rising more rapidly compared to the end of 2023. For instance, the yields of a 5-year and 10-year MGS increased by 8 and 13 basis points respectively from December 2023 levels.

The steeper rise in the short to medium-term segment of the yield curve could be attributed to the following factors:

Positive economic growth prospect

Malaysia’s economic growth accelerated in the first quarter of 2024, driven by strong domestic expenditure and a recovery in global trade. Gross domestic product (GDP) grew 4.4% in the first three months of 2024, beating the consensus forecast of 3.9% growth. On a seasonally adjusted basis, GDP rose by 1.4% quarter-on-quarter. The growth momentum is expected to continue in the near future. On domestic front, consumer spending, which accounts for 60% of Malaysia’s GDP is likely to remain robust supported by a resilient labour market and positive income growth. Meanwhile, on external front, Malaysia stands to benefit from the rebound on international trade, especially from the upturn of the global tech cycle. Electronics and electrical products, which contribute nearly 40% of Malaysia’s total exports, are anticipated to contribute positively in the coming quarters.

Higher inflation expectation

Since the beginning of 2024, Malaysia’s price level, as measured by the Consumer Price Index (CPI), has consistently remained below Bank Negara’s inflation target of 2-3% per annum. According to the latest data from the Department of Statistics Malaysia (DOSM), the inflation rate was 2% in June 2024. Despite a slower price increase during the first six months of 2024, inflation is expected to rise above 2% in the near term due to the implementation of several policies changes.

Introduction of EPF Account 3

In May, the Employees Provident Fund (EPF) introduced a new Account 3 (Akaun Fleksibel) which provides EPF members with the flexibility to withdraw up to 10% of their retirement savings at any time for any purpose. This new Account 3 will start with a balance of RM0, but members have the option to make a one-time transfer of funds from Account 2 (Akaun Sejahtera) to Account 3. EPF projections estimate that RM25 billion of funds may be withdrawn from Account 3 in the first year, with annual withdrawals moderating to RM4 billion to RM5 billion thereafter. This EPF account restructuring is expected to boost domestic consumption, although its impact may be less profound compared to the previous withdrawals allowed during the pandemic.

Rationalization of diesel subsidy

The government’s decision to move away from a blanket diesel subsidy to a more targeted approach is expected to push inflation higher in the second half of 2024. Following the rationalization of the diesel subsidy, the price of diesel in Peninsula Malaysia has increased from RM2.15 per litre to RM3.35 per litre. Given that diesel accounts for 0.2% of the CPI basket, a 56% jump in the diesel price would directly translate into a 0.1% increase in the CPI over the next 12 months. However, the overall impact on the CPI remains uncertain, but it is broadly expected to be moderate as logistics vehicles, public transport, fishermen, farmers and low-income group continue to receive diesel subsidies from the government. While this reform is expected to save the government RM4 billion, the government will still spend approximately RM10 billion per year on targeted diesel subsidy.

Civil servant[1] pay raise

During the labour day celebration, our Prime Minister announced that civil servants will enjoy a salary hike of more than 13%, starting from December this year. It is estimated that the government will allocate another RM10 billion next year for emoluments due to the salary hike. With civil servants accounting for more than 10% of Malaysia’s labour force, the increase in income for civil servants is anticipated to provide a boost to domestic consumption in 2025.

To sum up, Malaysia’s inflation expectation will be higher due to the various factors discussed above. This higher inflation expectation is anticipated to persist in the short to medium term, due to ongoing government efforts to rationalise subsidies on other price-controlled items such as the RON95 petrol.

Interaction between market supply and demand

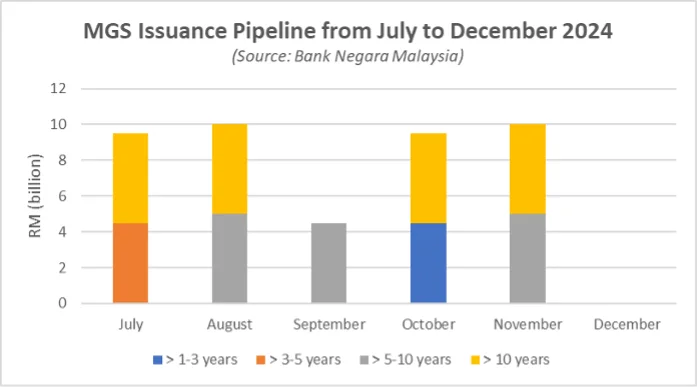

The increase in MGS yields observed, particularly in the 5 to 10-year term, may be attributed to a larger increase in supply relative to demand. In the first six months of 2024, the government issued RM45 billion worth of MGS. A substantial portion of these issuance, 44% (or RM20 billion), had term to maturity between 5 to 10 years. This large volume of issuance increased the supply of MGS in this range, which exerted upward pressure on the yields as the market adjusted to absorb the additional supply. MGS with terms to maturity between 1 to 5 years accounted for 22% of the issuance (or RM10 billion), while those with maturities longer than 10 years made up the remaining 34% (or RM15 billion).

Moving into the second half of 2024, the scheduled issuance of MGS remains broadly consistent with the first six months. However, unlike the first half of 2024, the majority of the issuance in the second half will be for MGS with maturities longer than 10 years, accounting for 46% of the total.

Corporate Bond Yield Curve

In contrast to the MGS yield curve, the corporate bond yield curve has shifted downward across all terms to maturity. Yields for longer-term corporate bonds fell more than those of shorter-term bonds, resulting in a flattening of the corporate bond yield curve. This movement is consistent across corporate bonds of different credit ratings. The chart below shows the movement of yield curve for AAA and AA-rated corporate bond yields.

Source: Bank Negara Malaysia

Corporate bonds are often viewed as riskier than government bonds due to their higher default risk and lower liquidity. To compensate investors for taking on these additional risks, corporate bond yields are typically higher than those of government bonds, with the difference in yields reflecting the risk premium. As a result, corporate bond yields are influenced by both movements in government bond yields and fluctuations in the risk premium.

Table 1 below shows the breakdown of the changes in corporate bond yields due to movements in MGS yields and the risk premium. Despite the rise in MGS yields, corporate bond yields dropped due to a significant reduction in the risk premium, suggesting an increase in investor risk appetite and improved corporate profitability.

Table 1: Breakdown of Changes in Corporate Bond Yields (in Basis Point)

| Term to Maturity (years) | 3 | 5 | 7 | 10 | 15 |

| Change in MGS yield | 6.0 | 7.7 | 7.4 | 13.2 | 2.0 |

| Grade: AAA | |||||

| Change in risk premium | -7.2 | -11.3 | -17.2 | -23.2 | -17.0 |

| Change in AAA bond yield | -1.2 | -3.6 | -9.8 | -10.0 | -15.0 |

| Grade: AA | |||||

| Change in risk premium | -13.0 | -18.1 | -22.7 | -29.7 | -25.0 |

| Change in AA bond yield | -7.0 | -10.4 | -15.3 | -16.5 | -23.0 |

| Grade: A | |||||

| Change in risk premium | -37.9 | -47.2 | -51.2 | -54.7 | -52.1 |

| Change in A bond yield | -31.9 | -39.5 | -43.8 | -41.5 | -50.1 |

| Grade: BBB | |||||

| Change in risk premium | -31.9 | -37.5 | -30.1 | -39.1 | -44.1 |

| Change in BBB bond yield | -25.9 | -29.8 | -22.7 | -25.9 | -42.1 |

| Grade: BB & Below | |||||

| Change in risk premium | -75.2 | -106.9 | -126 | -134.3 | -120.4 |

| Change in BB & Below bond yield | -69.2 | -99.2 | -118.6 | -121.1 | -118.4 |

Source: Bank Negara Malaysia

The increase in investor risk appetite and improved corporate profitability is also evident in Malaysia’s stock market, where the FTSE Bursa Malaysia KLCI increased by 9.3%, climbing from 1,454.66 to 1,590.09 during the same period and hitting a three-year high in July 2024. Our Malaysian stocks’ market capitalization had also achieved a historic milestone, surpassing RM2 trillion for the first time in May 2024.

Conclusion

The contrasting movements in Malaysia’s government and corporate bond yield curves during the first half of 2024 highlight the complex interplay of economic factors influencing the financial market. While the MGS yield curve saw a moderate upward shift in the short to medium-term segments due to positive economic growth prospects, higher inflation expectations and increased government bond issuance, the corporate bond yield curve experienced a notable downward shift. This divergence is primarily driven by a significant reduction in the risk premium, reflecting increased investor risk appetite and improved corporate profitability.

[1] Civil servants include those employed in the public healthcare sector and in uniformed services.