With so many current challenges in Takaful such as growing the business to achieve critical size it’s easy to lose sight of emerging risks. However, if Takaful is to go beyond simply following conventional insurance to lead the way in its own market segment, we simply must keep our eyes on potential risks and how to take these risks as opportunities rather than threats.

There are many ways to classify the types of risks in Takaful, such as the following:

- Shariah Risks

- Model Risks

- Distribution Risks

- Regulatory Risks

- Benefit Risks

- Investment Risk

- HR Risks

- Operational Risks

- Financial Reporting Risk

Shariah risks in Takaful can be hard to quantify and is unique to Islamic financial institutions. The reality however is that whereas other risks can be quantified and classified as to risk and severity, should a Takaful operator be temporarily shut down or exposed as being out of compliance with the Shariah this will be severe reputation risk and likely fatal. It is important to note that Shariah risks are likely to not be willful disobedience but rather a lack of awareness by staff as to when it is important to seek the advice of the Shariah committee or at least the internal Shariah officer. In one case we were auditing the actuarial work of a Malaysian Takaful operator and we noticed a practice which seemed questionable (being charged interest for a certain type of reinsurance), so when we asked the actuary how this got approved by the Shariah council the answer was that their approval was never sought (their processes did not make it clear when to seek the advice of the Shariah council).

During a project for another operator, the development of an internal capital adequacy assessment plan (ICAAP), an internal Shariah audit was reviewed whereby the internal Shariah audit team reviewed five accepted cases for Shariah acceptability. Unfortunately three of the cases were seen to be non-compliant. Thus as various new risks emerge for Takaful, proper processes simply must be in place to ensure compliance with the Shariah. Emerging risks are an opportunity rather than a threat but in Takaful the Shariah committee must ensure the resulting Shariah risk is manageable!

When discussing emerging risks, it’s important to understand the current situation of Takaful in terms of its products and market. In Malaysia the family (life) Takaful market is quite strong relative to general Takaful. The main Takaful products sold include unit linked plans with medical, critical illness and similar riders, mortgage reducing term plans which cover Islamic loans and group term Takaful. Savings plans, very popular in conventional insurance, have been much harder to sell in Takaful. In general Takaful the focus has been on personal lines such as motor and fire and PA. Takaful has had a much more difficult time with specialized commercial lines as compared to conventional insurance.

In addition to Shariah risk which is unique to Islamic finance, Model risk is a potential emerging risk which would be more relevant to Takaful than conventional insurance. Currently the Takaful models used in Malaysia as well as globally are mainly the Mudharabah and Wakalah models. Whilst there are various versions depending on country and operator and corresponding risks associated with them, emerging risks relate to new potential models as well as shifts in the types of assets available to back the models currently in use.

Under the new draft Takaful Operating Framework (TOF) guideline there is mention of using Qard as a model for the investment fund. Elsewhere we have seen operators experiment with the Wadiah and other models as well, with the desire to compete with the guaranteed returns of conventional insurance. Model Risk is not so much whether innovations in Takaful models are halal but rather what risks arise from these models. For instance in Takaful SHOULD we design guaranteed maturity value products? Will we have assets in the future to back these products? In Malaysia we have Islamic bonds which act very similar to conventional bonds but in some other countries this bond structure might not be acceptable. If Malaysia changes its bond structure to more closely align with structures used elsewhere then there will be severe risks with guaranteed maturity values for the operator.

On a deeper level the beauty of Takaful is the idea of participants working together to help each other. This is the theory, which in practice is seen in the surplus distribution practices. Suppose there was a large loss which caused a Qard in 2018. A participant starting in 2019 would not expect surplus for some time as they will be helping to pay off the Qard. We help each other, which is different than participating conventional insurance products in which the participant starting in 2019 would not be effected by any losses in 2018 which is thus more fair on an individual participant point of view but loses the idea of participants helping each other. Will new models dilute this beauty? If we lose the spirit of Takaful then Takaful is just another product line.

The current risk with respect to distribution is that should there be disruptions in distribution there might be insufficient fees collected to cover management expenses. There is also the risk of lack of diversification where there is over reliance on banking business (MRTT) or agency business.

In the future it is highly likely that new ways of distributing Takaful will disrupt the industry. We are seeing examples of conventional insurance being sold via channels such as online websites and mobile apps. These new channels are able to go one step further by applying new technologies such as data mining and blockchain to provide a greater value proposition.

You may have heard of the saying “Data is the new oil”, so whoever can get cheaper access to participants and their data will be able to disrupt the current agency distribution channel.

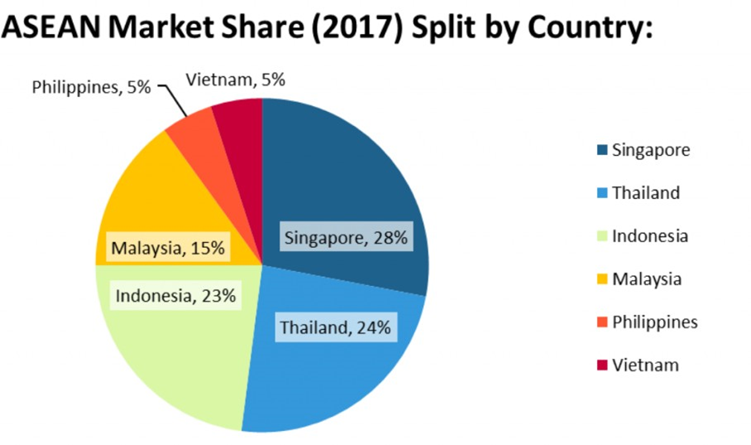

A potential disruption in the next ten years is the ASEAN Economic Community (AEC). The goal is to have ASEAN act as one economy and allow business to how freely amongst ASEAN nations. This would include insurance and Takaful. The potential for Takaful is the ability to reach Muslims in countries throughout ASEAN but the risk is the inhux of foreign Takaful operators, especially Indonesia. Should the Indonesian operators in particular be allowed to distribute products in Malaysia this would instantly disrupt the Malaysian Takaful market. This would affect local operators more than multinationals, as multinationals tend to have operations in both countries (and can rationalize operations to become more competitive).

Source: 2018 Swiss Re Rigma Report, other countries negligible

The AEC will also potentially introduce a myriad of other risks. Will it be ideal to have one central location for an insurer rather than be in each country, or perhaps decide on the location on a departmental level and what new operational risks does this create? (Free how of goods and services) Also there will be a much larger universe of potential investments, which is great but this expands investment and ALM risk as well (Free how of investment and capital).

Regulatory Risk is the risk of regulatory non-compliance or potential new regulations which hurt the operator. Currently regulations for Takaful tend to mirror conventional, but this perhaps leads to Takaful products which mirror conventional insurance products. We can make a strong argument that this has hurt the ability of Takaful to innovate to enter new market segments, such as micro products for the B40 which should be a strength for Takaful. BNM has mentioned a goal of having the market share of regular contribution non-agency business to be more than 30% of the total business. To achieve this, it is quite likely regulatory disruption is just starting.

One example of potential regulatory disruption is with respect to investment linked (IL) benefit Illustrations. We illustrate the benefits the participant would get under high and low investment returns. This is fine but what about the other assumptions? A main selling point of IL is the riders attached, especially medical. Do we really expect that medical costs will not increase in the future? If not then shouldn’t we build this into our projections to be fair to consumers? There is a strong risk of very unhappy participants in the future when their policy lapses due to these increased rider contributions. This is reputation risk (how can a Takaful operator do this to me?!) as well as a financial risk if BNM refuses to allow contribution increases due to a lack of transparency. Also in benefit illustrations the coverage period might last longer than the benefit illustration, so assumptions need to be reasonable for the lifetime of the policy.

A final example of regulatory disruption is with the minimum allocation rates (MAR). This change increases the allocation to participants funds for unit linked products. This has caused technical challenges unless commissions can be reduced (difficult to do). Conventional insurers can use financial reinsurance (reinsurer gives funds to the insurer to help with initial expenses in return for reinsurance premiums plus an interest charge on the funds given). However, the Takaful industry is still trying to figure out how to do this and is likely to put Takaful at a disadvantage. Takaful was given extra time to comply, but this just makes it seem like conventional is fairer to participants than Takaful, so we are in a lose – lose situation is a traditional risk in Takaful.

Benefit Risk is a traditional risk in Takaful. We have two types of benefit risks:

- Experience much worse than expected in a particular year

- Our assumptions ended up being wrong for long term plans (i.e., conditions change)

Although we sometimes say tabarru’ rates are not guaranteed, for single contribution plans such as MRTT we cannot increase tabarru’ so from a practical point of view we have given guarantees as to future experience. Due to climate change catastrophes such as hoods and drought are likely to get worse. This will affect Takaful experience, especially local operators with less access to global expertise to measure this risk. In terms of mortality, people are living longer but are they living longer and healthy or longer but unhealthy? Studies have shown that people are sleeping less now with social media and other technology being used until late at night. Over time this has the potential to reverse the trend of improving mortality.

An example of an emerging risk is genetic testing. Genetic testing could become more common, allowing more people to take it BUT is it okay for the operator to base contribution rates or to reject based on genetic testing results? In some countries it has already been considered not acceptable.

Investment Risks are another traditional risk in Takaful. Investment Risks include:

- Market Risks

- Credit

- Mismatch

- Currency

- Liquidity

As Islamic assets innovate and develop over time the investment risks of Takaful will also change. Mismatch risks are particularly important. Whereas for conventional insurance generally speaking a product is developed and then assets purchased to match, in Takaful we have less asset choices so we need to be careful with the design of our products.

HR risks are an emerging risk in Takaful over the near future. Employees are job hopping more than ever before, resulting in less and less expertise staying with the operator. There is much lower ‘loyalty’ to Takaful now as well, so it’s common to see employees leave for conventional insurers. This trend is not expected to reverse in the foreseeable future, and is likely to worsen as non-traditional job opportunities grow. Staff training and over- reliance on key staff are also HR risks.

Operational Risks can relate to data, new technology or anything else relating to the operations of the Takaful operator. More and more of our business operations will be in the cloud – for instance agents using online means to market to participants and participants paying and interacting online. This is in addition to the collection of data online which will grow exponentially. With online use and data collection comes cyber-risks. Some of the risks that entities face in this realm include computer security breaches, privacy breaches, cyber theft, loss of revenue, reputational damage, business continuity/supply chain disruptions and cyber threats to infrastructure.

Predictive analytics is using data to predict the experience, such as for Motor Takaful. We can collect very detailed information and use data science to help us charge accurate contributions as compared to our competitors. The risk is when we do not keep up. This is a new reality under detariffication. As a simple example in Motor Takaful, assume we have two cars: The first car has a cost of RM500 (good risk, wakalah fee plus benefit costs) and another RM1,500 (poor risk). The operator does not know which car will be the good risk (what predicts the good experience) so charges both participants RM1,000 (average of the two). This works fine as long as everyone is doing the same thing. As soon as a competitor understands what makes the good risk good and the bad risk bad, they can offer RM500 for the good risk and RM1,500 for the bad risk. From the participants point of view the good risk is offered a contribution of RM1,000 from the Takaful operator and RM500 by the competitor so he chooses the competitor. The bad risk is offered RM1,000 by the Takaful operator and RM1,500 by the competitor so he chooses the Takaful operator. This will be disastrous for the operator.

There will be huge innovation in motor Takaful in the near future. Within the next five years we will have driverless cars on the road. If there are accidents, who is liable: the car manufacturer or the passenger or maybe the programmer? We have seen the first accident involving a driverless bus, where the bus did not take evasive action that a driver would instinctually do. This was a limitation in the programming. From a technical point of view contributions are expected to be drastically lower as a result of these autonomous vehicles, which is a huge risk for general Takaful. How this work in reality will and what does Shariah think of such things? What about hying cars? The first hying cars are in production now and about to be available!

Drone use is already common in some countries and will be soon in Malaysia: Amazon delivers packages by drone, UPS is starting as well. There is pizza delivery by drone in India already. Drones will soon be helping with construction as well as in safety inspections which had been in dangerous areas. Drones are being used to monitor crops to improve agriculture output. This drone use will change the underlying risks we are covering as well as increase risks of being struck by drones which would increase personal accident costs. In insurance, drones are being used for quick assessment of accident sites and could affect other aspects of insurance such as how policies are underwritten.

Personal Accident Takaful is another source of innovation. With companies such as Uber (Grab) and Airbnb simply starting rather than waiting for licensing, we now live in a world where we ask for forgiveness rather than permission. Has the use of private cars for Grab resulted in increased claims in motor Takaful? What about having constant guests as an Airbnb home? This affects the future of many types of Takaful coverage. A particular issue arising now is with electric scooters, only RM3 to use but with no experience driving such things accidents are going to increase!

With the increasing use of online methods for sales, one remaining challenge with offering Takaful globally is getting payments overseas. With the development of Blockchain solutions we can instantaneously send and receive funds at a fraction of the cost currently. This is amazing for Takaful as it might allow us to offer Takaful around the world. This opens up a whole new realm of risks however, which the operator needs to understand. Smart contracts are connected with Blockchain solutions, but with automatic execution are there Shariah issues?

Financial reporting risk could mean many things, but the risk over the next several years is with a new accounting standard (IFRS 17) which will fundamentally change the way investors see Takaful. The goal of IFRS 17 is the fair and accurate depiction of the accounts of an insurer/takaful operator. There are two main methodologies for doing this as of now: traditional insurance approach and a mutuality approach. With mutuality different groups of policyholders assist each other whereas in the traditional approach we consider each tranche of policyholders independently.

Thus, the question: what do accountants (auditors) think of Takaful? Is there mutuality whereby different products and issue years (cohorts) assist each other, or is it more of a participating plan where mutuality is not present or at least minimized? The current thinking is for the PRF to be split into cohorts by issue year (at least) and likely by product type. The PRF itself will not be an integral part of the accounts but rather be relegated to the back of the accounting statements in the notes. This implies that the PRF is simply a notional means of allocating surplus rather than its own entity whereas traditionally it has been said or at least implied that the participants are the owners of the PRF. So, the key question is: Is Takaful just another name for insurance or is it honestly different? (We must answer this without using words like halal and haram or other Arabic terms!)