Recently Actuarial Partners conducted a series of webinars on takaful which culminated in demonstrating the complications that will arise applying B67 to B70 of IFRS 17 (the Standard) at the Takaful Entity (TE) level (for access to the webinar series please follow the following link https://learnatap.com/webinars2/.

During the webinars we emphasised two important considerations which should not be compromised in financial reporting at the TE level: that the reporting remains Shariah compliant and that the reporting does not result in altering the underlying economic phenomenon of the contract. The latter represents a fundamental principle underlying all IFRSs. This was demonstrated very clearly when the IASB decided to decline the request from correspondents to waive the requirement that insurance contracts need to be separated by annual cohorts. The IASB concluded that annual cohorts should be maintained, otherwise there remains the possibility, however remote, that unprofitable policies (to the insurer) would be masked by policies which are profitable. We can therefore conclude from this that, where contracts have cash flows that affect or are affected by cashflows to policyholders of other contracts, then B67 to B70 of the Standard must be applied when determining the net fulfilment cash flows to the individual contract. However, as our webinar has established the practicality of implementing this requirement at the TE level is challenging.

A question that comes to mind is, “Is there a consistent surplus apportionment ratio at the individual contract level between the participant and the takaful operator?”, the idea being that should there be such a consistency, then accounting the TE as an insurance entity would be relatively easy as all surpluses arising at the contract level could just as easily be allocated at the predetermined sharing percentages at the TE level.

In Malaysia the 50:50 sharing ratio comes to mind. However, the reality is that the 50:50 sharing ratio only applies to the surpluses arising in the Participants Risk Fund (PRF). The operator gets all the surpluses arising in the Operator’s Fund. This means that ultimately the surplus sharing ratio for each takaful contract at the TE level varies by how much the operator takes as a wakala fee. The table below illustrates.

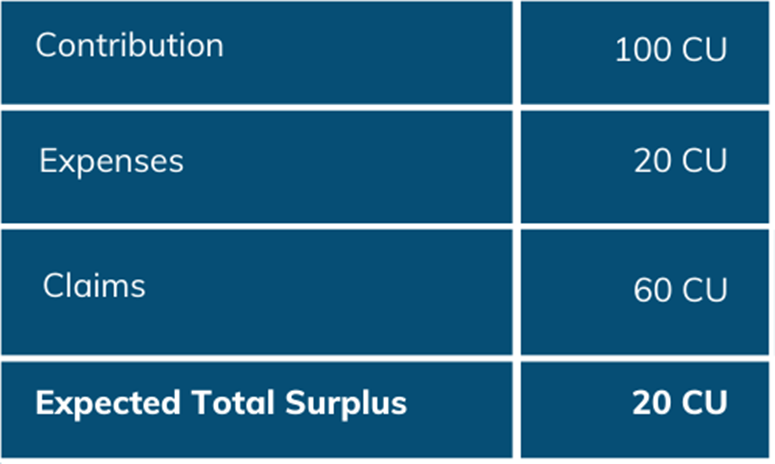

Assume a contract with the following features:

Expected Total Surplus is calculated as: Contribution less Expenses less Claims.

The examples given below analyse the impact on the surplus apportionment ratio between the participants and the operator of varying the wakala fee, the wakala fee being the proportion of the total contribution that the operator takes to cover its expenses. Total Profit to the operator is calculated as Surplus in the Operator Fund plus Performance Fee, the performance fee being the fee payable (max 50%) from the Surplus in the PRF.

Example 1: Wakala fee 20%

Surplus in the Operator Fund 20% of 100 CU less 20 CU = 0

Surplus in the PRF 80% of 100 CU less 60 CU = 20 CU

Operator Performance fees 50% of 20 CU = 10 CU

Participants Surplus 20 CU – 10 CU = 10 CU

Total Profit to operator 0 + 10 = 10 CU

Effective Profit Share percentage at contract level 50:50 (Participants: Operator)

Example 2: Wakala Fee 40%

Surplus in the Operator Fund 40% of 100 CU less 20 CU = 20 CU

Surplus in the PRF 60% of 100 CU less 60 CU = 0

Operator Performance Fee 50% of 0 = 0

Participants Surplus = 0

Total Profit to operator 20 + 0 = 20 CU

Effective Profit share percentage at contract level 0:100% (Participants: Operator).

The difficulty arises when there are multiple surplus sharing percentages across the multitude of contracts in the PRF. Thus, applying one surplus sharing percentage at the TE level is just not possible, simply because the surplus sharing percentage at the contract level depends on how the operator sets the wakala fee for each takaful contract.

The work gets even more complicated when you apply B67 to B70 at the TE level as this adjustment does not apply to the wakala fee, only to the remainder of the contribution. I will not go into detail why this is complicated, but the reader can refer to the Actuarial Partners takaful webinar series for a discussion on this matter.

Finally, we address whether treating the TE for accounting purposes as an insurance entity is Shariah compliant. The question to be asked of the Shariah is whether they can accept that the proposed accounting methodology to be applied at the TE level would imply that the TE is in fact underwriting the contract (i.e. risk transfer). Looking at the proposed IFRS 17 accounts, this fact would not be obvious to the untrained observer especially now that the columnar approach would continue to be observed. At the Takaful Fund level, the accounting will continue to reflect risk sharing notwithstanding that at the TE level accounting it is restated as risk transfer. I leave the answer to that question to the Shariah scholars reading this posting.