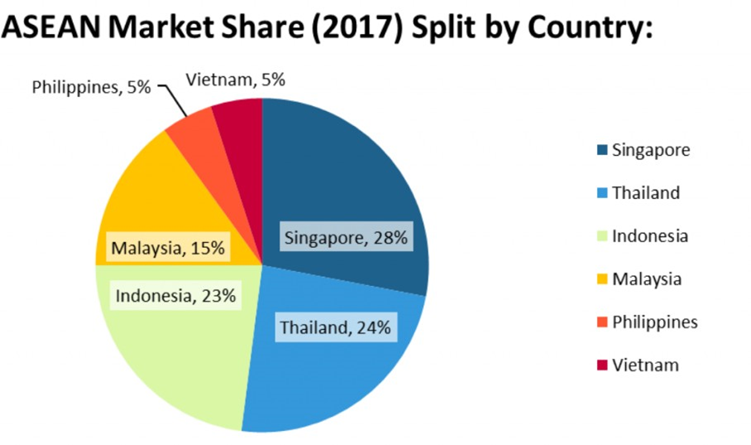

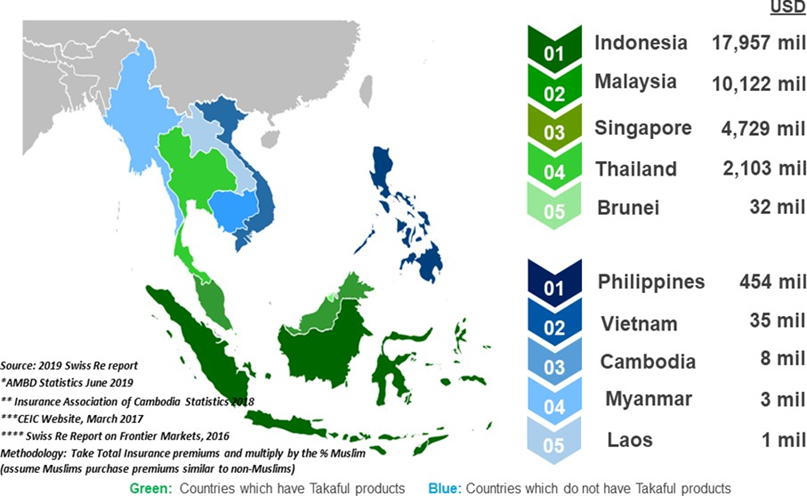

Takaful in Malaysia continues to grow, though not without its set of challenges. This article provides an update on Takaful in Malaysia. Malaysia, as a member of ASEAN, has the second largest potential market for Takaful here. The diagram below shows the Muslim spending on insurance or Takaful products in the ASEAN market. This represents the total current spend on insurance in the country multiplied by the proportion of the country which is Muslim. The countries are split between those with Takaful currently and those without Takaful. Currently, Indonesia, Malaysia, Singapore, Thailand, and Brunei have Takaful whereas Philippines, Vietnam, Cambodia, Myanmar, and Laos do not. Out of the countries without Takaful, there have been news reports out of Philippines on the interest in Takaful there.

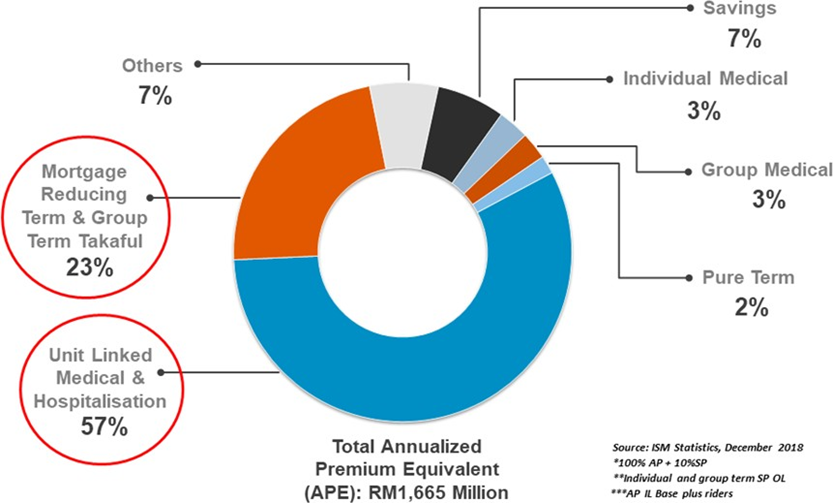

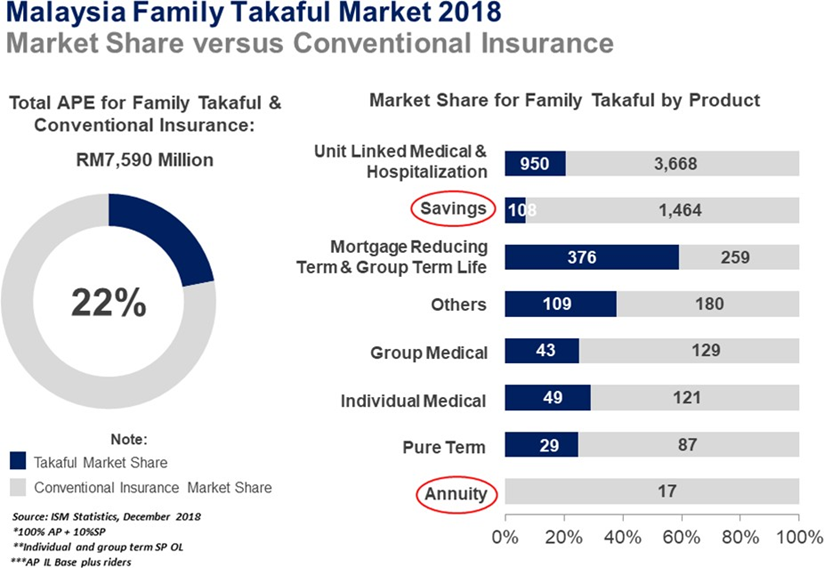

Malaysia Family Takaful Market 2018 by Product Type

This table is based on APE, where we take 100% of regular contributions (premiums) and 10% of single premiums. Unit Linked base plus riders consist of regular contribution plus riders under the unit linked category whereas for mortgage reducing term plus group term Takaful, this is individual plus group term single contribution ordinary life. The industry is facing some issues with some of these product groupings, explained below.

Unit Linked and Medical & hospitalization riders

This is the largest category for Takaful in Malaysia, with the products generally sold not so much as a savings product but rather the medical and hospitalization riders are the key selling point. This product category is currently the focus of several industry discussions, including the new Takaful Operating Framework. The New Takaful Operating Framework (TOF) states that in determining the pricing of Takaful products, a licensed Takaful operator must:

- Exercise prudence and due care to ensure the price of Takaful product is appropriate and reasonable;

- 2. Ensure that adequate tabarru’ charges into the PRF to cover risks and obligations associated with the Takaful certificate;

- 3. Ensure that the Takaful contributions are sufficient to cover the tabarru’ charges throughout the term of the Takaful product; and

- 4. Consider future market fluctuations and uncertainties.

The current pricing in the market varies somewhat. This clearly states that the sales illustration must check the effect of any riders being added to the base plan to ensure sufficiency until maturity. What about medical inhation? Shouldn’t the actuary review past experience with Tabarru’ increases and assume something in this sufficiency test? The word used is ‘ensure’, which implies that rather than sufficiency under best estimate conditions, this would be at least at best estimate plus PRAD. This could affect the competitiveness of Takaful versus conventional insurance depending how this sufficiency test is fulfilled for conventional.

Another aspect under the new TOF is the Potential for The Operator to Not Receive Fees From The Unit Funds: Unit Linked plus Riders.

“16.17 For the remuneration from PIF Investment, a licensed takaful operator must ensure that –

(a) financial accounts of the licensed takaful operator have been audited by an external auditor;

(b) the amount to be remunerated to the licensed takaful operator is within the profit sharing ratio as stated in the takaful certificate; and

(c) the amount to be remunerated to the licensed takaful operator shall not affect the future ability of PIF Investment to meet the tabarru` charges to PRF and take into consideration takaful participants’ reasonable expectations.”

How does this relate to the medical riders with UL, a walking time bomb? The implication is that the actuary has to restrict fees from the unit funds if taking such fees sufficiency is affected. Also, if IFRS 17 has a single column approach, it will be difficult to monitor this.

Mortgage Reducing Term (MRTT)

One challenge soon to be faced by MRTT is pricing under IFRS 17, as product pricing might be heavily affected due to the treatment of retakaful. There are several reasons to use retakaful (reinsurance):

- Risk management

- Solvency management

- Managing the look of financial statements

- Pricing

In Malaysia, MRTT business is very much a commodity, with many operators using very low retakaful rates to price competitively. On the other hand, under IFRS 17 we must determine the amount of profit of the policy at inception on a gross basis. The actuary will need to justify any assumptions used rather than relying on retakaful rates. If the policy is profitable, the profit, also known as CSM, will be released over time. Otherwise, the losses will be incurred at inception. The profit under reinsurance will be shown separately and similarly released over time. Although there are proposals to allow the profits for retakaful to offset losses under a gross basis, it is not clear at this point if this will be accepted. This means that, if the operator continues to price using retakaful rates, then under a gross basis the product is likely to be unprofitable and thus the loss incurred immediately but the matching gains under the retakaful treaty being released over time.

It is instructive to look at the market share by product segment of Takaful. Whereas overall 22% of life/family business is Takaful, and even a majority of MRTT business, for savings and annuity business Takaful market share is very low. This is shown below.

Another issue for MRTT is GPV for MRTT and the need for asset shares under TOF:

“14.3 In the case of single contribution for a long-term takaful product that is allocated only in the PRF as tabarru’, the surrender value shall include the unexpired tabarru’ amount and accrued surplus due to takaful participants in PRF, where applicable.”

The aim is to determine the unexpired tabarru’ amount. We use Gross Premium Valuation (GPV) reserving, meaning the reserve for unexpired tabarru’ varies by things such as our assumption for mortality and lapsation as well as the current yield curve. Do we need to make the surrender values clear in the contract or can they be left vague? In the past, under net premium reserving, there existed a formula for surrender values whereas under GPV we have had more hexibility. Are there Shariah issues with the amounts paid for surrender? Also, if the surplus is not allocated and paid out yearly then asset shares will need to be calculated to ensure the accrued surplus is paid out. A final issue of the new TOF for MRTT is paying back unexpired Wakalah fees for MRTT:

“14.2 A licensed Takaful operator must ensure that the amount payable to Takaful participants upon surrender is made from the appropriate funds.”

For example, in relation to a Takaful product adopting wakalah and where the surrender value is determined based on gross contributions basis, the surrender value shall include the amount of unexpired wakalah fees which shall be payable from the shareholders fund. Does this imply that we need to pay unexpired wakalah fees upon surrender? This has been the practice of a few operators currently. Perhaps the expense reserve can be paid out.

Looking at the Takaful market share as a percentage of Takaful plus conventional insurance gives insights into several other market segments, namely savings and annuities.

Savings

Takaful has not fared particularly well in the savings (non-unit linked) market segment. Several reasons have been suggested for this:

- Muslims do not save as much as non-Muslims

- There is stiff competition for Muslim savings, such as Amanah Saham Bumiputra and Tabung Haji.

- Whereas conventional insurance savings plans such as traditional endowments have guaranteed maturity benefits and returns, the lack of such guarantees affects the ability of Takaful to survive in this market segment.

The reality behind the challenges of savings products in Takaful is likely a combination of these reasons. The new TOF has suggested several product designs which could assist: The Qard savings contract which would provide explicit capital guarantees from the operator as well as guaranteed return structures from the risk fund.

Qard Contracts for the guaranteed savings market: “10.15 In relation to paragraph 10.14, where applicable, the legal documentation shall clearly stipulate the terms and conditions associated with the application of Shariah contracts in a Takaful product which include, at the minimum, the following: Qard* for PIF Savings

(i) specified amount of Takaful contributions placed as qard;

(ii) a statement that the principal amount of qard is guaranteed by a licensed Takaful operator;

(iii) specified events for qard payment, for example payable upon maturity of Takaful certificate; and

(iv) a statement that any benefits from the qard PIF Savings is based on the licensed Takaful operator’s discretion and not made conditional to the qard.” *Refers to the contract where the Takaful participant acts as the lender of money and the licensed takaful operator as borrower.

Qard: a new product design:

“16.8 Where wakalah is arranged with PIF Savings based on qard, a licensed Takaful operator must ensure that the upfront wakalah fee as a percentage of the Takaful contribution is determined after deducting the value of qard from the Takaful contribution, as per applicable rulings by Shariah Advisory Council, and the remuneration for managing the PIF Savings shall be in accordance with paragraph 16.18.”

As an example, if the gross contribution is RM1,600 and wakalah fee is RM400 then the amount which can have the qard contract is RM1,200. From this RM1,200 the tabarru’ for benefits is taken.

This new design obviously has investment and ALM challenges due to the guaranteed nature of the product. From a sales illustration point of view, if the operator desires to give additional amounts back to the participant upon its discretion, how can this be illustrated? Whatever is illustrated needs to be backed with very strong corporate governance. Currently, under RBC the savings fund would not have RBC charges, but by right this fund should indeed have charges. The IFRS 17 treatment would also need to account for these guarantees, and the investment portion would need to be split from the risk portion.

A second potential new design is having guaranteed returns from the risk fund:

“10.4 In relation to paragraph 10.3(a), a licensed takaful operator must ensure that the main takaful benefits payable from PRF consist of the following:

(a) benefits to cover for financial loss or misfortune arising from specified events; or

(b) survival or maturity benefits.”

The ‘or’ implies that for such structures two separate risk funds would be needed, a risk fund for benefits and a risk fund for investment. Similar to Qard there is a guarantee, but now the guarantee is from the risk fund, i.e. other participants.

For example, Tabarru’ of RM1,000 is put into a risk fund and at the end of the year a maturity benefit of RM1,100 is given out. Although I truly don’t understand how this is acceptable under shariah, this indeed opens up a lot of new guaranteed product designs.

Anticipated endowment type structures could also be designed. In the past, a number of operators have tried to design such products so this will allow the development. By right, the surrender values of such products would include asset share calculations to ‘build up’ to the survival / maturity benefit over time. If not then this is regressing from conventional insurance practices. There is obviously investment and ALM issues with this product design. These guarantees would also have an effect on IFRS 17. This structure would also require a separate risk fund.

Annuities

Annuities are a product which will be needed in the future. Unfortunately, design is a problem. In the past, a Takaful annuity plan had been sold in Malaysia, but it was on a waqf approach. Unfortunately, we now know that from a shariah point of view, the waqf amount cannot decrease. This is fine when the waqf is land, but for Takaful, the contribution to the waqf fund will definitely decrease. Temporary annuity paid from the risk fund might be a good idea where we can start.

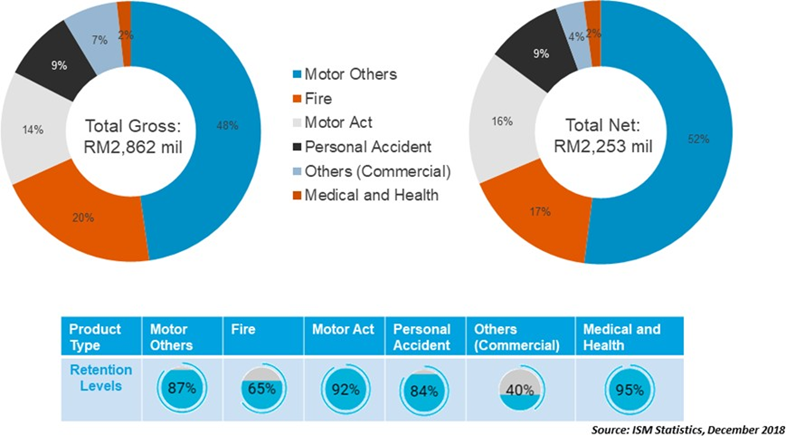

Malaysia General Takaful Market 2018: Analysis by Product Type

From the above diagram, the market share of motor comprehensive is the most in Malaysia general Takaful, followed by fire, act motor and personal accident. These are mostly personal lines, areas where Takaful has traditionally been strong.

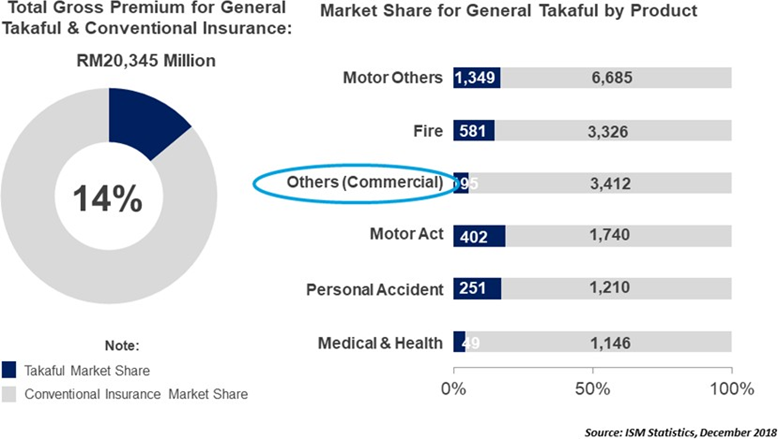

General Family Takaful Market 2018: Market Share versus Conventional Insurance

Compared to conventional insurance market in 2018, general family takaful is relatively low in market share where it has only 14%. Commercial lines remain a weakness for Takaful, due perhaps to a lack of internal expertise as well as retakaful challenges. It is hoped that now with composite Takaful licenses being split there will be a renewed focus on general Takaful, in particular commercial lines.

One potential challenge of yearly general Takaful products is with the potential need to split the risk fund by class of business:

“9.15 A licensed Takaful operator shall maintain separation of the Takaful fund(s) or create additional Takaful fund(s) as may be required by the Bank where the Bank deems it is necessary to protect the interests of Takaful participants and ensure sustainability of Takaful fund(s).”

Currently a wide variety of products and coverages are mixed in one risk fund. There is a significant amount of cross subsidization, which may or may not be acceptable by Bank Negara (BNM). BNM will have the ability to enforce a separation of risk funds, which may have effects on Risk Based Capital (RBC) as well as IFRS 17. What criteria will BNM use to decide when to require additional funds?

A second issue is with respect to long term general Takaful products. Only a small proportion of general Takaful policies have traditionally had a policy term greater than one year (other then retakaful treaties). Under IFRS 17, such long term treaties will need to be treated similar to life insurance.

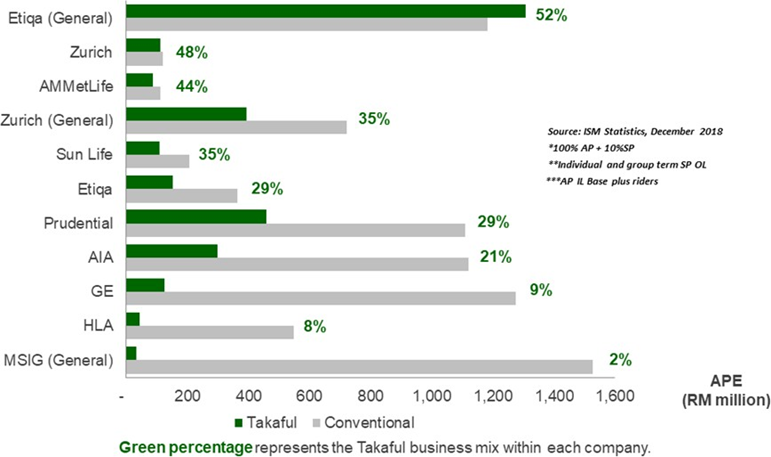

Among the insurers in Malaysia family Takaful market with both conventional and Takaful operations; Etiqa has the most market share in Takaful while MSIG (General) has the least. The diagram below is the chart illustrated Malaysia family Takaful market with both conventional and Takaful operation.