A VUCA environment is one which is volatile, uncertain, complex and ambiguous. Mr Hassan Scott Odierno of Actuarial Partners Consulting Sdn Bhd says this is quite an apt description of the environment facing insurers in Asia, whether from an economic, regulatory, accounting or competitive point of view.He elaborates.

VUCA will affect insurance markets differently depending on whether it is a developed, developing or frontier market. There is quite a bit written already on the developed and developing markets. Much less has been written about frontier markets, a term used by Swiss Re for countries such as Cambodia, Laos and Myanmar.

Economic aspects

From an economic point of view, VUCA can be the wider economy and how it affects demand, but also how economic conditions affect us as insurers such as investment experience.

In Malaysia, we have not had any major issues with economic VUCA but in our work in Cambodia, for example, we do not have sufficiant assets to sell certain types of products such as savings products. Put another way the volatility is simply too high.

Regulatory aspects

From a regulatory point of view, with the ASEAN Economic Community (AEC)slowly but surely becoming a reality, this will require all countries within ASEAN to be at a consistent level of regulatory sophistication.

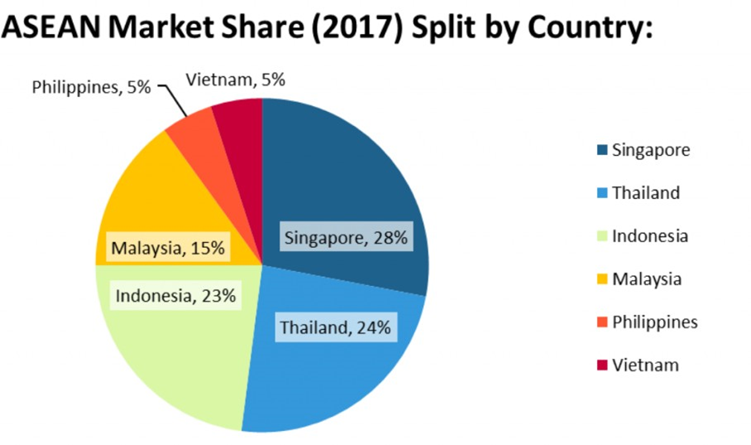

We can split this into the most regulated countries such as Malaysia and Singapore, the second level of Thailand, Indonesia, Philippines, Vietnam perhaps, and then Brunei and the frontier markets of Laos, Cambodia and Myanmar.

In Malaysia, in the past, we had this volatility when Risk-Based Capital (RBC)and Gross Premium Valuation (GPV) came in force, but we are fairly stabilised now. We worry about this as a major risk for frontier markets and we have seen some countries we operate in such as Mauritius implement regulations perhaps before the country was ready for it.

Even in countries with more expertise such as Sri Lanka, for instance, the risk-free yield curve is mandated for use in reserving regulations without the ability to actually invest in such assets, causing more volatility.

IFRS and market evolution

Accounting VUCA right now is IFRS17 which will affect everyone.

In Malaysia, we are discussing this regularly and accepting the fact that this new accounting guideline will be extremely expensive to implement and maintain. We hope it will result in less volatility, but this is not a given.

Competition/disruption VUCA could be a new player with the ability to bite into our existing clients and business. In Malaysia, we have many companies looking at FinTech as a way to disrupt the market. Even our regulator (governor of BNM) has made it clear that either existing insurers develop products and the ability to sell to the mass market (B40) or they will bring in players that will. In Cambodia, disruption is a constant as new players get approved into the market.

Managing VUCA

For economic VUCA, the approach for businesses will be constant monitoring of economic conditions and ensuring the unique selling proposition of the insurer is not dependent on uncertain economic conditions to the extent possible.

For regulatory VUCA, insurers will need to monitor regulatory developments and be proactive. For accounting VUCA, likewise, monitoring developments and being proactive is key.For competition/disruption, to me, it is focusing on our unique selling propositions and disrupting ourselves wherever possible in terms of our processes and ways of doing business.

Going beyond to turn changes into advantages

Turning VUCA into a competitive advantage requires an attitude of flexibility and constant self-disruption. IT and other back-office staff will increasingly be front and centre of a new VUCA world. Regulatory and accounting changes as well will need to go beyond simply a compliance exercise to finding ways to turn changes into advantages.

As ASEAN integrates, regulators will need to do their part in this VUCA world. Expectations for regulations and compliance need to be made clear and where an insurer is willing to be innovative and flexible and design products with new risk characteristics then solvency and other regulations need to be similarly innovative and flexible.