Mr Zainal Abidin Mohd Kassim of Actuarial Partners Consulting looks at four building blocks which can be used to structure a Shariah-compliant annuity scheme.

Other than those of us who expect to work until the end, we need to plan how to meet our living expenses once our income ceases on retirement. In some countries, the government provides a state pension once a citizen passes the retirement age. It should be remembered though that, while the state pension is a “promise”, the eventual quantum and payment of the retirement pension is still subject to the government having sufficient funds in the future to meet its promises.

For those who are not expecting to receive a state pension at retirement, what are the options available? How can we prepare for our golden years in a Shariah-compliant manner?

What is an annuity?

Whilst a work place pension is paid for through services rendered whilst being an employee, an annuity is a pension bought from an insurance company through the payment of a premium. The insurance company undertakes to pay the insured a regular income (usually for life) in return for the insured paying the prerequisite premium. The Shariah-compliant version of this should therefore be the participant paying a contribution to a takaful operator in return for the participant risk fund paying the participant an annuity. However, it is not as simple as that.

How are annuities different from family cover?

In a takaful contract, there is the takaful operator, the life underwritten (usually the participant) and the potential beneficiary (or the benefit recipient). The contract would also set out when and how the benefit is payable and the risk that is covered. The table below summarises the position for three types of takaful cover:

What is apparent from the above table is that life annuity is the only takaful product where both the benefit recipient and the underwritten life is the same. For both survivors’ annuity and family takaful, the benefit recipient is not the underwritten life as the benefit is only payable on the death of the underwritten life.

It should be noted that for life annuity, the risk covered is different from family cover. In fact they are opposites, the life annuity protecting against longevity, while the family cover is for premature death.

Addressing the prohibition against gharar in a commercial contract

For the insurance contract, in addition to the problem of maysir, the contract has a significant element of gharar. The Shariah solution is to treat the contribution (premium) as a tabarru’ (donation). When the contribution is treated as a tabarru’, the gharar present in the contract becomes acceptable.

Where the (takaful) benefit is used to alleviate a “loss”, the use of tabarru’ makes sense as it is consistent with the ultimate aim of solidarity among participants.

Example: The participant dies and a lump sum is paid to the participant’s family to alleviate the financial loss arising as result of the premature death of the breadwinner.

Can the concept of tabarru’ also address the uncertainty or gharar of the payment period in an annuity payable to a participant for life?

Example: A participant receives a monthly income from the participant risk pool for life. Where the annuity paid ultimately exceeds the contribution paid by the participant, will the excess be labelled by Shariah as “riba”?

A possible solution

The 1977 fatwa from the Assembly of Prominent Islamic Scholars in Saudi Arabia (No.51, dated 4/4/1397 Hijrah) proposed that cooperative insurance is Shariah compliant as “although the participants in cooperative insurance do not know or cannot determine the financial returns resulting from the contributions that they pay, it doesn’t mean ‘harm to them’ because they are ‘grantors without any risk or gambling’”.

A simple interpretation of this fatwa would seem to conclude that cooperative insurance is allowed to have elements of gharar as it is not oriented towards making financial gains (ie, cooperatives in this example are not involved in “financial and trade compensation”).

Taking comfort from this translation of the fatwa, it is proposed that the following building blocks can be used to structure a Shariah-compliant annuity scheme.

First building block

The annuity vehicle is a cooperative, not a takaful operator.

One important thing a takaful operator brings to the table is “risk capital”. Risk capital provides the “loss-absorbing” capability for a takaful set up. In a takaful company, shareholders’ capital provides a qard to finance temporary losses arising from claims (which are guaranteed) exceeding contributions. Cooperative set ups (in particular, new set ups) do not have risk capital.

The obvious solution then is to move away from “guarantees”. Risk sharing (which is the basis of Shariah-compliant financially transactions) allows profits and losses to be shared among all the participants.

There is a recent move in Europe away from guaranteed defined benefit pension schemes to defined “ambition” pension schemes. Under a defined ambition pension plan, there is an “in-built” different form of a “loss-absorbing” structure. In place of the need for risk capital, all benefits from the pension scheme (including the pensions already in payment) are uniformly reduced should the assets backing the benefits be deemed insufficient to meet its liabilities.

Second building block

Adopt the principles underlying a defined ambition pension scheme where all benefits are periodically adjusted according to what the scheme can afford.

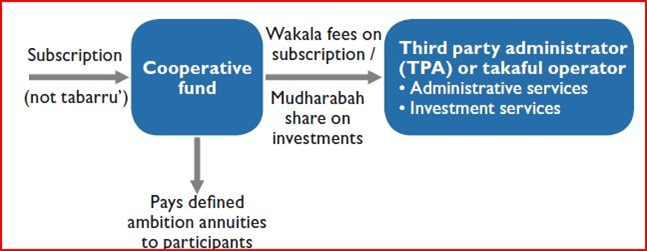

The diagram below describes how the Shariah-compliant annuity scheme can be structured.

Third building block

Availability of suitable TPAs to manage the scheme. The TPA is compensated by wakala fees and mudharaba share of return on investments. Alternatively, the administration and investment services can be provided by an existing takaful operator. The takaful operator is purely an administrator; the takaful operator is not responsible for providing a qard for any benefit shortfall.

Fourth building block

Availability of Shariah-based investments where the investor has upside inflation protection and is provided with a recurring income.

Annuities, to be relevant, have to be inflation protected. In order for this to happen, annuity funds need to be

invested in assets which are correlated with inflation, and investments which provide recurring income to meet the regular annuity payout.

Examples of such inflation-protected income are ijarah-based sukuks with “real” income increasing with inflation. There should also be investments in businesses related to providing services to the elderly population, for example, care homes. Such investments are expected to generate returns which are correlated to the longevity of its patrons.

The annuity fund should therefore hedge against price inflation and longevity through appropriate investments.

Summary

With proper planning, it is possible to provide for Shariah-compliant annuities. The four principal conditions suggested here in order to make it work are:

- The set up is a cooperative;

- The payout has a defined ambition benefit structure;

- Suitable TPA services remunerated on a Shariah-compliant basis are available; and

- True Shariah-based investments can be made where returns are “inflation proof”.

In trying to closely mimic existing conventional financial products, Islamic financial institutions miss the opportunity to promote a deeper appreciation of Islamic values, that of risk sharing and taking responsibility as a community for each community members’ wellbeing. The recent crisis of trust in the annuity market in the UK would give notice that there is much room for improvement in conventional financial products.