In January 2013, Bank Negara issued new revised guidelines on operating costs of family takaful business (BNM/RH/GL 004-5) (“OCC guidelines”). This guideline supersedes the previous guidelines on operating costs of family takaful business. This article provides a brief summary of the changes in the revised guidelines, a brief comparison against the corresponding existing guidelines for the conventional life insurance business, and the potential implications to the takaful industry.

Comparison against previous guidelines

The previous guidelines were specifically applicable only to family takaful operators who were charging the operating costs to the takaful funds. In comparison, the revised guidelines are now applicable to all family takaful operators, regardless of whether the operating costs are charged to the takaful funds or otherwise. This means that all family takaful operators are now required to observe the limitations on agency compensation (e.g. Agency-Related Expenses or ARE) and management expenses as specified in the guidelines.

In addition, there are minor revisions to the limits on agency commission and ARE in the new guidelines. A detailed summary of the changes in the revised guidelines is provided in Appendix A.

Comparison against conventional guidelines

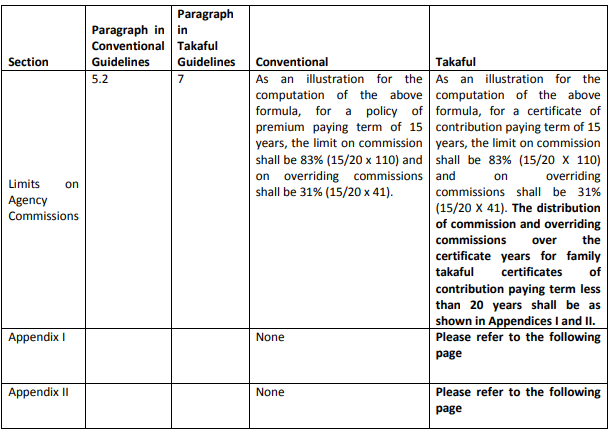

The revised guidelines for family takaful operators are largely similar to the corresponding revised guidelines issued for conventional life insurance business.

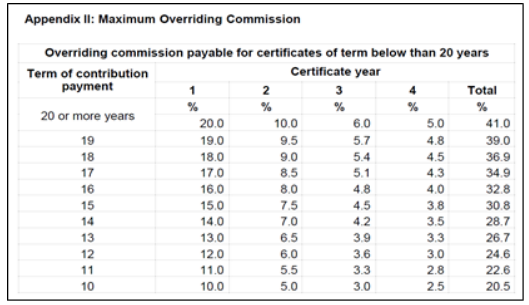

The key difference is that, for plans with contribution paying term of less than 20 years, the basic and overriding commissions payable for each certificate year are prescribed for takaful operators, whereas it appears that conventional insurers have the flexibility to structure the commission for each policy year for plans in that category. However, both takaful and conventional companies are still subject to the same total basic and overriding commissions over the policy term. For plans with contribution paying tem of more than 20 years, the limits on the basic and overriding commissions for each policy year are the same for both takaful and conventional insurers.

A comparison of the revised guidelines for family takaful operators against the corresponding conventional guidelines is provided in Appendix B.

Implications of the revised guidelines

A limitation on ARE and management expenses achieves two purposes, firstly consistency among insurers and takaful players in the market and secondly where expenses incurred affects the benefit payable it maximizes the latter.

On the first point, this would be a policy issue on the part of the regulators. It does however put many of the takaful companies in a disadvantaged position simply from the size perspective as takaful companies are relatively new operations and having a smaller volume of business limits their ability to compete when complying with the OCC guidelines.

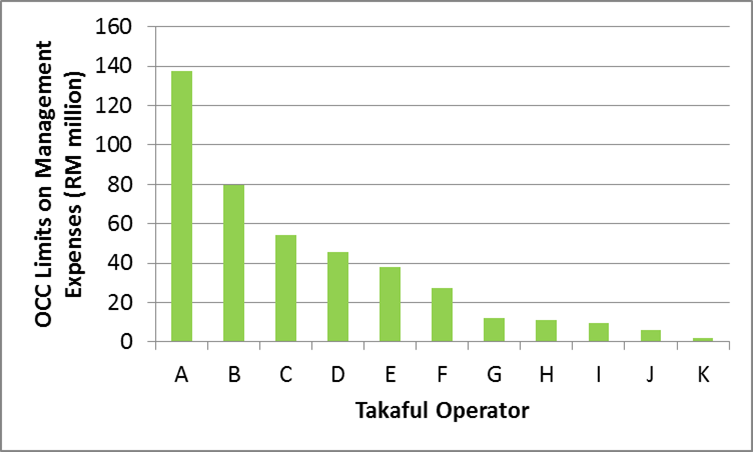

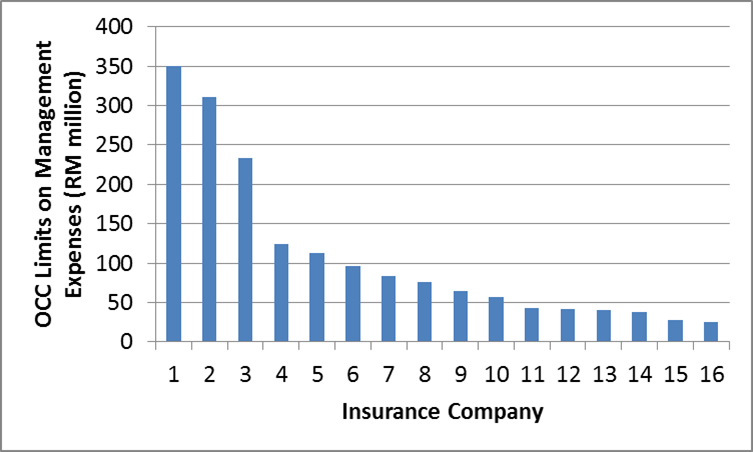

In the revised guidelines, the limits of management expenses, expressed as a percentage of contributions or premiums, are the same for both family takaful operators and conventional life insurers. The charts below compare the limits on management expenses between family takaful operators and conventional life insurers, based on the premium received as at the end of 2011.

Chart 1: OCC limits on management expenses for family takaful operators in Malaysia

Source: ISM statistics as at December 2011

Chart 2: OCC limits on management expenses for conventional insurers in Malaysia

Source: BNM Statistics as at December 2011

As shown in the charts above, the limits on management expenses in terms of ringgit-amount are significantly higher for conventional life insurers compared to family takaful operators. The limit for the largest life insurer (in ringgit-amount) is around RM350 million, which is more than twice the amount available for the largest family takaful player in the market at around RM140 million. Around two-thirds of the conventional life insurers are able to spend at least RM50 million on management expenses under the OCC guidelines due to higher premium income levels, whereas the limit on management expenses for the majority of family takaful operators is below RM50 million. In addition, in a growing operation, typically high expenses will be incurred before new business growth occurs in the following years. Therefore, limiting management expenses is likely to limit the potential for takaful operators to experience the exponential growth desired by the regulators.

On the second point it is noted that unlike conventional insurers nearly all expenses and agency costs are charged to the operators (i.e. shareholders) account, thus paying higher ARE (as a percentage of contributions) and incurring higher management expenses would not affect the participants’ fund financial position as it is charged fixed wakala fees. To the extent that the wakala fees are reduced as a result of limitations on ARE and management expenses the benefit of such savings will ultimately be passed on to the participants. It is more likely though that expense savings will be translated to higher profits to the shareholders. If this is indeed the expectation then shareholders should be given the flexibility to forgo current profits and instead invest this to grow the business. This may include the use of profits to finance competitive agency benefits.

The limits on the ARE is currently expressed as a percentage of contributions in any one year, and with such limitations, a new start-up will be disadvantaged as it will not be able to compete with an established takaful company or conventional insurer with significant renewal premium. There are quite a number of new family takaful operators in the industry and the new revised guidelines can have a negative impact on these operators. Given the restriction on the ARE, there is a risk that the new takaful operators will not be able to attract a viable agency force which in turn will limit the growth of the new takaful companies.

The existing guidelines on Takaful Operational Framework (TOF) do not limit the level of the wakala fees that can be charged to the participants. TOF says that wakala fees should be set to take into account the marginal level of expenses and commissions to be incurred by the shareholders’ fund. To the extent this level is fixed at the outset when the contract is written the actual commissions and expenses subsequently incurred by the operator should not affect the financial condition of the participants’ fund.

For a new company it is expected that ARE and management expenses will exceed the wakala fees collected until the contributions achieve a certain critical size. Similarly a new takaful company will not be able to comply with the OCC guidelines until it achieves a certain volume of business.

In our comparison between the revised guidelines issued to family takaful operators and conventional life insurers, although both industries are subject to the same maximum limit, for plans with contribution paying term of less than 20 years, the basic and overriding commissions payable for each certificate year are prescribed for takaful whereas it is not for conventional insurers (see Appendix B). The flexibility to structure the commission for each policy year for plans in that category means that conventional insurers are able to pay much higher commission in the early policy years compared to takaful. From the agents’ perspective, this represents a higher present value of commissions in selling conventional business compared to takaful business, and consequently, may tempt takaful agents towards joining the life insurance industry, which will further hamper the growth of new takaful companies. Given that the cost of commissions is borne by the life insurance fund in conventional business, as opposed to the shareholders fund for takaful business, a combination of higher initial commissions together with an adverse lapse experience can have a negative financial impact on the life fund which may subsequently affect the security of the benefit payable from the fund. Furthermore, higher present value of commissions would result in less benefit to policyholders generally.

Conclusion

The guidelines on limiting agency commissions and management expenses is directly relevant for companies where these expenses are charged to the insurance fund or takaful fund, as the guidelines will prevent the erosion of such funds and protect the policyholders benefit expectations. However, if expenses are not charged to the participant funds and they are fully borne by the shareholders it can be argued that it is not necessary to limit the level of expenses incurred as there is no impact on policyholder’s benefit expectation. In addition, the guidelines are likely to provide an unfair advantage to established companies with higher absolute ARE limit compared to a new start-up. New start-ups are more likely to incur higher ARE and management expenses (both expressed as a percentage of contributions) as shareholders are investing to grow the agency force and its management staff. Limiting such expenses can stunt the growth of the new takaful operators. Of equal concern is the ability of conventional insurers to shift the commission payable towards the early years for certain products as this will result in agents preferring to sell conventional products as opposed to takaful products.

The questions that should be posed to the industry are;

- Should takaful companies be limited by the OCC guidelines given that they are already limited to their wakala fees in what they can charge to participants?

- If (1) is not possible should new takaful companies be given an allowance as to when they are expected to comply with the OCC guidelines. The trigger point can either be time (e.g. after 5 years or establishment) or contribution volume.

- For plans with contribution paying term of less than 20 years, given that basic and overriding commissions payable for each certificate year are prescribed for family takaful operators, and in contrast, conventional insurers have the flexibility to structure the commission for each policy year for plans in the same category, will this difference create a non-level playing field in the market between the two industries?

If you have any queries on the above please do not hesitate to contact the authors of this article or your usual Actuarial Partners consultants.

Email:

zainal.kassim@actuarialpartners.com

farzana.ismail@actuarialpartners.com

Tel: +603 2161 0433

Fax: +603 2161 3595

Appendix A- Previous vs. Revised Guidelines on Operating Costs for Family Takaful

Appendix B – Guidelines on Operating Costs between Conventional vs. Takaful

Appendix I in the Takaful OCC Guidelines

Appendix II in the Takaful OCC Guidelines