With the release of the recent concept paper on RBC for takaful operators the following principles are obviously embedded in the proposed basis:

- Surplus in each takaful risk fund (the Participants Risk Fund or PRF) is not available for the purpose of meeting the required solvency margin in other PRFs.

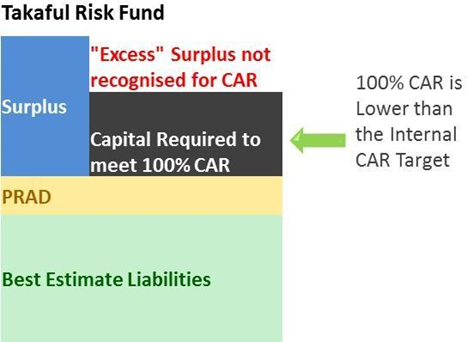

- Surplus in each risk fund can only be used to cover the risk charges in that fund (TCR). Thus where surplus is in excess of the TCR in the risk fund, the excess is ignored notwithstanding the requirement to hold in excess of 130% TCR.

While the principle (i) above is understood as sharia will not allow the surplus in one risk fund to be used to support a deficit in another risk fund, the reason for the limitation under (ii) is not so obvious.

Some takaful operators suggest that where the takaful operator shares in surplus, say 50% as allowed in TOF, then at least 50% of the surplus in the PRF should count as Tier 1 capital. This follows on from the concept in conventional participating fund where 50% of the surplus in the par fund counts as Tier 1 capital (the two 50% are not for the same reasons).

Before dwelling on this issue perhaps it is pertinent to consider the calculation of surplus itself.

Calculations of Surplus

Surplus is calculated as:

Fund Value less Accounting Liabilities less Actuarial Liabilities

Firstly if the PRF accrues a qard then by definition there is a deficit in the PRF, as accounting liabilities include the outstanding qard.

Indeed the CAR computation recognizes this problem by requiring that the shareholders fund be reduced by the outstanding qard before determining the CAR. As a result of this “write off” in the shareholders fund the Qard in the PRF is extinguished and the PRF is in a position of balance (no surplus or deficit).

Obviously for a PRF with an outstanding qard all solvency charges have to be met by the Operator’s fund.

The position is different where the PRF is in surplus. But is it?

If we consider the determination of the actuarial liabilities in a pooled fund (where all contributions less wakala is tabarru) then where the expected experience of the pool inclusive of the required PRAD is more favorable than the future tabarru charge would imply, the actuarial liabilities can indeed be negative! This negative reserve is a result of not factoring in the expected future surplus distribution to participants (and operator where applicable). The RBC requirement is to zerorize negative reserves at the fund level. In the extreme you can have a zero actuarial liability at the fund level; thus the surplus at the PRF is equal to the Fund (less of course the accounting liabilities)! Could this be the reason why BNM restricts to 100% how much ‘surplus’ in the PRF can be used to meet RBC charges?

Perhaps a more efficient way to determine surplus on the PRF is to do a BRV on total future cash flows. This would require an estimate of cash flows at best estimate (i.e. without PRAD) and include expected future surplus distribution to participants and the operator. The discount rate used would be the fund discount rate rather than risk free. This is consistent with the requirement under IFRS 4 Phase II where all future (including discretionary) cash flows should be included in determining liabilities. But yes part of this ‘bonus’ liability in the BRV should be available as credit to meet RBC charges as is the case in the conventional participating fund.

Options as to how this could be applied include:

- x% of the bonus liability towards the RBC charges where x% is the percentage share of surplus due to participants. Thus those takaful operators who do not share in surplus will see a bigger credit in the PRF for RBC charges in that fund. This is consistent with the mutual approach where participants carry their own risk on the principle of risk sharing.

Where the shareholders take (1-x)% of the surplus it is appropriate for the Operator’s fund to bear a proportionate share of the RBC charges.

An argument could be made that this proportionate share should be borne in the Operator’s fund rather than by the Operator’s share of the future surplus which has been capitalized in the PRF at the valuation date as any qard would be financed by the Operator’s funds. - Take the view that the Operator does not share in deficits but only surplus as a performance fee, and therefore 100% of the bonus liability in the PRF can count towards RBC charges regardless of how much future surplus the Operator is entitled to. With this approach, the actuarial liability should be subject to a minimum of the surrender value at the valuation date on a per policy basis.

This note highlights two issues for the industry to consider;

- Should not the takaful actuarial liabilities be determined as per conventional participating liabilities rather than as per the conventional non-participating liabilities? The former basis is consistent with Bank Negara’s TOF that requires that participants be treated fairly when surplus is distributed.

- How much of the discretionary portion of the actuarial liability can be made available to meet the RBC charges of the carrying PRF? Furthermore should this proportion vary according to the percentage share of future surplus that participants are entitled to?

Should you need further clarification on this note please contact:

Email: