Regulating Takaful is a challenge as there is such a wide variety of models and practices in the market globally. Adding to the complication is a need at times to replicate conventional insurance equivalents and infer guarantees. Thus the regulator will need to go beyond what is contractually provided for to ensure that participants are being treated fairly, which sounds straightforward but in reality can quickly become extremely complicated.

A prime goal in Takaful is to facilitate mutual support between various participants facing similar risks. This needs to be done while removing uncertainty (gharar), eliminating interest-bearing investments (riba) and un-Islamic investments such as investments in casinos, refinery or pork, and elimination of gambling (maysir). There should be a culture of transparency and fairness not only in the contracts themselves but in all aspects of the operations. Beyond all this is a need for the products to be competitive in the market, especially investment returns for family Takaful. Shareholders’ profit must also be competitive and fair. Finally, Takaful was originally developed to complement other Islamic fields such as Islamic finance. This remains an important goal, with significant volumes of business still coming from Islamic banks.

Regulations have as their prime goal protecting participants’ interests. This is done through a strong focus on corporate governance and facilitating fairness and equitability for participants. Regulations also promote reliability and solvency of the Takaful operators as well as technical soundness. Finally regulations promote competitive markets. Regulations can vary along a wide spectrum from pure rules-based regulations to principles-based ones. Rules-based regulations are generally appropriate for less mature markets where there is relatively less expertise in the market. In such cases, the regulator needs to provide regulations which do not require the extensive use of such experts as qualified actuaries. On the other hand, those markets with more technical expertise and maturity can follow more principles-based regulations. Whereas a rules-based regulation would provide formula and details for compliance, in a principles-based regulation a set of principles would be given and it is left to each insurer to interpret them based on their own particular situation.

The International Association of Insurance Supervisors (IAIS) has developed a set of Insurance Core Principles (ICP) for use in regulations. Many of these principles are equally applicable to Takaful but require some thought for specific issues in Takaful. A few examples of these issues are shown below:

Supervisory Objectives (ICP2) states that the principle objectives of insurance supervision are clearly defined. In Takaful there is the issue of Islamic acceptability and whether the regulator should ensure the Islamic acceptability of the operations or if this is the responsibility of the individual. In some jurisdictions, the issue of Islamic acceptability is completely the responsibility of the individual whereas in other jurisdictions it is the regulator itself that decides what is acceptable. While it is tempting to leave such issues to the individual, the complicated nature of Takaful makes it extremely difficult for an individual to do this. Regulators who give out separate Takaful licenses or windows implicitly sign off on the Islamic acceptability of these operations even if not intended.

Suitability of Persons (ICP7) notes that the significant owners, board members, senior management, auditors and actuaries of an insurer are fit and proper to fulfill their roles. Does this extend to knowledge of the Shariah? The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has ruled that compliance with the Shariah is the responsibility of management. If management of a Takaful operation is not familiar with the Shariah, does this imply noncompliance with ICP7?

Corporate Governance (ICP9) notes that the corporate governance framework recognizes and protects the rights of all interested parties. The supervisory authority requires compliance with all applicable corporate governance standards. This can get quite complicated in Takaful as the corporate governance of technical and Shariah issues can be intertwined in many cases. Some issues which appear to be completely Shariah issues can end up being technical in nature as well. Thus there is a risk of a Shariah council making a decision which has technical implications and which by right should have been run through the actuary or other technical personnel. Conversely there are other issues which appear technical but could have some Shariah implications. If they are not brought to the attention of the Shariah council there could be implications later if these issues ended up violating aspects of the Shariah and contracts needed to be cancelled or unwound.

Internal Control (ICP10) states that the supervisory authority requires insurers to have in place internal controls that are adequate for the nature and scale of the business. The oversight and reporting systems allow the board and management to monitor and control the operations. Does this extend to Shariah controls and audits?

Capital Adequacy and Solvency (ICP23) talks about how the supervisory authority requires insurers to comply with the prescribed solvency regime. This regime includes capital adequacy requirements and requires suitable forms of capital that enable the insurers to absorb significant unforeseen losses. This is again challenging in Takaful due to implicit rather than explicit guarantees as well as differences in the location and allocation of risks as compared to conventional insurers as well as between differing Takaful operations. Questions must be asked such as: Who holds the risk? Where is this risk held? (Risk fund? Savings fund? Operator’s fund?) How much capital is required? Insufficient capital will lead to insolvencies and harm to the industry but overcapitalization may lead to riskier practices by the operator to achieve a sufficient return on capital or charge high fees which would be detrimental to participants.

Intermediaries (ICP24) states that the supervisory authority sets requirements, directly or through the supervision of insurers, for the conduct of intermediaries. Does this include knowledge of the Shariah?

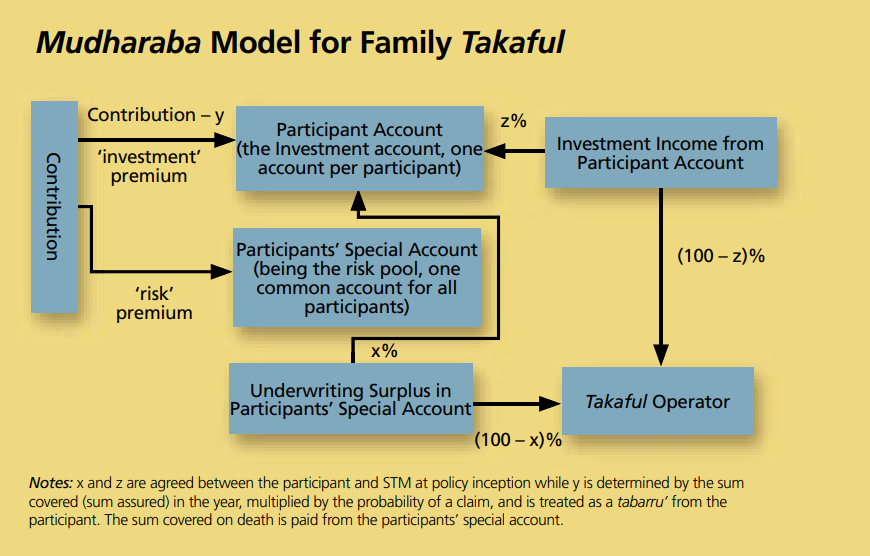

Consumer Protection (ICP25) states that the supervisory authority sets minimum requirements for business and intermediaries in dealing with consumers in its jurisdiction, including foreign insurers selling products on a cross-border basis. The requirements include provision of timely, complete and relevant information to consumers both before a contract is entered into through to the point at which all obligations under a contract have been fulfilled. In Takaful, are participants truly aware of the risks they are taking? Takaful can be made to look very similar to conventional insurance, but with subtle but very important differences. These differences should be made clear to participants. In addition to the above issues relating to Takaful and ICPs, there are a number of other issues which relate to the regulation of Takaful that require special consideration. One issue is whether the model used in Takaful should be regulated. Takaful is very much a developing market. The model used for operations is still being refined by each successive new operator. The first model to be used was the Mudarabah model, with several variations showing up in various parts of the world. Later the Wakalah model became prevalent. Now other variations and hybrids are appearing. There are significant variations as to matters such as profit sharing within the model. Should regulations specify the model to be used, or should this be left up to the operator? If the model choice is left to the operator, this leaves room for innovation, a key ingredient for success in any developing market. Unfortunately, this also makes the regulation of Takaful more challenging for a variety of reasons. Regulating the model to be used makes regulation more straightforward, but this move can be accused of holding back the industry. Currently, there are significant differences by country with regards to Takaful regulations.

Risk-Based Capital (RBC) is a key current issue in Takaful regulations. RBC is needed for Takaful, as capital requirements should reflect the risks being held. Without a careful determination of capital required, Takaful operators could be overcapitalized, which is not good for the industry. In conventional insurance in many cases 100% of the surplus belongs to shareholders. In Takaful at least some of this surplus is shared with participants, and some of the risks are passed on to them as well. If capital requirements are the same when risks are lower, shareholders must accept a lower return on capital, share in underwriting surplus or otherwise design the model to achieve an acceptable return and take higher risks in investments or types of products launched in order to achieve an acceptable return. This is dangerous as it may tempt management to deviate from technical or Shariah best practices in order to achieve acceptable returns. Whilst it is true that the managements of Takaful operations are extremely honest and sincere, they should not be placed in such a position. The Islamic Financial Services Board (IFSB) has developed guidelines which are a step in the right direction. It is nearly universally felt that ownership of the Takaful funds is with the participants. However, it is also nearly universally felt that the participants have little or no control over the Takaful funds. One way for regulations to assist in overcoming this is with the development of the concept of the participant advocate. The participant advocate would be hired by the participants at an annual meeting of participants and paid from the Takaful fund. The participant advocate would be charged with reviewing the operations and commenting on the fairness of the various practices to participants, and represent participants at Shariah council. The participant advocate would be at the same level of the technical experts of the operator. For instance, if the operator operates under the appointed actuary concept then the participants advocate would be a qualified actuary.

This article has raised some of the numerous questions which still remain in regulating Takaful, and clearly show that Takaful is still in the development stage. Regulators will need to think clearly about the above issues in order to regulate Takaful effectively and promote Takaful as an alternative market to conventional insurance.

This article originally appeared in the Islamic Finance News 21st April 2010. We are very happy to answer any questions on this, hassan.odierno@actuarialpartners.com.