IFRS17 (the Standard) requires that the fulfilment cash flows in the determining the liability underlying an insurance contract includes a Risk Adjustment (RA) for non-financial risks. Specifically Paragraph 37 says:

“An entity shall adjust the estimate of the present value of the future cash flows to reflect the compensation that the entity requires for bearing the uncertainty about the amount and timing of the cash flows that arises from non-financial risk.”

For insurance in which there is expected to be a residual interest after all obligations under the contract have been met, this residual interest is defined as the Contractual Service Margin (or CSM) and the following figure quantifies the relationship between the various fulfilment cash flows at the inception of the contract.

IFRS17 splits the present value of the future profits into the CSM (the CSM0, at policy inception, t=0) which is the expected profits to be earned, and the RA which is the margin above best estimate required to reflect the level of certainty that the projected future cash flows are sufficient. If RA0 = 0 then the probability of attaining the CSM0 is 50%. In contracts where Future Cash Outflows include a discretionary element for profit share to the policyholders, the presence of this discretionary component in the Cash Outflows does not exempt the entity from quantifying the RA as a liability. Indeed Paragraph 48 (a) of the Standard states that a group of insurance contracts becomes onerous if unfavourable changes relating to future service in the fulfilment cash flows allocated to the group arising from changes in estimates of future cash flows and the risk adjustment for non-financial risk exceeds the carrying amount of the contractual service margin.

It would follow from the above that it is not possible to incorporate the risk adjustment into the discretionary element of the fulfilment cash flows as the risk adjustment is a contractual liability in the same way that the Best Estimate Liability (BEL) is a contractual liability under the Standard.

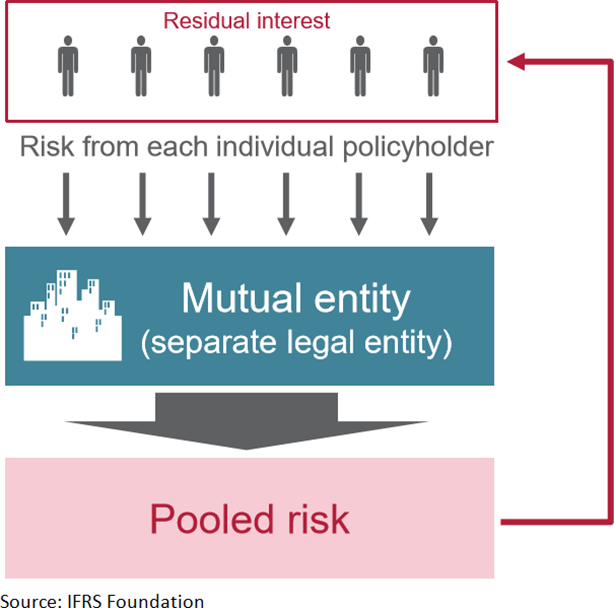

In July 2018 the IFRS Foundation published a presentation entitled “Insurance contract issued by mutual entities”. In the presentation it defines a mutual entity as an entity that accepts risks from each policyholder and pools that risk. The presentation illustrates this with the following diagram:

Although the policyholders with a residual interest as a whole bear the pooled risk collectively, the mutual as a separate entity (separate from the policyholders) accepts risk from each individual policyholder. Specifically, the risk adjustment for contracts with policyholders who have a residual interest in a mutual entity reflects the compensation the mutual entity (in the case of takaful the Participants Risk Fund, PRF) extracts from the individual policyholders (i.e. the participants in the PRF). This amount is identified separately from the residual amount which is due to the current and/or future policyholders/participants in the mutual entity/PRF.

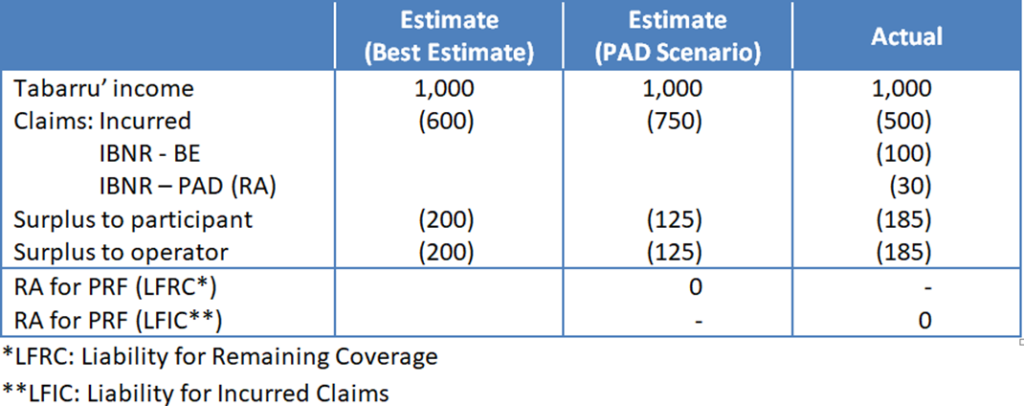

In a recent circular from the Malaysia Takaful Association (MTA) to its members, guidance was given that there is no need for an RA in the PRF as any additional actual claims over best estimate is offset by the expected surplus distribution to participants and the expected performance fee payable to the operator. The table below illustrates MTA’s example (annual policies with a start date of January 1st has been assumed):

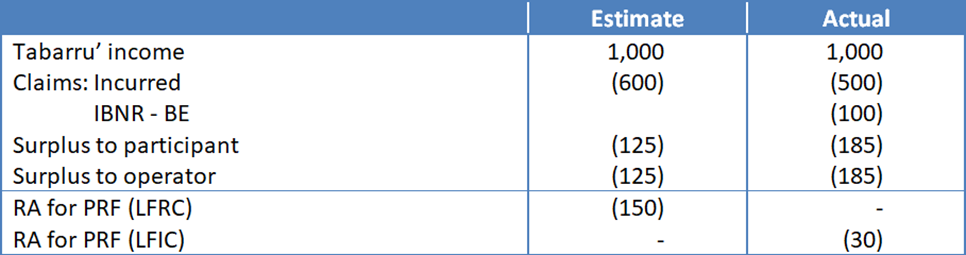

The above I would opine is NOT in compliance with IFRS17 as applied to mutual entities. As mentioned earlier the RA is applicable to the mutual entity for bearing the uncertainty about the amount and timing of the mutual entity’s cash flows, while the surplus is applicable to the individual policyholders, both current and future. The two (the mutual entity and the policyholders) are clearly different entities as explained in the IFRS Foundation presentation. The appropriate presentation would be instead:

To the observer it would seem that there is no difference in the end result as the surplus distributed is the same. However, the principle is different. By disregarding the existence of the RA in the PRF, the accounts would imply that the PRF entity is NOT underwriting the insurance risk. Indeed without the recognition of the RA in the PRF it would seem otherwise. The Shariah advisors should take note of this omission when determining whether the accounts are Shariah compliant.

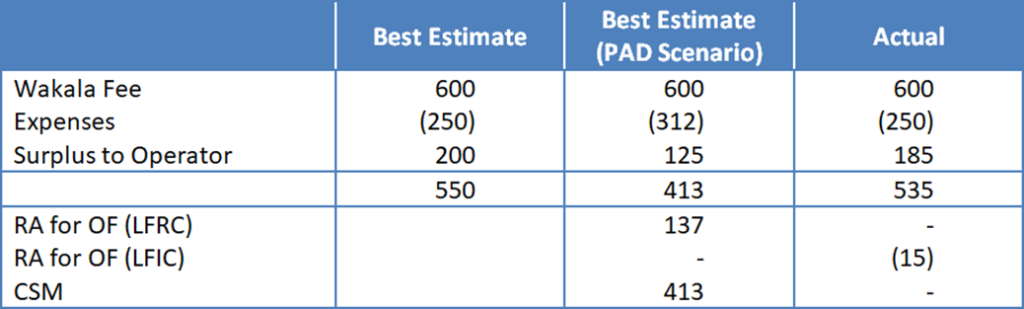

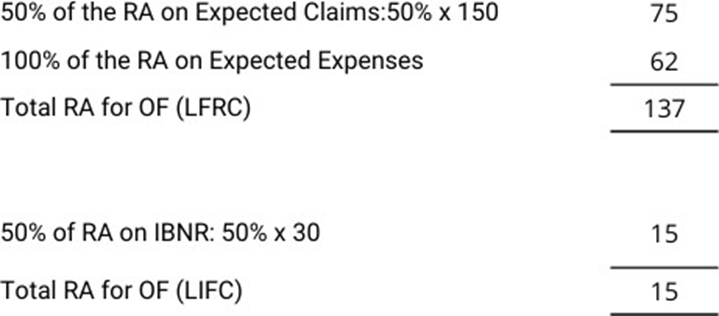

The guidance note from the MTA also shows the entries expected in the Shareholders fund (Operator Fund or OF).

This would seem to indicate a fundamental change proposed by the MTA (and its advisors) to the approach proposed in the MASB Paper (see my April Note) which says that the Takaful Entity (TE) underwrites the insurance risk. If we were to measure the level of risk undertaken by the TE based on the proportionate allocation of the total RA on the insured risk, it would seem that the TE (under this revised basis) undertakes 50% of the insurance risk, while the participants (not the PRF) undertake the other 50% of the insurance risk. I would presume the 50% would vary depending on the expected share of the surplus in the PRF allocated to the participants. In this case as 50% of surplus is assumed to be allocated to the participants, the operator can be entitled to a performance fee of the other 50% of the surplus in the PRF and, thus would carry 50% of the total RA in the PRF to the OF. Contracts which share in 70% of the surplus would see 30% of the RA in the PRF allocated to the OF. Extrapolating this further, if participants do not share in any surplus in the PRF, would 100% of the RA be allocated to the OF? Clearly this approach is not Shariah compliant on the risk transfer front. Assuming for a moment that this is the intention, how then would this accounting be done given that the transmission of the RA to the OF is through the performance fee and no performance fee is payable to the OF if participants do not share in any surplus in the PRF.

To summarize the concerns I have in the MTA’s proposal:

- The assumption that there is no need to show an RA in the PRF, on the premise that this would be implicit in the surplus expected to be distributed to the participants. This assumption is inconsistent with the Standard.

- The assumption that the TE shares in x% of the Total RA applicable to the insurance risk in the PRF if participants share in (1- x%) of the surplus in the PRF. This interpretation would also imply that the TE shares in x% in any residuals in the PRF which is inconsistent with the already agreed premise that the PRF is a mutual in which no residuals accrue to the TE. It is only because no residuals accrue to the TE that the PRF is able to avoid the need to group contracts in annual cohorts.

It is obvious that the MTA (and its advisors) have not sufficiently thought through, in the guidance provided to its members, how IFRS 17 should be applied to takaful. I urge the takaful operators to thoroughly research how the Standard should be consistently applied to a takaful contract (at inception and subsequent re measurements) rather than taking this piecemeal approach through periodic guidance notes which is not helpful when systems need to be designed to work under all scenarios at the outset.