The takaful model has shown itself to be malleable. The industry should now harness this adaptability and seek a more customised approach to ensure its relevance within its broad target audience, says Mr Zainal Abidin Kassim of Actuarial Partners.

To a global observer of takaful, he may be puzzled by the differences in practice among countries as to the implementation of takaful. Why for example, is the takaful model used in Egypt different from the takaful model used in Malaysia? He might also be perplexed as to why insurance is Shariah compliant in Iran but not in many other Muslim majority countries. From this observation, a misconception might arise that there is no common understanding of takaful.

Another surprisingly common misconception among many is the assumption that takaful is only for Muslims. The reality is that takaful is just doing insurance in a particular way; you need not be a Muslim to subscribe to takaful. For a non-Muslim, takaful is another “insurance product” while to a Muslim takaful is about ensuring fairness and transparency in the insurance contract.

The reason why insurance is not acceptable to Muslims is that the insurance contract has in it elements which are not consistent with a Muslim’s belief. Takaful is thus seen as meeting a need within the Muslim community.

Commercial element at play

Yet another misconception among many is that takaful is a charitable institution. It is not, it cannot be in the regulated world that is insurance. The practical implementation of takaful is very much influenced by what the regulations in the country allows or not allow. Therein lies one of the reasons why the practice of takaful varies by country.

Takaful products require capital support. Policyholders do not provide working/solvency capital, shareholders do, and so takaful products offered will depend on how much profit shareholders expect to reap for each unit of capital employed. Capital in takaful is used to finance the “loan” that the risk pool periodically requires either to fund a new business strain or bad claims experience. Capital is also required to finance risk capital for any mismatch between the liability profile and the assets backing this liability. All these considerations affect how the basic model is adjusted to meet shareholders expectations.

Differing interpretation of Islamic law

The other reason why takaful can vary from country to country is the flexibility within which fiqh (Shariah law) is

implemented in different countries. The shariah scholars in Iran for example, examined the insurance contract and are able to explain away the elements which other Shariah scholars in other countries deemed inconsistent with how business should be conducted to be consistent with fiqh muamalat (Shariah law governing commercial transactions).

The level of Shariah compliance which is acceptable in any one country may also vary. “Shariah compliant” is different form “Shariah based”. The former has greater leeway in interpretation while the latter leaves little room for variability. Generally, Shariah compliance, where a Shariah scholar or group of scholars give their blessings on a particular issue, is sufficient for acceptability among Muslims.

Model in theory

The basic commercial takaful model requires a separation between the shareholders’ capital and the policyholders’ fund (risk pool). Under this model the takaful company informs the policyholder what percentage of the contributions it is taking for its expenses and profit. The remainder of the contribution goes into the risk pool and is used to meet claims.

Transparency is addressed through the “fee” payable from the contribution at the point of entry into the pool and fairness through the sharing of surplus within the risk pool among the policyholders. That is the theoretical basic takaful model before factoring in the regulatory and Shariah consequences mentioned before.

Success factors

How successful is takaful? The growth of takaful has been impressive but this is primarily because the starting base is small. Takaful is more successful in countries where insurance generally have been successful. There are several reasons for this:

- The penetration for takaful corresponds with level of financial awareness among the population in the country. Also, compulsory insurance (eg, motor) would similarly drive the demand for takaful.

- The main basis of distribution for takaful would be agents. Other than for compulsory products, takaful is “sold” not bought. Thus, in countries where insurance is sold through agents, we see greater success for takaful. Takaful needs to be explained to the consumer and this is another reason why agency is more successful than bancatakaful.

Takaful companies are new set-up operations, requiring skilled human resources. A market with a thriving insurance industry can be a source of these skilled labours.

Market challenges

What has been the challenges for takaful? After the initial period of euphoria about the potential of takaful globally, the industry has come to realise the formidable challenges it faces to make a profit. These include:

- Consumer expectations. Notwithstanding the significant Muslim market globally, takaful companies have come to realise that policyholders are the same whether it is takaful or insurance, they want the “cheapest” offering. Thus, takaful companies compete on price with each other and also with insurance companies. This is the slippery slope to ruin. Takaful companies are start-ups with limited capital, competing on price simply uses up capital without growing a loyal group of policyholders. Competing with insurance companies on price is also a fruitless exercise. Insurance companies do not have to share any underwriting surplus with its policyholders and thus can recover faster in any subsequent upturn in the insurance cycle.

- An underdeveloped Islamic capital market. Takaful contributions need to be invested as contributions are paid before claims are paid. Takaful is also a means to a disciplined approach to saving. Other than in Malaysia, there does not exist a national liquid sukuk (Islamic bond) market. In many countries takaful companies invest their policyholders’ and shareholders’ funds in the equity market. In such instances the profitability of the takaful company is strongly correlated to the performance of the local stock market. Over the long term the sustainability of takaful companies is dependent on access to a sukuk market.

- The influence of regulations on the ability of takaful companies to make a profit cannot be overemphasised. Stringent regulations require greater investments in systems and manpower. The cost of regulations weighs more heavily for new start-ups then for well-established insurance companies. These costs make takaful operators less able to compete with the insurance industry.

Adapting takaful models to meet target audience

Is the takaful industry then doomed to slower growth going forward? Maybe. If takaful chooses to compete on price it will unlikely be a sustainable business model. To be successful, it has to reinvent its business model or request for regulatory concessions. It is perhaps unrealistic to ask the regulator for concessions if its products are clones of insurance products.

It would be unfortunate if takaful fails because of widespread misunderstanding of what takaful is and how takaful should be implemented. There are essentially two takaful markets and these should be considered separately. Firstly, there is the takaful market where currently the insurance industry is already serving. This consists of customers who are relatively financially aware of the importance of insurance as a means of risk management.

For this market, takaful can be a success and can compete with insurance as evidenced in Malaysia. What it needs to do to continue to grow is to reassess its product line and its distribution costs. Insurance is expensive because distribution cost is expensive. Takaful needs to demonstrate that it can improve consumer outcomes as compared to insurance. It should stick to its basic principles of providing transparency and fairness to consumers.

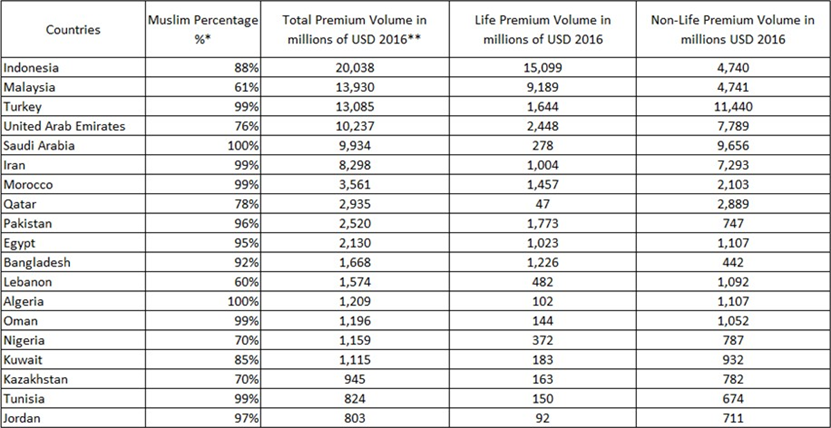

The other takaful market has to do with financial inclusion. Compared to other groups, Muslims are disproportionately distributed in poor and underdeveloped markets. The commercial takaful model cannot work for this market. There needs to be a different takaful model to apply to this underserved segment of the world’s population, Muslim or otherwise.

Highlights

- Differing interpretation of Shariah law, regulations, and shareholder expectation the main reasons why takaful differs among various markets.

- Takaful models can and should be adapted to meet the needs of its target audience.