Mr Hassan Scott P Odierno of Actuarial Partners explores the opportunities for health takaful and suggests how it can be structured to handle the difficulties in providing guaranteed rates.

Takaful in Malaysia is changing. We have a new Takaful Operating Framework (TOF) showing us which models are acceptable along with other best practices. We have new valuation guidelines formulating best estimate reserves, expense reserves and other aspects for the purpose of Bank Negara statutory reporting. We also have draft Risk Based Capital (RBC) guidelines to determine the amount of capital needed and who should provide this capital. Finally, there is IFRS 4 which requires figures to be produced on a specific basis for accounting purposes which may not necessarily be consistent with the statutory reporting basis.

In the face of all this, health takaful continues to flourish.

Types of health takaful plans

Health takaful in Malaysia is sold in several forms, two of which are standalone health plans and health riders attached to unit-linked plans. Standalone health plans tend to be sold by operators who focus more on traditional takaful savings products, whereas operators who focus on unit-linked designed products have actively sold health riders.

In Malaysia, multinationals such as PruBSN have tended to be more comfortable with unit-linked plans. With unit-linked plans, it is possible to launch products quite similar to those sold by their conventional insurance sister companies, which makes IT and other operational issues less of a concern. This is especially true where service level agreements are in place whereby the conventional insurance sister company assists in the backroom operations of the takaful company.

Both standalone health plans as well as the unit-linked riders have been predominantly major medical plans, though a whole spectrum of coverage is available, from major medical coverage on an indemnity basis to fixed payouts under surgeries, stays in a hospital and critical illness. Critical illness plans include both fixed payouts when a participant incurs a critical illness as well as payment of contributions for the participant’s policy under critical illness, or contributions of policy of the spouse or children (under waiver of contribution riders).

Prospects for health takaful

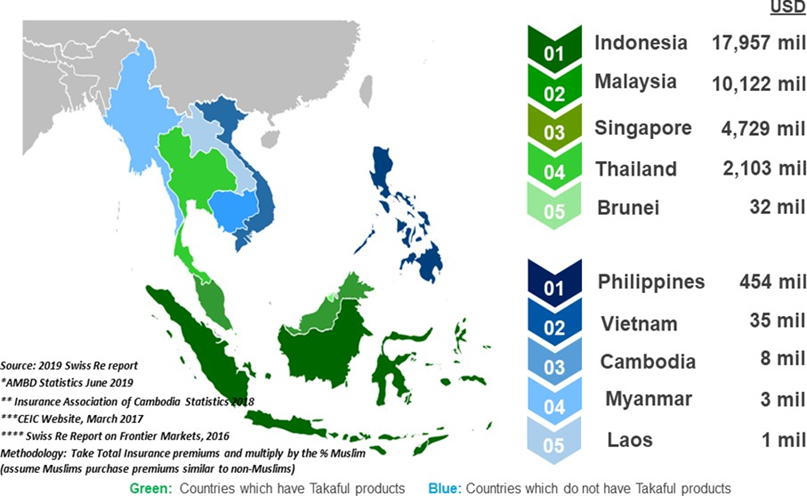

An important question in today’s changing world is what does the future hold for health takaful plans. There are changing demographics in Asia, and a changing political structure in the Middle East.

In Asia in the past, families were large, most of the children lived nearby and were able to take care of their parents as they aged and had health concerns. Now, families are smaller, and people are also living longer, thus compounding the deterioration in the dependency ratio where an ever-smaller working population is supporting an ever-growing retired population. With the spread of globalisation, it is also more likely for children to be staying further away and less likely to help with the healthcare of parents.

In the Middle East, it had been common for governments to take care of the healthcare needs of their citizens, but will this continue? These government-sponsored plans are generally either unfunded or only partially funded and are thus dependent on the governments continuing financial well-being for the promise to be honoured.

With this in mind, it is likely that health takaful plans, especially those catering to older age groups, will increase in importance. Health takaful plans will also likely evolve from being copies of conventional insurance plans to taking advantage of inherent strengths of takaful in general and takaful regulations, in Malaysia in particular. This is especially true of multinationals which adapt from capturing low-hanging fruits of plans similar to conventional insurance and similar market segments to extending into new market segments which will require innovation to succeed.

A possible health takaful structure

One such plan type is where contributions build up over a long period of time and pay out much later in life. The obvious example here is long-term care coverage, but it could also very well be post-retirement healthcare. In these cases, the participant will need to save up for many years. Assumptions will need to be made as to investment performance over a long period of time as well as expected health and long-term care experience in the distant future. For this type of plan, a conventional insurance plan will likely guarantee premium rates, causing RBC charges to be high, in addition to the mismatch charges from a lack of long-term assets to back such liabilities.

In takaful, a structure can be put together where the benefits are not guaranteed but instead depend on the developing experience of the fund. The operator (shareholders) will not benefit from underwriting surplus, but instead such surplus will be given back to participants. In such a case, contribution rates can be made higher than ordinarily would be the case, but with all surpluses going back to participants, the higher rates would be explainable and most importantly, equitable to participants. This surplus sharing would also allow the plans to look participating as well as offer a form of inflation protection.

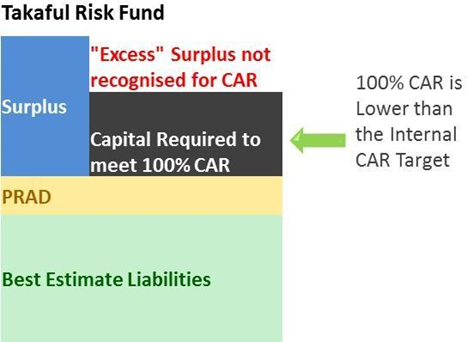

In this structure, the participant would pay contributions to the operator, who will keep a portion as wakala fees for its expenses and profit, with the remainder going into the savings fund. On a regular basis, there will be drips paid from the savings fund to the risk fund to pay for benefits. The savings fund will not attract RBC charges (in the draft RBC basis in Malaysia still under discussion), unlike a traditional conventional insurance plan which would have the full range of RBC charges. Indeed, it is not necessary for RBC regulations to be in place for such advantage of takaful over conventional to be apparent.

The lack of conventional medical products post-retirement is a result of the difficulties of providing guaranteed rates. The alternative to a risk transfer is a sharing of risk and a suitable takaful product could be designed to factor in this uncertainty in claims experience.

It will be interesting to see how health takaful plans develop over the medium term, and the extent of innovation and creativity building in the takaful marketing space.