Risk and Conventional Insurance

Risk is a word defined in the Oxford dictionary as exposure to danger or loss. This means that every individual or property is subject to Risk. However, Risk can be further subdivided into two kinds of risks, speculative risk and pure risk.

Speculative risk is attributable to a situation where there is a possibility of either making a gain or incurring a loss on the occurrence of an event. Gambling is an example of speculative risk, where at the throw of a dice, a gambler can either win or lose some money. On the other hand, pure risk is very different, in that the occurrence of the event can only result in a loss. Theft of a car is an example of pure risk, as the event can only result in a loss to the owner. Insurance from the perspective of the insured is therefore a contract of indemnity. The insurer would indemnify the insured on the occurrence of a loss by settling the monetary equivalent of the loss. The insured does not gain from that loss as the insured amount only brings him back to his financial position prior to the loss. Therefore, from the insured’s perspective, insurance is not gambling. For the Muslim, this is not the reason why conventional insurance is not in accordance with Fiqh (Muslim jurisprudence).

However, the insured represents only one side of the equation. What makes insurance work is the existence of the insured and the insurer. The insurer puts up his capital and sets his premiums. The insurer is also underwriting risk in that he underwrites the book of business for a profit. From the insurer’s perspective then he is not dealing with pure risk but with speculative risk. With the meticulous use of statistics and through reinsurance (which facilitates the spreading of risks) the element of speculative risk is reduced in line with the capital available. The investor in the insurance company puts his capital at risk in case the premiums are inadequate and can either make a financial gain or a financial loss when the insurance contract expires. One of the issues that Fiqh has with conventional insurance is this presence of speculative risk in the insurance process.

Insurance is also one of the few businesses where the “fee” (i.e. premium) is paid before the service (settlement of claims) is provided. Investment income derived from investing premiums before they are required to pay claims usually constitutes a significant percentage of the insurer’s income. Such investment income can form part of the amount used to pay claims. Premiums are normally invested in banks and interest bearing bonds. These sources of riba income also present a significant issue with conventional insurance from the Fiqh perspective.

Takaful

All Sharia compliant commercial transactions have to comply with certain basic restrictions. They should be devoid of:

- ‘Riba’ (interest)

- ‘Gharar’ (uncertainty)

- ‘Maysir’ (gambling) and

- Other investments which are ‘haram’ (prohibited) in Islam e.g. gambling, alcohol and tobacco production.

The insurance contract is no exception.

While reasons for avoiding Riba, Maysir and all Sharia prohibited investments are clear for most Muslims, the issue of Gharar needs some explanation. Gharar can be translated as uncertainty and by extension as the transfer of risk. Muslim jurisprudence is clear that business dealings must be transparent where the parties to the transaction are clear as to what the consideration is and what is bought with that consideration. Thus, the selling of the unborn calf or the fish in the sea (i.e. tomorrow’s catch) for example is strictly prohibited. In such a transaction there is much uncertainty and, were the transaction to be completed, the risk (the calf being aborted or deformed, a small catch at sea) is transferred from the seller to the buyer. Gharar in insurance and for that matter Takaful cannot be avoided. The premium that is paid is for the right to be indemnified in case the payer suffers a loss. Not only that the event insured may not transpire, but should the loss happen the monetary loss itself is uncertain. Gharar is therefore, an integral part of Insurance and Takaful. It is for this reason that the concept of Tabarru’ is introduced into Takaful. Tabarru’ is a gratuitous contract. Tabarru’ can be loosely translated as donation. In the act of giving a donation the utilisation of the amount donated need not be subject to strict preconditions, leaving room for the presence of Gharar in what is an acceptable Islamic contract.

The Islamic Fiqh Academy, emanating from the Organisation of Islamic Conference, convened in Jeddah, Saudi Arabia in December 1985, met to consider all available types and forms of insurances. After much deliberations, it subsequently decreed that insurance through the concept of a cooperative (which is founded on the basis of Tabarru’ and cooperation) is acceptable in Islam.

In a cooperative the insured is also the insurer and the element of speculative risk is removed. Excess of claims over premiums have to be met with additional premiums among the participants or alternatively funded by a collective loan against future underwriting surplus while any excess of premiums over claims can be refunded in the form of surplus sharing.

Takaful – the beginning

Takaful is very recent in Islamic history, although many point to the practice of the payment of ‘blood money’ for compensation in cases of wrongful death in the Prophet’s time as a precursor to modern takaful. Indeed, in some Islamic countries (for example Egypt and Turkey), Sharia scholars (scholars who are conversant with Fiqh) have ruled that in the absence of an Islamic alternative, conventional insurance is acceptable to Muslims, as it brings more good than harm and thus is of benefit to society. However, Islam being a very ‘personal’ religion (the Sunnis who make the majority of Muslims in the world have no supreme leader who can rule on contentious issues), this may still not be sufficient comfort for many Muslims to embrace conventional insurance. This fact has partly contributed to a lower level of insurance penetration among Muslims.

Sharia compliant commercial transactions should mirror one of the standard Islamic contracts available. By just specifying the contract type, the rights of all the parties to the transaction are known. For example, the ‘Mudharabah’ contract type involves two different parties:

- The ‘Mudharib’ – entrepreneur, the working partner, and

- The ‘Rabbal Maal’ – capital provider, the investor.

In a Mudharabah commercial transaction the capital provider makes the capital available for a venture while the entrepreneur brings his expertise. Any profits from the venture would be split in a pre-agreed percentage between the two parties. The unique features of this contract are:

- That any losses are borne only by the capital provider, and

- The entrepreneur cannot charge his personal expenses to the venture.

Thus, even though all losses are borne by the capital provider, the entrepreneur can also incur a loss to the extent that if the venture is loss making, he would not have any income to defray his expenses.

The first Takaful Company started in Sudan in 1976. It was effectively run as a cooperative even though there was a shareholders capital within the company. This capital was small and was seen purely as a statutory nuisance. All expenses were charged to the policyholders, who were represented on the Board of Directors even though they may have held no part of the share capital. The shareholders were only entitled to the income on the capital invested. All underwriting profits as befits a cooperative were retained by the policyholders and could be used to reduce premiums. Recently, Takaful companies were allowed to have a separate Mudharabah contract on the investment of the policyholders’ funds. With this contract, the shareholders were entitled to a proportion of any investment profits in the Takaful Fund. From the shareholders perspective, it was difficult to make an adequate return on capital without such an arrangement.

The first Takaful Company in Malaysia took the basic Mudharabah contract and adapted it to insurance. Under this interpretation, premiums were treated as capital and were paid into the Takaful Fund and all management expenses incurred by the insurer could not be charged to the Takaful Fund but were paid from the shareholders fund. The ‘profit’ is determined at the end of the year after claims are paid and adequate provisions made. This profit is then apportioned between the shareholders and the policyholders in a pre-agreed percentage. For a start up company with heavy initial expenses, this is an especially trying model.

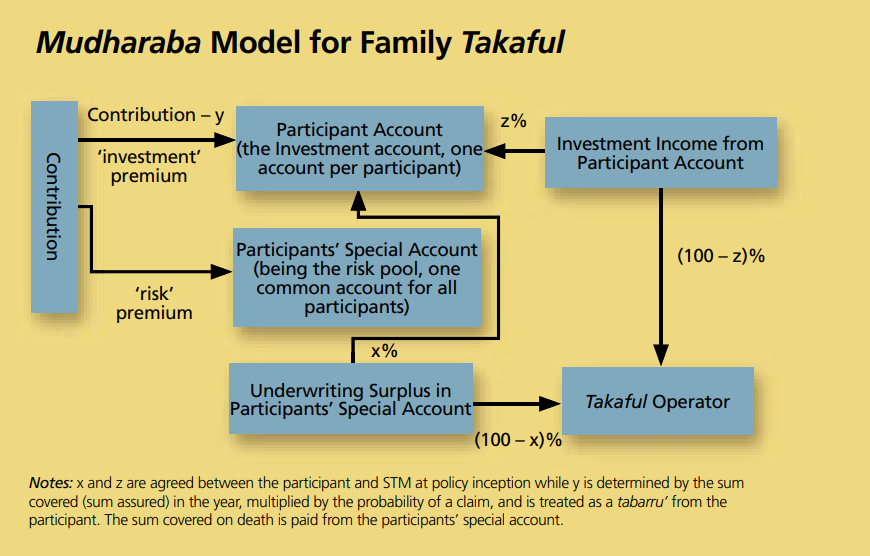

Chart 1: The basic Mudharabah model in Malaysia

Note: Surplus comprises both investment and underwriting profits.

This is a difficult business model especially for life (called ‘Family’) business but it was successful in Malaysia partly because there was only one Takaful Company in the country for almost 10 years. Another reason for its success was that it also transacts non-life business.

Although the Mudharabah is a difficult business model for the Family Takaful, it was fairly successful for the General (Casualty) Takaful business. The profit sharing ratio for the General Takaful business is usually 50:50 (as opposed to the usual 30% to the shareholders and 70% to the policyholders in Family Takaful) but can be

a higher percentage to the shareholders. It is pertinent to note that all the Takaful companies in Malaysia are composite and this has helped them to defray expenses at a faster rate than would have been the case if they were writing only Family Takaful business.

Takaful – subsequent development

An important development of Takaful worldwide is the emergence of a quasi standard in the Takaful business model. This has been brought about by the recognition of Takaful business as one that can be split into two ‘businesses’, one of underwriting and the other of asset management.

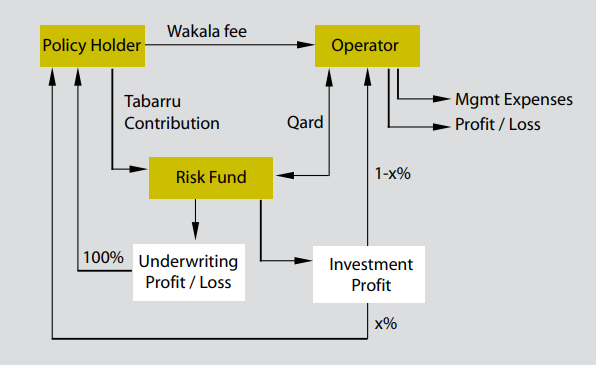

For the underwriting business, it was recognised that an agency (or ‘wakala’) contract would be appropriate. Under the wakala contract, the Operator (Takaful Company) would collect an agency fee to defray its costs in managing the underwriting side of the business. All underwriting profits or losses would accrue to the policyholders (called participants). For the fund management side of the business, the Operator can adopt either the same wakala contract (in which case a fee would be deducted as a percentage of the value of the fund under management) or the Mudharabah contract where instead of a fee, the Operator shares in the investment profits (but not investment losses). Seven of the nine Takaful companies in Malaysia now use the Wakala business model in some form or another. One of the remaining two has also indicated its intention to move to the wakala model.

Chart 2: The generic Wakala model, with a Mudharabah share on investment profit

Note: In Malaysia some Operators also share in Underwriting Profit (but not in Underwriting Loss), on the basis of an incentive compensation.

Takaful – Role of Capital

The role of capital in Takaful is a challenging one to address. Takaful companies in Malaysia are subject to the same capital requirements (but not solvency requirement as yet) as their conventional counterparts. One important role of capital is to act as the lender to the Takaful Funds (which are physically separate from shareholders assets) should the Funds fall insolvent due to volatile or adverse claims or investment experience. These loans (called Qard Hassan) are interest free and constitute a first charge on any future surplus from the Takaful Funds until they are fully repaid.

Although the Operators do not share in losses, it is in their interest to ensure that the Takaful Funds are financially strong, as the Qard which represents a shareholders loan, would ultimately be written off and hence never recovered, if the Takaful Funds continue to be in a position of deficit.

Capital has to be serviced as otherwise there will be no investors. The wakala fees and Mudharabah sharing ratio should therefore be set to service the capital required at an appropriate rate of return and not merely sufficient to meet the expenses of running the Takaful business. The economic capital should be appropriately set to support the chosen business model.

Takaful – Comparison with conventional insurance

It would be useful to compare the differences between Takaful and Conventional Insurance and this has been done in the table below by addressing key issues that arise in an insurance and takaful contract.

Conventional versus Takaful

| Issues | Conventional | Takaful |

| Nature of contract between policyholders and shareholders | An insurance contract where, for a consideration (called the premium), the shareholders agree to indemnify the policyholder from losses due to an accident or other calamities. There is a transfer of risk from the policyholder to the shareholders for the insured object and contingent. All expenses are met from policyholders’ premium. | A management contract to manage the Takaful business on behalf of policyholders. Typical contracts applied are the agency (wakala) contract or the mudharabah contract. Because it is a management contract, all management expenses are charged to shareholders and not to the policyholders (there is a clear physical separation between policyholders’ assets and shareholders’ assets). There is no transfer of underwriting risk from the policyholder to the shareholder. |

| Sharing of Profits and Losses between shareholders and policyholders | A proprietary insurer Where the contract is specified as a non participating contract, the premium immediately becomes the asset of the shareholders while the shareholders’ liabilities now include the contingent of a future claim. All profits and losses accrue to the shareholders. Where it is a participating contract there is a sharing of profits between policyholders and shareholders. All losses however, are met by the shareholders. A mutual insurer There is an agreement to share all profits and losses among policyholders. Policyholders remain as “owners” of the mutual fund. | Policyholders agree to share the risks among themselves. Policyholders are both the insured and the insurer. All underwriting profits and losses are shared between the policyholders through the premiums accumulated. In order to address the issue of gharar in Takaful, the risk premiums (termed contribution in Takaful) are deemed as tabarru’ (donations). Policyholders do not own the Tabarru’ Fund. |

| Investments | Investments of the policyholders’ and shareholders’ funds are not sharia compliant. They would include interest bearing securities and equities in forbidden businesses. | All investments (policyholders’ and shareholders’ funds) are sharia compliant. |

| Governance | There is management and a Board of Directors for a proprietary company | In addition to management and a Board of Directors there is a Sharia Advisory Board to monitor the Takaful company’s continuing sharia compliance. |

| Policy Conditions | Bound by contract law and subject to regulatory conditions (e.g. Treating Customers Fairly in the UK). | Policy conditions must be clear and transparent and sharia ‘friendly’ (issues such as whether a particular policy condition is fair to the policyholder may occasionally arise with Sharia) |

| Guarantees | Insurance contracts normally carry some guarantees which are underwritten by the shareholders. Typically, these are guarantees that premiums paid are sufficient to pay all claims and expenses. In savings products there can be a guarantee that a minimum rate of return on investments is achieved. | No guarantees, only an undertaking among policyholders to make sufficient tabarru’ to pay claims. Shareholders may be called to help in financing deficits in the Takaful Funds through interest free loans which would be repaid from future surpluses in the Tabarru’ Fund. |

RETAKAFUL

In addition to the requirement to have sharia compliant assets to support Takaful Liabilities, there is a need for a sharia compliant version of reinsurance.

The difference between reinsurance and retakaful is that the former provides a means of smoothening the claims experience of the shareholders. In retakaful there is an effective sharing of risks among the participants of the Takaful Funds, as the shareholders, by definition, do not underwrite but manage risks in the Takaful Funds on behalf of the participants.

As an example, a reinsurance surplus refund usually considers only the experience of the portfolio reinsured and surplus is returned to the insurance company (in this case the shareholders). In retakaful, the surplus is determined by the experience of the retakaful fund in addition to just the portfolio’s (i.e. the specific Takaful Fund) own experience and the surplus is returned to the participants.

Is Takaful only for Muslims?

Definitely not so, Takaful is another way of doing insurance. It is another product line in the same way that investment linked products are a natural development of the traditional whole life and endowment policies. There are no restrictions as to who can or cannot take on Takaful.

Takaful can accommodate non Muslim participants. As an example, when Muslims are involved in Takaful, the policy conditions would state that proceeds from the death of a participant (the sum assured) must be distributed in accordance with the Muslim Law of inheritance. But this would not apply if the participant is a non Muslim, in which case, the proceeds can go to a named beneficiary.

The distinctive features of Takaful – such as transparency of product documentation, the embedded feature of profit sharing to the participants, restriction to Socially Responsible Investments (no gambling, no alcohol)

– may be attractive to an increasingly active “ethical investment” market, which is not defined by religion. It is estimated that between 20% and 30% of Takaful participants in Malaysia are non Muslims. This is a country where over 40% of the population are non Muslims.

Takaful – Prospects

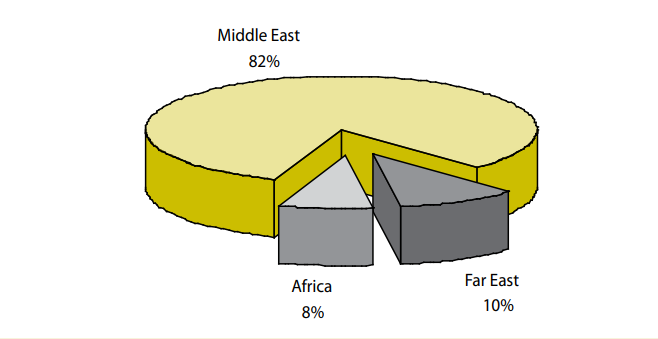

Currently, the most active markets are the Middle East, North Africa and South East Asia. In 2005, the total gross takaful contribution totalled US$4.3 billion, largely from the Middle East, with a historical annual growth rate that varies from 15% to 20%. This is in contrast to the potential market for Takaful, which is estimated to be in the region of US$20 billion.

Chart 3: 2005 Takaful Contributions by Region

Analysing further the potential market, taking into account not just the size of the Muslim population in a country but also the wealth and propensity of the Muslims in that country to buy insurance, Western Europe and the US market could surprisingly prove to be a lucrative Takaful market.

CONCLUSION

Takaful is not simply a name change, it is not simply a repackaging of conventional insurance under an Arabic sounding name but a new product line altogether.

There is an important role for Takaful in Islamic finance and investment. The ban against riba currently restricts the role of Islamic banks in the financing of business. The problem is one of mismatch of assets against liabilities. Banks are conduits for short-term deposits. Islam’s requirement that reward can come only with risk, while forbidding riba, means that the Islamic bank’s liability will be long term because banks will effectively hold equity in the investments they make with the depositors money.

Due to the issues of mismatching of deposits to investments, many Islamic banks are resigned to take a role more akin to investment banks than commercial banks. The money is in the masses, however, and accumulating small amounts of deposits over a large number of accounts among the population results in a large amount of money. Muslims make up more than one billion of the world’s population. The Muslim world is generally under invested and financially underdeveloped. It sports a young demographic profile with an increasing purchasing power and savings potential.

All this points to a huge potential for long-term savings and investments. Takaful, if developed and marketed effectively, has the unique ability to tap into this potential. Here, the assets and the liabilities match. Savings through family Takaful for retirement, in particular, would provide a valuable pool of long-term funds, ready for the right investment opportunities.