Mr Hassan Scott Odierno, Actuary and Consultant, Mercer Zainal Consulting Sdn Bhd in Malaysia, considers the issue of surplus (as opposed to profit or loss) in takaful which has been the subject of much debate among practitioners, and makes a call for equitable rules to be observed in the distribution, while clarifying the confusion in understanding the nature of the contributions made.

Surplus is a function of many factors which may vary from country to country (eg the statutory reserving basis) and from company to company (the practice with regards to surplus distribution, eg are all surplus distributed or are some held back to build up provisions for adverse claims experience).

The treatment of this surplus and the reasons given for this include:

- As contributions to the tabarru’ fund are considered donations, any surplus should remain in the tabarru’ fund to meet future claims and should not be distributed to any parties.

- Although the contributions to the tabarru’ fund are considered donations, their specific purpose is to pay claims. If a surplus arises, then the contribution donations were excessive and the surplus remains the property of the participant and should be returned to the participants.

- The surplus in the tabarru’ fund does not specifically belong to any party as they have been donated in the true sense. However, through the concept of hiba (or gift), the surplus can be distributed to participants and (in contrast to the second point) to the takaful operator in a predetermined agreed percentage.

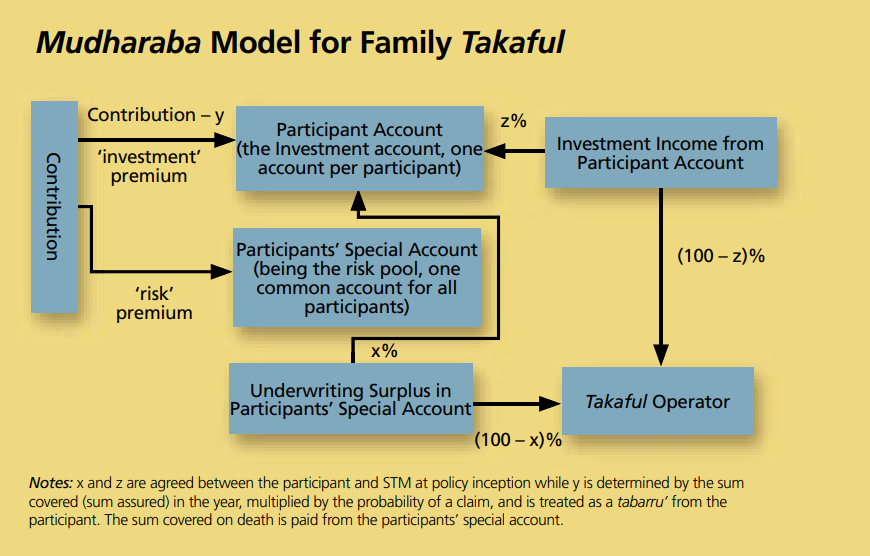

The way surplus is calculated and treated in takaful has an important bearing on how takaful works financially. The takaful model of choice is the wakala (or agency) model. Depending on how surplus is treated, the level of wakala fee would differ. Everything else being equal, where the takaful operator shares in surplus, the wakala fee is usually lower.

The Actuary’s Perspective

The actuary’s role in insurance includes the determination of statistically adequate premiums. This is done by observing historical data and extrapolating into the future. In an operation where all risks are undertaken by the insurance company, all underwriting profits and losses accrue to the insurer. Insurance works by ensuring that risks are spread as widely and as thinly as possible. The insurer does this by reinsuring its portfolio with other (re)insurers.

Consider the insurance cycle. Initially insurers compete by offering low and lower rates while claims experience remain favourable. When rates become so low as to be unprofitable or if the insured is hit by calamities, rates generally begin to rise. This happened after 9/11 and Typhoon Katrina when insurance and reinsurance rates increased significantly. Over one insurance cycle, the total premiums collected by the insurance industry in total should not vary too much from the total claims paid by the insurance industry. It is important to realise that even in conventional insurance, and over time, insurance claims are ultimately paid by the insured through the premiums paid.

The Nature of Contribution

The confusion as to the treatment of surplus in takaful is due to differences of opinion on the nature of contribution paid by the participants. Note though there are no differences in opinion among practitioners as to the treatment of deficits – all deficits are for the account of the participants.

Fairness in Treatment

From the actuary’s perspective, an overriding factor is that there should be fairness in the treatment of participants. This is not inconsistent with the spirit of Islam. Considering that all deficits are for the account of participants, all surpluses should be for the account of the participants as well. The concept of sharing of risks among participants should result in not a fixed contribution (as in conventional insurance), but a variable contribution for all takaful participants.

Thus, a surplus refund would effectively result in the participant paying less contribution for the year. Conversely, when in a deficit, the participant would be asked to pay for a higher contribution than originally envisaged. Practical consideration, though, would normally see either higher future contributions (to cover past deficits) or the recovery of past deficits from future surpluses.

Grouping of Risks

Among participants, the surplus should be determined by grouping similar risks with similar expected profit margins. This is especially pertinent where tariffs determine the contribution level like they do for personal lines motor and risks in Malaysia.

Shareholders and Surplus

One technical argument against shareholders sharing in surplus is that surplus in insurance are estimates and are thus subject to adjustments in reserves and provisions. A surplus in one year may actually be a deficit once provisions materialise and claims paid. As shareholders do not share in deficits, this can result in inequitability between participants and the shareholders.

Tabarru’ and Equity

Is the principle of tabarru’ inconsistent with the principle of equity?

It has often been quoted that where the contributions in takaful are made on the basis of tabarru’, then how the surplus is determined and distributed does not need to be guided by the principal of equity. This solves a lot of issues in takaful as surpluses or deficits, at any particular time, are, as stated above, only estimates at that point of time (as provisions made for claims incurred but not yet settled are subject to future adjustments, or as the Regulator imposes conservative valuation bases).

A literal interpretation of tabarru’ should not apply in the case of takaful. It is often quoted that, if someone wants to study the Quran, he should seek a teacher who understands God’s message. A literal translation of Quran can be misleading. Given that the concept of takaful is too technical for a layperson to understand, it is up to the practitioners to ensure that equity should not be less of an issue just because the participant has made the contribution on the basis of the concept of tabarru’.

Early Years: Surplus Distributed?

It is likely that over the initial years of a takaful operation, significant amounts of surpluses are not distributed, but rather kept as reserves. This may raise issue of intergenerational subsidies and can be deemed inequitable. Islam also preaches that the good of the majority can override the needs of the individual. There are merits in building up reserves so that a buffer exists to ride out future volatility in claims experience as ultimately policyholders are also the insurers in takaful.

Conclusion

For an actuary by training, it is difficult to justify not putting equity among participants first (subject to practical limitations and a need to build adequate reserves) before other considerations. This is not in any way inconsistent with Shariah law. The utilisation of the principle of tabarru’ is valid given the various uncertainty associated with managing a takaful operation. Using any other Islamic contract currently available would not be possible in takaful.

However, I would submit that the takaful industry should rise above the basic interpretation of tabarru’ as used in takaful to ensure that the concept of equity among participants is its first priority. A literal translation of tabarru’ should not apply in takaful as it is a means to an end, and not an end to itself.