How exactly should surplus be shared with participants in takaful? This is the heart of takaful as it involves solidarity amongst participants, elements of fairness and reduction of gharar (uncertainty). Mr Hassan Scott P Odierno, Principal and Actuary of Mercer Zainal Consulting, explains the steps involved in defining, calculating and sharing surplus.

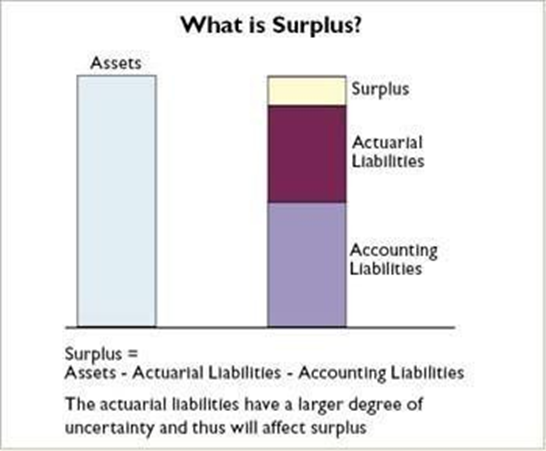

In takaful, surplus is defined as assets minus liabilities of the takaful risk fund. These liabilities are further defined as both accounting liabilities as well as actuarial liabilities. Accounting liabilities are generally set aside for things which are fairly well- known already, whereas actuarial liabilities are set aside for things (contingencies) which are likely to happen in the future and, thus, are much more uncertain.

Surplus can come from many sources such as excess investment income, favourable experience in benefits such as mortality benefits, fire or auto claims, etc. In general takaful, surplus sometimes, but not always, refers to that from all sources, whereas in family takaful, surplus is normally considered separately, with the balance called underwriting surplus. The reason for the split in family takaful is that there is often a separate model used for investments, such as mudahraba, whereas the underwriting surplus aspect is more likely to be considered under the wakala model.

Surplus can also be split between that given to participants (policyholders), given to the operator (shareholders), and that which is kept in the fund for contingencies. The sharing of surplus with the operator is a sensitive subject which will not be covered here. There are a number of good arguments actuarially why the operator should not share in surplus, such as the fact that the operator does not share in losses as well as corporate governance issues. We shall avoid this controversy and focus on how surplus should be shared with participants.

Surplus in General Takaful

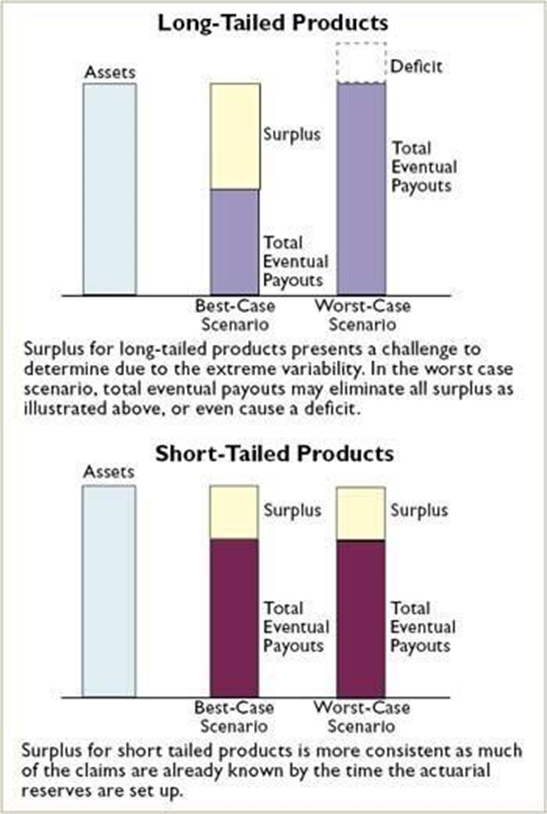

General takaful liabilities can be split between long-tailed products and short-tailed products. Long-tailed products are products where the contribution is paid in a particular year, but benefits might only be paid five to seven years in the future. These products tend to involve litigation or other legal processes which are time consuming. Short-tailed products, on the other hand, have benefits paid in the same year the contribution is paid or shortly thereafter.

From an actuary’s point of view, a long-tailed product is much more difficult to set reserves for, due mainly to the uncertain nature of future litigations, legal processes and claims inflation. This uncertainty is termed gharar, and should be minimised in takaful. Therefore, it can be argued that surplus on long-tailed business should only be distributed once the claims are fully cleared. Of course, this adds an operational difficulty in keeping track of these participants and paying surplus out to them eventually.

Surplus in Family Takaful

Family takaful products have a number of types and forms. Mortality products such as mortgage-reducing-term or long-term savings products might have an initial contribution, or a level contribution paid into a risk fund. Alternatively, it might have contributions paid into a savings fund first, and then dripped into a risk fund on a monthly or yearly basis. The type of products where the single or level contribution is paid directly into a risk fund represents a challenge for the actuary to reserve for as benefits might be paid for many years into the future. These products have benefits pre-funded through either single contribution or level contributions.

With this in mind, the reserves for these plans have quite a bit of uncertainty, similar to the long tailed general takaful products. Due to this uncertainty, a similar solution for the timing of surplus distribution is generally preferred as well. Family products for other benefits, where contributions are paid yearly and there is no pre-funding of benefits or where contributions are dripped into the risk fund are similar to short- tailed general takaful products as there is less uncertainty.

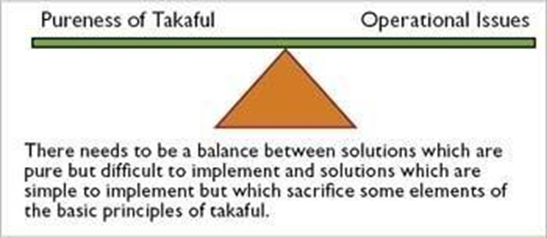

Thus, the decision as to when to distribute surplus requires the balancing of the need to follow the Shariah in reducing gharar, with practical considerations such as difficulties in keeping track of each group of participants’ years into the future. This is further complicated when the operator shares in surplus, as the operator would naturally want its share as soon as possible.

Balancing Required in Takaful

The inclusion of solvency requirements such as risk-based capital also creates tradeoffs as surplus is required to be kept inside the takaful funds to cover future contingencies. This potential tradeoff is sometimes handled through the reserving of a portion of surplus in either a separate contingency fund or inside the risk fund itself. The determination of how much surplus should be set aside is a function of the desire for fairness towards each individual participant versus the need to provide for the good of all participants. Most jurisdictions give some leeway to this, which gives the actuary the ability to balance the health and profitability of the operations versus individual fairness. The calculation of actuarial reserves to cover future contingencies which might happen to the fund is performed by the actuary based on the regulations of the country as well as international best practices.

Surplus Sharing Solutions

There are many options available for a takaful operator to share surplus, from a surplus distribution policy that promotes complete individual fairness to pure donation concept, or anything in between.

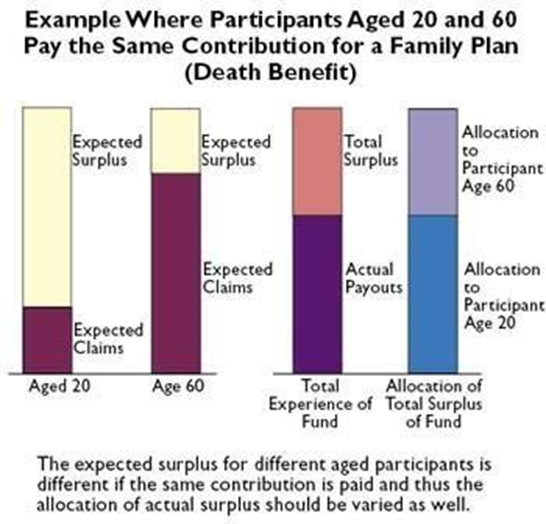

Once the timing of the surplus distribution and percentage to be distributed to participants is set, a decision must be made as to how exactly to allocate this surplus to the individual participants. Here, fairness is a key concern. How the contributions were calculated has a significant affect on this calculation. If the contributions for all policies were set with the same level of profitability expected, then the surplus can simply be allocated based on level of contribution and whether a claim was made.

If differing levels of profitability was expected, then the allocation of surplus should take this into account. The underlying theory is that participants can and should share in each other’s unexpected losses, but all participants should be in an equal or fair position when contributing to the fund. This is not always possible, which is why adjustments need to be considered in allocation of surplus.

The expected surplus for different aged participants is different if the same contribution is paid and thus the allocation of actual surplus should be varied as well.

Long term family funds such as savings funds and risk funds sometimes share in investment profit separately from the surplus sharing described above. In these cases, investment profit sharing is generally much more straightforward. However, there are still issues which must be considered, such as ensuring that only realised investment profit is shared.

Fairness Can Be Achieved

The careful design by the actuary of the surplus sharing methodology to participants in takaful thus ensures that to the greatest extent, possible fairness is achieved between participants while balancing profitability and operational issues. This is a very technical topic, requiring knowledge of the latest actuarial developments worldwide but is also at the heart of ensuring takaful goes beyond being simply a name change and Shariah-compliant to being Shariah-based, pure in spirit as well as name.