Up to 2009, Malaysia operated in a net premium environment. The margins in valuation are at best artificial. Capital held as RSM (required solvency margin) had no bearing on the risks taken on in terms of liabilities and assets held to meet those liabilities.

RBC framework for conventional companies was implemented in 2009. For takaful operators, RBCT was introduced in 2012. Initially the calculations gave rise to significantly high capital requirements. There were concerns voiced by the industry that this ultra conservative basis will mean Malaysian insurers will show lower Capital Adequacy Ratios (CAR) and are hence perceived as less strong as compared to companies in neighbouring countries. There was also a concern that the Appraisal Value of local companies will drop.

The current framework was arrived at by Bank Negara, the central bank, by consulting and taking into account the feedback by the industry. There were a number of concessions made after the consultation process; the following are the two significant ones.

- There was a major concession by the Central Bank to ring fence the local industry’s annuity fund as there were no provision for capital cost in pricing this politically sensitive product. This has been made worse by the lack of long term bonds to back the liabilities which would mean insurers would be penalised via the interest rate risk charge.

- Further, for participating funds, a portion of the excess assets after meeting guaranteed liabilities can be used to meet capital charges by allowing a provision for credit of 50% of value of future bonus to meet CAR in par funds. This means that shareholders do not have to wholly meet asset risk charges for example of holding equities to meet discretionary bonuses. It is however still considered conservative – for life insurance companies, the framework still does not account for diversification benefits between risk classes – in effect simply aggregating risk charges implies aggregating worse case scenarios.

As an aside, in the background, there was a flutter of activities going on. The industry, especially the actuarial departments and their consultants were working late nights and weekends. Actuarial softwares to run GPVs were purchased and extensively customised to allow for the different set of assumptions under the different stress scenarios. Expenses invariably went up.

With the added imposition of an increase in minimum capital around that time, the industry also consolidated – this was more apparent for general insurers where at the time they were still small family run outfits around. In one extreme scenario Bank Negara, took control of Tahan Insurance in 2009 after the previous owners were unable to meet the central bank’s capital threshold requirements. It was eventually sold.

Fragmentation has hence reduced; the 10 smallest general insurers have a 25.7% market share in 2012 compared to 13.6% in 2008.

With the implementation of RBC, general insurers also had their source of profits squeezed. In the previous regime, general insurers tend to invest reserves in the stock market to generate significant income on this “free money”. There were no capital cost involved. With the introduction of RBC, investing in equity became capital intensive – profits are now more than ever driven by underwriting performance.

The following is a chart of the CAR ratios of the industry since 2008. Industry CAR in 2012 was on average 220% – well above the the supervisory CAR of 130%. In sharp contrast, during the parallel tests in 2006, there were only 9 life companies (out of 16) that were above the supervisory CAR of 130%. When there was a drop in interest rate in 2007, only 6 life insurers were above this supervisory CAR.

What did insurance companies do to improve their CAR?

Review asset allocation: This was initially done very crudely by simply moving from capital intensive assets (like equity investments) to less capital intensive assets. One of our clients literally divested all its equity holding to cash given the uncertainty at the time – which very much improved their CAR position (no asset risk charge on cash deposits) but was not a suitable match for its liabilities. Another client divested its uncompleted properties. Companies also attempted to reduce their interest rate risk charge (which captures the difference in movements of assets and liabilities from a movement in interest rate) by investing in assets that better match their liabilities – generally this means bonds of suitably longer duration.

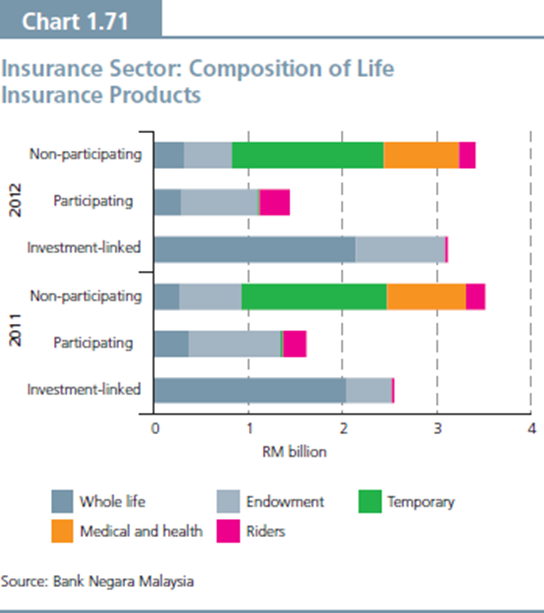

Relook at product offering: RBC was also introduced around the time asset share guidelines were introduced which meant participating business was more challenging to manage. A number of insurers moved their sales focus from traditional participating to investment linked plans – which was seen as a move to less capital intensive products. While investment linked plans are still popular, it is not without its challenges. For agents who were better versed with participating plans with its elements of smoothing (and less visible charges), it proved difficult to market investment linked plans.

Unfortunately the drawback with the industry moving to products that are less capital intensive (for example investment linked) is that these products pass back significant risk to policyholders. In this scenario, it places a greater onus on companies to sell responsibly so the risks are well communicated. One example is where unit funds fail to generate enough income, or perhaps due to premium holidays, is unable to continue paying for “expensive” riders like medical related riders down the road. This then raises the question if financial intermediaries should be introduced in this environment to provide financial advice on product selection, rather than relying on agents who are understandably more driven by sales commissions.

Relook at product pricing: Pricing of products under RBC has to take cognisance of the cost of capital involved. For most products that were priced thinly, the pricing had to be redone. Invariably, prices went up as the cost of providing insurance increased.

We are now in the 5th year since the RBC framework was first introduced. Regulators now require companies to perform internal capital assessment (ICAAP) to assess the target capital ratio it should hold given the risk profile of the company. Asset liability models where either assets or liabilities, or both, are modelled stochastically are becoming more of a necessity with companies implementing ICAAP. Scenarios are being generated to assess the solvency position of companies primarily over the next year, but even considering longer time periods.

Companies are further reassessing its investment strategy given the importance of investment returns as a source of profits. This is now being done more holistically by looking at both assets and liability in tandem. The use of ALM in determining a Strategic Asset Allocations (SAA) for each insurance fund, and the shareholders’ funds underline the fact that under RBC assets and liabilities cannot be looked at in isolation.

Solvency requirement is no longer straightforward and under a risk based capital framework, has many drivers. It is mainly influenced by the liability profile, the assets held, and the matching strategy. Liability risk charges capture the capital that is required to meet a 1 in 200 chance of ruin in one year. Asset charges would depend on the investments held and the mandated schedule of charges. The last item is captured via the interest rate risk charge (which captures the difference in movement of assets and liabilities from a change in interest rate).

There is now more volatility in results. Liability and solvency requirement changes with movements in interest rate. Asset values are marked to market (except perhaps held to maturity fixed interest investments). The interrelationship between the three has an impact on the all-important Capital Adequacy Ratio (CAR). Should CAR at any time drop below a supervisory limit (130% currently), there is a risk of regulatory intervention. Managing this Capital Adequacy Ratio hence requires investigating the likely movement of the surplus of assets over liability requirement (free assets) and that of the solvency or capital requirement.

If you have any queries on the article above please do not hesitate to contact the authors of this article or your usual Actuarial Partners consultants.