Introduction

The formal development of the Islamic Financial System in Malaysia started with the set up of the first Islamic Bank (Bank Islam) in Malaysia in 1983. This was followed by the set up of the first Takaful Company in 1985 (Takaful Malaysia). These institutions were set up under close supervision of the Regulators (Bank Negara), underlying the strong support extended to the Islamic Financial System given by the Government of Malaysia throughout its development. Indeed it has to be realised that it is this strong Government support which distinguishes Malaysia’s development of its Islamic Financial System with that we see in other parts of the Muslim world.

Phased Development

The development of both Islamic Banks and Takaful Companies were slow at the initial phase. Understandably so as there was a need to build up support systems around the institutions, not least the need to build up the appropriate Islamic asset class to fill the asset side of the balance sheet of both the Islamic Banks and the Takaful companies.

Sharia challenges

In creating Islamic financial products an ongoing challenge has been to determine what is and is not acceptable in Sharia. We must first make clear that Sharia sanctioned products should be simply be seen from the conventional perspective as another product in the wide range of products that is already available globally. If we were to ignore the words ‘Islamic’ and ‘Sharia’ I would describe these products as products that strive to promote the following values:

- Linking rewards to taking market risks rather than just depending on loans which carry only credit risks.

- Promoting transparency in all transactions.

- Linking rewards to effort

- Investing in Socially Responsible Investments.

Under Sharia terminology these intentions are reflected as:

- Avoiding ‘Riba’ (interest)

- Avoiding ‘Gharar’ (uncertainty)

- Avoiding ‘Maysir’ (gambling)

- Avoiding investments which are ‘haram’ (prohibited) in Islam e.g. gambling, alcohol and tobacco production.

Malaysia took a pragmatic approach to building up its Islamic Financial Institutions. Indeed some of the Islamic assets structure and business model used in Islamic finance in Malaysia are still seen as unacceptable by Sharia in other Islamic countries.

This represents one of the real challenges of Islamic finance, that there are differences in views as to what is approved in Islamic law and what is not. The Sharia scholars entrusted with interpreting these laws have slightly different approaches to determining what is acceptable and what is not.

It is often quoted that in Islamic law, unless something is expressly forbidden it is accepted in Islam. Certain things are clear cut in Islam (e.g. no alcohol and gambling) others are not. The ban on tobacco for example, is based on the edict that Islam forbids doing something which is harmful to our own life. Some Sharia scholars would interpret from this that smoking is ‘haram’ (prohibited) while others (e.g. certain Sharia in Malaysia) would only say its ‘makruh’ (disapproved; you are rewarded for not doing it but there is no sin in doing it). Thus, there can be differences in interpretation. However, this is both a weakness and strength in Islam as it does provide for the interpretation of Islamic law to evolve over time. Such would be the case if there are no clear ruling on these issues either in the Quran (which Muslims believe to be the word of God) or Sunnah (the words and practice of Prophet Muhammad s.a.w. as recorded in the ‘hadiths’). Unfortunately, unlike the Quran which has remained unchanged since it was revealed and which all Muslims accepts as the truth, the passage of hadiths over time has resulted in disputes over some of the hadiths authenticity.

Given the possibility of disputes in the interpretation of Islamic law one of the key to the successful development of Islamic Financial products in Malaysia has been the creation of a National Sharia Council in Bank Negara which has the final word as to what is haram (forbidden) or halal (acceptable) in Islam.

Takaful – the beginning

Takaful is something very recent in Islamic history, although many point to the practice of the payment of ‘blood money’ for compensation in cases of wrongful death in the Prophet’s time as a precursor to modern takaful. Indeed in certain Islamic countries (for example in Egypt and Turkey), Sharia scholars have ruled that in the absence of an Islamic alternative, conventional insurance is acceptable to Muslims as it brings more good than harm. However, Islam being a very ‘personal’ religion (the Sunnis who make the majority of Muslims in the word has no ‘Pope’ or supreme leader which can rule on contentious issues), this may still not be sufficient comfort for many Muslims to embrace conventional insurance. This fact has contributed to a lower level of insurance penetration among Muslims including in Malaysia.

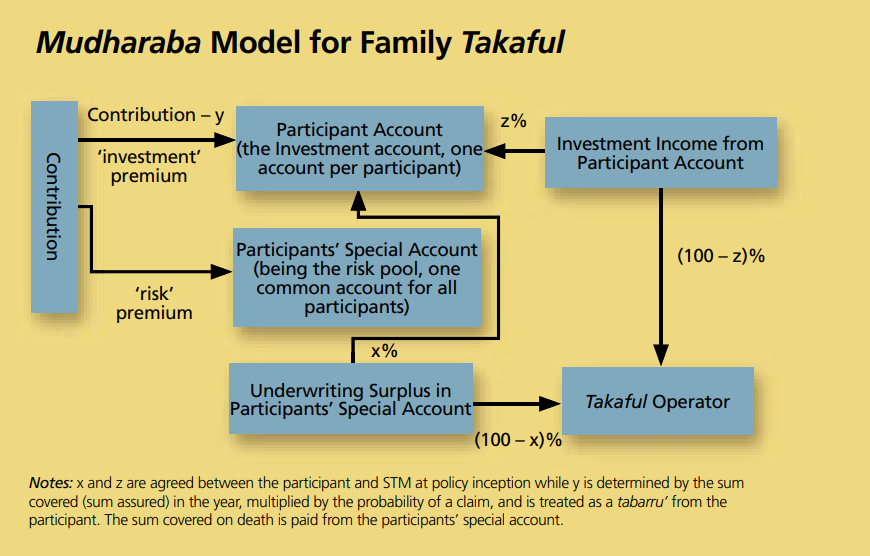

Sharia compliant commercial transactions should mirror one of the standard Islamic contracts available. These contracts are contract types in that by just specifying the contract type the rights of all the parties to the transaction are known. For example the ‘Mudharabah’ contract type involves two different parties.

- The ‘Mudharib’ – entrepreneur, the working partner

- The ‘Rabbal Maal’ – capital provider, the investor

In a Mudharabah commercial transaction the capital provider provides the capital for a venture while the entrepreneur brings his expertise. Any profits from the venture would be split in a pre agreed percentage between the two parties. The unique features of this contract are:

- That any losses are borne only by the capital provider

- The entrepreneur cannot charge his personal expenses to the venture.

Thus, even though all losses are borne by the capital provider, the entrepreneur can also incur a loss to the extent that if the effort is loss making, he would not have any income to defray his expenses.

Indeed the first Takaful Company in Malaysia adopted the Mudharabah contract and adapted it to insurance. Here, premiums were treated as capital and were paid into the policyholder fund (the Takaful Fund) and all management expenses incurred by the insurer cannot be charged to the Takaful Fund but were paid from the shareholders fund. The ‘profit’ is determined at the end of the year after claims are paid and adequate provisions made. This profit is then apportioned between the shareholders and the policyholders in a pre agreed percentage.

This is a difficult business model especially for life (called ‘Family’) business but Takaful Malaysia found success in this model and part of the reason was that it was the only Takaful Company in Malaysia for a good part of 10 years. Another reason for its success was that it also transacts non-life business.

Although the Mudharabah model is a difficult business model for the Family Takaful, it was a fairly successful model for the General (Casualty) Takaful business. The profit sharing ratio for the General Takaful business is usually 50:50 (as opposed to usually 30% to the shareholders and 70% to the policyholders in Family Takaful) but can be a higher percentage to the shareholders. It is pertinent to note that all the Takaful companies in Malaysia are composite companies and this has helped the Takaful companies to defray expenses at a faster rate than had it been writing only Family Takaful business.

Takaful – subsequent development

An important development of Takaful worldwide is the emergence of a quasi standard in the Takaful business model. This has been brought about by the recognition of Takaful business as one that can be split into two ‘businesses’, one of underwriting and the other of asset management.

For the underwriting business it was recognised that an agency (or ‘wakala’) contract would be appropriate. Under the wakala contract the Operator (Takaful Company) would collect an agency fee to defray its costs in managing the underwriting side of the Takaful business. All underwriting profits or losses would accrue to the policyholder (called participants). For the fund management side of the business the Operator can adopt either the same wakala contract (in which case a fee would be ducted as a percentage of the value of the fund under management) or the Mudharabah contract where instead of a fee, the Operator shares in the investment profits (but not investment losses). Seven of the nine Takaful companies in Malaysia now use the Wakala business model in some form or another. One of the two that does not has also indicated its intention to move to the wakala model.

Takaful – Role of Capital

The role of capital in Takaful is a challenging one to address. Takaful companies in Malaysia are subject to the same capital requirements (but not solvency requirement as yet) as their conventional counterparts. One important role of capital is to act as the lender to the Takaful Funds (which are physically separate from shareholders assets) should the Funds fall insolvent due to bad claims or investment experience. These loans are interest free (termed a Qard Hassan) and are a first charge on any future surplus from the Takaful Funds until they are fully repaid.

Notwithstanding that the Operator does not share in losses, it is in the Operators interest to ensure that the Takaful Funds are financially sound. As while the Qard represent a shareholders loan, should the Takaful Fund continue to be in a position of deficit, such loans would need to be ultimately written off.

Capital has to be serviced as otherwise there will be no investors. The wakala fees and Mudharabah sharing ratio should therefore be set to service the capital required at an appropriate rate of return and not be just sufficient to meet the expenses of running the Takaful business. The economic capital should be appropriately set to support the chosen business model.

Takaful – Comparison with conventional insurance

It would be useful to compare the differences between Takaful and Conventional Insurance and we have done this in the table below by addressing key issues that arises in an insurance and takaful contract.

Conventional versus Takaful

| Issues | Conventional | Takaful |

| Nature of contract between policyholder and shareholders | An insurance contract where for a consideration (called the premium), the shareholders agrees to indemnify the policyholder / his assets from loss due to an accident or other calamities. There is a transfer of risk between the policyholder to the shareholders for the insured object and the insured contingent. All expenses are met from policyholders’ premium. | A management contract to manage the Takaful business on behalf of policyholders. Typical contracts applied are the agency (wakala) contract or the mudharabah contract. Because it is a management contract all management expenses are charged to shareholders and not to the policyholders (there is a clear physical separation between policyholders’ assets and shareholders assets). There is no transfer of underwriting risk from the policyholder to the shareholder. |

| Nature of contract between shareholders and policyholders | A proprietary insurer Where the contract is specified as a non participating contract, the premium immediately becomes the asset of the shareholders while the shareholders liabilities now include the contingent of a future claim. All surplus and losses accrue to the shareholders. Where it is a participating contract there is a sharing of profits between policyholders and shareholders. All losses however, are met by the shareholders. A mutual insurer There is an agreement to share all profits and losses among policyholders. Policyholders remain as “owners” of the mutual fund. | Policyholders agree to share the risks among themselves. Policyholders are both the insured and the insurer. All underwriting profits and losses are shared between the policyholders through the premiums accumulated. In order to address the issue of gharar in Takaful, the risk premiums (termed contribution in Takaful) are deemed as tabarru’ (donations). Policyholders do not own the Tabarru’ Fund. |

| Investments | Investments of the policyholders and shareholders funds are not sharia compliant. They would include interest bearing securities and equities in forbidden businesses. | All investments (policyholders and shareholders funds) are sharia compliant. |

| Governance | There is management and a Board of Directors for a proprietary company | In addition to management and a Board of Directors there is a Sharia Advisory Board to monitor the Takaful company’s continuing sharia compliance. |

| Policy Conditions | Bound by contract law and subject to regulatory conditions (e.g. Treating Customers Fairly in the UK). | Policy conditions must be clear and transparent and sharia ‘friendly’ (issues such as to whether a particular policy condition is fair to the policyholder may occasionally arise with Sharia) |

| Guarantees | Insurance contracts normally carry some guarantees which are underwritten by the shareholders. Typically these are guarantees that premiums paid are sufficient to pay all claims and expenses. In savings products there can be a guarantee that a minimum rate of return on investments are achieved. | No guarantees, only an undertaking among policyholders to make sufficient tabarru’ to pay claims. Shareholders may be called to help in financing deficits in the Takaful Funds through interest free loans which would be repaid from future surpluses in the Tabarru’ Fund. |

Retakaful

Apart from the requirement to have sharia compliant assets to support Takaful Liabilities there is a need for a sharia compliant version of reinsurance.

The difference between reinsurance and retakaful is that the former provides a means of smoothing the claims experience of the shareholders. In retakaful there is an effective sharing of risks among the participants of the Takaful Funds.

As an example, a reinsurance surplus refund usually considers only the experience of the portfolio insured and surplus is returned to the insurer (in this case the shareholders). In retakaful the surplus is determined by the experience of the retakaful fund in addition to just the portfolio’s own experience and the surplus is returned to the participants.

Malaysia currently hosts at least 5 retakaful companies which include two Malaysian retakaful operators.

Is Takaful only for Muslims?

Definitely not so, Takaful is another way of doing insurance. It’s another product line in the same way that investment linked products are a natural development of the traditional whole of life and endowment policies. There are no restrictions as to who can or cannot take on Takaful. Islam is a flexible religion. As an example, in Takaful and for Muslims, the policy conditions would state that proceeds from the death of a participant (the sum covered) must be distributed in accordance with the Muslim Law of inheritance. But this would not apply if the participant is a non Muslim in which case the proceeds can go to a named beneficiary.

It is estimated that between 20% to 30% of Takaful participants in Malaysia are non Muslims. This is a country where over 40% of its population are non Muslims.

Growth of Takaful in Malaysia

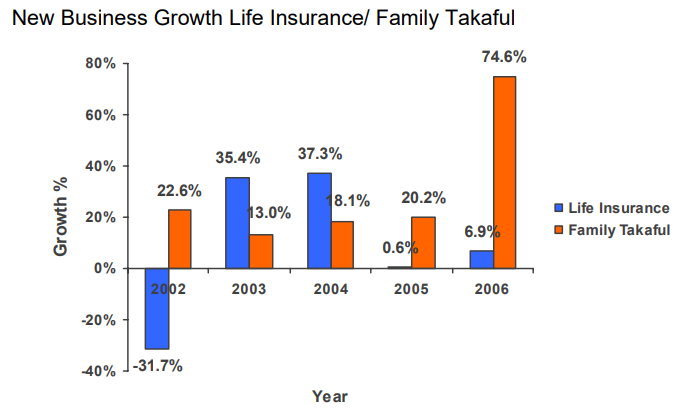

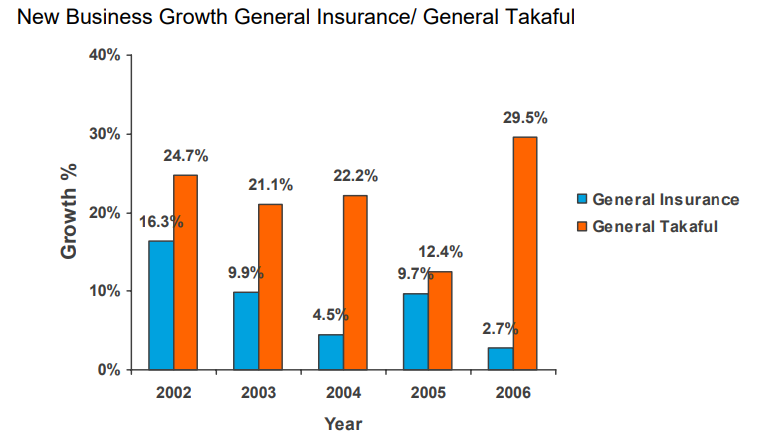

The charts below compare the growth of Takaful versus conventional insurance in Malaysia. Currently only about 5% of total insurance assets are from Takaful Funds. In 2006 15% of new premium in Life/Family and 7% of new premium in General are Takaful but this is expected to increase substantially now that the number of Takaful companies has doubled in the last year.

As can be seen from the above the growth of Takaful accelerated considerably with the start up of four new Takaful operators in 2006.

Conclusion

Takaful is not simply a name change (it is not simply a repackaging of conventional insurance under an Arabic sounding name) but is a new product line altogether.

I see an important role for takaful in Islamic finance and investment. The ban against riba currently restricts the role of Islamic banks in the financing of business. The problem is one of mismatch of assets against liabilities. Banks are conduits for short-term deposits. Islam’s requirement that reward can come only with risk, while forbidding riba, means that the Islamic bank’s liability will be long term because banks will effectively hold equity in the investments they make with the depositors money.

Due to the issues of mismatching of deposits to investments, many Islamic banks are resigned to take a role more akin to investments banks than commercial banks. The money is in the masses, however, and accumulating small amounts of deposits over a large number of accounts among the population results in a large amount of money. Muslims make up more than one billion of the world’s population. The Muslim world is generally under invested and financially underdeveloped. It sports a young demographic profile with an increasing purchasing power and savings potential.

All this points to a huge potential for long-term savings and investments, especially in the Muslim world. I believe takaful, if developed and marketed effectively, has the unique ability to tap into this potential. Here, the asset and the liability match. Savings through family takaful for retirement in particular would provide a valuable pool of long-term savings, ready for the right investment opportunities to rise.

zainal.kassim@actuarialpartners.com