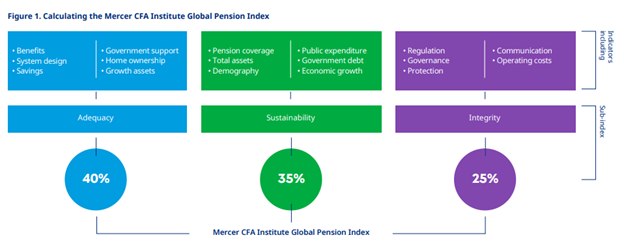

There are many variations of retirement systems around the world; each with its unique features or perhaps similar characteristics. Are you curious on which system is the best and how is Malaysia ranked? Each year, Mercer CFA Institute Global Pension Index compares and ranks retirement systems, based on three criteria: Adequacy, Sustainability and Integrity. The latest report, Mercer CFA Institute Global Pension Index 2023 compares 47 retirement income systems and uses more than 50 indicators to rank the systems accordingly. The overall index value is scored based on the weighted average of the 3 criteria illustrated in figure below.

Figure 1 Extracted from Mercer CFA Institute Global Pension Index 2023

In general, the research looks at:

- What benefits are future retirees likely to receive? In assessing adequacy;

- Can the existing systems continue to deliver, notwithstanding the demographic and financial challenges? In assessing Sustainability; and

- Are the private pension plans regulated in a manner that encourages long-term community confidence? In assessing Integrity.

In addition to benchmarking the retirement income system among the 47 countries, the report highlights shortcomings of each system and suggests areas of reform. Based on the overall index value, there are 7 grades: A, B+, B, C+, C, D and E (best to worst). In 2023, Malaysia’s score is 56.0 which falls under grade C. Our system, based on the Employee Provident Fund (EPF), is described as:

“A system that has some good features but also has major risks and/or shortcomings that should be addressed; without these improvements, its efficacy and/or long-term sustainability can be questioned.”

Malaysia can be proud for scoring full marks in some of the sub-index under Integrity. However, we scored zero marks for these sub-index under Adequacy:

- What is the basic (or targeted) state pension, as a percentage of the average wage, that a single aged person will receive?

- How is the basic (or targeted) state pension increased or adjusted over time (e.g., prices or wages or by some other means)?

- Are these increases or adjustments made on a regular basis? If yes, how often?

Three countries got a full score – Denmark, Iceland and Netherlands!

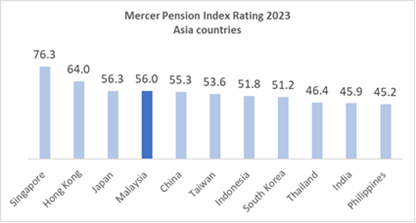

Figure below displays the 2023 ranks among the Asian countries; with Singapore being the first and Malaysia is ranked in 4th.

Figure 2: APC’s analysis of Mercer CFA Institute Global Pension Index 2023 for Asia countries

Unfortunately, our score has significantly dropped from 63.1 (2022) and Malaysia is one of two Asian countries that has a reduction in the score (apart from Hong Kong) since 2022. For Malaysia, the fall in our score is primarily due to the significant reduction in the net replacement rates published by the OECD; the net replacement rates were halved! The replacement rate is one of the common indicator to measure adequacy of benefits; it is the ratio of income at retirement over an individual’s pre-retirement income. The report states that:

“the OECD suggested a target replacement rate of 70% of final earnings, or around two-thirds of final salary, while noting that this level may need to be higher for low-income individuals.”

As we have discussed in our article “Are we saving enough for retirement?”, Malaysians who have EPF accounts (although not nearing to retirement) were allowed to withdraw parts of their retirement savings and the statutory contribution rate by members was also reduced from 11% to 9% of salary during the Covid-19 pandemic. It was reported that, around 30 per cent of EPF members in February 2021 have almost emptied their whole savings in Account 1 (which they normally could not withdraw from before they turn 55), and that over half of EPF members aged below 55 had less than RM10,000 in EPF savings[1]. In addition, as of 31 December 2022, the median savings of EPF active members aged 54 were at its lowest since 2018, at RM132,826[2] which is merely 55% of the recommended basic savings of RM240,000 at age 55. This could be the main reason why our score for the Adequacy index has dropped, resulting in our overall score being lower than 2022.

The Mercer CFA Institute Global Pension Index 2023 report suggested that the overall index value for the Malaysian system could be increased by:

- Increasing the minimum level of support for the poorest aged individuals

- Raising the level of household savings and lowering the level of household debt

- Introducing a requirement that part of the retirement benefit be taken as an income stream

- Increasing the pension age and the labour force participation rate at older ages as life expectancy continues to rise

We hope to see our policymakers advocating and putting in place legislations necessary to improve our retirement system.

[1] https://www.malaymail.com/news/malaysia/2023/10/29/report-is-ageing-malaysia-facing-retirement-time-bomb-with-insufficient-epf-savings/99010

[2] https://www.nst.com.my/business/corporate/2023/11/984676/median-savings-active-epf-members-aged-54-lowest-2018

Written by Raja Arina Safra Raja Arif