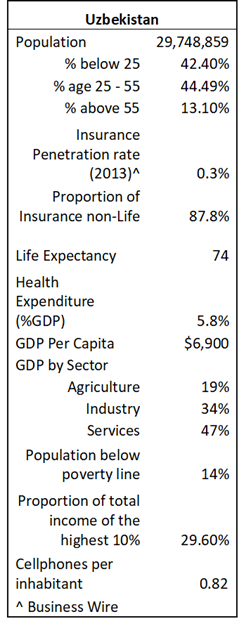

Uzbekistan has recently announced its intention to promote Islamic finance including Takaful. This is of course a welcome announcement as Uzbekistan is the most populous nation in Central Asia and 90% of its 32 million people are Muslim. Other nations in the region have made similar attempts, for instance in Kazakhstan there have been regulatory hurdles and in Azerbaijan its largest bank closed Islamic banking in 2015. The advantage Uzbekistan has going for it is that a working group has been created which will cut across all government agencies. With a success story in Uzbekistan, we can use this as a blueprint for the rest of the region.

As practitioners of Takaful elsewhere, what advice would we have for Uzbekistan?

- Takaful will follow Islamic banking, as Islamic banking grows, sales of Mortgage Reducing Term (MRTT) will correspondingly grow. Thus, any discussion of Takaful must start with Islamic banking, what risk management products such as MRTT do they need and with such products how can Islamic banking grow.

- If a tariff structure is used for compulsory classes of business such as motor and fire Takaful has the potential to truly disrupt conventional insurance due to surplus sharing. Regulations will need to find a balance between encouraging Takaful and cannibalization of conventional insurance business.

- Takaful can be extremely useful for micro type coverage, but a pure mutual structure is needed. With these structures pools are created for groups of people, whether neighbors, colleagues, associations or whatnot. These pools cover the participants on a best efforts basis with no guarantees. This provides coverage at a minimum cost with some simple regulations to ensure participants understand the pool and its limitations.

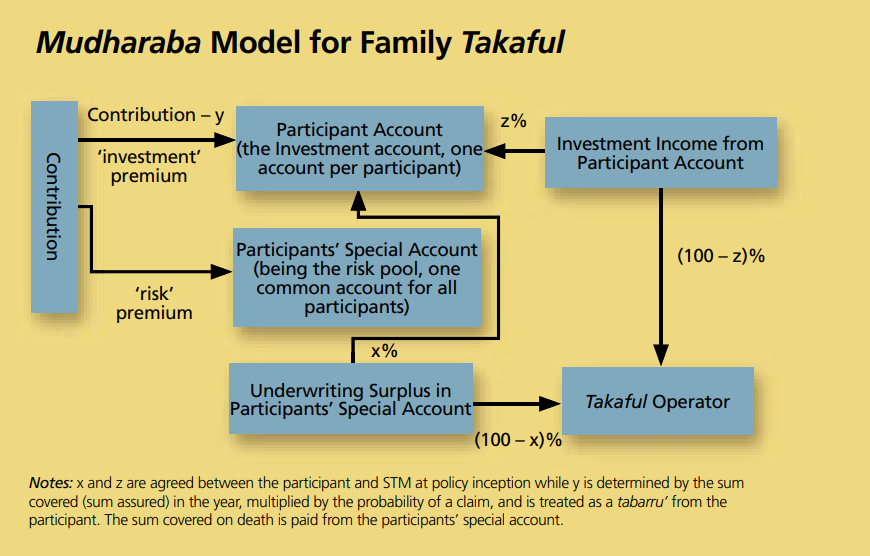

- Developing life insurance products in the conventional insurance world normally entails designing the product and features and then determining an appropriate investment strategy. In the early years there will not be sufficient Islamic assets for proper asset liability management of all product types. Thus in product development the available asset classes and characteristics should be taken into account. Conversely, if such products are desired by the industry and encouraged by regulations then relevant Islamic asset classes must also be encouraged.

- Takaful will start out small and must be nourished and cared for. Conventional insurers should be allowed to sell Takaful through carefully designed window operations. This will ensure expenses overruns can be kept to a minimum. Where possible composite Takaful operations can be allowed to further enable family (life) Takaful and general Takaful to assist each other in the growth phase of Takaful.

- At the earliest stage of development decisions should be made as to what Takaful should look like, will it look distinct from conventional insurance or simply be another product line. Similarly, will there be consistency in the model used or will differing Takaful operators be allowed to innovate with respect to the model.

These are exciting times for Takaful in Central Asia. It’s up to us to use our experience to nurture Takaful in Uzbekistan and beyond.

Key statistics (CIA World Factbook):