Under Risk Based Capital (RBC), we calculate the Capital adequacy ratio as the following:

The RCR consists of various risk charges, with market risk capital charge (MRCC) normally being one of if not the largest risk charge. Within MRCC, the IRCC is a major charge. In simplified terms, the IRCC is calculated by discounting the asset and liability cash flows with a higher/lower stressed interest rate. The interest rates used to discount the IRCC liability cash flows are normally the risk-free yields provided by the regulator or some other source with prescribed stress factors. This is used to test the sensitivity towards changes of interest rates. A higher IRCC would imply that there is a greater mismatch between assets and liabilities of the insurer.

For Sri Lanka, this is calculated using the risk-free yield and the cash flows of assets/liabilities which are filled into the RBC Forms provided by the regulator. The format of the RBC Forms DOES NOT allow for any recalculation of IRCC cash flows, as the IRCC results are automatically generated using the prescribed formulas and liability cash flows for the base calculation (which we fill in Table 5 of the RBC Forms). The challenge is that, for universal life products, there is the ability to adjust the dividend rates declared. For an insurer which uses a fixed dividend rate in projecting future liability cash flows, this calculation will work fine. For an insurer which adjusts the dividend rates according to the risk-free yield, we have a problem. For instance, the downward shock currently gives a yield curve below 5% whereas current dividend declaration rates (as per base scenario) are well above 8%. This would not be sustainable.

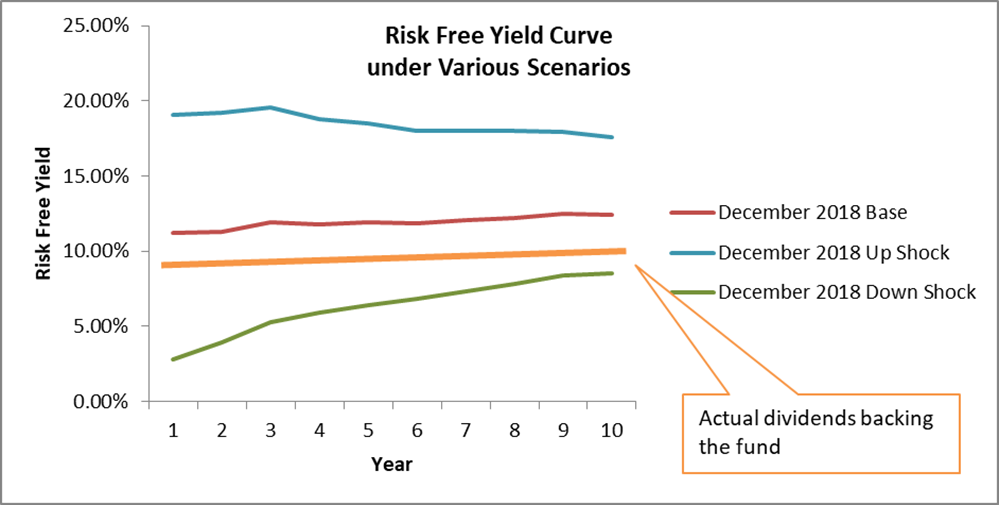

The chart below shows the risk-free yield curve as of December 2018 under the base, up shock and down shock scenarios.

With reference to the illustrations above, we set the dividend rate consistent to the base scenario of the risk-free yield (e.g., the red line). In reality, if the risk-free yield curve shifts upwards or downwards affecting investment returns, the dividend rates declared will also change. E.g., we should recalculate the IRCC cash flows using a higher/lower dividend based on the stressed risk-free yield. The IRCC calculation should involve changes in the dividend rates for universal life plans, and not just the discounting factors. This is a significant weakness of the RBC forms and causes significant IRCC charges which do not reflect the reality of the risks being measured.