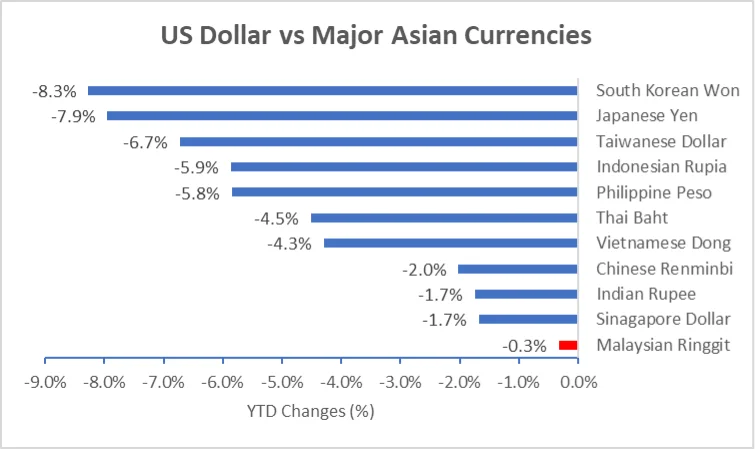

The Malaysian ringgit fell to its lowest level since the Asian Financial Crisis in February 2024, hitting RM4.80 against the US dollar before gradually rebounding to RM4.62 by the end of July. Despite a 0.3% depreciation against the US dollar in the first seven months of 2024, the Malaysian ringgit remains one of the strongest currencies in Asia. This decline reflects the general trend among Asian currencies, driven by robust US economic data and expectations of prolonged high interest rates from the US Federal Reserve.

Source: Yahoo Finance

From a broader perspective, the Malaysian ringgit has strengthened by 2.8% against the currencies of its main trading partners, as indicated by the MIDF Trade-weighted Ringgit Index (TWRI) during this period. This index provides a more comprehensive assessment of the ringgit’s value beyond the MYR/USD exchange rate, with weights assigned to each currency based on the size of total trade between Malaysia and the respective countries. Currently, the top three major components of the MIDF TWRI are Chinese Renminbi (weight: 19.0%), Singapore Dollar (15.3%) and US Dollar (10.6%). The chart below summarizes the ringgit’s performance against our 16 largest trading partners in the first seven months of 2024.

Source: Yahoo Finance

In recent months, the Malaysian ringgit has rebounded from its February lows, supported by a positive export outlook and proactive measures by Bank Negara Malaysia (BNM) to stabilize the currency. Malaysia recorded consecutive export growth in April and May, increasing by 11.8% and 7.3% year-on-year respectively, with total exports from January to May up by 4.5%. This growth is expected to continue, bolstered by China’s economy recovery efforts and an upswing in the tech sector, driving demand for electronic and electrical products.

Moreover, BNM has intervened in the forex market by selling foreign currencies and purchasing the ringgit. The central bank has also collaborated closely with government-linked companies (GLCs), government-linked investment companies (GLICs) and exporters to repatriate their foreign earnings, aiming to stabilize the ringgit and prevent excessive depreciation. Converting foreign currencies into ringgit increases demand for the currency in the forex market, contributing to its appreciation against other currencies. These measures have proven to be effective in the short term.

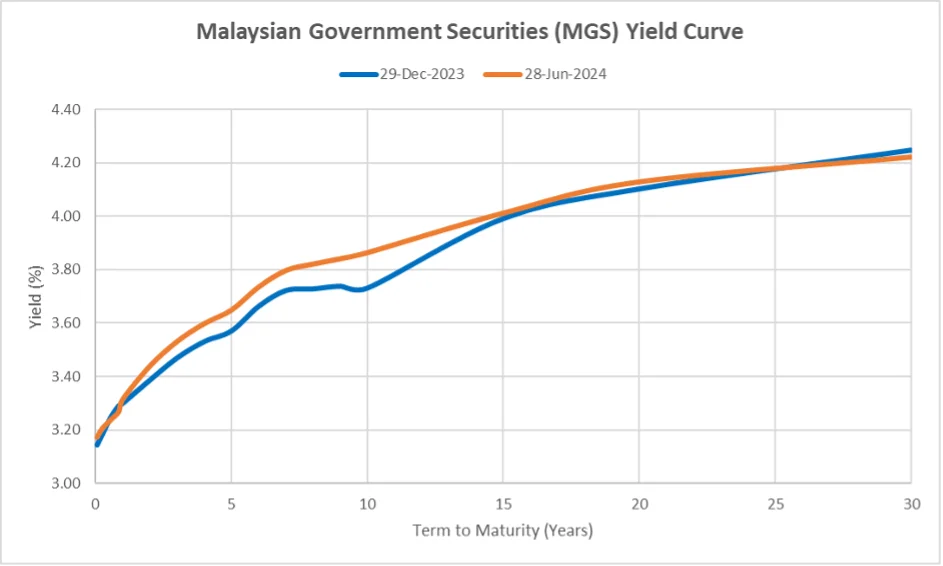

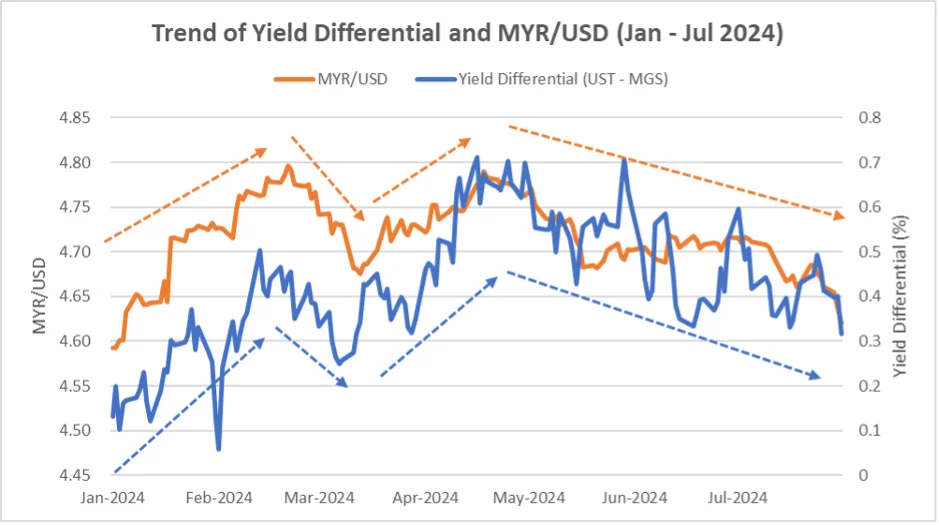

Looking ahead, the performance of ringgit will be significantly influenced by the extent and timing of interest rate cuts by the US Federal Reserve. According to the latest Federal Reserve dot plot released in June, members of the Federal Open Market Committee (FOMC) foresee a 0.25% interest rate reduction by the end of 2024, followed by cuts of 1% in 2025 and an additional 1% decrease in 2026. Given that BNM is likely to maintain the Overnight Policy Rate (OPR) in the near future, the yield differential between US Treasury bonds and Malaysian Government Securities (MGS) is expected to narrow. The narrowing yield differential between the US and Malaysia will enhance the attractiveness of the ringgit, leading to its appreciation. The chart below illustrates the relationship between the yield differential and MYR/USD movement in the first seven months of 2024.

Conclusion

In the short term, robust economic fundamentals are expected to bolster the ringgit. Over the medium to long term, the currency’s performance will largely depend on the progress of the government’s structural and fiscal reforms. Potential downside risks for the ringgit include weaker-than-expected economic growth, escalation of geopolitical tensions and changes in investor risk appetites.