In my December note I referred to how qard works in takaful and compared that with the ‘burn-through’ event in with-profit policies in life insurance.

In this January note I would like to dwell a bit on surplus in takaful and compare that with the bonus that is expected from with-profits life policies. When we consider surplus or profit sharing we need to first consider the element of risk sharing within the contract of insurance. There are fundamental differences between how risks are shared in takaful as compared to under with–profits life policies. We consider the differences under the following headings:

Which risks are shared?

Under takaful, the expense risks are solely for the account of the shareholders whilst the other risks reside in the Participants Risk Fund. Under with-profit policies in Malaysia all risks (i.e. expense, mortality and investment) are shared between the shareholders and the policyholders.

What is the impact of this difference?

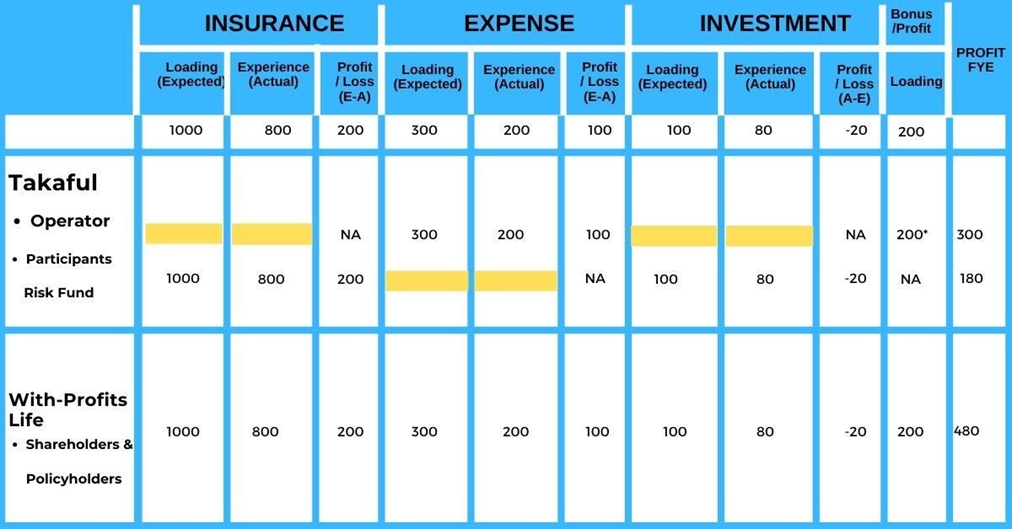

Take the following example where the total surplus arising in the year was split as follows:

*In takaful the profit loading generally resides in the wakala fee that is allocated to the Operator Fund.

Taking the practice in Malaysia, the surplus in the Participants Risk Fund is shared 50:50 between the Operator and the participants, whilst the surplus in the Operator Fund accrues solely to the Operator. For with-profits policies in life insurance there is only one fund and the surplus arising there is shared 10:90 between the shareholders and policyholders respectively. Thus in the example above, for takaful, the Operator get 390 (300 + 50% of 180, 390 which is 81% of total surplus) whilst in the with-profits example the shareholders get only 48 (10% of total surplus of 480). Another difference between takaful and with-profits life insurance is that the sharing percentage between the Operator and participants for each contract varies from year to year whilst for the with-profits policy it is fixed for the whole duration of the contract. This is because although in takaful the sharing percentage in the Risk Fund is fixed, the surplus arising in the Operator fund accrues 100% to the Operator.

Notwithstanding this variation in surplus sharing under each takaful contract, it is clear in the above example that the Operator generally gets the lion’s share of the surplus generated. The Operator’s actual share of the total surplus of course varies by product design (in particular the split between the wakala fees and the remainder of the contribution that makes its way to the Risk Fund) and the Operator’s pricing strategy.

How are surpluses/bonuses distributed?

When considering this question we first need to distinguish between how surplus is recognised and how surplus is actually distributed. The former is determined by accounting convention whilst the latter is determined by the company’s surplus distribution policy. In Malaysia for with-profits life policies, surplus distribution is determined through Asset Share computation. Under the Asset Share computation basis surpluses are effectively calculated on a cohort basis and distributed to the cohort members such that when the last policy leaves the cohort, the entire surplus within the cohort would have effectively been distributed. So for with-profits policies other than perhaps for investment profits, the risk-sharing, as it were, is restricted to the members within the cohort and not across all policies within the with-profits fund. This also means that depending on when the policy leaves the cohort, its attributed surplus would vary from policy to policy. Furthermore until the policy leaves the cohort, the policy’s own undistributed surplus would be available to offset any adverse shocks to the experience of the particular cohort.

Under takaful, the surplus sharing basis (i.e. excluding surplus arising in the Operator fund) is determined by the Operator but it is unusual to witness sharing by cohorts or Asset Share. Also the surplus distribution policy typically varies from company to company and can also vary from one Participants’ Risk Fund to another in the same company (one Operator can have multiple Risk Funds). Generally though in takaful, the risk sharing extends to all participants within the Participants’ Risk Fund.

It is also pertinent to note that with-profits policies in Malaysia are exclusively saving related policies whilst for takaful the Participants’ Risk Fund does not currently host the savings element (if any) of the contract.

How are deficits managed?

Firstly we need to define deficits. Deficits are defined in this note as when the net assets in the fund are not sufficient to cover the statutory liabilities. Unlike accounting liabilities, statutory liabilities are determined by the regulator in the country, in this case Bank Negara Malaysia.

For with-profits life fund, the guaranteed benefits constitute the initial sum assured, and the reversionary (i.e. recognised/allocated but not yet due for payment) bonuses already declared by the company. Taking into consideration that the Asset Share for the policy is usually very much in excess of the value of the guaranteed benefits as bonuses are usually pushed towards the end of the policy duration, it would be rare that deficits do arise. Nonetheless should it arise, the shareholders are expected to inject cash into the with-profits fund to ensure that the fund is always in a position of surplus. Such injections cannot be easily reversed (as discussed in the December note).

Under takaful, the way deficits are addressed is also determined by the Operator’s surplus distribution policy. The major difference is that any Operator’s cash injection would subsequently be a first charge on the future surpluses from the Participants Risk Fund.

One way to look at it is that the way deficits are treated in takaful is the mirror image of how deficits are treated in with-profits fund. In takaful the deficits are for the account of the participants whilst in a with-profits fund any deficits are for the account of the shareholders.

As observed in my December note the risk sharing in takaful is not just among the participants in the Participants Risk Fund at any time but is also risk sharing across current and future participants in the Participants Risk Fund, as the future participants in the Risk Fund are also liable to repay any outstanding qard during their participation in the pool. Such sharing of deficits is prohibited by the Regulator for with-profits funds in Malaysia. The smoothing of surplus arising/distributed is possible within the with-profits fund but this is limited to that portion of the Asset Share in excess of the value of the accrued guaranteed benefits within the particular cohort.

Observation

This note dwelled on the differences in surplus distribution between takaful and the with-profits life insurance business. This is because, in my November note it was mentioned that certain quarters have raised the possibility that takaful is no different from insurance from the accounting perspective. Further discussions have revealed that this conclusion was driven by the misconception that the surplus sharing mechanism in takaful is no different from the surplus distribution already practiced in with-profits life insurance fund. Thus it was suggested that accounting under IFRS 17 for with- profits life insurance can also be used for takaful. As this note illustrates, further thought would be necessary before such a conclusion can be made.